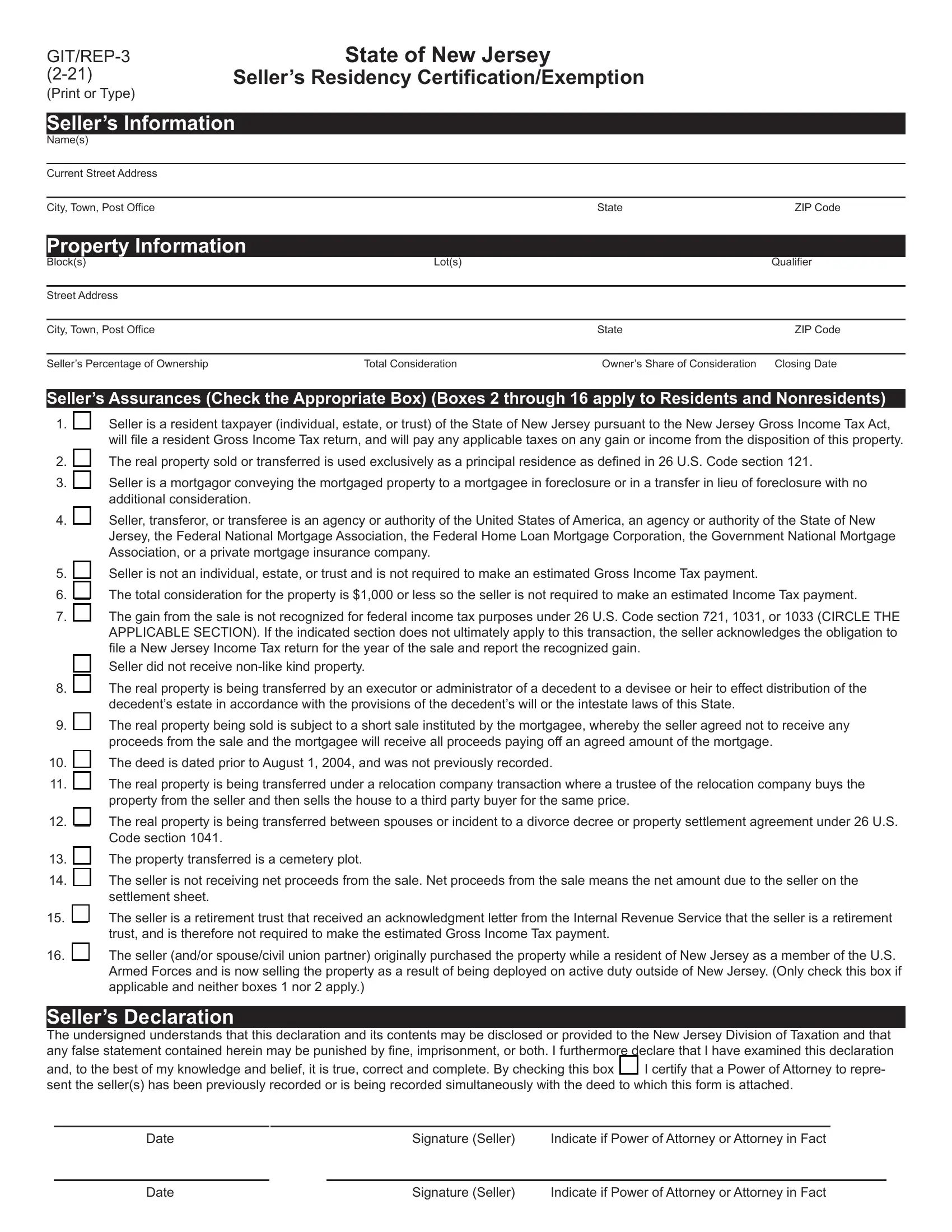

GIT/REP-3 (2-21)

(Print or Type)

