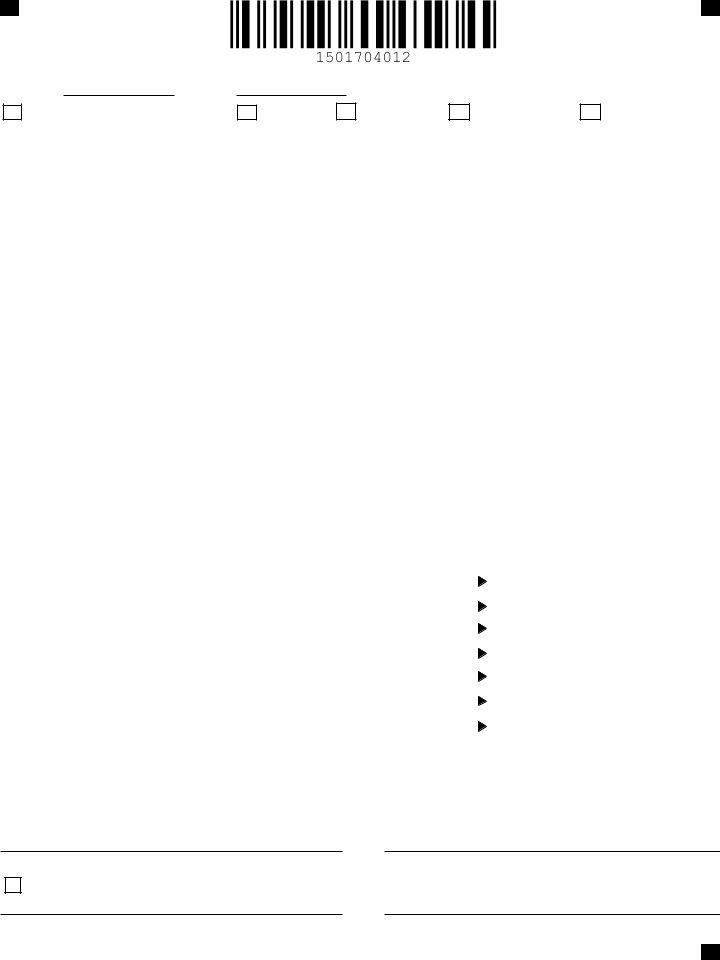

When navigating the complexities of filing partnership tax returns in Georgia, the Georgia Form 700, revised October 2014, serves as an essential document. This form, designated for partnership tax returns for the year 2014, provides a structured framework to report income, deductions, and credits associated with the operations of a partnership within the state. Businesses are required to indicate whether the form represents an original, amended, or final return and to notify of any changes in name or address. The form is intricately designed to capture detailed information about the partnership, including federal employer identification numbers, Georgia withholding tax numbers, and sales tax registration numbers. Additionally, it requires the location of books for audit purposes, information on the kind of business, the date the business commenced operations in Georgia, and the accounting method employed. The partnership's income for Georgia purposes is meticulously calculated through various schedules, which include total income, apportioned and allocated income, and Georgia net income, involving sophisticated computations such as the Georgia ratio. This form also obliges partnerships to attach a copy of the federal return and supporting schedules, ensuring thorough documentation. It culminates in a declaration section that must be signed under the penalty of perjury, attesting to the accuracy and completeness of the information provided. Completing and submitting the Georgia Form 700 is a critical step for partnerships in complying with state tax obligations and ensuring accurate financial reporting.

| Question | Answer |

|---|---|

| Form Name | Georgia Form 700 |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | georgia form 700 instructions 2020, form ga 700 instructions 2020, 2020 ga 700 form instructions, ga form 700 instructions |

Georgia Form 700 (Rev. 10/14)

