This form is available electronically. |

|

Form Approved – OMB No. 0560-0237 |

|

|

|

FSA-2001 |

U.S. DEPARTMENT OF AGRICULTURE |

Position 3 |

(03-06-15) |

Farm Service Agency |

|

|

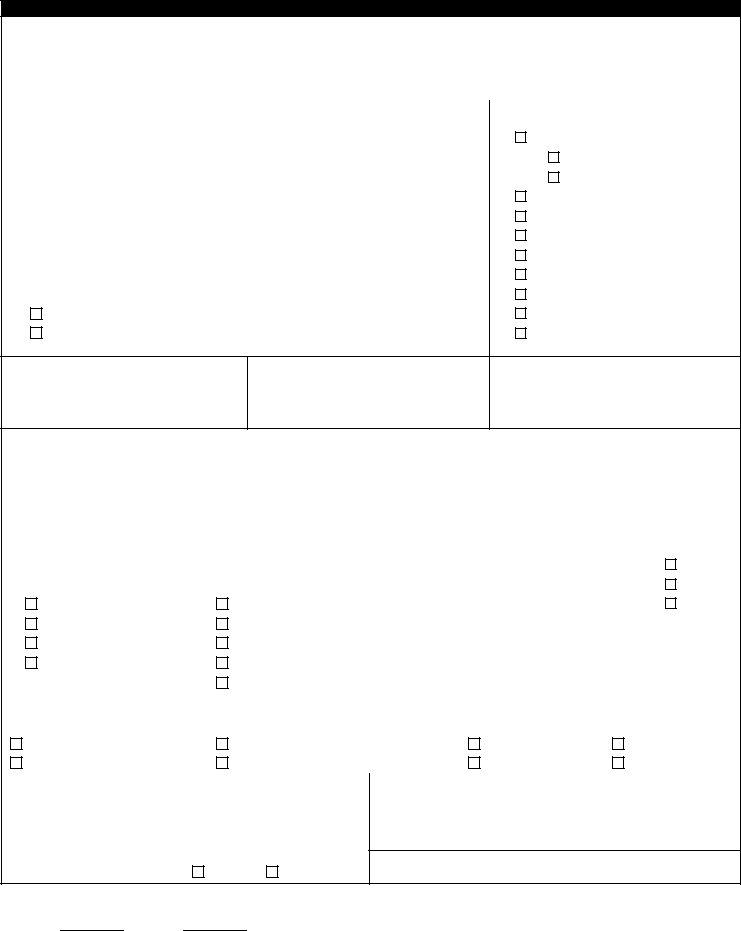

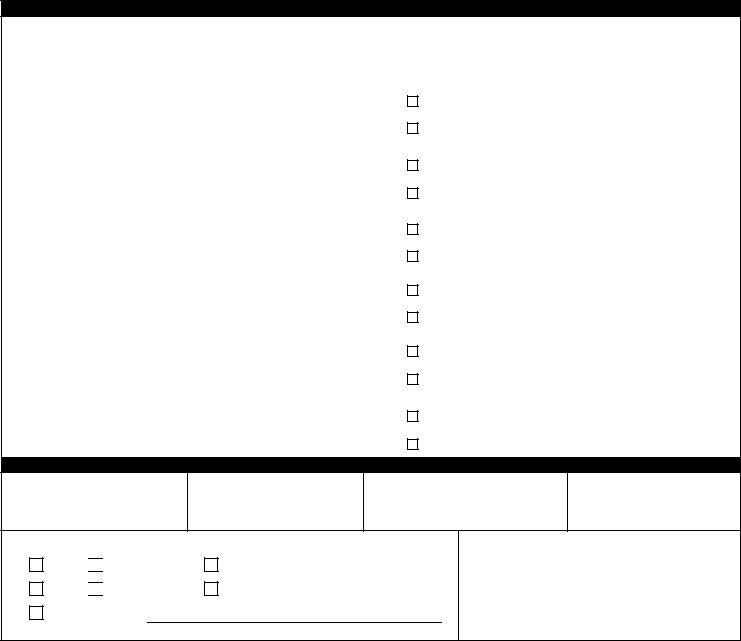

REQUEST FOR DIRECT LOAN ASSISTANCE |

INSTRUCTIONS: FSA suggests applicants use the available corresponding instructions found on the internet at http://tinyurl.com/kwm5rem for the proper completion of this form. Assistance is also available from local FSA offices for any part of the application process. FSA can provide assistance in completing requested forms, explain what information is necessary, and answer any questions regarding the application process.

Farm Loan Teams located at USDA Service Centers or FSA County Offices are responsible for all direct loan applications. You can find the address and telephone number of the nearest Farm Loan Team serving the County where you plan to farm from the Internet at http://tinyurl.com/7syle36.

The Federal Government requests race, ethnicity and gender information to monitor FSA’s compliance with Federal laws prohibiting discrimination against applicants. Applicants are encouraged to furnish this information. This information is not used to evaluate an application and choosing not to provide this information will not affect the application process.

Targeted funding is available to any member of a targeted underserved group. Targeted underserved groups include American Indians or Alaskan Natives, Asians, Blacks or African Americans, Native Hawaiians or other Pacific Islanders, Hispanics, and Women. Targeted funding may not be received if an applicant fails to voluntarily provide race, ethnicity and gender information.

IMPORTANT NOTICE

Within 10 calendars days of the date FSA receives your application, FSA will send you a letter that will tell you if your application is complete, or additional information is needed to complete your loan application. Incomplete applications cannot be processed. If you do not receive this letter within 10 days of the submission of your application, please contact your local FSA office.

APPLICANT IDENTIFICATION

The loan application must be submitted in the name of the ACTUAL OPERATOR of the farm or ranch.

An individual who operates as a legal entity, or two or more applicants operating and applying jointly, are considered an ENTITY applicant.

Married persons are considered joint operations if the day-to-day management and operation responsibilities of the farm enterprise are shared. Married couples who wish to apply together and have not formed an operating entity such as a partnership, LLC, trust or corporation, are to proceed as designated below. Married couples who have formed a legal entity as part of the farm or ranch should complete this application as an entity applicant.

