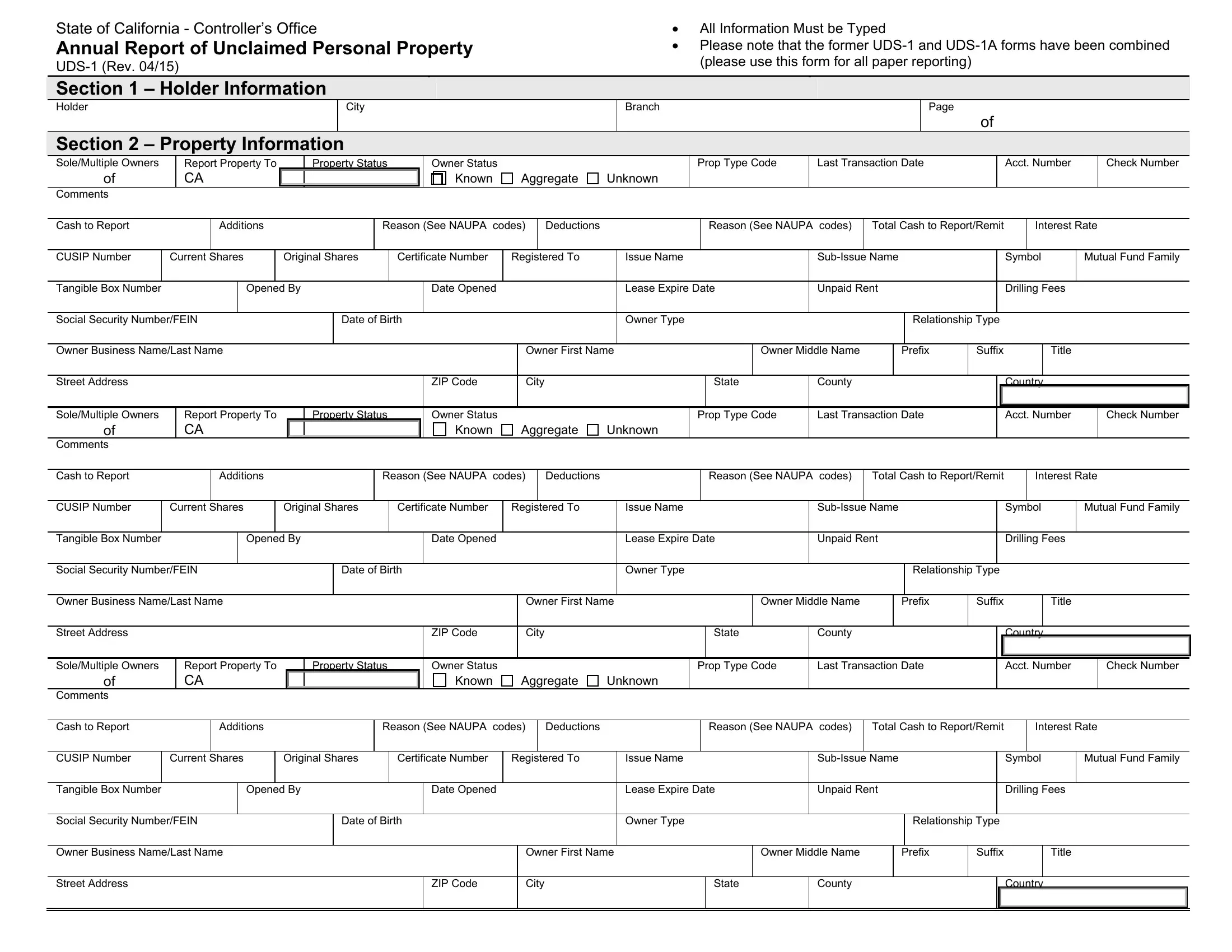

State of California - Controller’s Office

Annual Report of Unclaimed Personal Property

UDS-1 (Rev. 04/15)

•All Information Must be Typed

•Please note that the former UDS-1 and UDS-1A forms have been combined (please use this form for all paper reporting)

