FS Form 5336 (Revised November 2021) |

OMB No. 1530-0055 |

Disposition of Treasury Securities Belonging to a

Decedent’s Estate Being Settled Without Administration

IMPORTANT: Follow instructions in filling out this form. Making any false, fictitious, or fraudulent claim or statement to the United States is a crime and may be prosecuted. Print in ink or type all information.

A person applying to act as voluntary representative of a decedent’s estate that is not being administered uses this form 1) to apply to act as voluntary representative, and 2) to request disposition of United States Treasury Securities and/or related payments belonging to the estate. See the instructions for the definition of a voluntary representative.

•ALL securities belonging to the decedent’s estate must be included in this transaction.

•If the decedent’s securities and/or related payments are worth over $100,000 redemption and/or par value as of the date of death, Treasury regulations require that the estate be administered through the court; in that event, this form may not be used.

•We will recognize only ONE voluntary representative to act at any time on behalf of the decedent's estate.

•You cannot use this form to distribute bonds or to make payment to a trust.

NOTE: When we reissue Series EE or Series I savings bonds, we no longer provide paper bonds. The reissued bonds are in electronic form, in our online system TreasuryDirect. For information on opening an account in TreasuryDirect, go to www.treasurydirect.gov

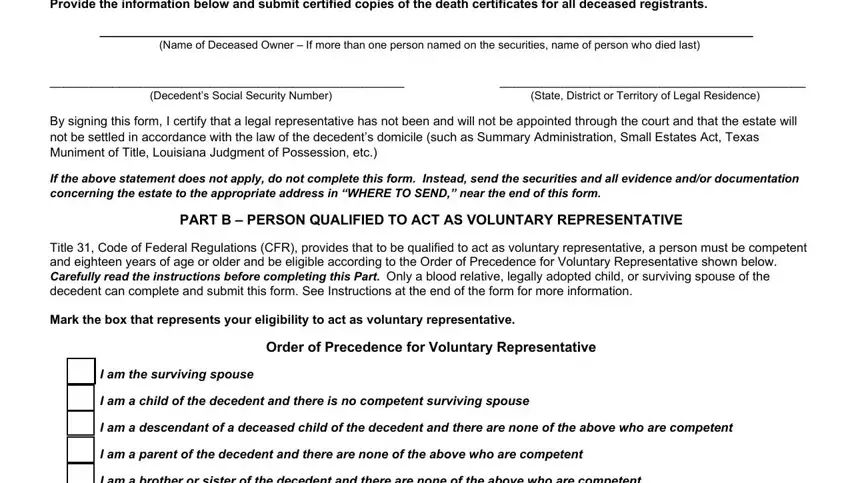

PART A – ESTATE INFORMATION

Provide the information below and submit certified copies of the death certificates for all deceased registrants.

______________________________________________________________________________________________

(Name of Deceased Owner – If more than one person named on the securities, name of person who died last)

___________________________________________________ |

____________________________________________ |

(Decedent’s Social Security Number) |

(State, District or Territory of Legal Residence) |

By signing this form, I certify that a legal representative has not been and will not be appointed through the court and that the estate will not be settled in accordance with the law of the decedent’s domicile (such as Summary Administration, Small Estates Act, Texas Muniment of Title, Louisiana Judgment of Possession, etc.)

If the above statement does not apply, do not complete this form. Instead, send the securities and all evidence and/or documentation concerning the estate to the appropriate address in “WHERE TO SEND,” near the end of this form.

PART B – PERSON QUALIFIED TO ACT AS VOLUNTARY REPRESENTATIVE

Title 31, Code of Federal Regulations (CFR), provides that to be qualified to act as voluntary representative, a person must be competent and eighteen years of age or older and be eligible according to the Order of Precedence for Voluntary Representative shown below. Carefully read the instructions before completing this Part. Only a blood relative, legally adopted child, or surviving spouse of the decedent can complete and submit this form. See Instructions at the end of the form for more information.

Mark the box that represents your eligibility to act as voluntary representative.