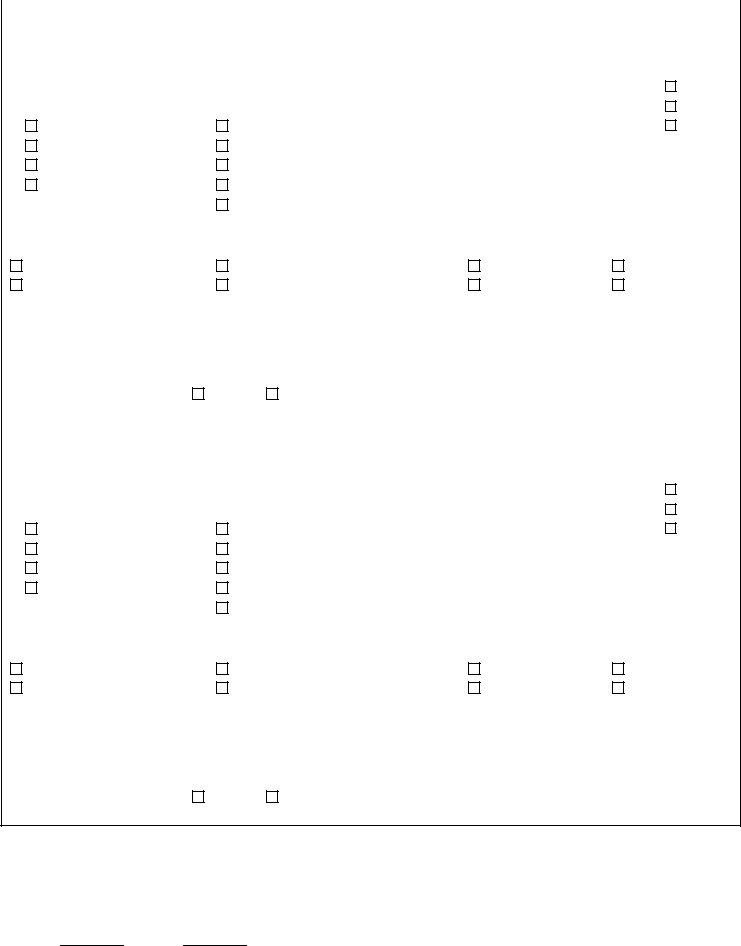

The Applicant is a/an:

∙Individual, Not Married, Not Operating as a Legal Entity. BEGIN at PART A.

∙Individual, Operating as a Legal Entity. BEGIN at PART C.

∙Married Couple, One Spouse Applying. BEGIN at PART A.

∙Married Couple, Applying Jointly, Not a Legal Entity. BEGIN at PART B.

∙Joint Operation, Two or More Persons, Not Married, Not a Legal Entity. BEGIN at PART C.

∙Entity Applicant. BEGIN at PART C.

NOTE: Entity Applicants are required to provide supporting documentation such as, and not necessarily limited to, Articles of Incorporation; Articles of Organization; Certificate of Limited Partnership; Formal Partnership Agreement; By-Laws and Operational Authorities of all shareholders, members and owners to verify the legal status of the entity, the authority of the shareholders, members or owners, and the composition of the entity structure(s).

