mi uia need file claim can be completed easily. Simply use FormsPal PDF editor to complete the job without delay. We are devoted to giving you the ideal experience with our editor by consistently presenting new functions and improvements. With these improvements, using our editor becomes better than ever! Starting is simple! Everything you need to do is follow these simple steps directly below:

Step 1: Simply click on the "Get Form Button" at the top of this page to see our pdf editing tool. There you'll find all that is required to work with your document.

Step 2: As soon as you open the file editor, you will notice the document prepared to be completed. Besides filling in different blanks, you may also perform other sorts of actions with the form, particularly writing any text, modifying the initial text, adding images, affixing your signature to the form, and much more.

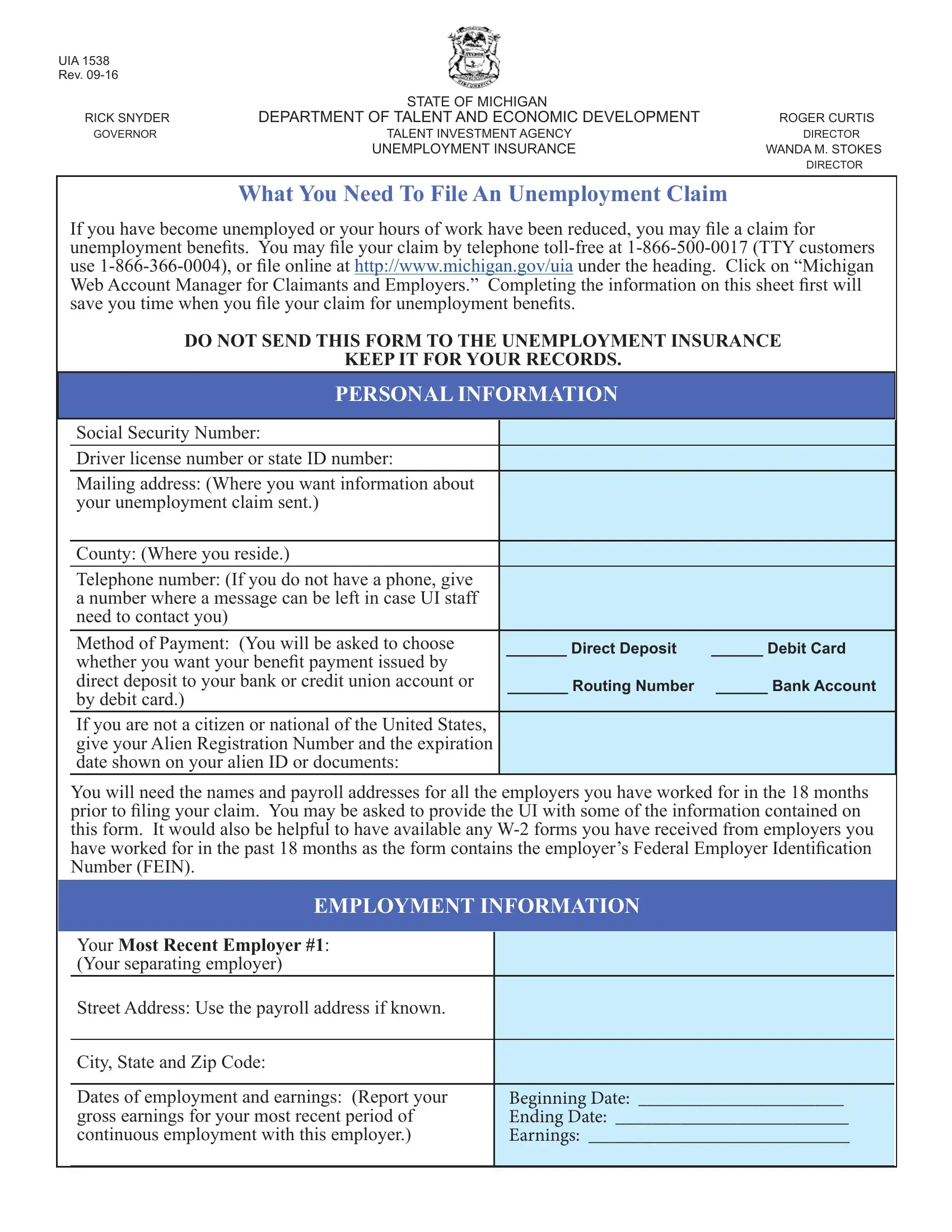

In an effort to fill out this PDF form, ensure you type in the necessary details in every field:

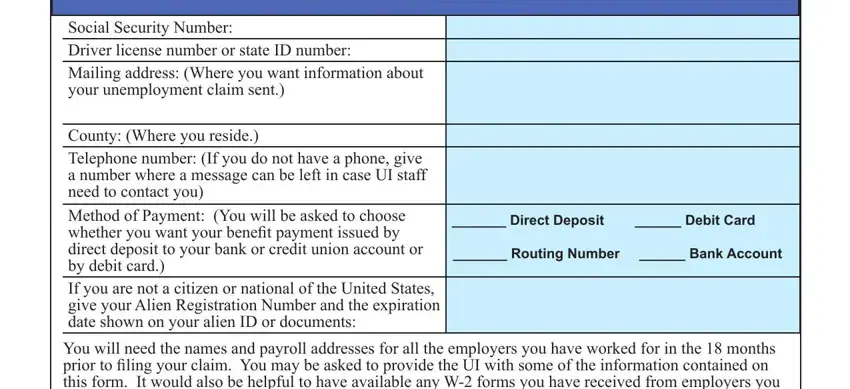

1. Fill out your mi uia need file claim with a selection of major blanks. Note all of the important information and make certain not a single thing omitted!