Partnership Tax Return

2014 Income Tax Return

BeginningEnding

Original Return |

|

Amended Return |

Final Return

Name Change

Address Change

Page 1

Composite Return Filed

A. Federal Employer Id. No. |

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

Location of Books for Audit (City) & (State) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B. GA. Withholding Tax Numbers |

|

|

Number and Street |

|

|

|

|

Country |

|

Telephone Number |

||||||||||||||

Payroll WH Number |

Nonresident WH Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

C. GA. Sales Tax Reg. No. |

|

|

City or Town |

|

|

|

|

|

|

|

|

|

|

|

State |

|

Zip Code |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D. Name (if different from last year’s return) |

|

|

|

|

Number and Street (if different from last year’s return) |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

|

Zip Code |

|

If no return was filed last year, state the reason why |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E. NAICS Code |

|

F. Kind of Business |

|

|

G. Date began doing |

|

|

H. Basis of this return |

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

business in GA |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( ) CASH ( ) ACCRUAL ( ) OTHER |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

I. Indicate latest taxable year |

J. Number of Partners |

K. Do you have Nonresident |

L. Number of Nonresident |

|

M. Amount of Nonresident |

|||||||||||||||||||

|

adjusted by the IRS |

|

|

|

|

|

Partners? |

|

|

Partners |

|

Withholding paid for tax year |

||||||||||||

|

|

|

|

|

|

|

|

|

( ) Yes or ( ) No |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPUTATION OF GEORGIA NET INCOME |

|

|

|

|

(ROUND TO NEAREST DOLLAR) |

|

SCHEDULE 1 |

||||||||||||||||

1. |

Total Income for Georgia purposes (Line 12, Schedule 7) |

|

|

|

|

|

1. |

|

|

|

|

|

||||||||||||

2. |

Income allocated everywhere (Attach Schedule) |

............................................................ |

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|||||||

3. |

Business income subject to apportionment (Line 1 less Line 2) |

.................................. |

|

|

|

|

|

3. |

|

|

|

|

|

|||||||||||

4. |

Georgia ratio (Schedule 6, Column C) |

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

||||||||

5. |

Net business income apportioned to Georgia (Line 3 x Line 4) |

|

|

|

|

|

5. |

|

|

|

|

|

||||||||||||

6. |

Net income allocated to Georgia (Attach Schedule) |

|

|

|

|

|

|

|

|

|

6. |

|

|

|

|

|

||||||||

7. |

Total Georgia net income (Add Line 5 and Line 6) |

|

|

|

|

|

|

|

|

|

7. |

|

|

|

|

|

||||||||

Copy of the Federal Return and supporting Schedules must beattached. Otherwise this return shall be deemed incomplete.

DECLARATION

I/We declare under the penalties of perjury that I/we have examined this return (including accompanying schedules and statements) and to the best of my/our knowledge and belief it is true, correct, and complete. If prepared by a person other than taxpayer, this declaration is based on all information of which the preparer has any knowledge.

MAIL TO: Georgia Department of Revenue, Processing Center, PO Box 740315, Atlanta, Georgia

Signature of Partner (Must be signed by partner) |

Signature of Preparer other than partner or member |

I authorize the Georgia Department of Revenue to electronically notify me at the below

Email Address |

Preparer’s Firm Name |

|

|

|

|

|

|

Date |

Preparer’s SSN or PTIN |

Date |

|

TRIAL MODE − a valid license will remove this message. See the keywords property of this PDF for more information.