PLEASE KEEP THIS PAGE FOR YOUR RECORDS

This form is available electronically. |

|

Form Approved – OMB No. 0560-0237 |

|

|

|

FSA-2001 |

U.S. DEPARTMENT OF AGRICULTURE |

Position 3 |

(03-06-15) |

Farm Service Agency |

|

|

REQUEST FOR DIRECT LOAN ASSISTANCE |

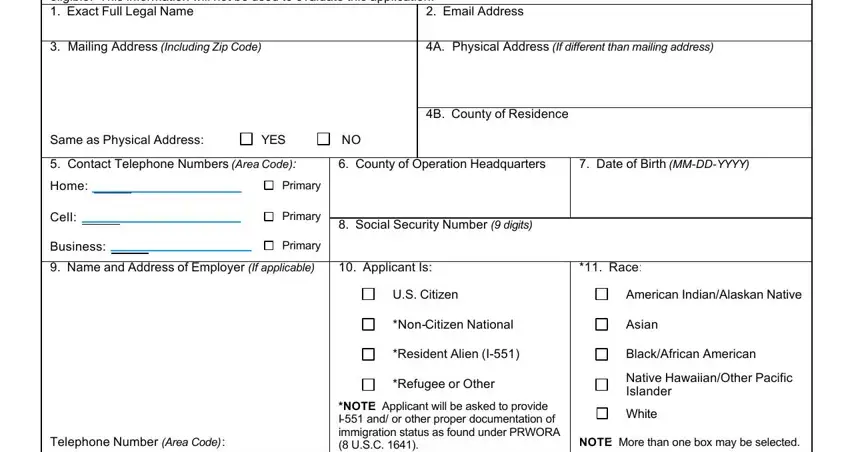

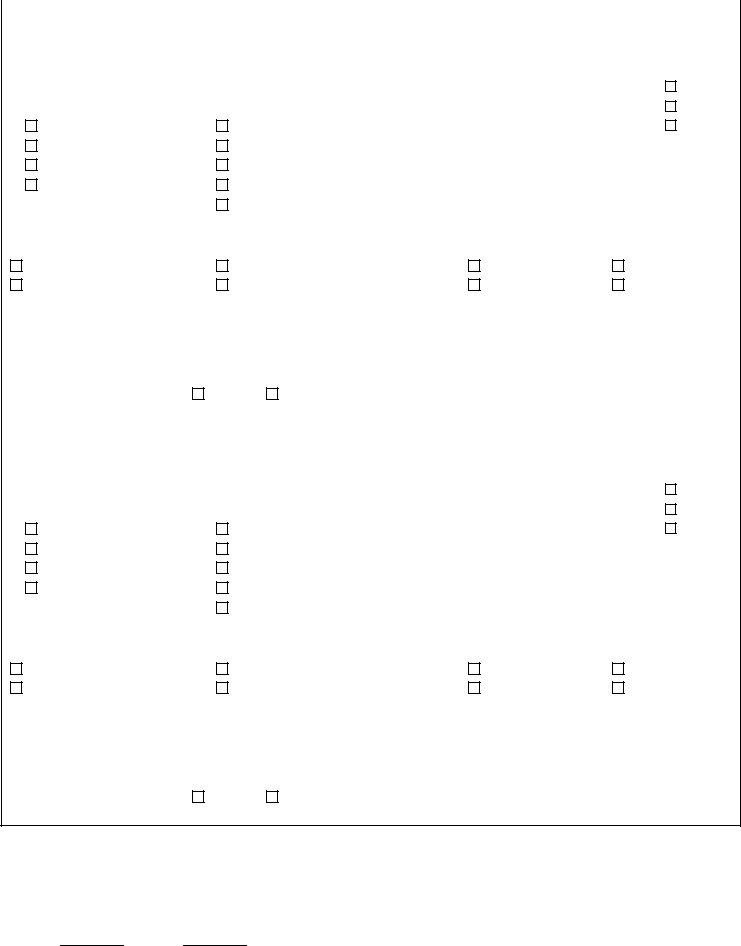

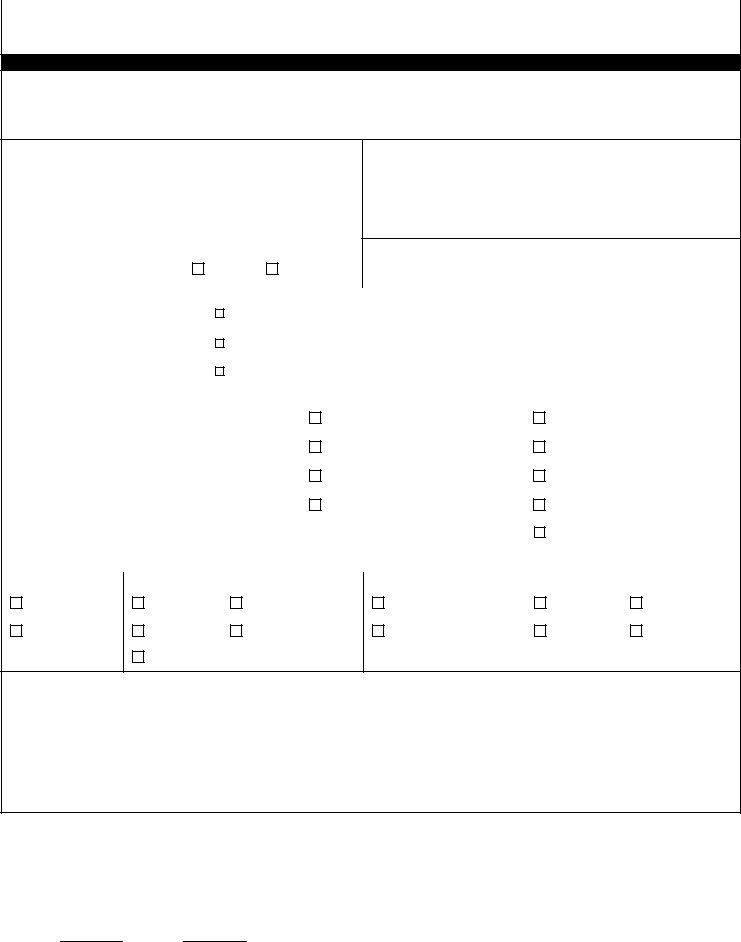

PART A – INDIVIDUAL APPLICANT, NOT A LEGAL ENTITY

Instructions: Individual applicants and married applicants with a non-applicant spouse will complete Items 1 through 16. Items 1 1, 14 and 15 are voluntary. *Race, ethnicity, and gender information is requested by the Federal Government to monitor FSA's compliance with Federal laws prohibiting discrimination against applicants. Applicants are not required to furnish this information but are encouraged to do so. Failure to provide this information may result in not receiving targeted funds for which the applicant may be eligible. This information will not be used to evaluate this application.

1. |

Exact Full Legal Name |

2. Email Address |

|

|

|

3. |

Mailing Address (Including Zip Code) |

4A. Physical Address (If different than mailing address) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4B. County of Residence |

|

|

|

Same as Physical Address: |

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. Contact Telephone Numbers (Area Code): |

6. County of Operation Headquarters |

|

7. Date of Birth (MM-DD-YYYY) |

Home: |

|

|

|

|

|

|

|

Primary |

|

|

|

|

|

|

|

Cell: |

|

|

|

|

|

|

Primary |

|

|

|

|

|

|

|

|

|

|

|

8. Social Security Number (9 digits) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Primary |

|

|

|

Business: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. Name and Address of Employer (If applicable) |

10. Applicant Is: |

|

*11. Race: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Citizen |

|

|

American Indian/Alaskan Native |

|

|

|

|

|

|

|

|

|

|

|

|

|

*Non-Citizen National |

|

|

Asian |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Resident Alien (I-551) |

|

|

Black/African American |

|

|

|

|

|

|

|

|

|

|

|

|

|

*Refugee or Other |

|

|

Native Hawaiian/Other Pacific |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Islander |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*NOTE: Applicant will be asked to provide |

|

|

White |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I-551 and/ or other proper documentation of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone Number (Area Code): |

|

|

immigration status as found under PRWORA |

|

NOTE: More than one box may be selected. |

|

|

(8 U.S.C. 1641). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

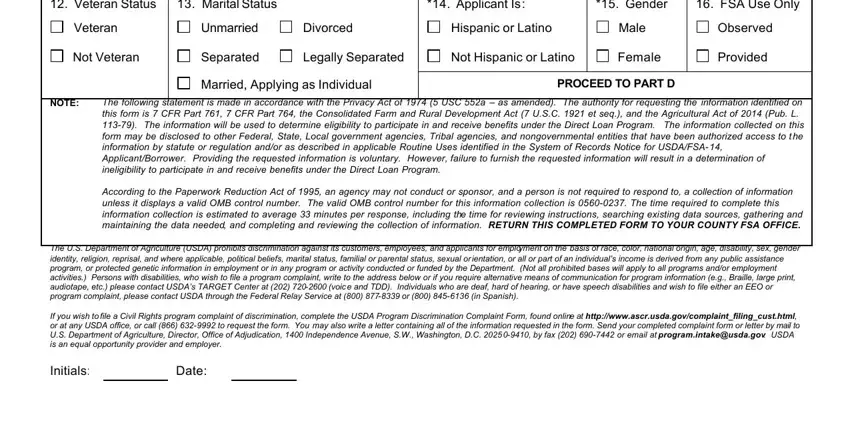

12. Veteran Status |

13. Marital Status |

|

|

|

*14. Applicant Is: |

|

*15. Gender |

16. FSA Use Only |

Veteran |

Unmarried |

|

Divorced |

Hispanic or Latino |

|

Male |

Observed |

Not Veteran |

Separated |

|

Legally Separated |

Not Hispanic or Latino |

|

Female |

Provided |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Married, Applying as Individual |

PROCEED TO PART D |

|

NOTE: The following statement is made in accordance with the Privacy Act of 1974 (5 USC 552a – as amended). The authority for requesting the information identified on this form is 7 CFR Part 761, 7 CFR Part 764, the Consolidated Farm and Rural Development Act (7 U.S.C. 1921 et seq.), and the Agricultural Act of 2014 (Pub. L. 113-79). The information will be used to determine eligibility to participate in and receive benefits under the Direct Loan Program. The information collected on this form may be disclosed to other Federal, State, Local government agencies, Tribal agencies, and nongovernmental entities that have been authorized access to the information by statute or regulation and/or as described in applicable Routine Uses identified in the System of Records Notice for USDA/FSA-14, Applicant/Borrower. Providing the requested information is voluntary. However, failure to furnish the requested information will result in a determination of ineligibility to participate in and receive benefits under the Direct Loan Program.

According to the Paperwork Reduction Act of 1995, an agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a valid OMB control number. The valid OMB control number for this information collection is 0560-0237. The time required to complete this information collection is estimated to average 33 minutes per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. RETURN THIS COMPLETED FORM TO YOUR COUNTY FSA OFFICE.

