You can fill out Form W 2As effortlessly with our PDFinity® online PDF tool. To make our tool better and less complicated to use, we continuously design new features, taking into account feedback from our users. With just several basic steps, you'll be able to begin your PDF editing:

Step 1: Simply click the "Get Form Button" in the top section of this webpage to launch our pdf editing tool. Here you will find all that is required to fill out your file.

Step 2: As soon as you open the PDF editor, you will get the form prepared to be filled out. Apart from filling in different blanks, you may as well do some other things with the file, that is putting on your own textual content, changing the initial text, adding illustrations or photos, signing the form, and much more.

This PDF form will need you to enter some specific details; in order to guarantee consistency, please bear in mind the guidelines further down:

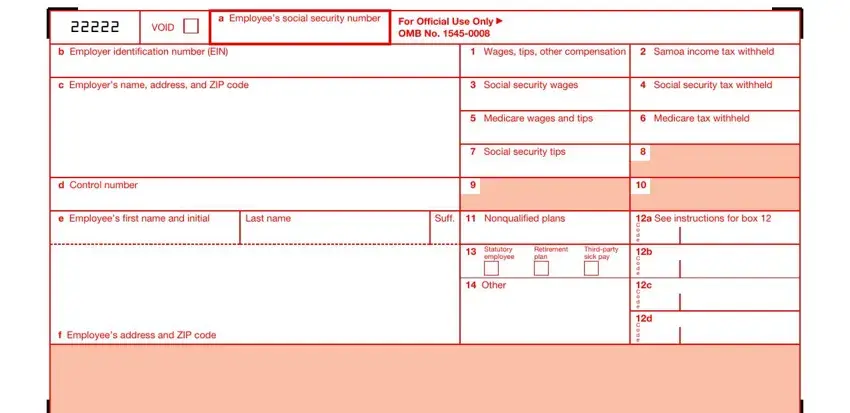

1. Begin filling out your Form W 2As with a group of major blanks. Consider all the required information and make certain there is nothing neglected!

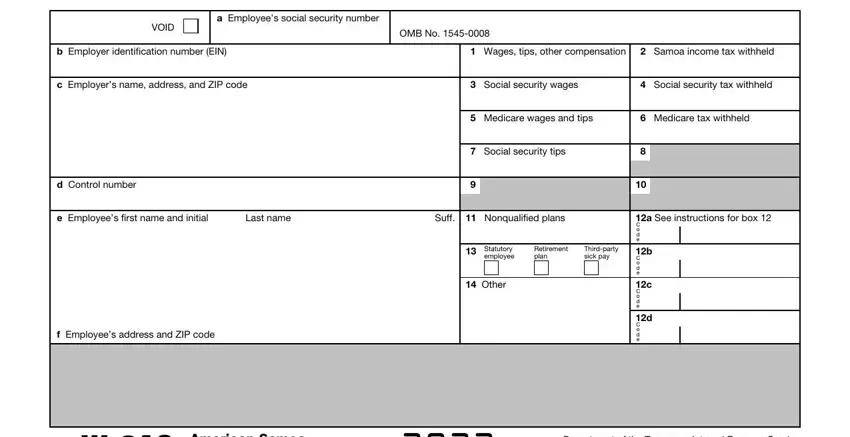

2. Given that this section is done, it's time to add the necessary details in VOID, a Employees social security number, OMB No, b Employer identification number, Wages tips other compensation, Samoa income tax withheld, c Employers name address and ZIP, Social security wages, Social security tax withheld, Medicare wages and tips, Medicare tax withheld, d Control number, Social security tips, e Employees first name and initial, and Last name in order to progress to the third stage.

People who use this form generally make mistakes when completing Medicare wages and tips in this area. You should definitely reread what you type in right here.

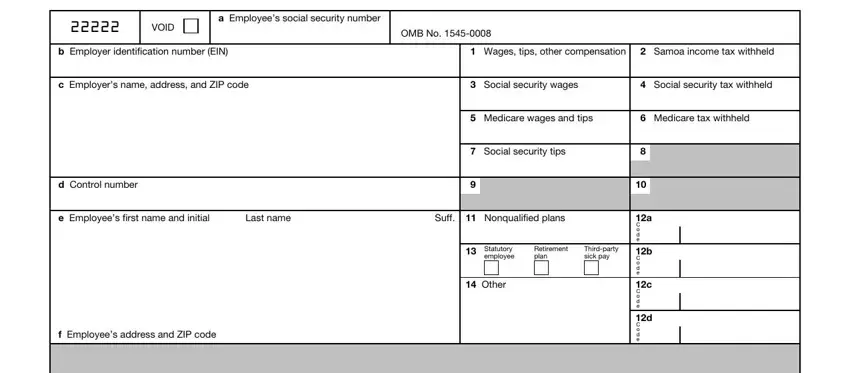

3. Completing a Employees social security number, OMB No, b Employer identification number, Wages tips other compensation, Samoa income tax withheld, c Employers name address and ZIP, Social security wages, Social security tax withheld, d Control number, Medicare wages and tips, Medicare tax withheld, Social security tips, e Employees first name and initial, Last name, and Suff is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