Order of Precedence for Voluntary Representative

I am the surviving spouse

I am a child of the decedent and there is no competent surviving spouse

I am a descendant of a deceased child of the decedent and there are none of the above who are competent I am a parent of the decedent and there are none of the above who are competent

I am a brother or sister of the decedent and there are none of the above who are competent

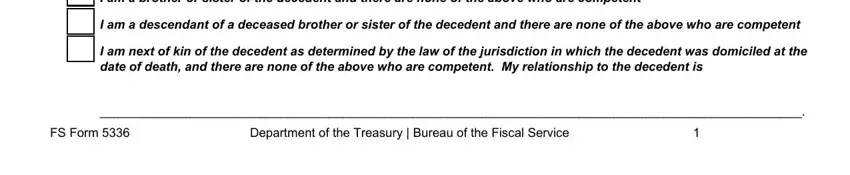

I am a descendant of a deceased brother or sister of the decedent and there are none of the above who are competent

I am next of kin of the decedent as determined by the law of the jurisdiction in which the decedent was domiciled at the date of death, and there are none of the above who are competent. My relationship to the decedent is

_____________________________________________________________________________________________________.

FS Form 5336 |

Department of the Treasury | Bureau of the Fiscal Service |

1 |

PART C – TYPE OF DISPOSITION

Title 31, Code of Federal Regulations (CFR), provides that as voluntary representative, you may make a request from the following (mark the appropriate box or boxes):

Payment to myself as voluntary representative on behalf of all persons entitled to share in the decedent’s estate (except for unmatured marketable securities). (Continue to Part D. or check the next box also if unmatured marketable securities are included.)

Transfer of unmatured marketable securities to a financial institution, broker, or dealer account in MY name to be sold on behalf of all persons entitled. (Check the previous box also if savings bonds and/or matured marketable securities are included.) (Skip to

Part E.)

Distribution of securities and/or related payments to the persons entitled according to the law of the jurisdiction in which the decedent was domiciled at the date of death. (If this box is checked, the other two cannot be checked.) (Skip to Part F.)

PART D – PAYMENT TO VOLUNTARY REPRESENTATIVE

I request that payment of the savings bonds or matured Treasury bills, notes, bonds, TIPS or Floating Rate Notes and/or related payments be made to me as voluntary representative. (If you have unmatured marketable securities, use Part E.)

1. Pay to: ___________________________________________________________ |

____________________________________ |

(Name) |

(Social Security Number) |

___________________________________________________________ |

____________________________________ |

(Mailing Address) |

(E-Mail Address) |

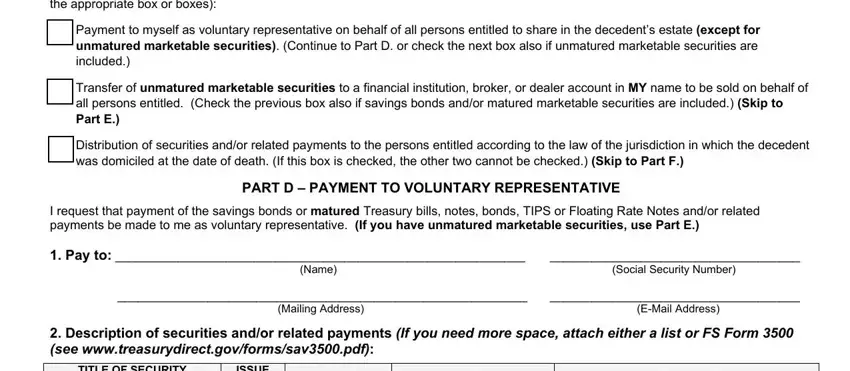

2.Description of securities and/or related payments (If you need more space, attach either a list or FS Form 3500 (see www.treasurydirect.gov/forms/sav3500.pdf):

TITLE OF SECURITY

(See page 7 for examples)

3. Payment information

Payment for savings bonds (paper or electronic) and matured electronic marketable securities will be made by direct deposit. Below, please identify the account where you want your payment for these securities.

For information on payment of paper marketable securities, see the Instructions.

________________________________________________________________________________________

(Name/Names on the Account) |

|

|

|

|

|

Bank Routing No. (nine digits, and begins with 0, 1, 2, or 3): _______________________________ |

|

_________________________________________ |

Type of Account |

|

Checking |

|

Savings |

|

|

(Depositor’s Account No.) |

|

|

|

|

|

|

|

|

|

|

|

|

___________________________________________________ |

______________________________ |

(Financial Institution’s Name) |

|

|

(Financial Institution’s Phone No.) |

(If you completed Part D to receive payment as voluntary representative, only complete Part E if unmatured marketable securities are

included. Skip Part F, and sign in Part G.)