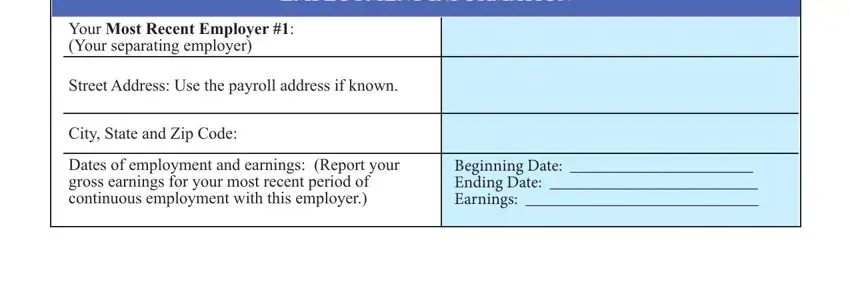

2. Soon after finishing this section, head on to the subsequent step and fill in all required particulars in these blank fields - EMPLOYMENT INFORMATION, Your Most Recent Employer Your, Street Address Use the payroll, City State and Zip Code Dates of, and Beginning Date Ending Date.

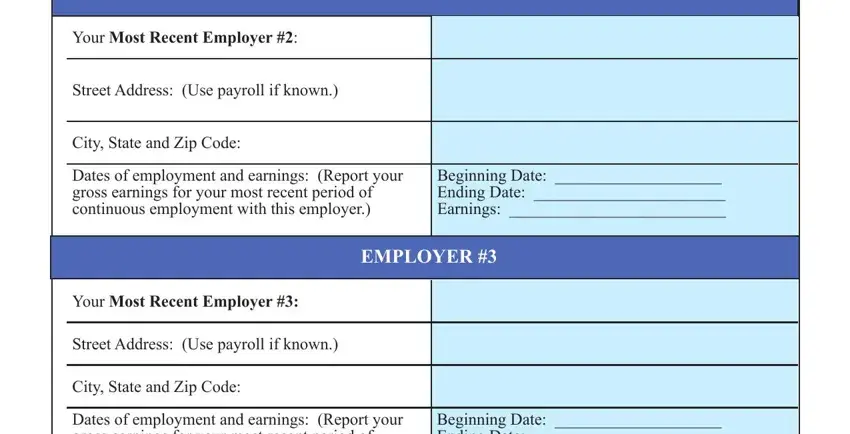

3. This third segment is normally fairly straightforward, EMPLOYER, Your Most Recent Employer, Street Address Use payroll if known, City State and Zip Code Dates of, Beginning Date Ending Date, EMPLOYER, Your Most Recent Employer, Street Address Use payroll if known, City State and Zip Code Dates of, and Beginning Date Ending Date - these fields will have to be completed here.

It is possible to make errors when completing the Your Most Recent Employer, and so make sure to take another look before you'll send it in.

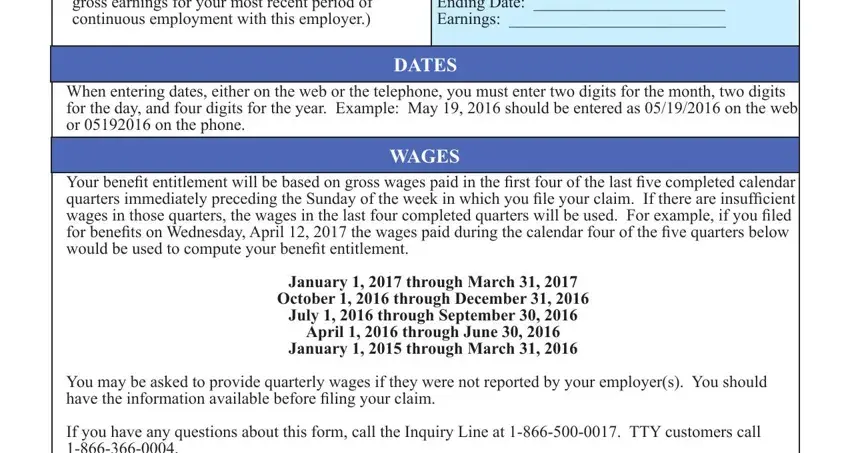

4. Filling in City State and Zip Code Dates of, Beginning Date Ending Date, DATES, When entering dates either on the, WAGES, Your benefit entitlement will be, January through March, October through December, July through September, April through June, January through March, You may be asked to provide, and If you have any questions about is vital in the next section - make certain that you take the time and fill out each and every blank!

Step 3: Before submitting the document, make certain that blanks were filled out as intended. The moment you think it is all fine, click on “Done." Create a 7-day free trial account with us and gain immediate access to mi uia need file claim - which you can then use as you would like from your personal account page. At FormsPal, we do our utmost to guarantee that all of your details are stored secure.