The U.S. Department of Agriculture (USDA) prohibits discrimination against its customers, employees, and applicants for employment on the basis of race, color, national origin, age, disability, sex, gender identity, religion, reprisal, and where applicable, political beliefs, marital status, familial or parental status, sexual orientation, or all or part of an individual’s income is derived from any public assistance program, or protected genetic information in employment or in any program or activity conducted or funded by the Department. (Not all prohibited bases will apply to all programs and/or employment activities.) Persons with disabilities, who wish to file a program complaint, write to the address below or if you require alternative means of communication for program information (e.g., Braille, large print, audiotape, etc.) please contact USDA’s TARGET Center at (202) 720-2600 (voice and TDD). Individuals who are deaf, hard of hearing, or have speech disabilities and wish to file either an EEO or program complaint, please contact USDA through the Federal Relay Service at (800) 877-8339 or (800) 845-6136 (in Spanish).

If you wish to file a Civil Rights program complaint of discrimination, complete the USDA Program Discrimination Complaint Form, found online at http://www.ascr.usda.gov/complaint_filing_cust.html, or at any USDA office, or call (866) 632-9992 to request the form. You may also write a letter containing all of the information requested in the form. Send your completed complaint form or letter by mail to U.S. Department of Agriculture, Director, Office of Adjudication, 1400 Independence Avenue, S.W., Washington, D.C. 20250-9410, by fax (202) 690-7442 or email at program.intake@usda.gov. USDA is an equal opportunity provider and employer.

|

FSA-2001 (03-06-15) |

Page 2 of 8 |

|

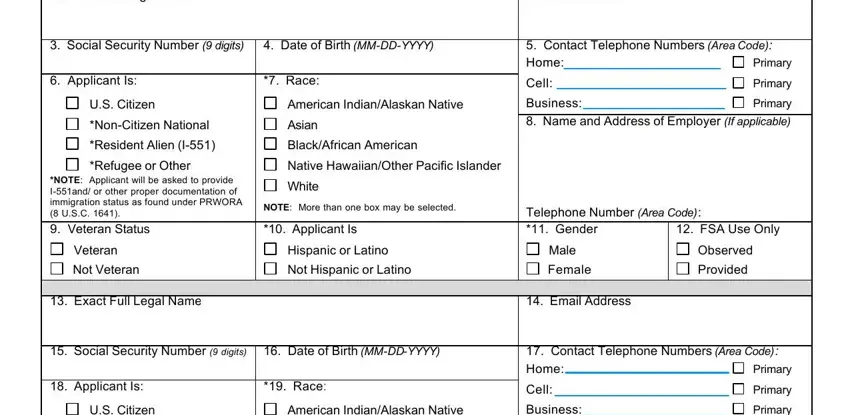

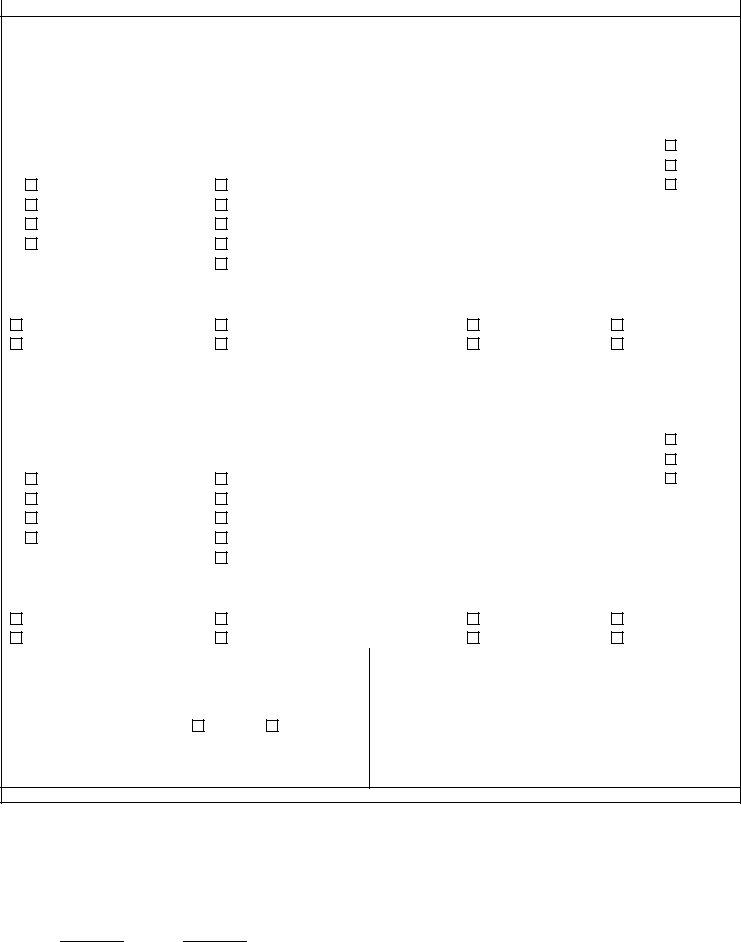

PART B – MARRIED COUPLE, APPLYING JOINTLY, NOT A LEGAL ENTITY |

|

Instructions: Married couples who are joint operators of the operation, are applying jointly, and who have not formed a legal entity will complete the sections below. Items 7, 10 and 11 are voluntary. The other spouse will complete Items 13 through 23; Items 19, 22 and 23 are voluntary. Items 25 through 29 pertain to both applicants jointly.

|

1. Exact Full Legal Name |

|

|

2. Email Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Social Security Number (9 digits) |

4. Date of Birth (MM-DD-YYYY) |

5. Contact Telephone Numbers (Area Code): |

|

|

|

|

Home: |

|

|

|

Primary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. Applicant Is: |

*7. Race: |

Cell: |

|

|

|

|

Primary |

|

U.S. Citizen |

|

American Indian/Alaskan Native |

Business: |

|

|

|

|

Primary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Non-Citizen National |

|

Asian |

8. Name and Address of Employer (If applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

*Resident Alien (I-551) |

|

Black/African American |

|

|

|

|

|

|

|

|

|

|

|

*Refugee or Other |

|

Native Hawaiian/Other Pacific Islander |

|

|

|

|

|

|

|

|

|

|

|

*NOTE: Applicant will be asked to provide |

|

White |

|

|

|

|

|

|

|

|

|

|

|

I-551and/ or other proper documentation of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

immigration status as found under PRWORA |

NOTE: More than one box may be selected. |

|

|

|

|

|

|

|

|

|

|

|

(8 U.S.C. 1641). |

Telephone Number (Area Code): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. Veteran Status |

