Navigating the requirements for nonresident entertainers performing in Wisconsin involves understanding the essentials of the Form WT-11, also known as the Nonresident Entertainer’s Report. This form plays a critical role in ensuring that entertainers, who do not reside in Wisconsin, comply with the state's tax obligations related to their performance earnings. It requires detailed information about the entertainer, including legal name, stage or professional name, social security or federal ID number, and the entity type under which they operate—options include Sole Proprietor, Limited Liability Company (LLC), Partnership, C Corporation, or S Corporation, with specific designations for LLCs based on tax treatment. The form also mandates details about the entertainment entity hiring the nonresident performer, performance specifics such as date and location, and financial aspects including the contract price and applicable withholding rate. The obligation extends to submitting a copy to the Wisconsin Department of Revenue along with the proper payment or surety bond, while also keeping records for all parties involved. The completion and accurate submission of this form ensure legal compliance, illustrating the interplay between performance art and state tax regulations, central to maintaining the integrity of both the entertainment and fiscal domains in Wisconsin.

| Question | Answer |

|---|---|

| Form Name | Form Wt 11 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | W-011, wt11 wisconsin form, surety, WT-11 |

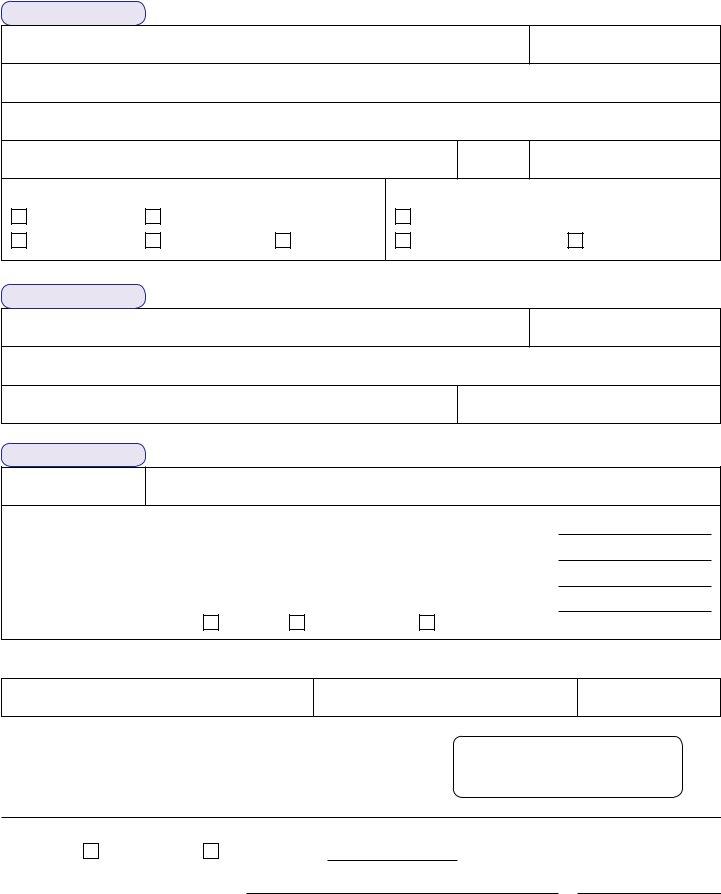

Form

Nonresident Entertainer’s Report

ENTERTAINER

Legal name of entertainer performing in Wisconsin

Entertainer’s Federal ID Number or SSN

Stage or professional name of nonresident entertainer

Address

City

State

Zip Code

Entertainer’s Entity Type (check one)

Sole Proprietor |

Limited Liability Company (LLC) |

|

Partnership |

C Corporation |

S Corporation |

If LLC is checked, indicate type

Disregarded (single member LLC only)

Taxed as Corporation |

Taxed as Partnership |

EMPLOYER

Name

Address

City

Telephone Number

()

State |

Zip Code |

|

|

PERFORMANCE

Date of Performance

Location of Performance

1. |

Total contract price |

. . . . . . . . . . . |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . 1 |

2. |

If lower rate was not granted, enter 6% (.06) . |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . 2 |

|

3. |

If lower rate was granted, indicate the percentage granted . |

. . . . . . . . . . . . . . . . . . 3 |

||

4. |

Multiply Line 1 by Line 2 or Line 3, whichever is applicable. |

Enter on Line 4 . . . . . 4 |

||

|

Amount of (check one): |

bond |

cash deposit |

withholding |

I declare that this report is true, correct and complete to the best of my knowledge and belief.

Signature

Title

Date

•Submit one copy to Wisconsin Department of Revenue with payment or surety bond.

•Print one copy for nonresident entertainer.

•Retain one copy for your records.

Wisconsin Department of Revenue PO Box 8966

Madison WI

This space for Department use only

Receipt for:

Surety Bond

Cash Deposit $

Department Representative |

Date |