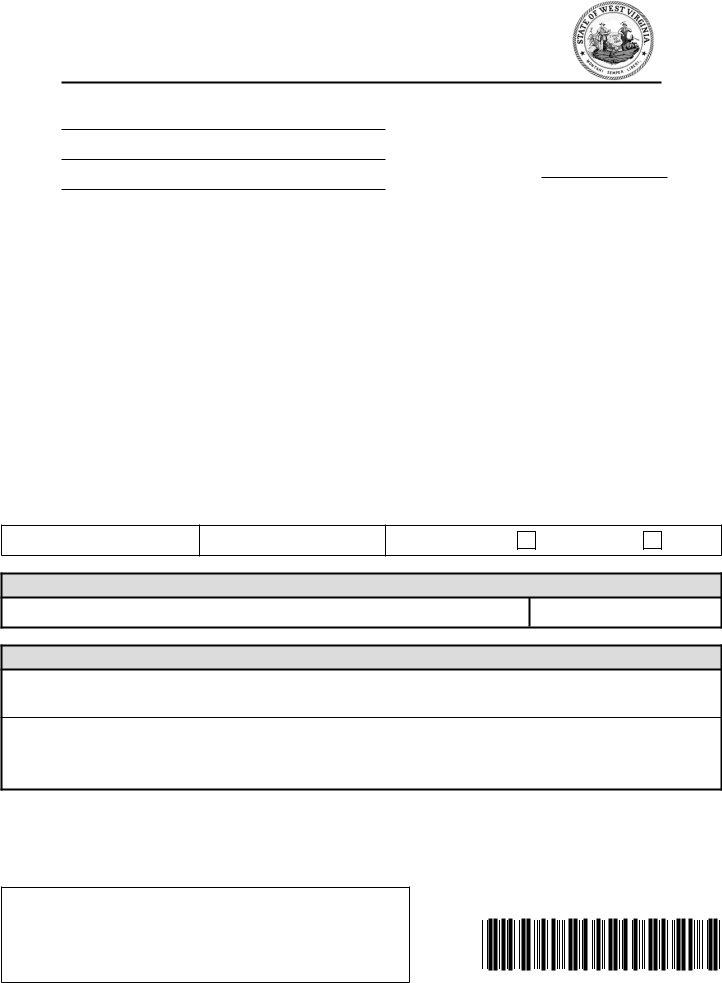

In West Virginia, licensed farm wineries are required to meticulously report their wine production to the State Tax Department through the WV FRM-01 form. The regulations, part of the West Virginia Legislative Regulations Title 175, Series 3-4.11, mandate the submission of a comprehensive production report for both the twelve-month period ending June 30 of each year and any partial year within 30 days after such fiscal year concludes. This report can also be submitted monthly for the convenience of the wineries. The redesigned FRM-01 form, which now needs to be used to avoid processing delays, highlights not just the total gallonage of wine produced through fermentation but also aligns with the requirements set out in the ATF Form 702, Part 1, Line 2. It is important for filers to ensure the accurate and complete sign-off of the form under penalty of perjury, including a space for both the taxpayer and, if applicable, a preparer other than the taxpayer to sign. This form serves a critical role in maintaining transparent and accurate records of wine production within the state, offering both the state and the wineries themselves a reliable audit trail and operational data. For those seeking assistance, the form specifies contact details, including a physical mailing address, phone numbers, and an online portal for both information and submission, emphasizing the importance of compliance and the resources available to ensure it is met.

| Question | Answer |

|---|---|

| Form Name | Form Wv Frm 01 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | frm01 frm01 form |

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 2991

Charleston, WV

Earl Ray Tomblin, Governor |

Craig A. Griffith, Tax Commissioner |

Name

Address

Account #:

City |

State |

Zip |

WEST VIRGINIA LICENSED FARM WINERIES PRODUCTION REPORT

NOTE: This return has been redesigned. To avoid delays in the processing of this return, DO NOT use any older forms you may have. For information regarding the State Tax Department’s new computer system, visit our website at www.wvtax.gov

This report must be filed even if no activity has occurred

West Virginia Legislative Regulations, Title 175, Series 3

(12)month period ending June 30 of each year or partial year. Such report shall be submitted by letter report within thirty (30) days after the end of such fiscal year."

For your convenience, the information may be reported monthly. Information contained on this form should show the same quantities as ATF Form 702, Part 1, Line 2.

Period Ending:

Due Date:

FINAL

AMENDED

TOTAL PRODUCTION

GALLONS OF WINE PRODUCED BY FERMENTATION

.

Sign Your Return

Under penalties of perjury, I declare that I have examined this return (including accompanying schedules and statements) and to the best of my knowledge and belief it is true and complete.

(Signature of Taxpayer) |

(Name of Taxpayer - Type or Print) |

(Title) |

(Date) |

|

|

|

|

(Person to Contact Concerning this Return) |

(Telephone Number) |

|

|

|

|

|

|

(Signature of preparer other than taxpayer) |

(Address) |

|

(Date) |

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT |

|

|

|

|

|

|

|

|

|

|

Tax Account Administration Div |

|

|

|

|

|

|

|

|

|

|

P.O. Box 2991, Charleston, WV |

|

|

|

|

|

|

|

|

|

|

FOR ASSISTANCE CALL (304) |

|

|

|

|

|

|

|

|

|

|

For more information visit our web site at: www.wvtax.gov |

|

|

|

|

|

|

|

|

|

|

File online at https://mytaxes.wvtax.gov |

O |

3 |

5 |

0 |

2 |

0 |

9 |

0 |

1 |

W |

|