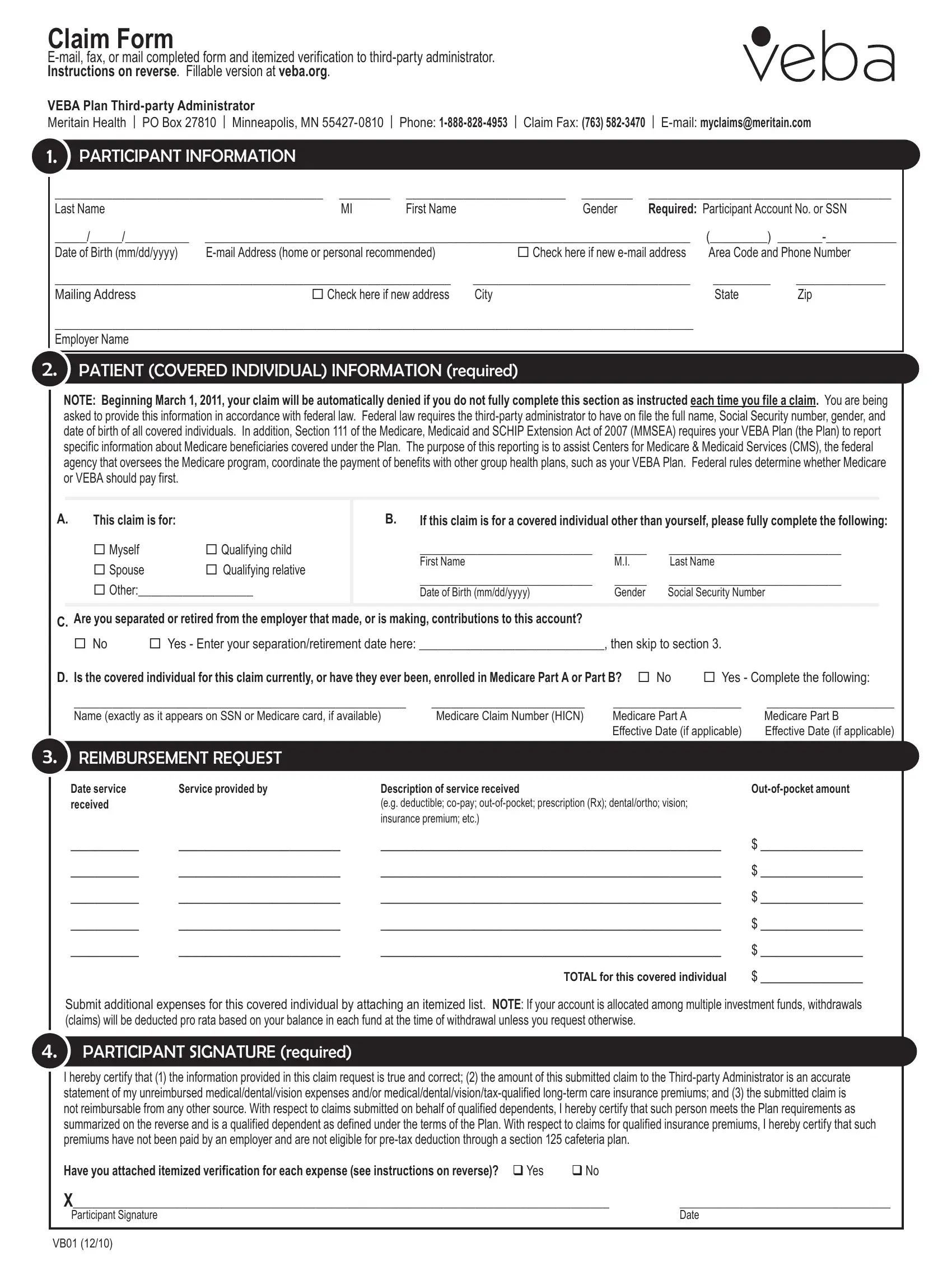

Claim Form

E-mail, fax, or mail completed form and itemized verification to third-party administrator.

Instructions on reverse. Fillable version at veba.org.