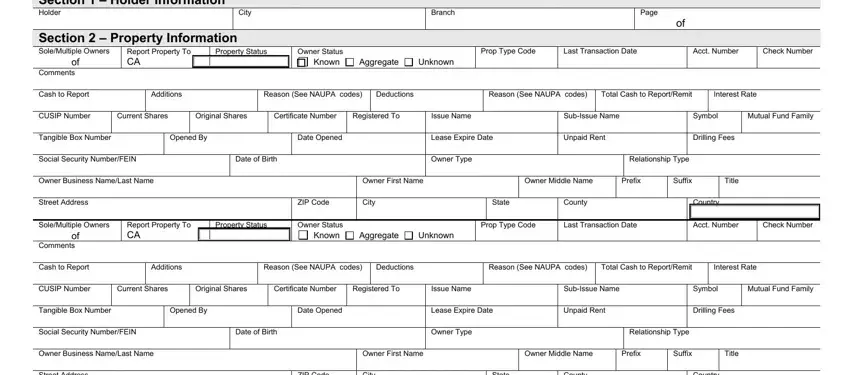

Section 1 – Holder Information

Section 2 – Property Information

Sole/Multiple Owners |

|

Report Property To |

|

|

Property Status |

|

|

Owner Status |

|

|

|

|

|

|

Prop Type Code |

Last Transaction Date |

|

|

Acct. Number |

|

Check Number |

of |

|

CA |

|

|

|

|

|

|

|

Known |

|

Aggregate |

Unknown |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash to Report |

|

|

Additions |

|

|

|

|

Reason (See NAUPA codes) |

|

Deductions |

|

|

|

|

Reason (See NAUPA codes) |

Total Cash to Report/Remit |

|

Interest Rate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CUSIP Number |

Current |

Shares |

|

Original Shares |

|

Certificate Number |

Registered To |

|

Issue Name |

Sub-Issue Name |

|

|

Symbol |

Mutual Fund Family |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible Box Number |

|

|

|

Opened |

|

|

By |

|

|

|

|

|

Date Opened |

|

|

|

|

|

Lease Expire Date |

Unpaid Rent |

|

|

Drilling Fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security Number/FEIN |

|

|

|

|

Date of Birth |

|

|

|

|

|

|

Owner Type |

|

|

|

Relationship Type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owner Business Name/Last Name |

|

|

|

|

|

|

|

|

|

|

Owner First Name |

|

|

|

|

Owner Middle Name |

|

|

Prefix |

Suffix |

|

|

Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address |

|

|

|

|

|

|

|

|

|

|

|

|

ZIP Code |

|

|

City |

|

|

|

|

State |

|

County |

|

|

|

|

|

Country |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

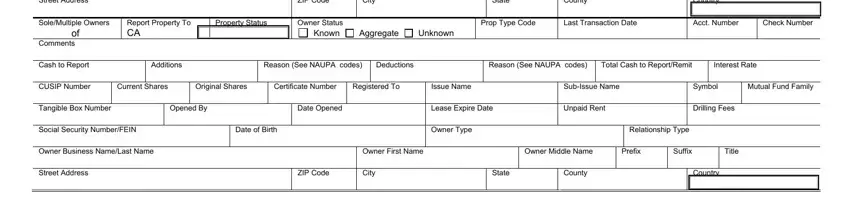

Sole/Multiple Owners |

|

Report Property To |

|

|

Property Status |

|

|

Owner Status |

|

|

|

|

|

|

Prop Type Code |

Last Transaction Date |

|

|

Acct. Number |

|

Check Number |

of |

|

CA |

|

|

|

|

|

|

|

Known |

|

Aggregate |

Unknown |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash to Report |

|

|

Additions |

|

|

|

|

Reason (See NAUPA codes) |

|

Deductions |

|

|

|

|

Reason (See NAUPA codes) |

Total Cash to Report/Remit |

|

Interest Rate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CUSIP Number |

Current |

Shares |

|

Original Shares |

|

Certificate Number |

Registered To |

|

Issue Name |

Sub-Issue Name |

|

|

Symbol |

Mutual Fund Family |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible Box Number |

|

|

|

Opened |

|

|

By |

|

|

|

|

|

Date Opened |

|

|

|

|

|

Lease Expire Date |

Unpaid Rent |

|

|

Drilling Fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security Number/FEIN |

|

|

|

|

Date of Birth |

|

|

|

|

|

|

Owner Type |

|

|

|

Relationship Type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owner Business Name/Last Name |

