The Georgia Form 501X, revised in November 2011, serves as an essential document for fiduciaries needing to amend a previously filed fiduciary income tax return. This form addresses various reasons for amendments, such as changes dictated by the IRS, modifications in the trust or estate name, updates to the fiduciary’s information, or adjustments in the address. Moreover, it necessitates the inclusion of the Federal Employer Identification Number alongside details about the estate or trust, including the date of creation and the decedent’s death date. Fiduciaries must also report comprehensive financial data, starting with the adjusted total income and moving through adjustments, exemptions, and the net taxable income, leading to the calculation of the total tax due or refundable. The form includes specific sections for detailing beneficiaries’ shares of income, adjustments to income, and applicable tax credits, reinforcing its role in ensuring accurate tax reporting and compliance. Importantly, the form mandates attachments like a copy of the federal amended return and supporting documents for any changes made, underlining the importance of transparency and thorough documentation in the amendment process.

| Question | Answer |

|---|---|

| Form Name | Georgia Form 501X |

| Form Length | 5 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 15 sec |

| Other names | TSD_Amended_Fid uciary_Income_T ax_Return_501X_ TY2011 2011 taxes ga 500 uet form |

Georgia Form 501X(Rev. 11/11) |

Mailing Address: |

|

|

|

|||

|

|

||

Georgia Department of Revenue |

|||

Amended Fiduciary Income Tax Return |

|||

Processing Center |

|||

|

|||

|

P.O. Box 740316 |

||

|

Atlanta, Georgia |

||

|

Page 1 |

||

FOR FILING YEAR 2011

BEGINNING ____/____/ |

|

ENDING ____/____/ |

Federal Amended Return Filed (please attach copy)

Amended due to IRS changes

Change in Trust or Estate Name |

|

|

Change in Fiduciary |

|

500 UET |

|

||

|

|

Exception Attached |

Change of Address |

|

|

A. Federal Employer Id. No. |

Name of Estate or Trust |

|

|

|

|

|

Date of Creation of Trust |

|

|

|

|

|

|

|

|

|

|

B. Date of Decendent’s Death |

Name of Fiduciary |

|

|

|

Title of Fiduciary |

Telephone No. |

|

|

|

|

|

|

|

|

|

|

|

C. Address of Fiduciary (Number and Street) |

|

|

( Apt., Suite or Building Number) |

|

|

|||

|

|

|

|

|

|

|

|

|

City |

|

State |

Zip Code |

|

Country |

|

|

|

|

|

|

|

|

|

|

|

|

D. If no return was filed last year, state reason |

|

|

|

|

|

|

|

|

Schedule 1 - Computation of Tax

1. |

|

Income of fiduciary (Adjusted total income from attached Form 1041) |

|

1. |

|

|

|

||

|

|

|

|

|

|||||

2. |

|

Adjustments: (List of all items in Schedule 3, Page 3) |

|

2. |

|

|

|

||

|

|

|

|

|

|||||

3. |

|

Total (Net total of Line 1 and 2) |

|

|

3. |

|

|

|

|

4. |

|

Beneficiaries’ Share of Income (Total of Schedule 2) |

|

4. |

|

|

|

||

|

|

|

|

|

|||||

5. |

|

Balance (Line 3 less Line 4) |

|

|

5. |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

6. |

|

Exemptions: |

6a. Trust $1350 |

6b. Estate $2700 |

6. |

|

|

|

|

7. |

|

Net taxable income of fiduciary (Line 5 less Line 6) |

|

7. |

|

|

|

||

|

|

|

|

|

|||||

8. |

|

Total tax |

|

|

8. |

|

|

|

|

9. |

|

Less Credits: |

9a. Other State Credit |

|

9a. |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

9b. Pass Through and Business Credits |

|

9b. |

|

|

|

|

|

|

|

9c. Total |

|

9c. |

|

|

|

|

10. |

Tax less credit |

(Net total of Line 8 less Line 9, if 0 or less, enter 0) |

|

10. |

|

|

|

||

|

11a. |

|

|

|

|||||

11. Less payments: 11a. Georgia Estimated Tax Paid |

|

|

|

|

|||||

|

|

|

|

||||||

|

|

|

.................................................................11b. Georgia Tax Withheld |

