You'll be able to complete hi taxation certificate effortlessly in our PDFinity® PDF editor. Our editor is continually evolving to grant the very best user experience achievable, and that is because of our resolve for constant development and listening closely to user feedback. Getting underway is effortless! All you need to do is adhere to the next simple steps below:

Step 1: Click on the "Get Form" button above. It will open our tool so you could begin filling out your form.

Step 2: When you launch the PDF editor, you will find the document all set to be filled in. Other than filling in various blanks, it's also possible to perform several other actions with the form, including adding custom words, changing the original textual content, inserting images, putting your signature on the form, and more.

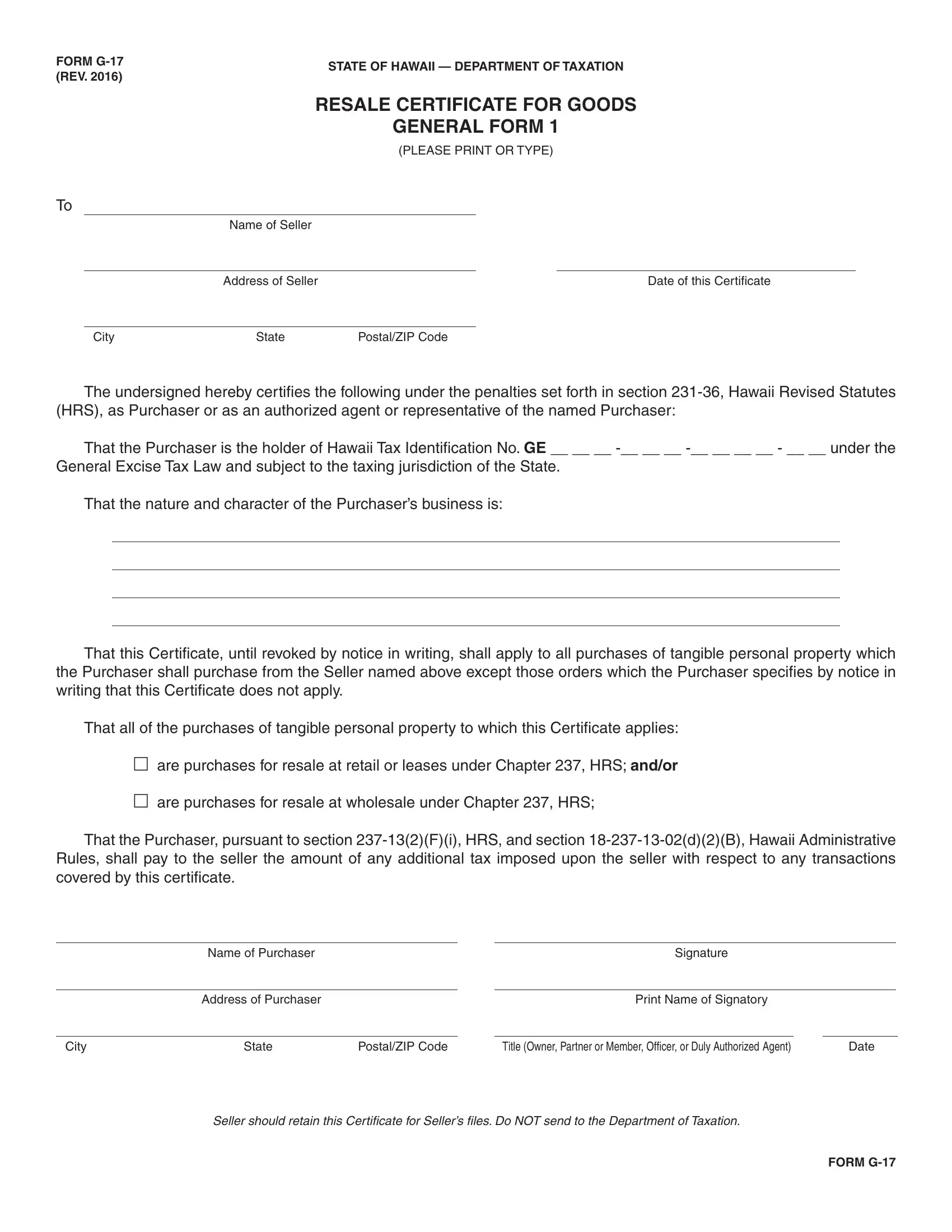

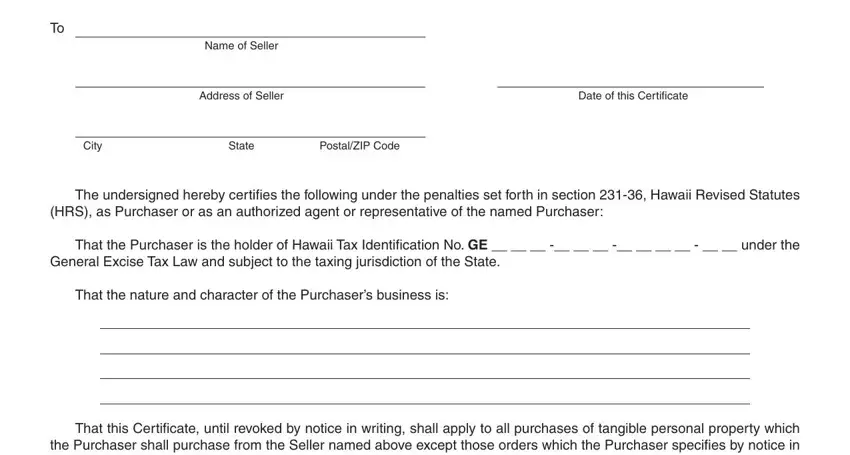

This PDF form will require some specific details; to ensure accuracy, please be sure to bear in mind the following guidelines:

1. Fill out your hi taxation certificate with a number of major blanks. Note all of the information you need and ensure not a single thing neglected!

