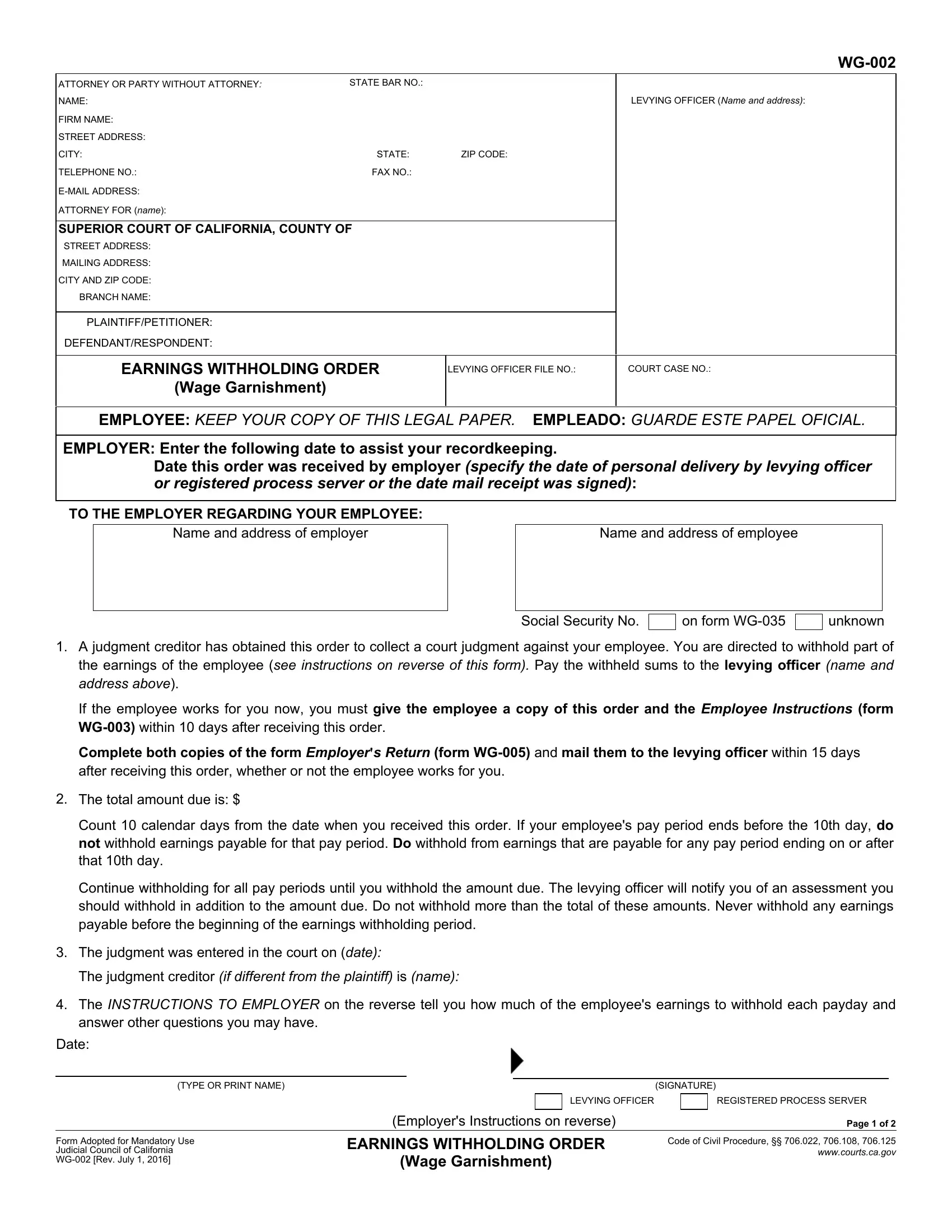

The instructions in paragraph 1 on the reverse of this form describe your early duties to provide information to your employee and the levying officer.

Your other duties are TO WITHHOLD THE CORRECT AMOUNT OF EARNINGS (if any) and PAY IT TO THE LEVYING OFFICER during the withholding period.

The withholding period is the period covered by the Earnings With- holding Order (this order). The withholding period begins 10 calendar days after you receive the order and continues until the total amount due, plus additional amounts for costs and interest (which will be listed in a levying officer's notice), is withheld.

It may end sooner if (1) you receive a written notice signed by the levying officer specifying an earlier termination date, or (2) an order of higher priority (explained on the reverse of the Employer's Return (form WG-005) is received.

You are entitled to rely on and must obey all written notices signed by the levying officer.

The Employer's Return (form WG-005) describes several situations that could affect the withholding period for this order. If you receive more than one Earnings Withholding Order during a withholding period, review that form (Employer's Return) for instructions.