*10. Applicant Is |

*11. Gender |

12. FSA Use Only |

|

Veteran |

|

Hispanic or Latino |

Male |

Observed |

|

Not Veteran |

|

Not Hispanic or Latino |

Female |

Provided |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. Exact Full Legal Name |

|

|

14. Email Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15. Social Security Number (9 digits) |

16. Date of Birth (MM-DD-YYYY) |

17. Contact Telephone Numbers (Area Code): |

|

|

|

|

Home: |

|

|

|

|

|

Primary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18. Applicant Is: |

*19. |

Race: |

Cell: |

|

|

|

|

Primary |

|

|

|

|

|

|

|

|

U.S. Citizen |

|

American Indian/Alaskan Native |

Business: |

|

|

|

Primary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

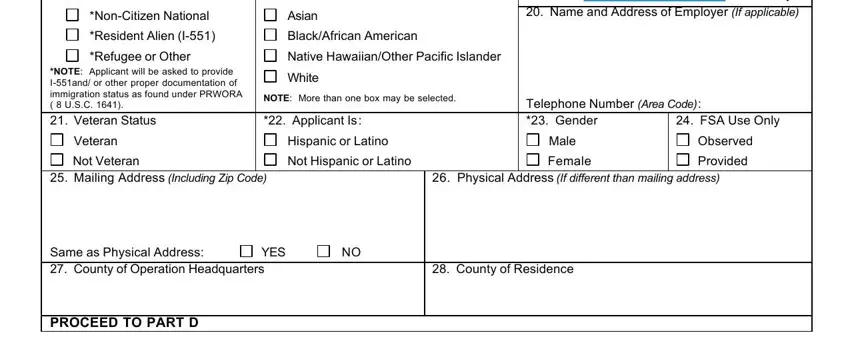

*Non-Citizen National |

|

Asian |

20. Name and Address of Employer (If applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

*Resident Alien (I-551) |

|

Black/African American |

|

|

|

|

|

|

|

|

|

|

|

*Refugee or Other |

|

Native Hawaiian/Other Pacific Islander |

|

|

|

|

|

|

|

|

|

|

|

*NOTE: Applicant will be asked to provide |

|

White |

|

|

|

|

|

|

|

|

|

|

|

I-551and/ or other proper documentation of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

immigration status as found under PRWORA |

NOTE: More than one box may be selected. |

Telephone Number (Area Code): |

|

( 8 U.S.C. 1641). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21. Veteran Status |

*22. Applicant Is: |

*23. Gender |

24. FSA Use Only |

|

Veteran |

|

Hispanic or Latino |

Male |

Observed |

|

Not Veteran |

|

Not Hispanic or Latino |

Female |

Provided |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25. Mailing Address (Including Zip Code) |

26. Physical Address (If different than mailing address) |

Same as Physical Address: |

YES |

NO |

|

|

27. County of Operation Headquarters |

28. County of Residence |

PROCEED TO PART D

FSA-2001 (03-06-15)Page 3 of 8

PART C – ENTITY APPLICANT

Instructions: An entity is a corporation, formal, joint operation, Limited Liability Corporation, Trust or other legal business organization comprised of 1 or more individuals which may or may not have an entity name or entity tax identification number. Organizations operating as non-profit entities and Estates are not considered eligible entities for Farm Loan Program purposes. Informal entities may leave Items 3 through 8 blank. Items 22, 25 and 26 are voluntary. All other information must be provided on each entity associated with the operation and each individual member of the associated entity. NOTE: Individual liability is required regardless of entity type.

1. |

Full Entity or Trust Name |

2. |

Entity Address (Including Zip Code) |

3. Entity Type: |

|

|

|

|

Corporation |

|

|

|

|

S Corp |

|

|

|

|

|

|

|

4. |

Entity Contact Telephone Number |

5. |

State of Registration/Corporation |

C Corp |

|

|

|

|

|

|

|

|

Limited Liability Company |

|

|

|

|

|

|

|

6. |

Registration ID Number |

7. |

Date of Formation (MM-DD-YYYY) |

Joint Operation |

|

|

|

|

|

|

|

|

Formal Partnership |

|

|

|

|

|

|

|

8. |

Tax Identification Number (9 digits) |

9. |

County of Operation Headquarters |

Revocable Trust |

|

|

|

|

|

|

|

|

Irrevocable Trust |

|

|

|

|

|

|

10. Does Entity Contain Embedded Entity? |

|

|

Cooperative |

|

|

|

|

|

YES, (Complete Items 11, 12, and 13 for each entity) |

Life Estate |

|

NO, (Proceed to Item 14) |

|

|

Other: |

|

|

11. List all Embedded Entities

12. Percentage of Interest

13. Number of Entity Members

%

NOTE: Items 14 through 28 pertain to individual members of the entity, or in the case of partnerships and joint operations, each co-applicant. Every member of the entity must complete Items 14 through 28. If farm operation operates with more than 1 entity, each entity and all its members must provide this information. This application provides for the entry of 1 entity and 3 entity members. Please make copies of this section, as necessary. Items 21, 24 and 25 are voluntary.

|

14. Exact Full Legal Name of Entity Member |

|

15. Percentage of Interest |

16. Email Address |

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. Social Security Number (9 digits) |

|

|

18. Date of Birth (MM-DD-YYYY) |

19. Contact Telephone Numbers (Area Code): |

|

|

|

|

|

Home: |

|

|

Primary |

|

|

|

|

|

|

|

|

|

|

|

|

|

20. Applicant Is: |

*21. Race |

|

Cell: |

|

|

|

Primary |

|

|

|

|

|

|

|

|

U.S. Citizen |

American Indian/Alaskan Native |

Business: |

|

|

|

Primary |

|

|

|

|

|

|

|

|

|

|

|

|

|

*Non-Citizen National |

Asian |

|

22. Name and Address of Employer (If applicable) |

|

*Resident Alien (I-551) |

Black/African American |

|

|

|

|

|

|

|

|

*Refugee or Other |

Native Hawaiian/Other Pacific Islander |

|

|

|

|

|

|

|

|

*NOTE: Applicant will be asked to provide |

White |

|

|

|

|

|

|

|

|

|

I-551 and/ or other proper documentation of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

immigration status as found under PRWORA |

NOTE: More than one box may be selected. |

Telephone Number (Area Code): |

|

(8 U.S.C. 1641) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23. Veteran Status |

*24. Applicant Is |

*25. Gender |

26. FSA Use Only |

|

Veteran |

Hispanic or Latino |

Male |

Observed |

|

Not Veteran |

Not Hispanic or Latino |

Female |

Provided |

|

|

|

|

|

|

|

|

|

|

|

|

27. Mailing Address (Including Zip Code) |

28A. Physical Address (If different than mailing address) |

Same as Physical Address:

|

FSA-2001 (03-06-15) |

|

|

|

|

|

|

|

|

|

|

|

Page 4 of 8 |

|

PART C – ENTITY APPLICANT (Continued) |

|

|

|

|

|

|

|

|

|

|

|

14. Exact Full Legal name of Entity Member |

|

15. Percentage of Interest |

16. Email Address |

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. Social Security Number (9 digits) |

|

|

18. Date of Birth (MM-DD-YYYY) |

19. Contact Telephone Numbers (Area Code): |

|

|

|

|

|

|

Home: |

|

|

|

Primary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20. Applicant Is: |

*21. Race |

|

|

Cell: |

|

|

|

|

|

|

|

Primary |

|

U.S. Citizen |

American Indian/Alaskan Native |

Business: |

|

|

|

|

Primary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Non-Citizen National |

