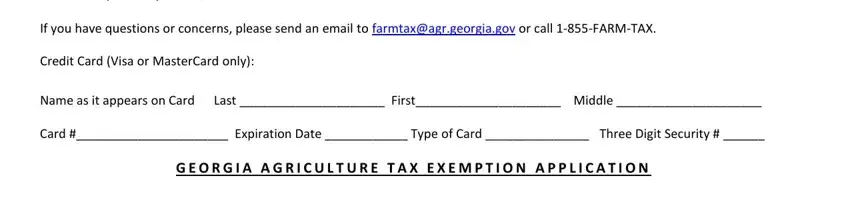

Georgia Agriculture

Tax Exemption Application

Instructions: The applicant must complete this entire document and submit both pages to Georgia Department of Agriculture, P.O. Box 742304, Atlanta, GA 30374-2304.

1.Reason for Application

New Registration Registration Renewal (current GATE number DORAG __ __ __ __ __ __ )

|

|

|

|

|

2. |

Contact Information |

Primary Card Holder: First ___________________ Last__________________________ |

|

Business Name: _______________________________________ |

Cell: __________________________________ |

|

Street: _______________________________________________ |

Home: _________________________________ |

|

______________________________________________ |

Email: _________________________________ |

|

City: ____________________________ |

State: ___________ |

Zip Code: _________________________________ |

|

|

|

3. |

Primary Mailing Address |

Check if address is the same as above |

|

|

|

First Name: ________________ Last Name: ____________________ |

City: ________________________________ |

Street: ___________________________________ |

State: _______________________________ |

____________________________________ |

Zip Code: _____________________________ |

4.Please list your Federal Employer Identification Number (if applicable).

___ ___ - ___ ___ ___ ___ ___ ___ ___

5.Please list two (2) additional authorized purchasers with this card (if applicable).

1.First _____________ Last _________________

2.First _____________ Last _________________

6.Applicant must meet at least one of the following criteria (check all that apply).

A)The person or entity is the owner or lessee of agricultural land or other real property from which $2,500.00 or more of agricultural products were produced and sold during the year, including payments from government sources;

B)The person or entity is in the business of providing for hire custom agricultural services, including, but not limited to, plowing, planting, harvesting, growing, animal husbandry or the maintenance of livestock, raising or substantially modifying agricultural products, or the maintenance of agricultural land from which $2,500.00 or more of such services were provided during the year;

C)The person or entity is the owner of land that qualifies for taxation under the qualifications of bona fide conservation use property as defined in Code Section 48-5-7.4 or qualifies for taxation under the provisions of the Georgia Forest Land Protection Act as defined in Code Section 48-5-7.7; or qualifies under Code Section 48-5-7.1.

D)The person or entity is in the business of producing long-term agricultural products from which there might not be annual income, including, but not limited to, timber, pulpwood, orchard crops, pecans, and horticultural or other multiyear agricultural or farm products. Applicants must demonstrate that sufficient volumes of such long-term agricultural products will be produced which have the capacity to generate at least $2,500.00 in sales annually in the future.

7.Type of Agricultural Service (choose one):