If the employee stops working for you, the Earnings Withholding Order ends after no amounts are withheld for a continuous 180-day period. If withholding ends because the earnings are subject to an order of higher priority, the Earnings Withholding Order ends after a continuous two-year period during which no amounts are withheld under the order. Return the

Earnings Withholding Order to the levying officer with a statement of the reason it is being returned.

WHAT TO DO WITH THE MONEY

The amounts withheld during the withholding period must be paid to the levying officer by the 15th of the next month after each payday. If you wish to pay more frequently than monthly, each payment must be made within 10 days after the close of the pay period.

Be sure to mark each check with the case number, the levying officer's file number, if different, and the employee's name so the money will be applied to the correct account.

WHAT IF YOU STILL HAVE QUESTIONS?

The garnishment law is contained in the Code of Civil Procedure beginning with section 706.010. Sections 706.022, 706.025, 706.050, and 706.104 explain the employer's duties.

The Federal Wage Garnishment Law and federal rules provide the basic protections on which the California law is based. Inquiries about the federal law will be answered by mail, telephone, or personal interview at any office of the Wage and Hour Division of the U.S. Department of Labor. Offices are listed in the telephone directory under the U.S. Department of Labor in the U.S. Government listing.

COMPUTATION INSTRUCTIONS

California law provides how much earnings to withhold, if any, for different amounts of disposable earnings and different pay periods, and takes into consideration different minimum wage amounts. The method of calculation is at Code of Civil Procedure section 706.050 and is described in the column to the right. You may also look on the California Courts Self-Help website for assistance in determining the maximum withholding amounts for different amounts of disposable income, for different pay periods, and with different minimum wage amounts. The information is at www.courts.ca.gov/self-help-employerwagecivil.htm.

THESE COMPUTATION INSTRUCTIONS APPLY UNDER NORMAL CIRCUMSTANCES. THEY DO NOT APPLY TO ORDERS FOR THE SUPPORT OF A SPOUSE, FORMER SPOUSE, OR CHILD.

State law limits the amount of earnings that can be withheld. The limitations are based on the employee's disposable earnings, which are different from gross pay or take-home pay.

(A)To determine the CORRECT AMOUNT OF EARNINGS TO BE WITH- HELD (if any), first compute the employee's disposable earnings.

Earnings include any money (whether called wages, salary, commissions, bonuses, or anything else) that is paid by an employer to an employee for personal services. Vacation or sick pay is subject to withholding as it is received by the employee. Tips are generally not included as earnings because they are not paid by the employer.

Disposable earnings are the earnings left after subtracting the part of the earnings a state or federal law requires an employer to withhold. Generally these required deductions are (1) federal income tax, (2) federal social security, (3) state income tax, (4) state disability insurance, and

(5)payments to public employee retirement systems. Disposable earnings will change when the required deductions change.

(B)After the employee's disposable earnings are known, to determine what amount should be withheld, you may look to the statute, follow the directions below in (C), or seek assistance on the California Courts Self- Help website at www.courts.ca.gov/self-help-employerwagecivil.htm. Note that you also need to know the amount of the minimum wage in the location where the employee works.

(C)Calculate the maximum amount that may be withheld from the employee's disposable earnings, which is the lesser of the following two amounts:

∙25 percent of disposable earnings for that week; or

∙50 percent of the amount by which the employee's disposable earnings that week exceed the applicable minimum wage. If there is a local minimum wage in effect in the location where the employee works that exceeds the state minimum wage at the time the earnings are payable, the local minimum wage is the applicable minimum wage.

To calculate the correct amount, follow the steps below:

Step 1: Determine the applicable minimum wage per pay period.

∙For a daily or weekly pay period, multiply the applicable hourly minimum wage by 40.

∙For a biweekly pay period, multiply the applicable hourly minimum wage by 80.

∙For a semimonthly pay period, multiply the applicable hourly minimum wage by 86 2/3.

∙For a monthly pay period, multiply the applicable hourly minimum wage by 173 1/3.

Step 2: Subtract the amount from Step 1 from the employee's disposable earnings during that pay period.

Step 3: If the amount from Step 2 is less than zero, do not withhold any money from the employee's earnings.

Step 4: If the amount from Step 2 is greater than zero, multiply that amount by one-half.

Step 5: If the amount from Step 4 is lower than 25 percent of the employee's disposable earnings, withhold this amount. If it is greater than 25 percent of the employee's disposable earnings, withhold 25 percent of the disposable earnings.

Occasionally, the employee's earnings will also be subject to a Wage and Earnings Assignment Order, an order available from family law courts for child, spousal, or family support. The amount required to be withheld for that order should be deducted from the amount to be withheld for this order.