PART E – TRANSFER TO VOLUNTARY REPRESENTATIVE

Transfer all unmatured marketable securities in the below account(s) to a financial institution, broker, or dealer account in MY name to be

sold on behalf of all persons entitled. |

|

1. Transfer to: _______________________________________________________ |

__________________________________ |

|

(Name) |

(Social Security Number) |

|

_______________________________________________________________________________________________ |

|

(Mailing Address) |

|

FS Form 5336 |

Department of the Treasury | Bureau of the Fiscal Service |

2 |

2. Securities identification:

Account number(s): _______________________________________________________________________________

3. External transfer to a financial institution

NOTE: Failure to provide any of the following information could delay the transfer. See instructions before completing. Routing Number (nine digits, and begins with 0, 1, 2, or 3): _________________________________

Financial Institution Wire Name: ___________________________________________________________________________________

Agent or Broker Name: _______________________________________ Agent or Broker Phone Number: ________________________

Agent or Broker Address: ________________________________________________________________________________________

Special Handling Instructions: _____________________________________________________________________________________

_____________________________________________________________________________________________________________

(If you completed Part E to transfer as voluntary representative, only complete Part D if matured marketable securities and/or

savings bonds are also included. Skip Part F, and sign in Part G.)

PART F – DISTRIBUTION OF SECURITIES AND/OR RELATED PAYMENTS TO PERSON ENTITLED

If a person entitled to paper savings bonds (Series EE, E, I, HH, or H) wants:

•payment, he or she must submit FS Form 1522

•reissue to himself or herself, he or she must submit FS Form 4000

•reissue to a trust, he or she must submit FS Form 1851

A person entitled to electronic securities held in TreasuryDirect must submit FS Form 5511 for transfer or FS Form 5512 for redemption.

For forms, go to www.treasurydirect.gov

NOTE: Savings bonds within one month of final maturity cannot be reissued.

I request that the securities and/or related payments be distributed as follows:

1.Distribute to: ______________________________________________________________________________________________

(Name of first distributee)

_____________________________________________________ |

____________________________________________ |

(Social Security Number) |

(Telephone Number) |

_____________________________________________________ |

____________________________________________ |

(Address) |

(E-mail Address) |

2. Description of securities and/or related payments to go to the first distribute (If you need more space, attach either a list or FS Form 3500 (see www.treasurydirect.gov/forms/sav3500.pdf):

TITLE OF SECURITY

(See page 7 for examples)

NOTE: Individual savings bonds (Series EE, E, I, HH, and H) may not be split. Each savings bond must be distributed, in its entirety, to an entitled individual. Marketable securities may be distributed in full or in increments of $100. Savings bonds issued in electronic form must be at least $25.

If you want to split a marketable security, describe the exact amount of the distribution: ________________________________________

_____________________________________________________________________________________________________________

FS Form 5336 |

Department of the Treasury | Bureau of the Fiscal Service |

3 |

PART F – DISTRIBUTION OF SECURITIES AND/OR RELATED PAYMENTS TO PERSON ENTITLED (Continued)

I request that the securities and/or related payments be distributed as follows:

1.Distribute to: ______________________________________________________________________________________________

(Name of second distributee)

_____________________________________________________ |

____________________________________________ |

(Social Security Number) |

(Telephone Number) |

_____________________________________________________ |

____________________________________________ |

(Address) |

(E-mail Address) |

2.Description of securities and/or related payments to go to the second distribute (If you need more space, attach either a list or FS Form 3500 (see www.treasurydirect.gov/forms/sav3500.pdf):

TITLE OF SECURITY

(See page 7 for examples)

NOTE: Individual savings bonds (Series EE, E, I, HH, and H) may not be split. Each savings bond must be distributed, in its entirety, to an entitled individual. Marketable securities may be distributed in full or in increments of $100. Savings bonds issued in electronic form must be at least $25.