VEBA Plan Third-party Administrator |

|

|

|

|

|

Meritain Health | PO Box 27810 | Minneapolis, MN 55427-0810 | |

Phone: 1-888-828-4953 | Claim Fax: (763) 582-3470 |

| E-mail: myclaims@meritain.com |

|

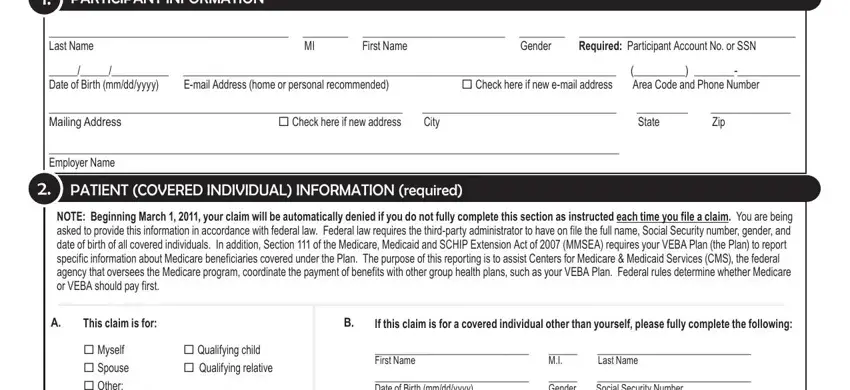

1. |

participant information |

|

|

|

|

|

|

__________________________________________ ________ |

_________________________ ________ |

______________________________________ |

|

Last Name |

MI |

First Name |

Gender |

Required: Participant Account No. or SSN |

|

_____/_____/__________ ____________________________________________________________________________ |

(_________) _______-___________ |

|

Date of Birth (mm/dd/yyyy) |

E-mail Address (home or personal recommended) |

Check here if new e-mail address |

Area Code and Phone Number |

|

______________________________________________________________ |

__________________________________ |

_________ |

______________ |

|

Mailing Address |

Check here if new address |

City |

|

State |

Zip |

|

____________________________________________________________________________________________________ |

|

|

|

Employer Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.patient (covered individual) information (required)

NOTE: Beginning March 1, 2011, your claim will be automatically denied if you do not fully complete this section as instructed each time you file a claim. You are being asked to provide this information in accordance with federal law. Federal law requires the third-party administrator to have on file the full name, Social Security number, gender, and date of birth of all covered individuals. In addition, Section 111 of the Medicare, Medicaid and SCHIP Extension Act of 2007 (MMSEA) requires your VEBA Plan (the Plan) to report specific information about Medicare beneficiaries covered under the Plan. The purpose of this reporting is to assist Centers for Medicare & Medicaid Services (CMS), the federal agency that oversees the Medicare program, coordinate the payment of benefits with other group health plans, such as your VEBA Plan. Federal rules determine whether Medicare or VEBA should pay first.

A.This claim is for:

Myself |

Qualifying child |

Spouse |

Qualifying relative |

Other:__________________

B.If this claim is for a covered individual other than yourself, please fully complete the following:

___________________________ |

_____ |

___________________________ |

First Name |

M.I. |

Last Name |

___________________________ |

_____ |

___________________________ |

Date of Birth (mm/dd/yyyy) |

Gender |

Social Security Number |

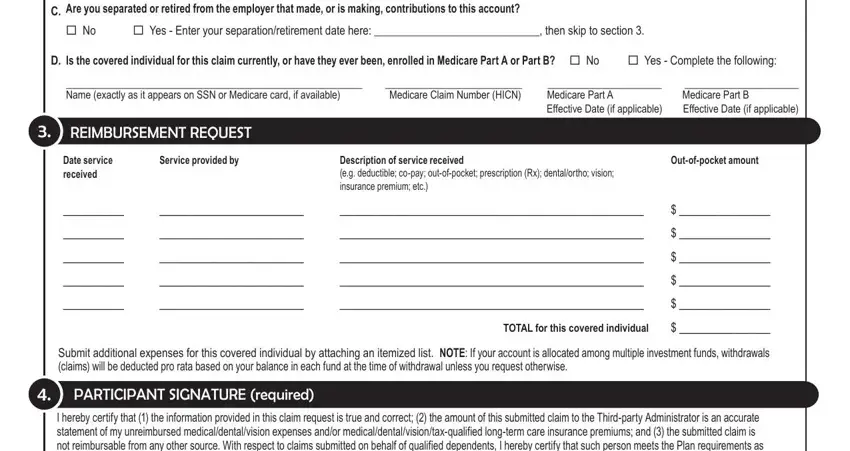

C.Are you separated or retired from the employer that made, or is making, contributions to this account?

No Yes - Enter your separation/retirement date here: _____________________________, then skip to section 3.