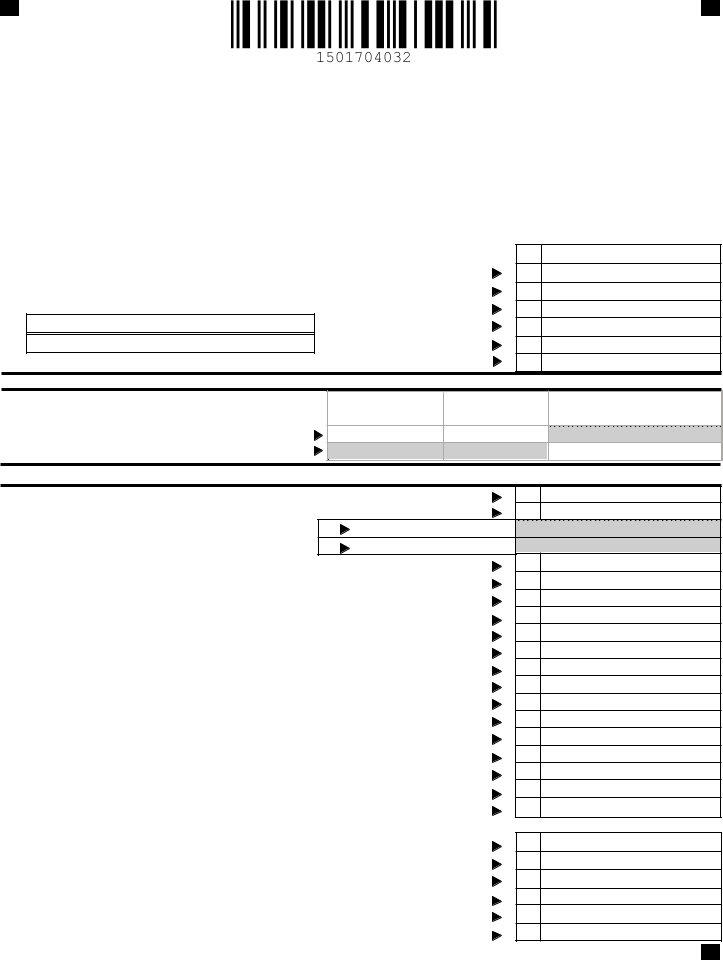

Georgia Form 700/2014

Page 2

(Partnership) Name |

|

|

FEIN |

|

|

|

|

|

|

||

GEORGIA TAX CREDITS |

(ROUND TO NEAREST DOLLAR) |

SCHEDULE 2 |

|||

|

|

|

|

|

|

These are for information purposes only and do not affect Schedules 1 or

Credit Type Code |

Company Name |

|

FEIN |

% |

|

Amount of Credit |

|

|

|

|

|

|

|

|

|

1. |

|

|

|

|

|

1. |

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

5. |

|

|

|

|

|

5. |

|

|

|

|

|

|

|

|

|

6. |

|

|

|

|

|

6. |

|

|

|

|

|

|

|

|

|

7. |

|

|

|

|

|

7. |

|

|

|

|

|

|

|

|

|

8. |

|

|

|

|

|

8. |

|

|

|

|

|

|

|

|

|

9. |

|

|

|

|

|

9. |

|

|

|

|

|

|

|

|

|

10. |

|

|

|

|

|

10. |

|

|

|

|

|

|

|

|

|

11. |

Enter the total from attached schedule(s) |

|

11. |

|

|||

12. TOTALALLOWABLE GEORGIATAXCREDITS FOR THEYEAR |

......................................... |

|

12. |

|

|||

Attach the appropriate form or a detailed schedule for each credit claimed (See pages

|

INCOME TO PARTNERS |

|

(ROUND TO NEAREST DOLLAR) |

|

SCHEDULE 3 |

|||||

|

|

(1.) Name |

(3.) City, State and Zip |

|

|

|

|

|

||

|

|

(2.) Street and Number |

(4.) I.D. Number |

Profit Sharing % |

|

Georgia Source Income |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

|

|

5. |

|

|

6. |

|

|

A |

|

2. |

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

1. |

|

|

5. |

|

|

6. |

|

|

B |

|

2. |

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

1. |

|

|

5. |

|

|

6. |

|

|

C |

|

2. |

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

1. |

|

|

5. |

|

|

6. |

|

|

D |

|

2. |

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

1. |

|

|

5. |

|

|

6. |

|

|

E |

|

2. |

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

TOTAL |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||||

|

ADDITIONS TO FEDERAL TAXABLE INCOME |

(ROUND TO NEAREST DOLLAR) |

|

SCHEDULE 4 |

||||||

|

|

|

|

|

|

|||||

1. |

State and municipal bond interest other than Georgia or political subdivision thereof |

|

1. |

|

|

|||||

2. |

Net income or net profits taxes imposed by taxing jurisdictions other than Georgia |

|

2. |

|

|

|||||

3. |

Expenses attributable to tax exempt income |

|

3. |

|

|

|||||

|

Schedule 4 continued on Page 3 |

|

|

|

|

|

||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

TRIAL MODE − a valid license will remove this message. See the keywords property of this PDF for more information.