Asian |

|

|

22. Name and Address of Employer (If applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Resident Alien (I-551) |

Black/African American |

|

|

|

|

|

|

|

|

|

|

|

*Refugee or Other |

Native Hawaiian/Other Pacific Islander |

|

|

|

|

|

|

|

|

|

|

|

*NOTE: Applicant will be asked to provide |

White |

|

|

|

|

|

|

|

|

|

|

|

|

|

I-551 and/ or other proper documentation of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

immigration status as found under PRWORA |

NOTE: More than one box may be selected. |

Telephone Number (Area Code): |

|

(8 U.S.C. 1641) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23. Veteran Status |

*24. Applicant Is |

*25. Gender |

26. FSA Use Only |

|

Veteran |

Hispanic or Latino |

Male |

Observed |

|

Not Veteran |

Not Hispanic or Latino |

Female |

Provided |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27. Mailing Address (Including Zip Code) |

|

28A. Physical Address (If different than mailing address) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28B. County of Residence |

|

|

|

|

|

Same as Physical Address: |

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. Exact Full Legal name of Entity Member |

|

15. Percentage of Interest |

16. Email Address |

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. Social Security Number (9 digits) |

|

|

18. Date of Birth (MM-DD-YYYY) |

19. Contact Telephone Numbers (Area Code): |

|

|

|

|

|

|

Home: |

|

|

|

Primary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20. Applicant Is: |

*21. Race |

|

|

Cell: |

|

|

|

|

Primary |

|

U.S. Citizen |

American Indian/Alaskan Native |

Business: |

|

|

|

|

Primary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Non-Citizen National |

Asian |

|

|

22. Name and Address of Employer (If applicable) |

|

*Resident Alien (I-551) |

Black/African American |

|

|

|

|

|

|

|

|

|

|

|

*Refugee or Other |

Native Hawaiian/Other Pacific Islander |

|

|

|

|

|

|

|

|

|

|

|

*NOTE: Applicant will be asked to provide |

White |

|

|

|

|

|

|

|

|

|

|

|

|

|

I-551 and/ or other proper documentation of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

immigration status as found under PRWORA |

NOTE: More than one box may be selected. |

Telephone Number (Area Code): |

|

(8 U.S.C. 1641) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23. Veteran Status |

*24. Applicant Is |

*25. Gender |

26. FSA Use Only |

|

Veteran |

Hispanic or Latino |

Male |

Observed |

|

Not Veteran |

Not Hispanic or Latino |

Female |

Provided |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27. Mailing Address (Including Zip Code) |

|

28A. Physical Address (If different than mailing address) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28B. County of Residence |

