Handling PDF files online can be a breeze with our PDF editor. Anyone can fill in Form W 3Pr here effortlessly. To retain our tool on the leading edge of efficiency, we work to implement user-driven capabilities and enhancements on a regular basis. We're always looking for suggestions - assist us with remolding the way you work with PDF forms. With a few basic steps, it is possible to start your PDF editing:

Step 1: Just click the "Get Form Button" at the top of this page to access our pdf form editor. This way, you'll find everything that is necessary to work with your file.

Step 2: The tool lets you customize nearly all PDF forms in a range of ways. Transform it by adding any text, correct what's originally in the file, and place in a signature - all readily available!

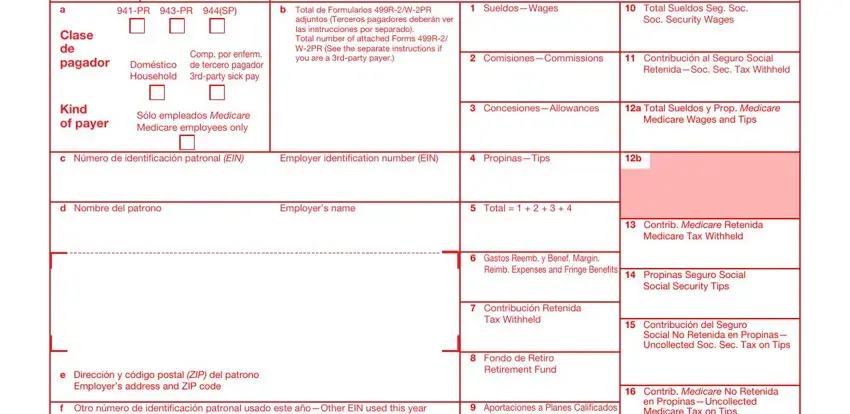

This PDF form requires particular data to be filled out, thus you should take some time to fill in precisely what is asked:

1. It's very important to complete the Form W 3Pr accurately, thus pay close attention while filling out the sections including all these blank fields:

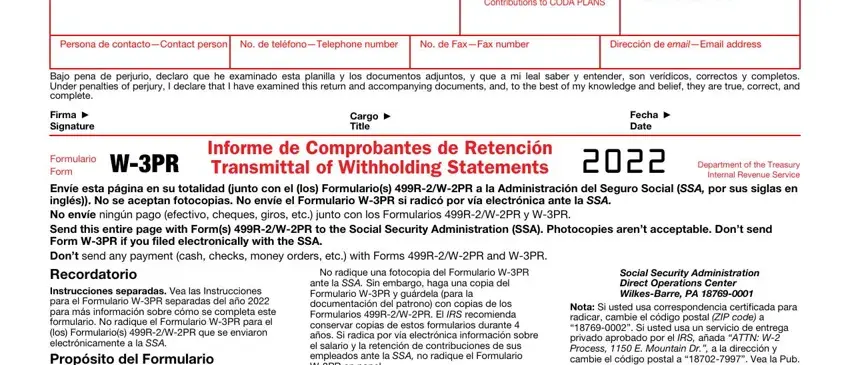

2. The next part is to fill out the next few blanks: Contributions to CODA PLANS, en PropinasUncollected Medicare, Persona de contactoContact person, No de FaxFax number, Dirección de emailEmail address, Bajo pena de perjurio declaro que, Firma Signature, Cargo Title, Fecha Date, Formulario, Form WPR, Informe de Comprobantes de, Internal Revenue Service Envíe, Recordatorio Instrucciones, and No radique una fotocopia del.

As for Informe de Comprobantes de and No de FaxFax number, be sure that you review things in this current part. These are viewed as the most important ones in the PDF.

Step 3: Before addressing the next step, you should make sure that blank fields are filled out the proper way. The moment you are satisfied with it, press “Done." Right after starting a7-day free trial account at FormsPal, you'll be able to download Form W 3Pr or email it immediately. The file will also be available via your personal account page with all of your changes. Here at FormsPal, we do our utmost to ensure that all your details are stored secure.