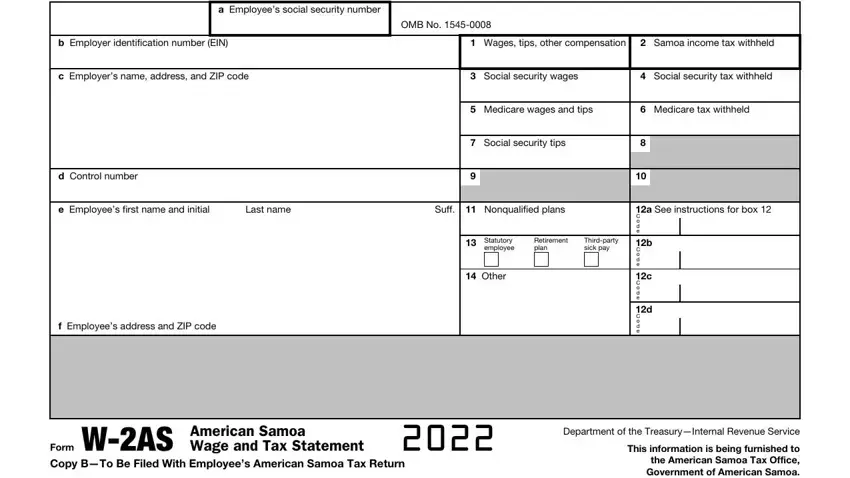

4. You're ready to begin working on this next portion! In this case you have these a Employees social security number, OMB No, b Employer identification number, Wages tips other compensation, Samoa income tax withheld, c Employers name address and ZIP, Social security wages, Social security tax withheld, d Control number, Medicare wages and tips, Medicare tax withheld, Social security tips, e Employees first name and initial, Last name, and Suff blanks to do.

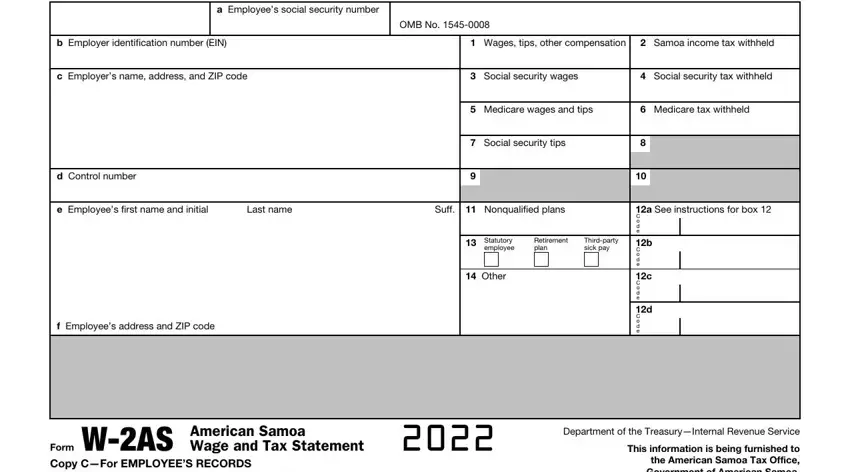

5. As a final point, the following last subsection is what you have to finish prior to submitting the PDF. The blank fields under consideration are the following: VOID, a Employees social security number, OMB No, b Employer identification number, Wages tips other compensation, Samoa income tax withheld, c Employers name address and ZIP, Social security wages, Social security tax withheld, d Control number, Medicare wages and tips, Medicare tax withheld, Social security tips, e Employees first name and initial, and Last name.

Step 3: When you have reviewed the information provided, simply click "Done" to finalize your form at FormsPal. Sign up with FormsPal now and instantly get access to Form W 2As, ready for downloading. Each and every modification you make is conveniently saved , which enables you to customize the file later as needed. Here at FormsPal.com, we aim to be certain that your information is kept private.