D. Is the covered individual for this claim currently, or have they ever been, enrolled in Medicare Part A or Part B? No |

Yes - Complete the following: |

____________________________________________________ |

________________________ |

____________________ |

____________________ |

Name (exactly as it appears on SSN or Medicare card, if available) |

Medicare Claim Number (HICN) |

Medicare Part A |

|

Medicare Part B |

|

|

Effective Date (if applicable) |

Effective Date (if applicable) |

3.reimBursement reQuest

Date service |

Service provided by |

Description of service received |

Out-of-pocket amount |

received |

|

(e.g. deductible; co-pay; out-of-pocket; prescription (Rx); dental/ortho; vision; |

|

|

|

insurance premium; etc.) |

|

________ |

___________________ |

________________________________________ |

$ ____________ |

________ |

___________________ |

________________________________________ |

$ ____________ |

________ |

___________________ |

________________________________________ |

$ ____________ |

________ |

___________________ |

________________________________________ |

$ ____________ |

________ |

___________________ |

________________________________________ |

$ ____________ |

|

|

TOTAL for this covered individual |

$ ____________ |

Submit additional expenses for this covered individual by attaching an itemized list. NOTE: If your account is allocated among multiple investment funds, withdrawals (claims) will be deducted pro rata based on your balance in each fund at the time of withdrawal unless you request otherwise.

4.participant signature (required)

I hereby certify that (1) the information provided in this claim request is true and correct; (2) the amount of this submitted claim to the Third-party Administrator is an accurate statement of my unreimbursed medical/dental/vision expenses and/or medical/dental/vision/tax-qualified long-term care insurance premiums; and (3) the submitted claim is not reimbursable from any other source. With respect to claims submitted on behalf of qualified dependents, I hereby certify that such person meets the Plan requirements as summarized on the reverse and is a qualified dependent as defined under the terms of the Plan. With respect to claims for qualified insurance premiums, I hereby certify that such premiums have not been paid by an employer and are not eligible for pre-tax deduction through a section 125 cafeteria plan.

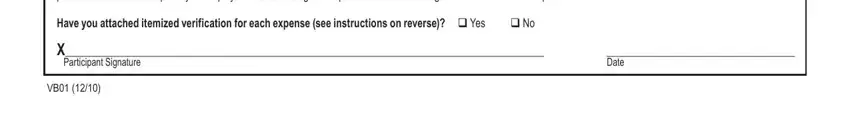

Have you attached itemized verification for each expense (see instructions on reverse)? q Yes |

q No |

|

X____________________________________________________________________________________ |

_________________________________ |

Participant Signature |

|

Date |

VB01 (12/10)

instructions for suBmitting claims

Use this form to request reimbursement of qualiied healthcare expenses and/or insurance premiums you have incurred on behalf of yourself, your spouse, and/or your eligible dependents (illable version available at veba.org). Qualiied expenses and premiums submitted for reimbursement must have been incurred after you became a participant eligible to ile claims. Want to see your claims in progress and claims history? Go to veba.org and click myVEBA Plan online to login to your account.

For more information, read Guidelines for Submitting Claims available online. To expedite your claim:

1.E-mail your claim to myclaims@meritain.com and sign up for direct deposit; its faster and more secure. Go to veba.org And click myVEBA Plan online to login to your account and sign up for direct deposit. Claims sent via e-mail will receive an auto-reply conirming receipt of claim. If you fax your claim, check the fax machine’s conirmation report to conirm the transmission was successful. Claims submitted by mail may be viewed online after logging into your account.

2.Fully complete each section of the claim form. Missing information may delay the processing of your claim and could result in your claim being denied. Don’t forget to sign and date the form.

3.You must attach itemized veriication for each expense or service. Generally, veriication should contain (1) patient (covered individual) name; (2) date item was purchased or service was provided; (3) description of expense or service; and (4) out-of-pocket amount. Acceptable forms of veriication include (1) an explanation of beneits (EOB); (2) an itemized billing or statement from your provider; or (3) a detailed receipt for prescription or over-the-counter (OTC)

medications. Cancelled checks, credit card or debit card receipts, balance forward or payment on account statements, and documentation which indicates that inal insurance payment has not yet been determined are not acceptable. NOTE: Please do not use a highlighter on your expense receipts. If you want to identify certain items on your receipts, circle the items with a regular pen instead. Highlighting often appears illegible on faxes and electronic imaging equipment used to process your claim.

4.For qualiied insurance premium reimbursement, you must attach documentation which includes the following: (1) name(s) of covered individual(s); (2) premium amount(s); (3) policy period; and (4) insurance provider name and address. This information is typically contained on your premium billing notice.