If you want to split a marketable security, describe the exact amount of the distribution: ________________________________________

_____________________________________________________________________________________________________________

========================================================================================================

I request that the securities and/or related payments be distributed as follows:

1.Distribute to: ______________________________________________________________________________________________

(Name of third distributee)

_____________________________________________________ |

____________________________________________ |

(Social Security Number) |

(Telephone Number) |

_____________________________________________________ |

____________________________________________ |

(Address) |

(E-mail Address) |

2.Description of securities and/or related payments to go to the third distribute (If you need more space, attach either a list or FS Form 3500 (see www.treasurydirect.gov/forms/sav3500.pdf):

TITLE OF SECURITY

(See page 7 for examples)

NOTE: Individual savings bonds (Series EE, E, I, HH, and H) may not be split. Each savings bond must be distributed, in its entirety, to an entitled individual. Marketable securities may be distributed in full or in increments of $100. Savings bonds issued in electronic form must be at least $25.

If you want to split a marketable security, describe the exact amount of the distribution: ________________________________________

_____________________________________________________________________________________________________________

FS Form 5336 |

Department of the Treasury | Bureau of the Fiscal Service |

4 |

PART G – SIGNATURE AND CERTIFICATION

I certify under penalty of perjury that the information provided herein is true and correct to the best of my knowledge and belief and that I am eligible to act as voluntary representative. I further certify that I will distribute payment made to me as voluntary representative or that I am distributing the securities and/or related payments to the persons entitled by the law of the jurisdiction in which the decedent was domiciled at the date of death. The United States is not liable to any person for the improper distribution of payments or securities. Upon payment or distribution of the securities at my request as voluntary representative, the United States is released to the same extent as if it had paid or delivered to a representative of the estate appointed pursuant to the law of the jurisdiction in which the decedent was domiciled at the date of death.

I bind myself, my heirs, legatees, successors and assigns, jointly and severally, to hold the United States harmless on account of the transaction requested, to indemnify unconditionally and promptly repay the United States in the event of any loss which results from this request, including interest, administrative costs, and penalties. I consent to the release of any information regarding this transaction, including information contained in this application, to any party having an ownership or entitlement interest in the securities or payments.

Sign in ink in the presence of a certifying officer and provide the requested information, OR

if your transaction is for paper savings bonds only, you can appear before a notary or a certifying officer.

Sign

Here: __________________________________________________________________________________________________

_____________________________________________________ |

______________________________________________ |

(Print Name) |

|

|

(Social Security Number) |

Home Address ________________________________________ |

______________________________________________ |

(Number and Street or Rural Route) |

|

(Daytime Telephone Number) |

_____________________________________________________ |

______________________________________________ |

(City) |

(State) |

(ZIP Code) |

(E-mail Address) |

Instructions to Notary or Certifying Officer: 1. Name(s) of the person(s) who appeared, and date of appearance MUST be completed. 2. Original signature is required if a Medallion stamp is used. 3. Person(s) must sign in your presence. 4. A notary may certify only for a transaction that involves just paper savings bonds.

I CERTIFY that ____________________________________________________________________________ , whose identity(ies)

(Names of Persons Who Appeared)

is/are known or proven to me, personally appeared before me this _________________ day of _______________ |

__________ |

(Month) |

(Year) |

at _________________________________________________________ and signed this form. |

|

(City, State) |

|

________________________________________________________ |

|

(Signature and Title of Notary or Certifying Officer) |

|

________________________________________________________ |

|

(Name of Financial Institution) |

|

________________________________________________________

(Address)

________________________________________________________

(City, State, ZIP code)

SEE INSTRUCTIONS FOR ACCEPTABLE CERTIFICATION

FS Form 5336 |

Department of the Treasury | Bureau of the Fiscal Service |

5 |

INSTRUCTIONS

USE OF FORM – A voluntary representative is a person qualified by the Department of the Treasury to request disposition of United States Treasury Securities (Treasury bills, notes, bonds, TIPS, Floating Rate Notes, Savings Bonds, and Savings Notes) and/or related payments (not exceeding $100,000) that belong to a decedent’s estate if the estate is not being administered through the court. A voluntary representative of the decedent’s estate must complete this form to request:

•Payment on behalf of persons entitled to the estate according to the law of the jurisdiction in which the decedent was domiciled at the date of death.

•Transfer of unmatured marketable securities to a financial institution, broker, or dealer account in the voluntary representative’s name to be sold on behalf of all persons entitled.

•Distribution of the securities to the persons entitled to the estate according to the law of the jurisdiction in which the decedent was domiciled at the date of death.

