It is possible to fill out or wr instantly with the help of our online editor for PDFs. Our team is constantly endeavoring to improve the editor and ensure it is even easier for clients with its multiple features. Make use of today's innovative opportunities, and discover a trove of new experiences! This is what you will need to do to start:

Step 1: Firstly, access the pdf editor by clicking the "Get Form Button" above on this page.

Step 2: The tool will let you work with PDF files in many different ways. Improve it by writing customized text, adjust existing content, and put in a signature - all close at hand!

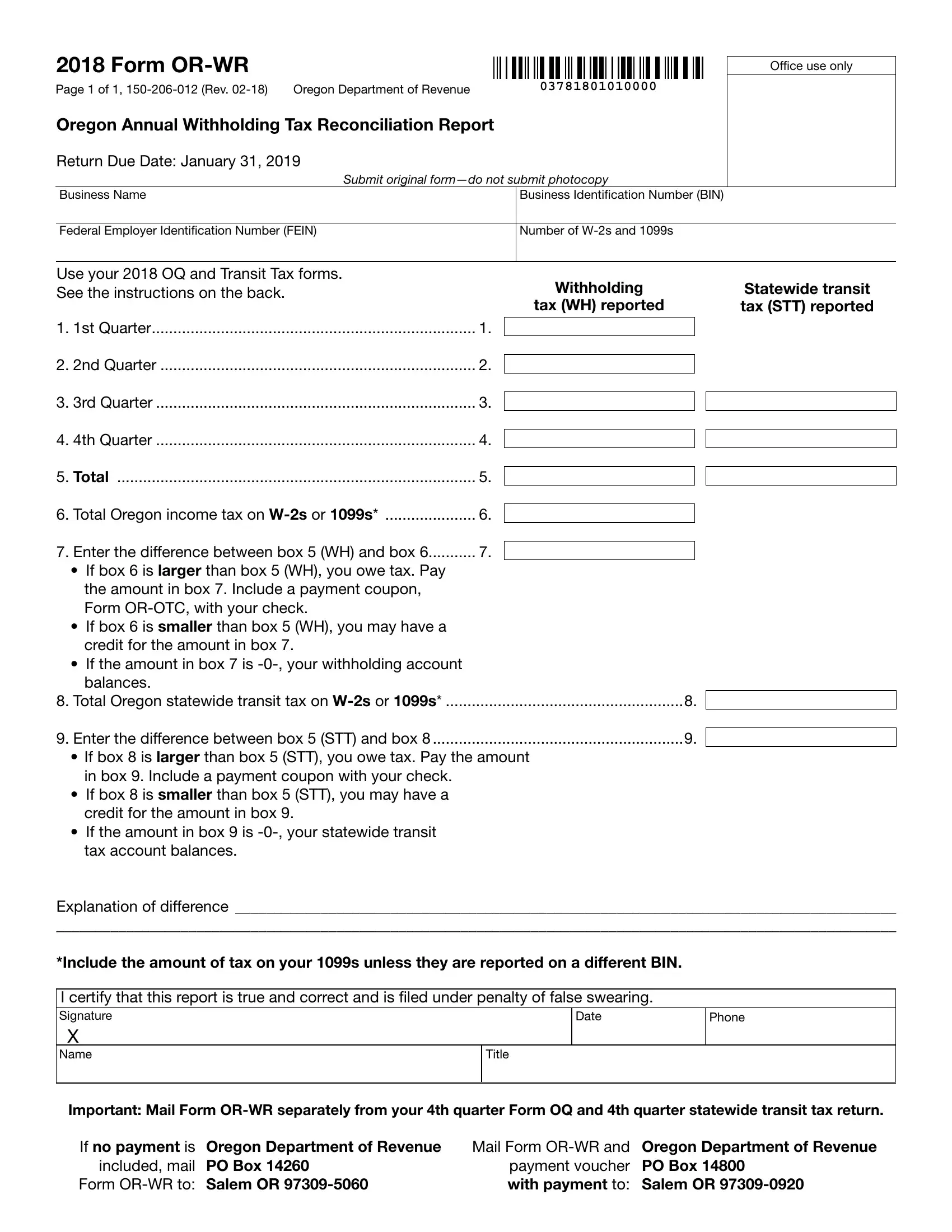

Filling out this PDF needs attention to detail. Make certain all necessary blank fields are completed correctly.

1. Start completing your or wr with a group of essential fields. Consider all of the required information and make sure there is nothing overlooked!

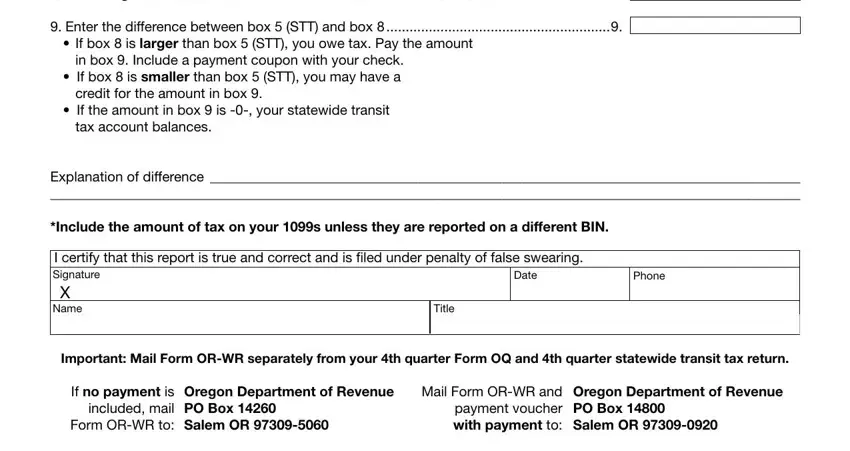

2. Given that the last part is done, you need to put in the required particulars in Total Oregon statewide transit, Enter the difference between box, If box is larger than box STT, in box Include a payment coupon, credit for the amount in box, If the amount in box is your, tax account balances, Explanation of difference, Include the amount of tax on your, I certify that this report is true, Date, Title, Phone, Important Mail Form ORWR, and If no payment is included mail so that you can progress further.

As to Explanation of difference and Date, make certain you take a second look here. These two are definitely the most important fields in the file.

Step 3: Immediately after taking another look at your fields and details, press "Done" and you're good to go! Right after creating a7-day free trial account with us, you will be able to download or wr or send it through email directly. The PDF form will also be at your disposal in your personal cabinet with your every single modification. Whenever you work with FormsPal, you'll be able to complete forms without being concerned about information incidents or data entries being shared. Our protected software helps to ensure that your private data is stored safely.