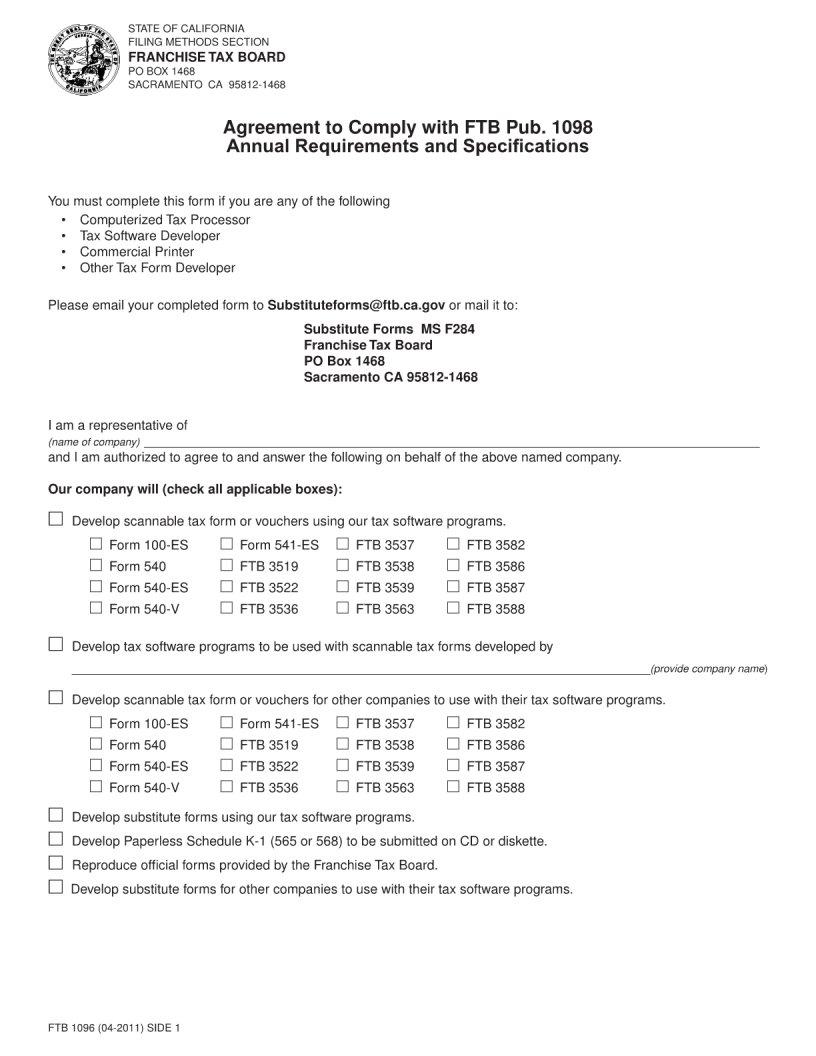

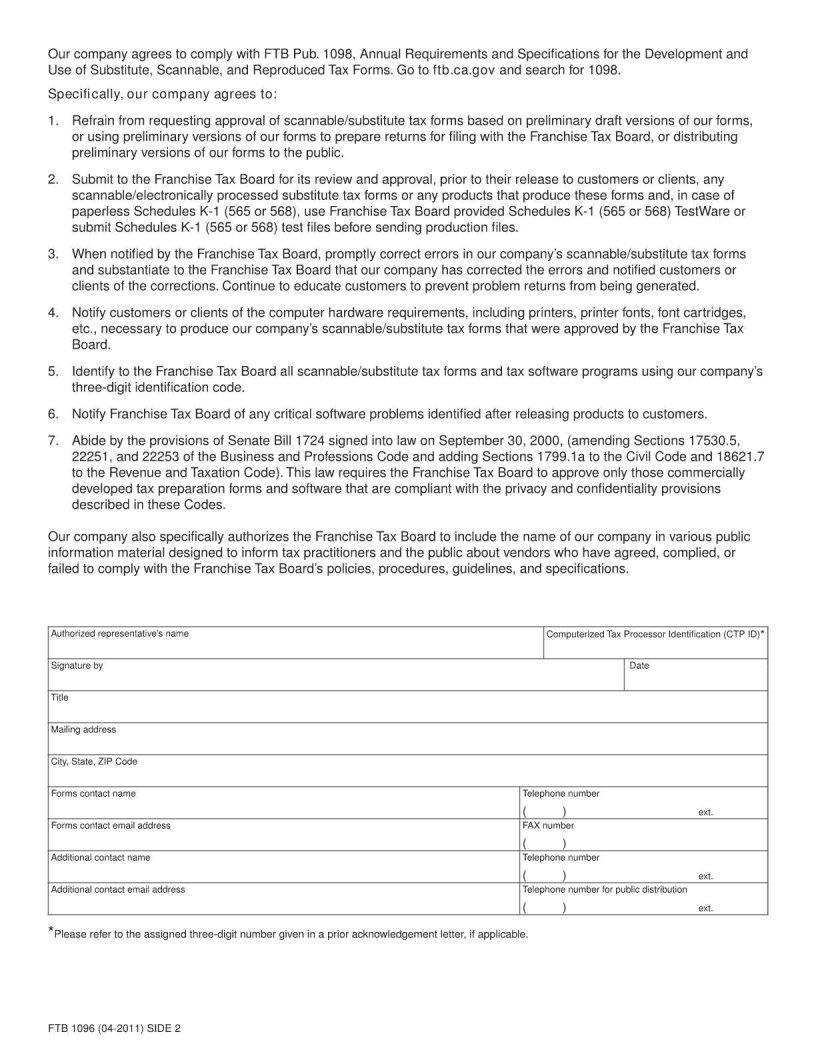

The landscape of tax documentation and reporting is vast and intricate, touching on numerous requirements that both individuals and businesses must adhere to annually. Within this complex framework, the Ftb1096 form emerges as a crucial document for those engaging in certain financial transactions or payment arrangements. This form serves as a vital tool in the process of reporting specific types of income, showcasing its importance for accurate tax reporting and compliance. By providing a standardized method for detailing the nature and amount of income paid throughout the tax year, it aids entities in adhering to state tax obligations while facilitating a smoother interaction with tax authorities. Additionally, the Ftb1096 form plays a pivotal role in ensuring transparency and accountability in financial dealings, underscoring its significance in the broader tapestry of financial and tax regulation. Understanding the nuances of this form, including when and how to properly complete and submit it, is essential for anyone involved in financial operations that fall within its purview, thereby mitigating potential legal complications and fostering a culture of compliance.

| Question | Answer |

|---|---|

| Form Name | Ftb1096 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | 540-ES, pdffiller 1096 form, 100-ES, where to mail 1096 in california |