If you need more space for any item, use a plain sheet of paper or make a photocopy of the relevant section, and attach to the form.

PART A – ESTATE INFORMATION

Provide the requested information regarding the decedent. If more than one deceased person is named on the securities, provide the information for the person who died last. Submit certified copies of the death certificates for all deceased registrants.

Insert the following information:

•Decedent’s name.

•Decedent’s Social Security Number.

•Jurisdiction (state, district, or territory) of decedent’s last legal residence.

By signing this form you certify that the decedent’s estate has not been and will not be administered through a court or settled in accordance with the law of the decedent’s domicile (such as Summary Administration, Small Estates Act, Texas Muniment of Title, Louisiana Judgment of Possession, etc.). If a legal representative has been appointed by the court, if the estate has been administered and is now closed, or if you have a document establishing entitlement to the estate (other than an unprobated will), do not complete this form. Instead, send the securities and all evidence and/or documentation concerning the estate to the appropriate address in “WHERE TO SEND,” near the end of this form. Upon review of the submission, we will provide additional instructions, if necessary.

PART B – PERSON QUALIFIED TO ACT AS VOLUNTARY REPRESENTATIVE

Starting at the top, read down the Order of Precedence until you find the situation that applies to you. Mark the box that represents your eligibility to act as voluntary representative. (If the last box is marked, show your relationship to the decedent.) For example, if the decedent leaves a competent surviving spouse and children (over the age of eighteen), the competent surviving spouse must complete this form. If there is no competent surviving spouse, one of the children (over the age of eighteen) must complete this form.

NOTE: Only a blood relative, legally adopted child, or surviving spouse of the decedent can complete and submit this form. This restriction applies even to a person acting as an attorney-in-fact. The estate may need to be settled in accordance with the laws of the decedent’s domicile (such as Summary Administration, Small Estates Act, Texas Muniment of Title, Louisiana Judgment of Possession, etc.)

NOTE: This form cannot be used to distribute bonds to a trust or to make payment to a trust.

PART C – TYPE OF DISPOSITION

Mark the appropriate box. If you are requesting payment, continue to Part D. If you are requesting distribution, skip Part D.

PART D – PAYMENT TO VOLUNTARY REPRESENTATIVE

Complete this part to receive payment as voluntary representative for savings bonds or matured marketable securities.

A person acting as voluntary representative who receives payment of securities and/or related payments warrants, certifies, and unconditionally guarantees that he or she will make distribution of the proceeds to the persons entitled by the law of the decedent's domicile at the date of death. Payment to a voluntary representative is for the convenience of the United States and does not determine ownership of the securities or their proceeds.

1.Provide your name, Social Security Number, and mailing address.

Note: Your Social Security Number may be used to report all of the interest earned to the Internal Revenue Service for Federal income tax purposes. For Federal income tax information, see IRS Publication 550 or contact the IRS or your tax advisor.

