In case you want to fill out g ga file, you won't have to install any programs - just try our PDF editor. FormsPal team is aimed at providing you with the best possible experience with our tool by constantly adding new functions and upgrades. Our tool is now much more intuitive with the latest updates! Now, working with PDF documents is a lot easier and faster than ever before. It merely requires several easy steps:

Step 1: Hit the orange "Get Form" button above. It is going to open up our pdf tool so that you can start filling out your form.

Step 2: The tool grants the capability to customize the majority of PDF forms in a variety of ways. Modify it by adding customized text, correct what's already in the file, and put in a signature - all readily available!

It will be easy to fill out the pdf with our detailed tutorial! This is what you need to do:

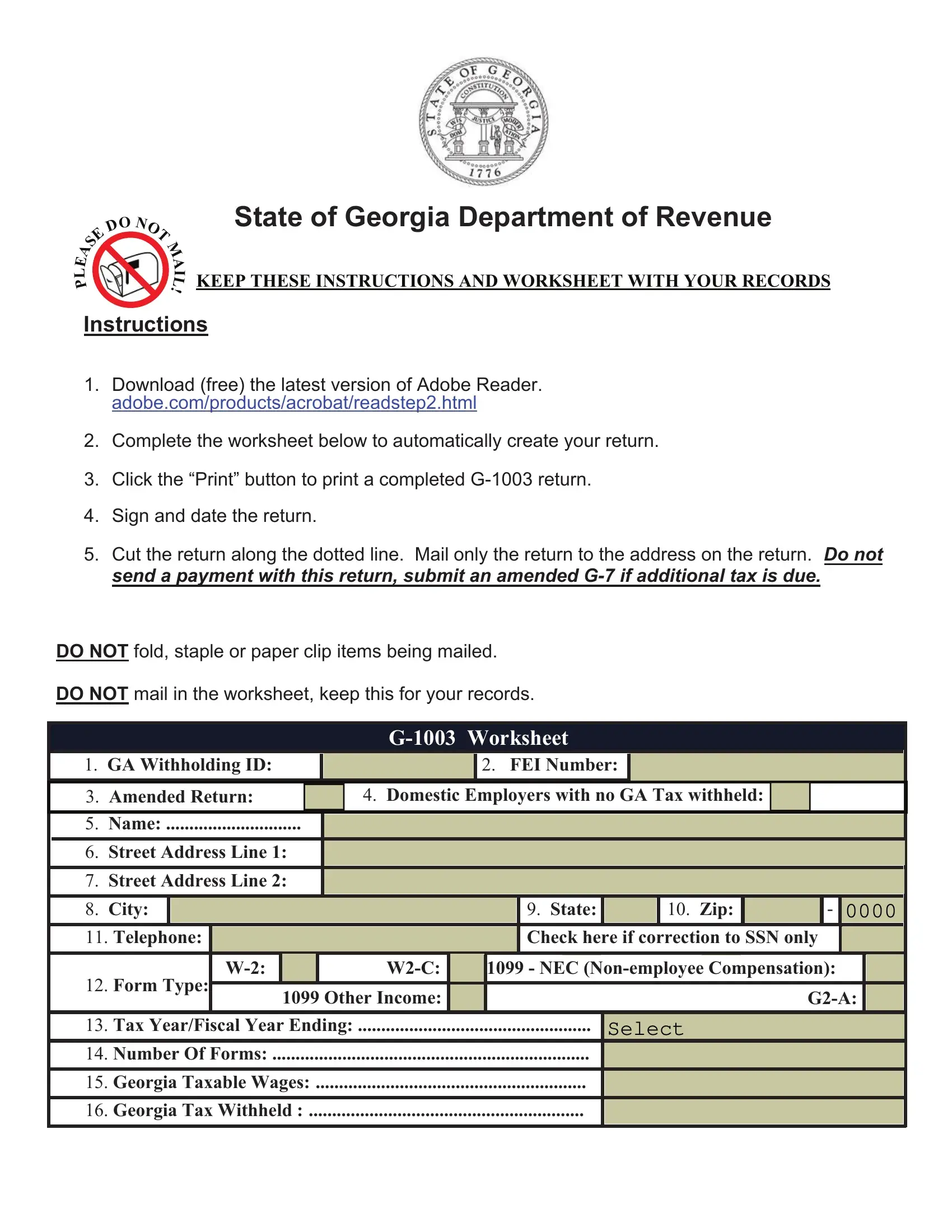

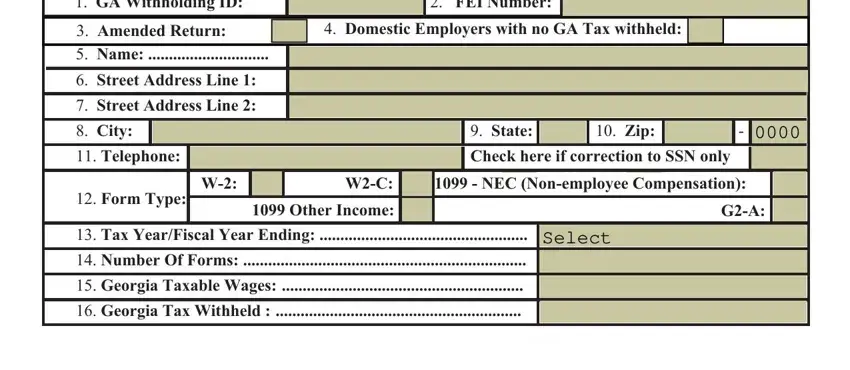

1. When completing the g ga file, make certain to incorporate all of the important fields within the relevant section. It will help hasten the work, allowing your information to be handled swiftly and correctly.

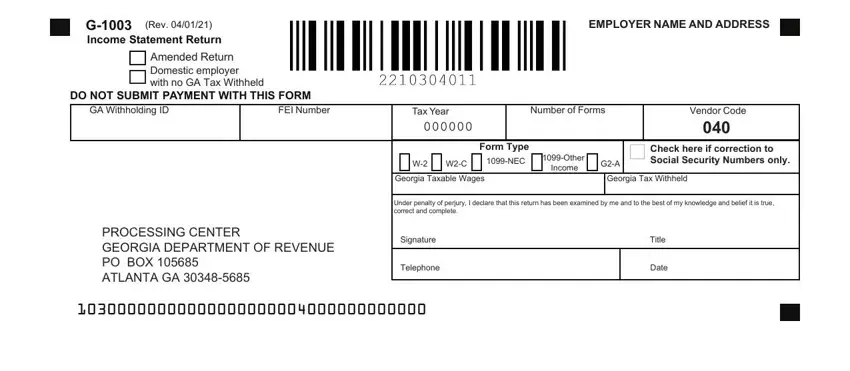

2. The next part is to submit the next few blanks: G Income Statement Return, Rev, Amended Return Domestic empl oyer, DO NOT SUBMIT PAYMENT WITH THIS, GA Withholding ID, FEI Number, EMPLOYER NAME AND ADDRESS, Tax Year, Number of Forms, Vendor Code, Form Type, NEC, Other, Income, and Check here if correction to Social.

Always be really attentive while completing DO NOT SUBMIT PAYMENT WITH THIS and Number of Forms, as this is where a lot of people make a few mistakes.

Step 3: When you've glanced through the details in the file's blanks, click "Done" to complete your document generation. After getting afree trial account with us, you'll be able to download g ga file or send it via email directly. The file will also be accessible via your personal account page with your each and every change. Here at FormsPal.com, we endeavor to make sure all your details are maintained protected.