|

|

|

|

|

|

|

|

|

|

Owner First Name |

|

|

|

|

Owner Middle Name |

|

|

Prefix |

Suffix |

|

|

Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address |

|

|

|

|

|

|

|

|

|

|

|

|

ZIP Code |

|

|

City |

|

|

|

|

State |

|

County |

|

|

|

|

|

Country |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sole/Multiple Owners |

|

Report Property To |

|

|

Property Status |

|

|

Owner Status |

|

|

|

|

|

|

Prop Type Code |

Last Transaction Date |

|

|

Acct. Number |

|

Check Number |

of |

|

CA |

|

|

|

|

|

|

|

Known |

|

Aggregate |

Unknown |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash to Report |

|

|

Additions |

|

|

|

|

Reason (See NAUPA codes) |

|

Deductions |

|

|

|

|

Reason (See NAUPA codes) |

Total Cash to Report/Remit |

|

Interest Rate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CUSIP Number |

Current |

Shares |

|

Original Shares |

|

Certificate Number |

Registered To |

|

Issue Name |

Sub-Issue Name |

|

|

Symbol |

Mutual Fund Family |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible Box Number |

|

|

|

Opened |

|

|

By |

|

|

|

|

|

Date Opened |

|

|

|

|

|

Lease Expire Date |

Unpaid Rent |

|

|

Drilling Fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security Number/FEIN |

|

|

|

|

Date of Birth |

|

|

|

|

|

|

Owner Type |

|

|

|

Relationship Type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owner Business Name/Last Name |

|

|

|

|

|

|

|

|

|

|

Owner First Name |

|

|

|

|

Owner Middle Name |

|

|

Prefix |

Suffix |

|

|

Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address |

|

|

|

|

|

|

|

|

|

|

|

|

ZIP Code |

|

|

City |

|

|

|

|

State |

|

County |

|

|

|

|

|

Country |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual Report of Unclaimed Personal Property Owner Detail Sheet

(UDS-1) Instructions

Paper Reports may be submitted by holders reporting less than ten properties. A Paper Report must be submitted on the Annual Report of Unclaimed Personal Property Owner Detail Sheet (UDS-1).

Electronic reports are required for holders reporting ten or more properties. Holders are encouraged to submit a report in electronic format regardless of the number of properties.

Property valued at $24.99 or less may be combined into one aggregate account, except for securities property types SC01-SC20 and safekeeping property types SD01-SD03. Holders are encouraged to provide account information when available. When property included in an aggregate report is claimed, holders that did not provide identifying information may be asked to further assist property owners during the process. It is preferred that holders do not report in aggregate.

Section 1: Holder Information

Holder — Enter the name of your company

City — Enter the city where your company is located

Branch — Enter the branch number or name

Page — Enter the page number and total pages in report

Section 2: Property Information

Sole/Multiple Owners — For each property, enter the individual owner number associated within the owner group, and the total number of owners in the group (i.e. 1 of 2; 2 of 2).

Property Status — Select the appropriate Property Status:

∙ Report First – property being reported, but not remitted. Please ote that Report First ill e the o l appropriate e tr when submitting a Holder Notice Report. When

choosing this designation, cash remitted to the State will always calculate to zero.

∙Reporta le – property being submitted with the Holder Remit Report.

∙Rea ti ated/Refu ded – property reunited with the rightful owner after the

submission of the Holder Notice Report but prior to the submission of the Holder Remit Report.

Owner Status — Check the appropriate Owner Status:

∙K o – if property owner information is known;

∙ |

Aggregate |

– if properties are valued at less than $25 and will be reported as a single |

|

line item without owner information; or, |

∙ |

U k o |

– if property owner information is not known. |

Property Type — This field is mandatory. Select the appropriate four-digit property type code. Last Transaction Date — This field is mandatory. Enter the last transaction date. The last Transaction Date (also known as the date of last contact, or last activity date) is the date on which the last deposit or withdrawal occurred or the date on which the property became payable, redeemable, dormant, or returnable (e.g., issue date of a check). The date must be formatted as MM/DD/YY.

Account Number — Enter the account number on the check, account, or remittance, if applicable.

Check Number — Enter the check number, if applicable. Comments — Add any comments on the property, if applicable. Cash to Report/Remit — Enter the original property cash amount.