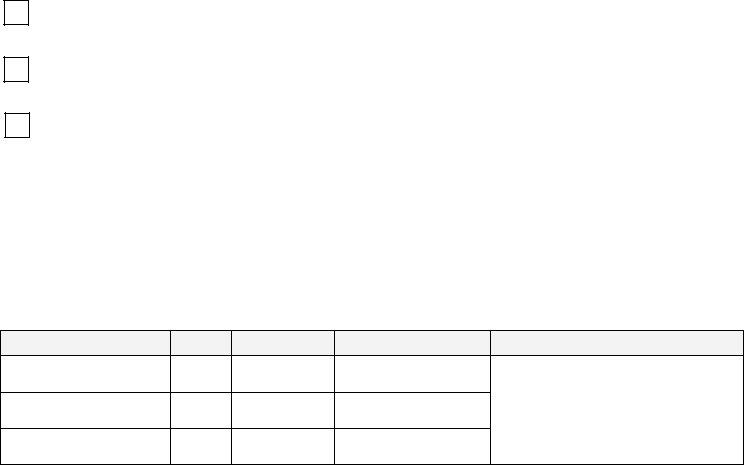

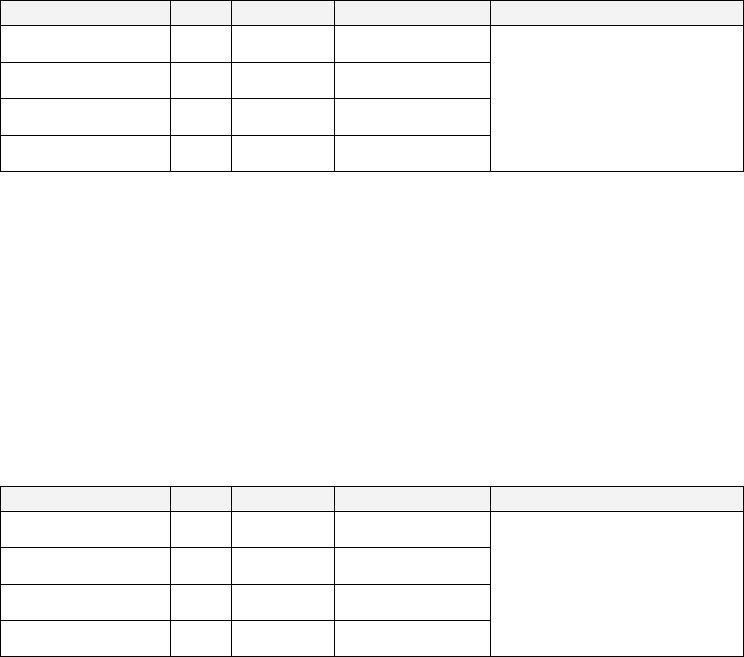

2.Describe the securities and/or checks:

•TITLE OF SECURITY – Identify each security by series, interest rate, type, CUSIP, and call and maturity date, as appropriate. If describing a check, insert the word “check.”

•ISSUE DATE – Provide the issue date of each security or check.

•FACE AMOUNT – Provide the face amount (par or denomination) of each security or check.

•IDENTIFYING NUMBER (if applicable) – Provide the serial number of each security, the confirmation number, or the check number.

FS Form 5336 |

Department of the Treasury | Bureau of the Fiscal Service |

6 |

•REGISTRATION – Provide the registration of each security, check, or account; also provide the account number, if any. Note: If the Taxpayer Identification Number is included in the registration but is masked (i.e. XXX-XX-1234), please be sure to provide the entire number.

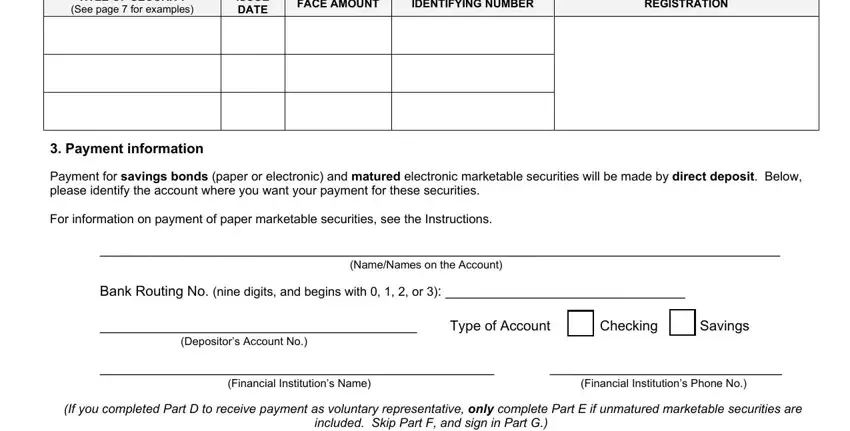

Examples:

|

TITLE OF SECURITY |

|

|

ISSUE |

|

|

FACE AMOUNT |

|

|

IDENTIFYING NUMBER |

|

|

REGISTRATION |

|

|

|

|

DATE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paper Marketable Security |

|

|

|

|

|

|

|

Serial # |

|

|

|

|

9 1/8 % TREASURY BOND OF |

|

|

|

|

|

|

|

|

JOHN DOE AND JANE DOE |

|

5/15/79 |

|

$5,000 |

|

123 |

|

|

|

2004-2009 MATURES 5/15/09 |

|

|

|

|

SSN 222-22-2222 |

|

|

|

|

|

|

|

|

|

|

|

|

CUSIP 912810CG1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electronic Marketable Security |

|

|

|

|

|

|

|

|

|

|

ACCT # 4800-123-1234 |

|

2/5/04 |

|

$1,000 |

|

|

|

|

|

JOHN DOE |

|

CUSIP 912795QW4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN 222-22-2222 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electronic Series I Savings Bond |