|

|

|

|

|

Same as Physical Address: |

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROCEED TO PART D

|

FSA-2001 (03-06-15) |

|

|

Page 5 of 8 |

|

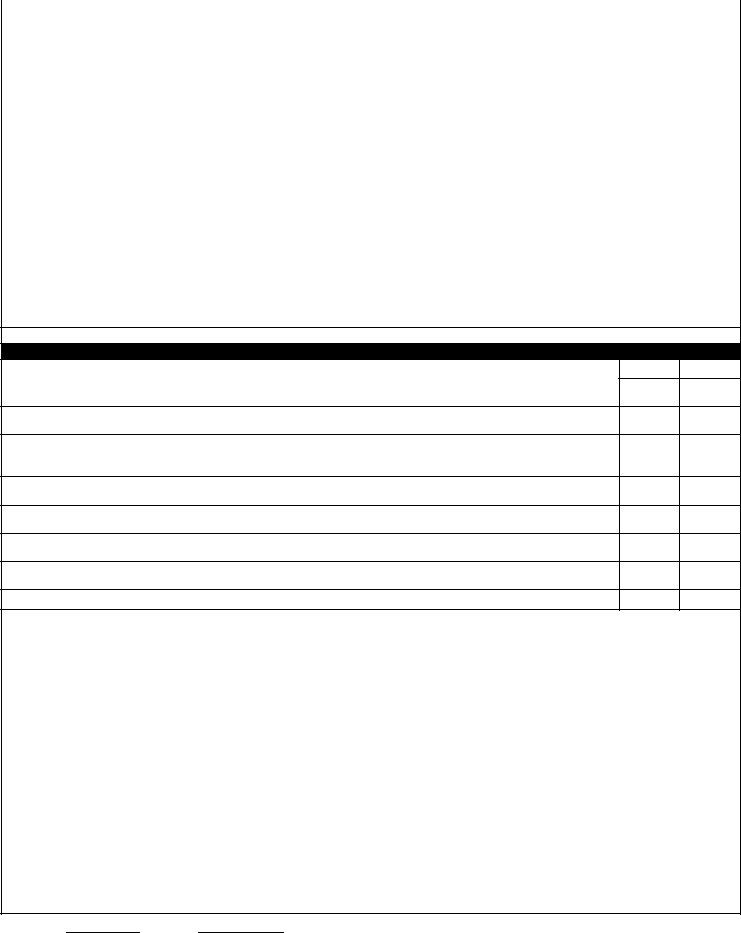

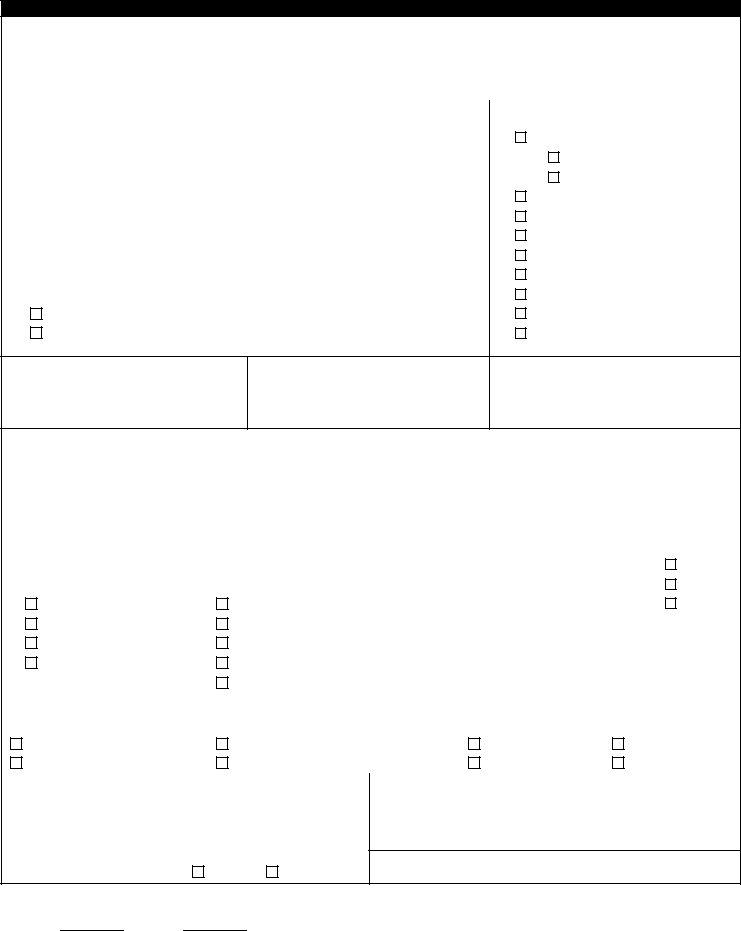

PART D – GENERAL INFORMATION |

|

|

|

|

1. Counties Being Farmed |

2. |

Acres Owned |

|

|

|

|

|

|

|

|

3. |

Acres Rented |

|

|

|

|

|

|

4A. |

Purpose of Loan |

4B. |

Amount Requested |

|

|

|

|

|

$ |

|

|

|

|

|

|

5A. |

Purpose of Loan |

5B. |

Amount Requested |

|

|

|

|

|

$ |

|

|

|

|

|

|

6. Description of Operation |

|

|

|

PROCEED TO PART E

PART E – NOTIFICATIONS, CERTIFICATIONS AND ACKNOWLEDGMENT

1.Are you currently or have you ever, and in the case of an entity any member of the entity, conducted business under any other name? If "YES," list names in Item 9.

2.Have you ever, or in the case of an entity any member of the entity, obtained a direct or guaranteed farm loan from FSA or Farmers Home Administration?

3.If Item 2 is "YES," did you receive any debt forgiveness through write-down, write-off, compromise, adjustment, reduction, charge-off, paying a loss on a guarantee, or bankruptcy? If "YES," provide details in Item 9.

4.Are you, or in the case of an entity any member of the entity, delinquent on any Federal debt or have any outstanding Federal judgments? If "YES," provide details in Item 9.

5.Are you, or in the case of an entity any member of the entity, involved in any pending litigation? If "YES," provide details in Item 9.

6.Have you, or in the case of an entity any member of the entity, ever been in receivership, discharged in bankruptcy, or filed a petition for reorganization in bankruptcy? If "YES," provide details in Item 9.

7.Are you, or in the case of an entity any member of the entity, an FSA employee or related to or closely associated with an FSA employee? If "YES," provide details in Item 9.

8.Are you now or have you ever, operated a farm? If "YES," provide number of years and details in Item 9.

9.Additional answers. Write the Item number to which each answer applies. If you need additional space, use sheets of paper the same size as this page and write the applicant's name on each additional sheet.

Initials:Date:

|

FSA-2001 (03-06-15) |

Page 6 of 8 |

|

|

|

|

PART E – NOTIFICATIONS, CERTIFICATIONS AND ACKNOWLEDGMENT (Continued) |

|

|

|

|

10. SPECIAL PROGRAM INFORMATION.

Certain FSA programs are, by law, designed to reach targeted applicants. If you are interested in any of the programs described here, or have questions about these programs and whether you may qualify for a specific program, the FSA office processing your application will help you.

A.SOCIALLY DISADVANTAGED APPLICANTS: A portion of FSA farm ownership, operating, and conservation loan funds are, by law, targeted to applicants who have been subjected to racial, ethnic or gender prejudice because of their identity as a member of a group, without regard to individual qualities. Under the applicable law, groups meeting this condition are: American Indians/Alaskan Natives, Asians, Blacks or African Americans, Native Hawaiians/Other Pacific Islanders, Hispanics and women. In addition, FSA has a down payment program, which receives special funding.

B.BEGINNING FARMER ASSISTANCE: FSA has the authority to assist beginning farmers through the farm ownership, operating, and conservation loan programs. A portion of FSA farm ownership, operating, and conservation loan funds are, by law, targeted to beginning farmers. In addition, FSA has a down payment program, which receives special funding. In some States, FSA has agreements with State beginning farmer programs to help meet the credit needs of beginning farmers.

C. LIMITED RESOURCE LOANS: Limited resource farm ownership and operating loans are available to qualified applicants. This program provides loans at reduced interest rates to low-income farmers whose operations and resources are so limited that they cannot pay the regular rates for FSA loans. The program is also intended to provide beginning farmers the opportunity to start a successful farming operation.

11.RIGHTS AND POLICIES.

A.RIGHT TO FINANCIAL PRIVACY ACT OF 1978 (PUBLIC LAW 95-630): FSA has a right of access to financial records held by financial institutions in connection with providing assistance to you as well as collecting on loans made to you or guaranteed by the Government. Financial records involving your transaction will be available to FSA without further notice or authorization but will not be disclosed or released by this institution to another Government Agency or Department without your consent except as required by law.

B.THE FEDERAL EQUAL CREDIT OPPORTUNITY ACT: Prohibits creditors from discriminating against applicants on the basis of race, color, religion, sex, national origin, marital status, age (provided the applicant has the capacity to enter into a binding contract), because all or a part of the applicant's income derives from any public assistance program, or because the applicant has in good faith exercised any right under the Consumer Credit Protection Act.

C.FEDERAL COLLECTION POLICIES: Delinquencies, defaults, foreclosures and abuses of loans involving programs of the Federal Government can be costly and detrimental to your credit, now and in the future. The lender in this transaction, its agents and assigns as well as the Federal Government, its agencies, agents and assigns, are authorized to take any and all of the following actions in the event loan payments become delinquent: (1) Report your name and account information to a credit bureau; (2) Assess additional interest and penalty charges for the period of time that payment is not made; (3) Assess charges to cover additional administrative costs incurred by the Government to service your account; (4) Offset amounts owed to you under other Federal programs; (5) Refer your account to a private attorney, collection agency or mortgage servicing agency to collect the amount due, foreclose the mortgage, sell the property and seek judgment against you for any deficiency; (6) Refer your account to the Department of Justice for litigation; (7) Take action to offset your salary, or retirement benefits; (8) Refer your debt to the Department of the Treasury for cross-servicing and offset against any amount owed to you by any Federal Agency such as an income tax refund; and (9) Report any resulting written-off debt to the Internal Revenue Service as taxable income. All of these actions can and will be used to recover debts owed to the Federal Government when in its best interests.

12.RESTRICTIONS AND DISCLOSURE OF LOBBYING ACTIVITIES: A. The applicant:

(1)Certifies that if any funds, by or on behalf of the applicant, have been or will be paid to any person for influencing or attempting to influence an officer or employee of any agency, a Member, an officer or employee of Congress, or an employee of a Member of Congress in connection with the awarding of any Federal contract, the making of any Federal grant or Federal loan, and the extension, continuation, renewal, amendment, or modification of any Federal contract, grant, or loan, the applicant shall complete and submit Standard Form - LLL, "Dis closure of Lobbying Activities," in accordance with its instructions.