|

11b. |

|

|

|

|

|

|

|

11c. Amount paid with original return, plus any additional payments |

|

11c. |

|

|

|

|

|

|

|

made after it was filed |

|

|

|

|

||

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

|

|

|

11d. Total |

|

11d. |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

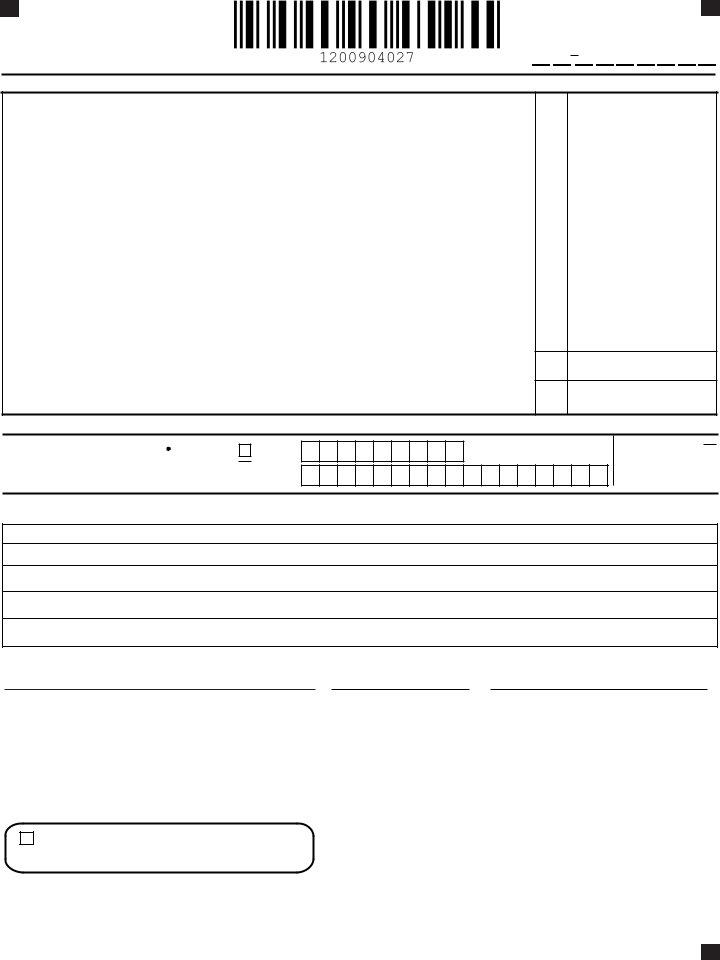

Georgia Form 501X |

Page 2 |

Amended Fiduciary Income Tax Return

TAXPAYER’S FEIN

____ ____ ____ ____ ____ ____ ____ ____ ____

Schedule 1- Computation of Tax (continued)

12. |

Previous refund(s), if any, shown on previous return(s) |

12. |

13. |

Net (Line 11d minus Line 12) |

13. |

14. |

Balance of tax due. If Line 10 exceeds Line 13, enter Line 10 less Line 13 |

14. |

15. |

Overpayment. If Line 13 exceeds Line 10, enter Line 13 less Line 10 |

15. |

16. |

Amount from Line 15 to be credited to next year’s estimated tax |

16. |

17. |

Interest |

17. |

18. |

Late payment penalty |

18. |

.........................................................................................................19. Late filing penalty |

19. |

|

20. Penalty for underpayment of estimated tax (UET) |

20. |

|

21.(If you owe) Add lines 14, 17 thru 20. Make check payable to Georgia Department of Revenue. 21.

22. (If you are due a refund) Subtract Lines 16 and 20 from Line 15. This is your refund |

22. |

Direct Deposit Options

22a. Direct Deposit (For U.S. Accounts Only)

See Instructions in the

Type: Checking |

Routing |

|

Number |

Savings Account

Number

22b.Paper Check

DECLARATION: I/we declare under the penalties of perjury that I/we have examined this return (including accompanying schedules and statements) and to the best of our knowledge and belief it is true, correct and complete. If prepared by a person other than taxpayer this delcaration is based on all information of which the preparer has any knowledge.