Farmer |

Nursery Operator |

Conservation Use |

Agricultural Processor /Farm Services |

|

|

|

|

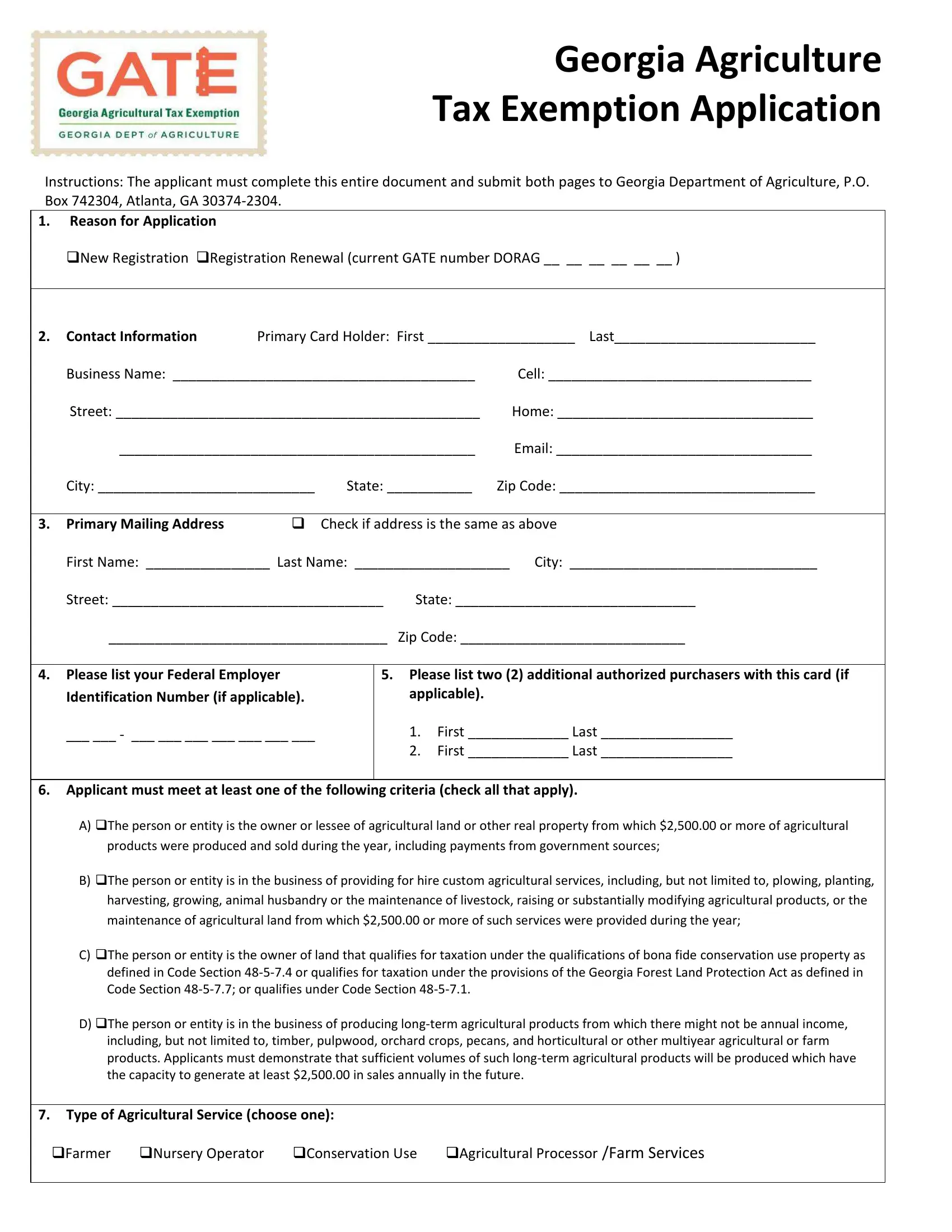

8.To the best of your ability, please indicate which of the 2012 North American Industry Classification System (NAICS) codes best describes your operation or can look up on page below.

NAICS Code: ____________________ NAICS Title: __________________________________________

Other: ____________________________ Explain: ___________________________________________

9. Please pla e an x in the |

ox elow des ri ing the type of crop produced (if applicable and limit to three): |

Apples |

Corn |

Greens |

Peppers |

Timber |

Carrots |

Beef |

Cotton |

Green House |

Poultry |

Tobacco |

Grapes |

Bees/Honey |

Cucumbers |

Hay |

Rye |

Tomatoes |

Peanuts |

Blackberries |

Dairy |

Hogs |

Sheep |

Turfgrass |

Pecans |

Blueberries |

Eggplant |

Olives |

Snap Beans |

Watermelon |

Squash |

Broilers |

Eggs |

Onions |

Southern Peas |

Wheat |

Strawberries |

Cabbage |

Equine |

Ornamentals |

Sorghum |

Zucchini |

Other _________ |

Cantaloupe |

Goats |

Peaches |

Soybeans |

|

|

10. For the purpose of meeting eligibility requirements, I file one of the following to meet my federal tax obligations.

IRS schedule F IRS form 4797 IRS form 4835 IRS form 1065 IRS schedule E IRS form 1120 or 1120(s) IRS form 1040 Other _____________________________

I acknowledge that all of the information submitted in this application is true and accurate. I certify under penalty of the law that I meet these qualifications and have the records on file.

Applicant Name (Printed):_____________________________________ |

|

Applicant Name (Signed):______________________________________ |

|

Date: _________________ |

|

---------- ---- ---- -- -------- -------- --------- -------- -------- ------- ---------- ---------- |

-------- ----- ----------- ---- |

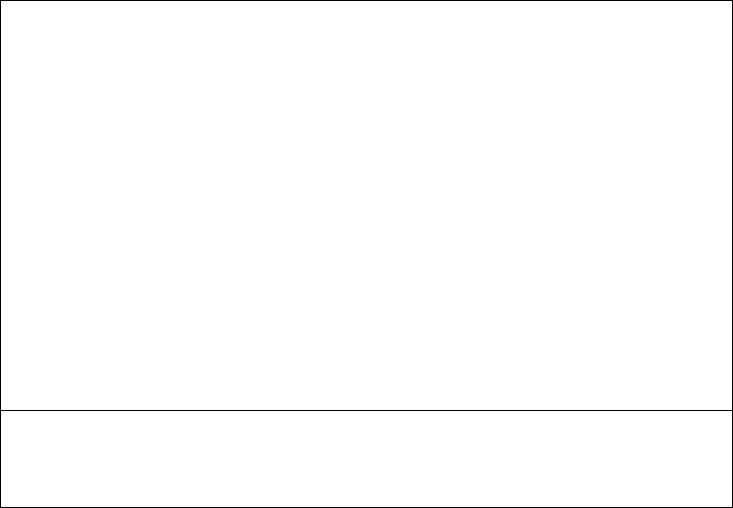

Written Application: $25

Method of Payment

Check:

Please make checks payable to the Georgia Department of Agriculture. Mail payment to Georgia Department of Agriculture, P.O.

Box 742304, Atlanta, GA 30374-2304.

If you have questions or concerns, please send an email to farmtax@agr.georgia.gov or call 1-855-FARM-TAX. Credit Card (Visa or MasterCard only):

Name as it appears on Card Last _____________________ First_____________________ Middle _____________________

Card #______________________ Expiration Date ____________ Type of Card _______________ Three Digit Security # ______

G E O R G I A A G R I C U L T U R E T A X E X E M P T I O N A P P L I C A T I O N