Initials:Date:

|

FSA-2001 (03-06-15) |

Page 7 of 8 |

|

|

|

|

PART E – NOTIFICATIONS, CERTIFICATIONS AND ACKNOWLEDGMENT (Continued) |

|

|

|

|

RESTRICTIONS AND DISCLOSURE OF LOBBYING ACTIVITIES:(CONTINUED)

(2)Shall require that the language of this certification be included in the award documents for all sub-awards at all tiers (including contracts, subcontracts, and subgrants, under grants and loans) and that all subrecipients shall certify and disclose accordingly.

B.This certification is a material representation of fact upon which reliance was placed when this transaction was made or entered into. Submission of this statement is a prerequisite for making or entering into this transaction. Any person who fails to file the required statement shall be subject to a civil penalty imposed by 31 U.S.C. 1352.

13.CONTROLLED SUBSTANCES:

The applicant certifies that as an individual, or any member of an entity applicant, has not been convicted under Federal or State law of planting, cultivating, growing, producing, harvesting, or storing a controlled substance within the previous 5 crop years. See the Food Security Act of 1985 (Public Law 99-198). The applicant also certifies that as an individual, or any member of an entity applicant, is not ineligible for Federal benefits based on a conviction for the distribution of controlled substances or any offense involving the possession of a controlled substance under 21 U.S.C. § 862.

14.DISQUALIFICATION DUE TO FEDERAL CROP INSURANCE FRAUD:

The applicant certifies that as an individual or any member of the entity, has not been disqualified for Federal benefits as provided in Section 515(h) of the Federal Crop Insurance Act (FCIA). Applicants who willfully and intentionally provide fals e or inaccurate information to the Federal Crop Insurance Corporation (FCIC) or to an approved insurance provider with respect to a policy or plan of FCIC insurance, after notice and an opportunity for a hearing on the record, will be subject to one or more of the sanctions described in section 515(h)(3) of FCIA.

15.TEST FOR CREDIT:

The applicant certifies that the needed credit, with or without a loan guarantee, cannot be obtained by (1) the individual applicant; (2) in the case of an entity, considering all assets owned by the entity and all of the individual members. The provisions of this paragraph do not apply if the request is for a Conservation Loan.

16.PERMISSION TO FILE FINANCING STATEMENT:

Under the Uniform Commercial Code, you do not have to sign the financing statement which allows FSA to obtain a security interest in your property. If the loan is approved and funded, FSA will file a financing statement at the earliest possible date, before you enter into a SECURITY AGREEMENT. BY SIGNING BELOW, I GIVE FSA PERMISSION TO FILE A

FINANCING STATEMENT PRIOR TO THE EXECUTION OF THE SECURITY AGREEMENT AS WELL AS TO FILE AMENDMENTS AND CONTINUATIONS OF THE FINANCING STATEMENT THEREAFTER.

PROCEED TO PART F

Initials:Date:

FSA-2001 (03-06-15)Page 8 of 8

PART F – CERTIFICATION AND SIGNATURES

CERTIFICATION: I certify that the information provided is true, complete, and correct to the best of my knowledge and is

provided in good faith to obtain a loan. (WARNING: Section 1001 of Title 18, United States Code, provides for criminal penalties to those who provide false statements to the Government. If any information is found to be false or incomplete, such finding may be grounds for denial of the requested action).

1A. |

Signature of Individual Applicant, Spouse or Entity Member |

1B. |

Capacity |

1C. |

Date Signed (MM-DD-YYYY) |

|

|

|

Self |

|

|

|

|

|

Entity Representative |

|

|

|

|

|

|

|

|

2A. |

Signature of Individual Applicant, Spouse or Entity Member |

2B. |

Capacity |

2C. |

Date Signed (MM-DD-YYYY) |

|

|

|

Self |

|

|

|

|

|

Entity Representative |

|

|

|

|

|

|

|

|

3A. |

Signature of Individual Applicant, Spouse or Entity Member |

3B. |

Capacity |

3C. |

Date Signed (MM-DD-YYYY) |

|

|

|

Self |

|

|

|

|

|

Entity Representative |

|

|

|

|

|

|

|

|

4A. |

Signature of Individual Applicant, Spouse or Entity Member |

4B. |

Capacity |

4C. |

Date Signed (MM-DD-YYYY) |

|

|

|

Self |

|

|

|

|

|

Entity Representative |

|

|

|

|

|

|

|

|

5A. |

Signature of Individual Applicant, Spouse or Entity Member |

5B. |

Capacity |

5C. |

Date Signed (MM-DD-YYYY) |

|

|

|

Self |

|

|

|

|

|

Entity Representative |

|

|

|

|

|

|

|

|

6A. |

Signature of Individual Applicant, Spouse or Entity Member |

6B. |

Capacity |

6C. |

Date Signed (MM-DD-YYYY) |

|

|

|

Self |

|

|

|

|

|

Entity Representative |

|

|

|

|

|

|

|

|

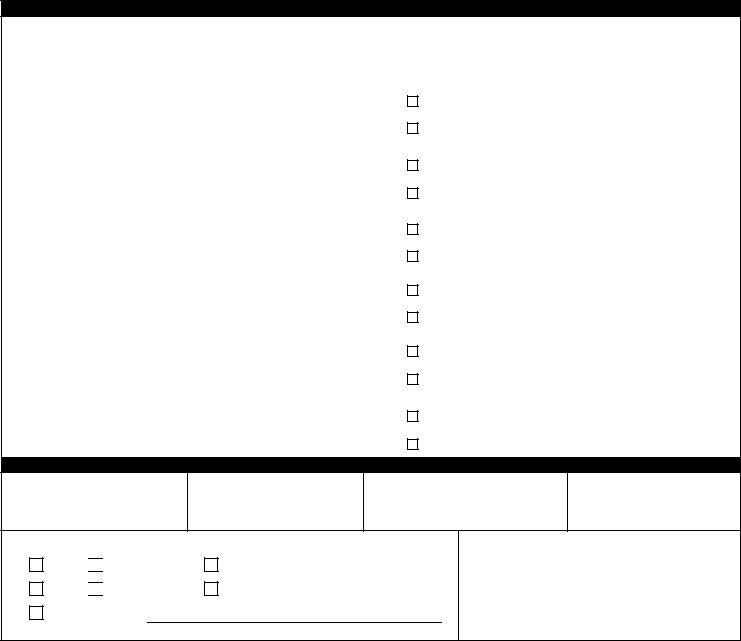

PART G– FSA USE ONLY

1. Date FSA-2001 Received

2. Date Application Complete

3A. Amount of Credit Report Fee Received

$

3B. Date Credit Report

Fee Received

4. Type of Assistance Requested:

FO OL

EM CL

Other (Specify):

Primary Loan Servicing Subordination

5. Name of Agency Official Receiving Application