EXPLANATIONS OF CHANGES: Provide an explanation of changes below. Attach any supporting documents and schedules.

|

SIGNATURE OF FIDUCIARY |

|

DATE |

|

PHONE NUMBER |

||||

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE OF PREPARER OTHER THAN FIDUCIARY |

|

DATE |

|

PREPARER’S IDENTIFICATION NUMBER |

||||

|

|

|

|

|

|

|

|

|

|

|

NAME OF PREPARER OTHER THAN FIDUCIARY |

|

PHONE NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

I authorize Georgia Department of Revenue to electroni- |

|

|

|

|

Department Use Only |

|

||

|

cally notify me at the below email address regarding any |

|

|

|

|

|

|

|

|

|

updates to my account(s). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FIDUCIARY EMAIL ADDRESS |

|

|

|

|

|

|

|

|

THE FIDUCIARY MUST ATTACH TO THIS RETURN A COPY OF ITS FEDERAL RETURN AND SUPPORTING SCHEDULES

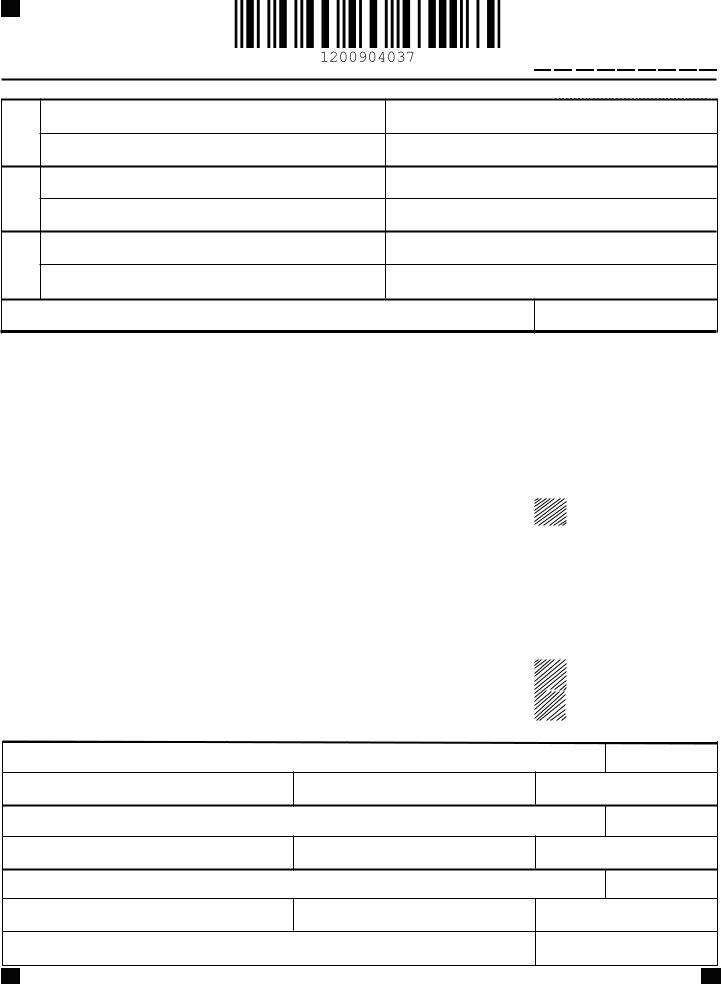

Georgia Form 501X |

|

Page 3 |

|

|

|

|

|

Amended Fiduciary Income Tax Return |

|

|

|

TAXPAYER’S FEIN |

|||

____ ____ |

|

||

|

____ ____ ____ ____ ____ ____ ____ |

||

Schedule 2 - Beneficiaries’ Share of Income

Name

AAddress

Name

BAddress

Name

CAddress

ID Number |

|

Share of Income |

|

|

|

|

|

City |

State |

ZIP |

|

|

|

|

|

ID Number |

|

Share of Income |

|

|

|

|

|

City |

State |

ZIP |

|

|

|

|

|

ID Number |

|

Share of Income |

|

|

|

|

|

City |

State |

ZIP |

|

|

|

|

|

Enter total (Including additional Beneficiaries’ Share of Income from attached schedule).