Additions/Deductions — Enter the amount of any additional charges or deductions to the original amount.

Reason — (Deduction and Withholding Codes) - Select the appropriate deduction or addition code.

Cash to Report/Remit — This field is mandatory. Total amount of cash to be reported/remitted after applying the appropriate additions and deductions. Cash will be reported on the Holder Notice Report and remitted on the Holder Remit Report.

Interest Rate — Enter the amount of interest to be assessed to the report/remit amount if applicable.

CUSIP Number — Enter the CUSIP (Committee on Uniform Securities Identification Procedures) number of the security, if applicable.

Current Shares — Enter the number of shares the owner is entitled to at the time the property is reported to the State, carrying the number out to the fourth decimal place (i.e. 12.0725). Original Shares — Enter the number of shares that the owner was entitled to at the time of last activity on the account, carrying the number out to the fourth decimal place (i.e. 12.0725). Certificate Number — Enter the security certificate number.

Registered To — Enter the exact name that does or would appear on a stock certificate. Issue Name — Enter the name of the security being reported.

Sub-Issue Name — List the sub-issues under the mutual fund family name, if applicable. Symbol — Enter the symbol for the security if traded on a stock exchange.

Mutual Fund Family — Enter the mutual fund family name.

Tangible Box Number — Enter the safe-deposit box number. Use this field for property type SD01 or SD02 only.

Opened by — Enter the name of the person who opened the box.

Date Opened — Enter the date the box was opened. Please enter in MM/DD/YYYY format. Lease Expire Date — Enter the date on which the safe deposit box lease expired. Enter in MM/DD/YYYY format.

Unpaid Rent — Enter the total amount of unpaid rent due. Drilling Fees — Enter the total amount charged for drilling services.

Social Security Number (SSN)/Federal Tax Identification Number (FEIN) – This field is mandatory. Enter the property o er’s SSN if the named property owner is an individual or

the FEIN if the named owner is a business. This field is required for all named property owners. If the SSN or the FEIN is ot i the holder’s re ords, a ritte e pla atio ust a o pa the

report.

Date of Birth — Enter the property o er’s date of irth. Please enter in MM/DD/YYYY format. Owner Type — This field is mandatory. Select the appropriate owner type code.

Relationship Type — This field is mandatory. Select the relationship type code. Owner Business Name — Enter the business name of the account owner. If the first word of the

usi ess is |

The, put The after the |

a |

e. |

|

|

|

|

|

Example: |

Correct |

|

|

|

|

|

|

Incorrect |

|

|

Adam Company The |

|

|

|

|

|

The Adam Company |

Owner Last Name — Enter the property o |

er’s last |

a |

e. If the property o |

er’s a e is |

unavailable, enter U k o . |

|

|

|

|

|

|

|

|

Owner First Name — Enter the property o |

er’s first |

a |

e. |

|

Owner Middle Name — Enter the property o |

er’s |

iddle a e. |

|

Prefix — Enter the property o |

er’s |

a |

e prefi |

i.e. Dr |

Doctor), Pvt (Private), Rev (Reverend), |

etc.) without punctuation. |

|

|

|

|

|

|

|

|

Suffix — Enter the property o |

er’s |

a |

e suffi |

i.e. Jr, “r, III, et . if appli a |

le, without |

punctuation.

Title — Enter the appropriate title, if applicable, (i.e. Dr (doctor), Pvt (Private), Rev (Reverend),

etc.) without punctuation. |

|

|

|

|

Street Address — Enter the property o |

er’s last k |

o |

address. If the address is unknown |

leave this blank. |

|

|

|

|

Zip — Enter the propert o er’s zip code. |

|

|

|

City — Enter the city of the property o |

er’s last k |

o |

address. If unknown, leave this field |

blank. |

|

|

|

|

State — Select the state of the property o er’s last k |

o |

address. If unknown, leave this |

field blank. |

|

|

|

|

County — Enter the county of the property o er’s last k o |

address. If unknown, leave this |

field blank. |

|

|

|

|

Country — Select the country code if the property o |

|

er’s last known address is in a foreign |

country.

A copy of the Owner Detail Sheet, UDS-1 form, can be found at:

http://www.sco.ca.gov/upd_rptg.html