1/1/02 |

|

$100 |

|

|

Confirmation # |

|

ACCT # N-111-111-111 |

|

|

|

|

IAAAA |

|

|

SERIES I |

|

|

|

|

JOHN DOE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paper Series EE Savings Bond |

|

|

|

|

|

|

|

Serial # |

|

SSN 222-22-2222 |

|

7/99 |

|

$100 |

|

|

C-123,456,789-EE |

|

JOHN DOE |

|

SERIES EE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OR JANE DOE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check |

7/26/04 |

|

$351.02 |

|

|

Check # |

|

JOHN DOE |

|

CHECK |

|

|

502123456 |

|

|

|

|

|

|

|

|

|

|

|

|

|

If unsure what to provide in each of the areas, furnish all identifying information in the space for REGISTRATION.

3.Payment for savings bonds (paper or electronic) and matured electronic marketable securities will be made by direct deposit. To receive payment for these securities, please provide the requested information. If you don’t know the routing number of your financial institution, the financial institution can give it to you.

Payment for paper marketable securities will be made by check. (This does NOT include savings bonds. Payment for savings bonds will be made by direct deposit.)

If you completed Part D to receive payment as voluntary representative, only complete Part E if unmatured marketable securities are included. Skip Part F, and sign in Part G.

PART E – TRANSFER TO VOLUNTARY REPRESENTATIVE

Complete this part to transfer the unmatured marketable securities to a financial institution, broker, or dealer account in YOUR name to receive payment on behalf of all persons entitled.

A person acting as voluntary representative who transfers securities warrants, certifies, and unconditionally guarantees that he/she will make distribution of the proceeds to the persons entitled by the law of the decedent's domicile at the date of death. Transfer to a voluntary representative is for the convenience of the United States and does not determine ownership of the securities or their proceeds.

IMPORTANT NOTICES

•All scheduled reinvestments will be cancelled at the time of transfer.

•This form must be signed. Only original signatures and forms will be accepted (stamped signatures are not acceptable).

•TRANSFER REQUESTS WILL NOT BE ACCEPTED WITH ALTERATIONS OR CORRECTIONS.

1.Provide your name and mailing address.

2.Securities Identification

Provide the information requested. All required information is listed on the Legacy Treasury Direct statement of account or in the TreasuryDirect account of the decedent.

3.External transfer to a financial institution that accepts wire transfers.

Contact the financial institution for its "Book-Entry" delivery instructions. Please note: Securities CANNOT be transferred to a checking or savings account since they can only accept money. Provide the following information:

ROUTING NUMBER - ABA (identification) number of the financial institution receiving the securities.

FINANCIAL INSTITUTION WIRE NAME - Provide the financial institution's "Book-Entry" delivery instructions. Instructions include the receiving bank's name and the brokerage firm's name (these must be approved telegraphic abbreviation "short" form).

AGENT or BROKER NAME, PHONE NUMBER, ADDRESS

SPECIAL HANDLING INSTRUCTIONS - The voluntary representative’s name and account number at the financial institution for delivery of securities; and other instructions required by your financial institution.

Examples:

To a financial institution for safekeeping:

To a financial institution for transfer to brokerage firm:

Routing Number: XXXXXXXXX |

Routing Number: |

XXXXXXXXX |

Financial Institution Wire Name: ABC BK/TRUST |

Financial Institution Wire Name: |

ABC/CUST/BRKG |

Special Handling Instructions: FURTHER CREDIT TO JOHN DOE |

Special Handling Instructions: FURTHER CREDIT TO JOHN DOE |

TRUST ACCOUNT NUMBER XXXXXX |

|

BROKERAGE ACCOUNT NUMBER XXXXXX |

CONFIRMATION OF THE TRANSFER

Legacy Treasury Direct: You will receive a Statement of Account after the securities have been transferred. Under certain circumstances, there may be a hold on the account and a statement won't be mailed.

FS Form 5336 |

Department of the Treasury | Bureau of the Fiscal Service |

7 |

If you completed Part E to transfer as voluntary representative, only complete Part D if matured marketable securities and/or savings bonds are also included. Skip Part F, and sign in Part G.