Schedule 3 - Adjustments to Income

ADDITIONS |

|

|

||||

1. |

Municipal bond interest - Other states |

1. |

|

|||

2. |

Income tax deduction other than Georgia |

2. |

|

|||

3. |

Expense allocable to exempt income (Other than US obligations) |

3. |

|

|||

|

|

|

|

4a. |

|

|

4a. Other |

|

................................................. |

|

|||

|

|

|

4b. |

|

||

4b. Other |

|

................................................. |

|

|||

.............................................................................................................................................TOTAL ADDITIONS |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUBTRACTIONS |

|

|

||||

1. Interest - U.S. Government Bonds (Must be reduced by direct and indirect interest expense) |

1. |

|

||||

2. |

|

|||||

2. Income Tax Refund other than Georgia |

|

|||||

3a. |

|

|||||

|

|

|

|

|||

3a. Other |

|

............................................... |

|

|||

|

|

|

3b. |

|

||

|

|

|||||

3b. Other |

|

............................................... |

|

|||

|

|

|

|

|

||

TOTAL SUBTRACTIONS |

|

|

||||

............NET ADJUSTMENT: Total additions less total subtractions. (Enter also on Line 2, Schedule 1) |

|

|

||||

|

|

|

|

|

|

|

Schedule 4 - Pass Through and Business Credits - If more than 3 enclose schedule

Company Name

Credit Code Type

Ownership Percentage

FEIN

Credit Claimed

Company Name

Credit Code Type

Ownership Percentage

FEIN

Credit Claimed

Company Name

Credit Code Type

Ownership Percentage

FEIN

Credit Claimed

Enter total (Including additional

Georgia Form 501X |

Page 4 |

Amended Fiduciary Income Tax Return |

|

Instructions

Every resident and nonresident fiduciary having income from sources within Georgia or managing funds or property for the benefit of a resident of this state is required to file a Georgia income tax return on Form 501.

Returns are required to be filed by the 15th day of the 4th month following the close of the taxable year. If the due date falls on weekend or holiday, the tax shall be due on the next day that is not a weekend or holiday.

The Georgia Code provides penalties for failure to comply with its provisions and for interest on late payments of tax and deficiencies.

SPECIFIC INSTRUCTIONS

Schedule 1

Enter on Line 1 the amount of gross income less the itemized deductions shown on the Federal Form 1041.

Enter on Line 2 the net adjustment from Schedule 3.

Enter on Line 4 the total portion of income distributable to all beneficiaries as listed in Schedule 2.

Enter on Line 6 the exemption: Trusts $1,350, Estates $2,700.

Compute the total income tax on the amount shown on Line 7 from the following tax

rate schedule, entering the total tax due on Line 8. |

|

|

||||

If the amount |

But Not |

Amount of |

|

Of |

||

on Line 7 is |

|

Over |

|

Tax is |

Excess |

|

Over |

|

|

|

|

Over |

|

............................... |

$ |

750 |

|

1% |

........................ |

|

$ 750 |

$ |

2250 |

$ |

7.50+2%. |

............ $ |

750 |

$ 2250 |

$ |

3750 |

$ |

37.50+3% |

............. $ |

2250 |

$ 3750 |

$ |

5250 |

$ |

82.50+4% |

$ |

3750 |

$ 5250 |

$ |

7000 |

$ |

142.50+5% |

$ |

5250 |

$ 7000 |

|

$ |

230.00+6% |

$ |

7000 |

|

Line 9a

A credit is allowed on Line 9a for income tax period to other States. A copy of the other state’s(s) return must be attached.

Line 9b

For more information about pass through and business credits, see our website. Submit a schedule for the total credit claimed if more than 3 credits are claimed. The amount on the schedule must equal the amount claimed on Line 9b.

Line 11b

Credit for nonresident withholding on distributions from pass through entities and sale of property by nonresidents. See O.C.G.A. Sections

The amount withheld from a

Schedule 2

If there are more than 4 beneficiaries, attach a list showing the same information for each.The total of Schedule 2 must be the same as the amount on Line 4, Schedule 1

Schedule 3

Georgia taxable income of a fiduciary is its Federal income with certain adjustments as provided in Code Section

Schedule 4

Pass - through and business Credits are from ownership of Sole Proprietor, S Corp., LLC or

ADDITIONS: Interest on State and Municipal bonds other than Georgia and its political subdivisions. Any income tax claimed as a deduction on Form 1041 other than Georgia. Fiduciary fee and other expense allocable to income exempt from Georgia tax (other than U.S. obligations).

