Should you would like to fill out EI, you won't need to download and install any kind of applications - just try using our PDF editor. To maintain our tool on the leading edge of efficiency, we work to integrate user-oriented capabilities and enhancements on a regular basis. We're always looking for suggestions - play a pivotal role in revampimg how we work with PDF forms. Here's what you would want to do to get started:

Step 1: Just press the "Get Form Button" at the top of this page to see our form editor. Here you will find everything that is needed to fill out your file.

Step 2: As soon as you launch the tool, you will notice the document all set to be filled out. Aside from filling out various fields, you could also perform several other things with the file, that is adding your own words, changing the initial textual content, inserting graphics, affixing your signature to the document, and much more.

Be attentive when filling out this form. Make sure that all mandatory fields are filled in properly.

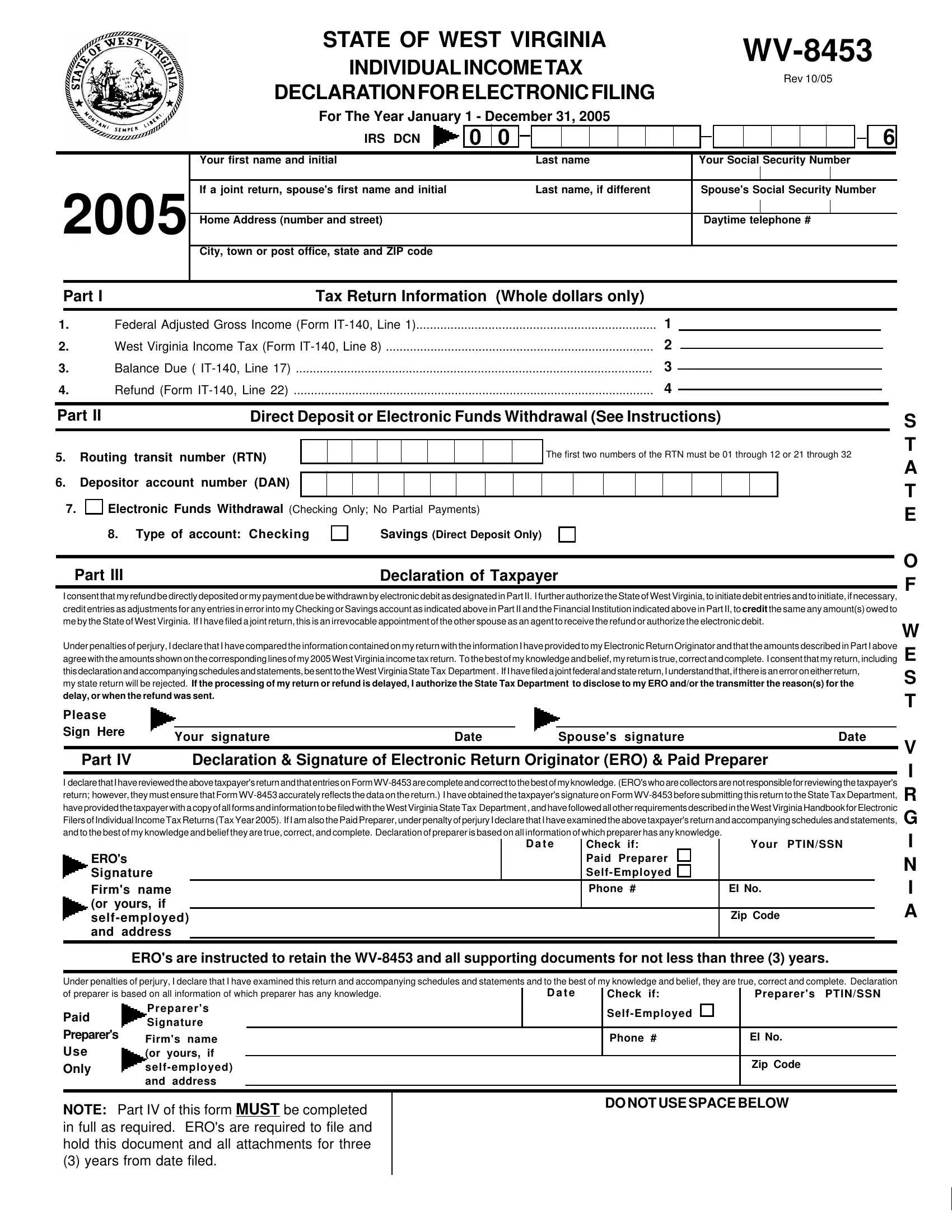

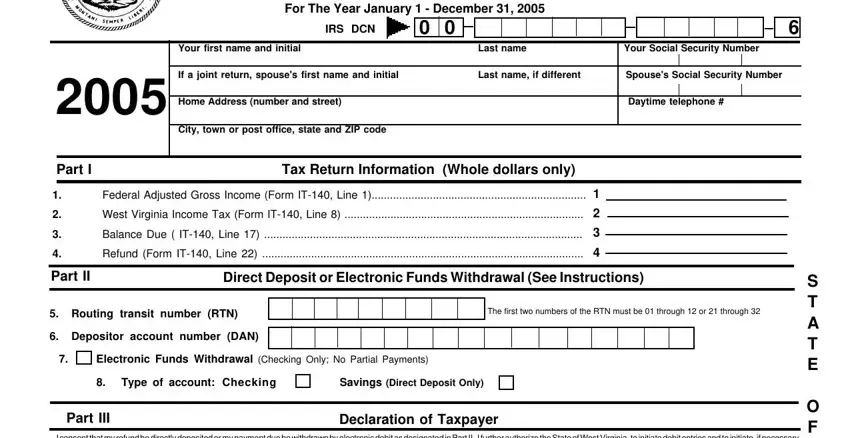

1. Start completing the EI with a selection of major blank fields. Collect all the required information and make sure nothing is omitted!

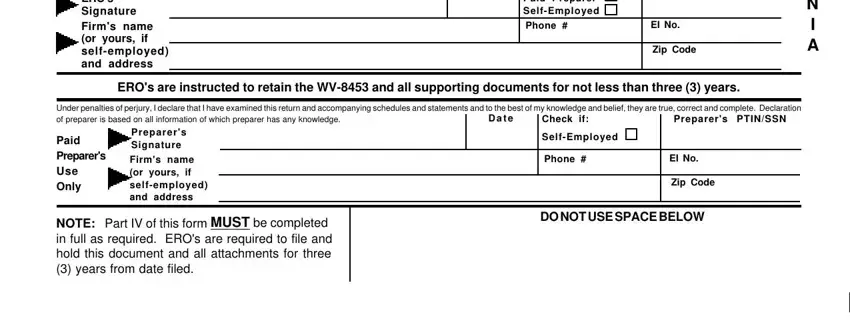

2. The third step is to fill out all of the following blanks: EROs Signature Firms name or yours, Check if Paid Preparer SelfEmployed, Phone, EI No, Zip Code, EROs are instructed to retain the, V I R G I N I A, Under penalties of perjury I, Preparers PTINSSN, D a t e, Check if, Paid Preparers Use Only, Preparers Signature, Firms name or yours if, and NOTE Part IV of this form MUST be.

Many people generally make some mistakes when filling out Check if Paid Preparer SelfEmployed in this part. You should reread what you type in right here.

Step 3: Revise the details you have inserted in the blanks and then click on the "Done" button. Grab the EI once you join for a 7-day free trial. Quickly gain access to the pdf form in your FormsPal account page, along with any modifications and changes being conveniently saved! At FormsPal, we do our utmost to make sure that your details are stored protected.