PART F – DISTRIBUTION OF SECURITIES AND/OR RELATED PAYMENTS TO PERSON ENTITLED Note: Savings bonds within one month of final maturity cannot be reissued.

A person acting as voluntary representative who distributes securities and/or related payments warrants, certifies, and unconditionally guarantees that he or she is making distribution to the persons entitled by the law of the decedent's domicile at the date of death.

1.Enter the name, Social Security Number, address, and phone number of only one distributee in each Part F, Item 1. (Complete a separate Part F for each distributee.)

2.Describe only the securities and/or checks that the person shown in Item 1 is to receive. In the instructions, see Item 2 in Part D for information on how to describe securities and/or checks.

In all cases, we need an additional form or forms from the distributee as indicated in Part F. Our forms may be downloaded at www.treasurydirect.gov.

If an entitled person wants payment of paper marketable securities not held electronically, the fiduciary must complete the assignment on the reverse of the security. The distributee must complete IRS Form W-9.

Any interest that is or becomes due on securities belonging to the estate of a decedent will be paid to the person to whom the securities are distributed, unless otherwise requested.

PART G – SIGNATURES AND CERTIFICATIONS

SIGNATURES – Application must be signed in ink.

CERTIFICATION – You must appear before and establish identification to the satisfaction of an authorized certifying officer or, if your transaction is for paper savings bonds only, you may choose to appear before a notary instead. The form must be signed in the presence of the notary or officer. The notary or certifying officer must affix the seal or stamp that is used when certifying requests for payment. Authorized certifying officers are available at most financial institutions, including credit unions. Examples of acceptable seals and stamps:

•The seal or stamp of a notary, for a transaction that involves only paper savings bonds.

•A financial institution’s official seal or stamp, including: Signature Guaranteed seal or stamp; Endorsement Guaranteed seal or stamp; Corporate seal or stamp (a corporate resolution isn’t required); or Issuing or paying agent seal or stamp (including name, location, and four-digit identification number or nine-digit routing number).

•The seal or stamp of Treasury-recognized Signature Guarantee Programs or other Treasury-approved Medallion Programs.

ADDITIONAL REQUIREMENTS – The Commissioner of the Fiscal Service, as designee of the Secretary of the Treasury, reserves the right in any particular case to require the submission of additional evidence and/or the formal administration of the estate.

WHERE TO SEND – Unless otherwise instructed in accompanying correspondence, mail this form (without instruction pages), mail all securities and/or related checks, and mail any necessary evidence to the address below. Legal evidence or documentation you submit cannot be returned.

Treasury Retail Securities Services, P.O. Box 9150, Minneapolis, MN 55480-9150

Note: Use only one form and describe all the securities.

NOTICE UNDER THE PRIVACY AND PAPERWORK REDUCTION ACTS

The collection of the information you are requested to provide on this form is authorized by 31 U.S.C. CH. 31 relating to the public debt of the United States. The furnishing of a Social Security Number, if requested, is also required by Section 6109 of the Internal Revenue Code (26 U.S.C. 6109).

The purpose of requesting the information is to enable the Bureau of the Fiscal Service and its agents to issue securities, process transactions, make payments, identify owners and their accounts, and provide reports to the Internal Revenue Service. Furnishing the information is voluntary; however, without the information, the Fiscal Service may be unable to process transactions.

Information concerning securities holdings and transactions is considered confidential under Treasury regulations (31 CFR, Part 323) and the Privacy Act. This information may be disclosed to a law enforcement agency for investigation purposes; courts and counsel for litigation purposes; others entitled to distribution or payment; agents and contractors to administer the public debt; agencies or entities for debt collection or to obtain current addresses for payment; agencies through approved computer matches; Congressional offices in response to an inquiry by the individual to whom the record pertains; as otherwise authorized by law or regulation.

We estimate it will take you about 30 minutes to complete this form. However, you are not required to provide information requested unless a valid OMB control number is displayed on the form. Any comments or suggestions regarding this form should be sent to the Bureau of the Fiscal Service, Forms Management Officer, Parkersburg, WV 26106-1328. DO NOT SEND the completed form to this address; send it to the address shown in "WHERE TO SEND.”

FS Form 5336 |

Department of the Treasury | Bureau of the Fiscal Service |

8 |