SUBTRACTIONS: Interest and dividends on U.S. Government bonds and other U.S. obligations. U.S. obligation income must be reduced by direct and indirect interest expense. To arrive at this reduction, the total interest expense is multiplied by a fraction, the numerator of which is the taxpayers average adjusted basis of the U.S. obligations, and the denominator of which is the average adjusted basis of all assets of the taxpayer. NOTE: Interest received from the Federal National Mortgage Association (FNMA), Government National Mortgage Association (GNMA), Federal Home Loan Mortgage Corporation (FHLMC), and interest derived from repurchase agreements are not considered to be obligations of the United States and are taxable. Federally taxable interest on “Build America Bonds” and other Georgia municipal interest for which there is a special exemption under Georgia law. “ Recovery Zone Economic Development Bonds” under Section

Income Tax refunds included as income on Form 1041 other than Georgia. Enter the total adjustments on the indicated line of Schedule 3 and on Line 2, Schedule 1.

GENERAL INFORMATION

PENALTIESAND INTEREST

DELINQUENT FILING OF RETURN - 5% of the tax not paid by original due date

for each month or fractional part thereof - up to 25%.

FAILURE TO PAY tax shown on a return by due date - 1/2 of 1% of the tax due for each month or fractional part thereof - up to 25%. Failure to pay is not due if the return is being amended due to an IRS audit.

Note: Late payment and late filing penalties together cannot exceed 25% of tax not paid by original due dates.

A PENALTY OF $1,000 may be assessed against an individual who files a frivolous return.

NEGLIGENT underpayment of tax - 5% of the underpayment. FRAUDULENT UNDERPAYMENT - 50% thereof.

FAILURE TO FILE ESTIMATED TAX - 9% per annum for the period of underpayment. Form 500UET is available upon request for computation of underestimated installment payments. If you were eligible for an estimated tax penalty exception on Form 500 UET, please check the “500 UET Exception Attached” box, include the revised penalty on line 18 of the Form 501 (if the revised penalty is zero enter zero), and include the 500UET with the return.

INTEREST is computed at 12% per year on any unpaid tax from the date due until paid. An extension of time for filing does not relieve late payment penalty or interest.

ESTIMATEDTAX

Code Section

WHEN AND WHERE TO FILE ESTIMATED TAX. Estimated tax payments required to be filed by persons not regarded as farmers or fishermen shall be filed on or before April 15th of the taxable year, except that if the above requirements are first met on or after April 1st, and before June 1st, the tax must be paid by June 15th; on or after June 1st and before September 1st, by September 15th; and on or after September 1st, by January 15th of the following year. If the due date falls on a weekend or holiday, the tax shall be due on the next day that is not a weekend or holiday. Fiduciaries filing on a

The estimate coupon, Form 500ES, should be mailed to the Department of Revenue, Processing Center, P.O. Box 740319, Atlanta, GA

PAYMENT OF ESTIMATED TAX. Payment in full or your estimated tax may be made with the first required payment or in equal installments during this year on or before April 15th, June 15th, September 15th, and the following January 15th. Make your check or money order payable to “Georgia Department of Revenue.” Georgia Public Revenue Code Section

TAX CREDITS

Page 5

The following

NOTE: Credit code numbers are subject to change annually. Current code numbers are listed below. See Form

For additional information on the

Code |

Name of Credit |

101Employer’s Credit for Basic Skills Education

102Employer’s Credit for Approved Employee Retraining

103Employer’s Jobs Tax Credit

104Employer’s Credit for Purchasing Child Care Property

105Employer’s Credit for Providing or Sponsoring Child Care for Employees

106Manufacturer’s Investment Tax Credit

107Optional Investment Tax Credit

108Qualified Transportation Credit

109Low Income Housing Credit (enclose Form

110Diesel Particulate Emission Reduction Technology Equipment

111Business Enterprise Vehicle Credit

112Research Tax Credit

113Headquarters Tax Credit

114Port Activity Tax Credit

115Bank Tax Credit

116Low Emission Vehicle Credit (enclose DNR certification)

117Zero Emission Vehicle Credit (enclose DNR certification)

118New Facilities Job Credit

119Electric Vehicle Charger Credit (enclose DNR certification)

120New Facilities Property Credit

121Historic Rehabilitation Credit (enclose Form

122Film Tax Credit

123Teleworking Credit

124Land Conservation Credit (enclose Form

125Qualified Education Expense Credit (enclose Form

126

127Clean Energy Property Credit (enclose Form

128 Wood Residual Credit

129 Qualified Health Insurance Expense Credit (enclose Form

130Quality Jobs Tax Credit

131Alternate Port Activity Tax Credit