Georgia Form 700/2014 |

Page 3 |

(Partnership) Name |

|

|

FEIN |

|

|

|

|

|||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

||

|

ADDITIONS TO FEDERAL TAXABLE INCOME |

(ROUND TO NEAREST DOLLAR) |

|

|

SCHEDULE 4 (continued) |

|||||

|

|

|

|

|

|

|

|

|

|

|

4. |

|

Federal deduction for income attributable to domestic production activities (IRC section 199) |

|

4. |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

5. |

|

Intangible expenses and related interest costs |

|

|

|

5. |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

6. |

|

Captive REIT expenses and costs |

|

|

|

6. |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

7. |

|

Other additions (Attach schedule) |

|

|

|

7. |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

8. |

|

|

|

.......................................................... |

|

8. |

|

|

||

9. Total (Add Lines 1 through 8) Enter here and on Line 9, Schedule 7 |

|

9. |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

SUBTRACTIONS FROM FEDERAL TAXABLE INCOME |

(ROUND TO NEAREST DOLLAR) |

|

|

SCHEDULE 5 |

|||||

1.Interest on obligations of United States (must be reduced by direct and indirect interest expenses)

2. Exception to intangible expenses and related interest cost (Attach

3. Exception to captive REIT expenses and costs (Attach

4. Other subtractions (Attach Schedule) ..............................................................................

5.

6.

7. Total (Add Lines 1 through 6) enter here and on Line 11, Schedule 7..........................

1.

2.

3.

4.

5.

6.

7.

APPORTIONMENT OF INCOME |

(ROUND TO NEAREST DOLLAR) |

SCHEDULE 6 |

|

A. WITHIN GEORGIA B. EVERYWHERE |

C. DO NOT ROUND COL (A)/ COL (B) |

|

|

COMPUTE TO SIX DECIMALS |

1. Gross receipts from business |

|

|

2. Georgia Ratio (Divide Column A by Column B) |

|

|

|

COMPUTATION OF TOTAL INCOME FOR GEORGIA PURPOSES (ROUND TO NEAREST DOLLAR) |

SCHEDULE 7 |

||

1. |

Ordinary income (loss) |

|

1. |

|

2. |

Net income (loss) from rental real estate activities |

....................................... |

2. |

|

3. |

a. Gross income from other rental activities |

3a. |

|

|

|

b. Less expenses (attach schedule) |

3b. |

|

|

|

c. Net income (loss) from other rental activities (Line 3a less Line 3b) |

3c. |

||

4. |

Portfolio income (loss): |

a. Interest Income |

4a. |

|

|

|

b. Dividend Income |

4b. |

|

|

|

c. Royalty Income |

4c. |

|

|

|

d. Net |

4d. |

|

|

|

e. Net |

4e. |

|

|

|

f. Other portfolio income (loss) |

4f. |

|

5. |

Guaranteed payments to partners |

5. |

||

6. |

Net gain (loss) under Section 1231 |

6. |

||

7. |

Other Income (loss) |

|

7. |

|

8. |

Total Federal income (add Lines 1 through 7) |

8. |

||

9. |

Additions to Federal income (Schedule 4, Line 9) |

9. |

||

10. |

Total (add Lines 8 and 9) |

............................................................................................ |

10. |

|

11. |

Subtractions from Federal income (Schedule 5, Line 7) |

11. |

||

12. |

Total income for Georgia purposes (Line 10 less Line 11) |

12. |

||

Other Required Federal Information

1.Salaries and wages (Form 1065) ...............................................................................

2.Taxes and licenses (Form 1065) ................................................................................

3.Section 179 deduction (Form 1065) ...........................................................................

4.Contributions (Form 1065) .......................................................................................

5.Investment interest expense (Form 1065) .................................................................

6.Section 59(e)(2) expenditures (Form 1065) ...............................................................

1.

2.

3.

4.

5.

6.

TRIAL MODE − a valid license will remove this message. See the keywords property of this PDF for more information.