NOTE: IRS regulations provide that insurance premiums paid by an employer, or premiums that are or could be deducted pre-tax through your (or

your spouse’s) employer’s Section 125 plan, are not eligible for reimbursement. If you request reimbursement of after-tax premiums deducted from your (or your spouse’s) paycheck, you should include a letter from the employer which conirms that a pre-tax option for the payment of such premiums is not available.

To set up systematic reimbursement of monthly insurance premiums, go to veba.org and click myVEBA Plan online to login to your account. Or, submit a com-

pleted Systematic Premium Reimbursement Form.

Questions? Contact the third-party administrator, Meritain Health, at myVEBAPlan@meritain.com or 1-888-828-4953.

Qualified expenses and premiums

Internal Revenue Code § 213(d) deines qualiied expenses and premiums, in part, as “medical care” amounts paid for insurance or “for the diagnosis, cure, mitigation, treatment, or prevention of disease…” Expenses solely for cosmetic reasons generally are not eligible (e.g. facelifts, hair transplants, hair removal, etc.). Common expenses include co-pays, coinsurance, deductibles, and prescriptions. Common insurance premiums include medical, dental, vision, tax-qualiied long-term care

(subject to IRS limits), Medicare Part B, Medicare Part D, and Medicare supplement plans. Go to veba.org to view a more extensive list. Please note the following:

1.Qualiied expenses and premiums you submit for reimbursement must be incurred after you become a claims-eligible participant.

2.If a person covered by this plan has a Section 125 healthcare lexible spending account (FSA), the FSA beneits must be exhausted before submitting eligible claims.

3.Qualiied insurance premiums are reimbursable beginning with the month in which you become a claims-eligible participant.

4.IRS regulations provide that insurance premiums paid by an employer, or premiums that are or could be deducted pre-tax through a Section 125

plan, are not eligible for reimbursement. If you request reimbursement of premiums deducted from your (or your spouse’s) paycheck, you should include a letter from the employer which conirms that a pre-tax option for the payment of such premiums is not available.

5.Systematic reimbursement of recurring qualiied insurance premiums may be set up online after logging in to your account or by submitting a Systematic Premium Reimbursement Form.

IMPORTANT NOTICE REGARDING OVER-THE-COUNTER (OTC) DRUGS AND MEDICINES: To be eligible for reimbursement, federal healthcare reform

requires that OTC medicines and drugs (except insulin) purchased on or after January 1, 2011 be prescribed by a medical professional or accompanied by a note from a medical practitioner recommending the item to treat a speciic medical condition. Thus, OTC medicines and drugs such as aspirin, antihistamines,

and cough syrup must be prescribed. Eligible OTC medicines and drugs purchased on or before December 31, 2010 remain reimbursable without a prescription. The prescription requirement applies only to medicines and drugs, not to other types of OTC items such as bandages and crutches.

Qualified dependents

Generally, dependents must satisfy the IRS deinition of Qualifying Child or Qualifying Relative as of the end of the calendar year in which expenses were incurred to be eligible for beneits. These requirements are deined by Internal Revenue Code § 152 and described in IRS Publication 502. These deinitions supersede and may differ from state deinitions. Go to veba.org for more information.

Qualifying Child. A qualifying child is an individual who is your son or daughter and has not attained age 27 as of the end of the taxable year; or: (1) is your stepchild, foster child, brother, sister, stepbrother, stepsister, or a descendant of any of them (for example, your grandchild, niece, or nephew); and (2) at the end of the calendar year in which expenses were incurred will be (a) under age 19, or (b) under age 24 and a full-time student, or (c) permanently and totally disabled; and (3) is younger than you; and (4) is unmarried; and (5) lives with you for more than half the year; and (6) does not provide more than half of his or her own support; and (7) is a citizen, national, or resident of the U.S. or a resident of Canada or Mexico.

Qualifying Relative. A qualifying relative is a person who: (1) is your (a) son, daughter, stepchild, foster child, or a descendant of any of them (e.g. your grandchild); or (b) brother, sister, or a son or daughter of either of them; or (c) father, mother, or an ancestor or sibling of either of them (for example, your grandmother, grandfather, aunt, or uncle); or (d) stepbrother, stepsister, stepfather, stepmother, son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, or sister-in-law; or (e) any other person (other than your spouse) who lived with you all year as a member of your household; and (2) will not be a qualifying child of any other person as of the last day of the calendar year in which expenses were incurred; and (3) does not provide more than half of his or her own support; and (4) is a citizen, national, or resident of the U.S. or a resident of Canada or Mexico.