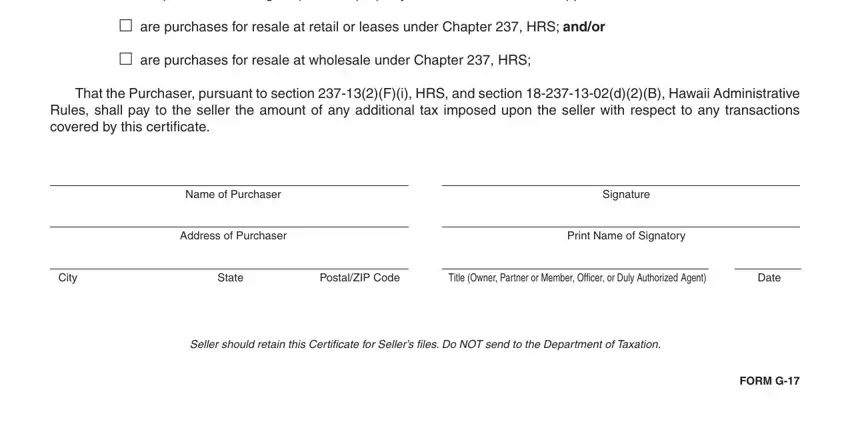

2. Just after filling out the last step, go to the subsequent part and enter the essential particulars in these fields - That all of the purchases of, are purchases for resale at, are purchases for resale at, That the Purchaser pursuant to, Name of Purchaser, Address of Purchaser, Signature, Print Name of Signatory, City, State, PostalZIP Code, Title Owner Partner or Member, Date, Seller should retain this, and FORM G.

Many people often make errors while filling out That the Purchaser pursuant to in this part. Remember to reread everything you enter right here.

Step 3: Go through everything you've typed into the blank fields and click the "Done" button. After getting afree trial account at FormsPal, it will be possible to download hi taxation certificate or email it immediately. The PDF document will also be easily accessible in your personal account menu with your each modification. FormsPal is committed to the confidentiality of all our users; we ensure that all personal data used in our tool is secure.