State of New Jersey

Seller’s Residency Certification/Exemption

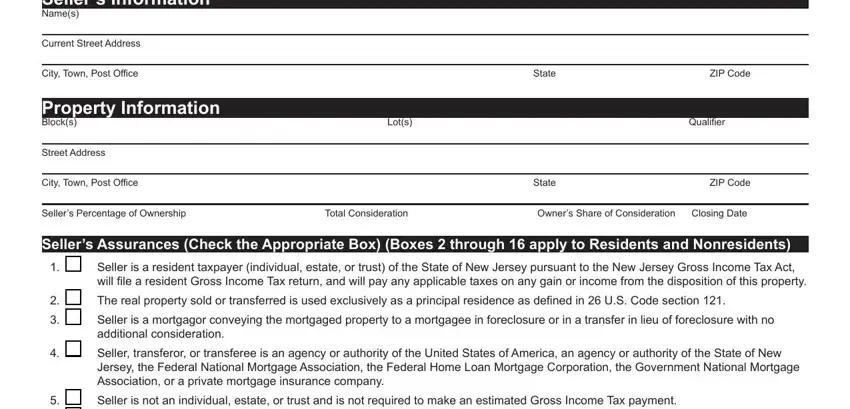

Seller’s Information

Name(s)

Current Street Address

City, Town, Post OfficeStateZIP Code

Property Information

Block(s) |

Lot(s) |

|

Qualifier |

|

|

|

|

Street Address |

|

|

|

|

|

|

|

City, Town, Post Office |

|

State |

ZIP Code |

|

|

|

|

Seller’s Percentage of Ownership |

Total Consideration |

Owner’s Share of Consideration |

Closing Date |

Seller’s Assurances (Check the Appropriate Box) (Boxes 2 through 16 apply to Residents and Nonresidents)

1.

2.

3.

4.

5.

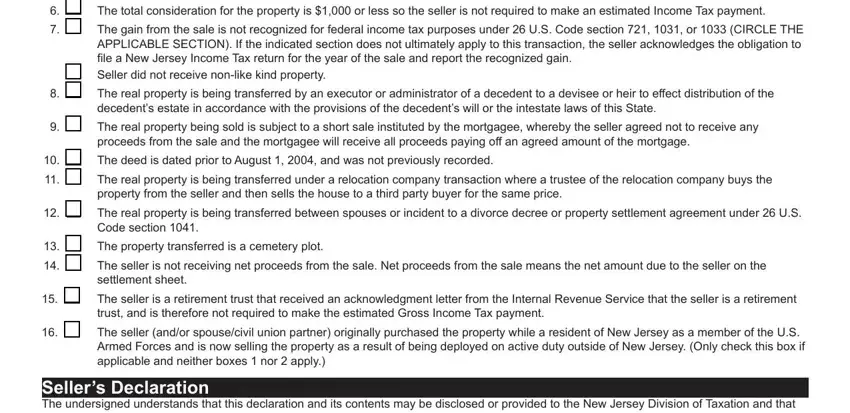

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

Seller is a resident taxpayer (individual, estate, or trust) of the State of New Jersey pursuant to the New Jersey Gross Income Tax Act, will file a resident Gross Income Tax return, and will pay any applicable taxes on any gain or income from the disposition of this property.

The real property sold or transferred is used exclusively as a principal residence as defined in 26 U.S. Code section 121.

Seller is a mortgagor conveying the mortgaged property to a mortgagee in foreclosure or in a transfer in lieu of foreclosure with no additional consideration.

Seller, transferor, or transferee is an agency or authority of the United States of America, an agency or authority of the State of New Jersey, the Federal National Mortgage Association, the Federal Home Loan Mortgage Corporation, the Government National Mortgage Association, or a private mortgage insurance company.

Seller is not an individual, estate, or trust and is not required to make an estimated Gross Income Tax payment.

The total consideration for the property is $1,000 or less so the seller is not required to make an estimated Income Tax payment.

The gain from the sale is not recognized for federal income tax purposes under 26 U.S. Code section 721, 1031, or 1033 (CIRCLE THE APPLICABLE SECTION). If the indicated section does not ultimately apply to this transaction, the seller acknowledges the obligation to file a New Jersey Income Tax return for the year of the sale and report the recognized gain.

Seller did not receive non-like kind property.

The real property is being transferred by an executor or administrator of a decedent to a devisee or heir to effect distribution of the decedent’s estate in accordance with the provisions of the decedent’s will or the intestate laws of this State.

The real property being sold is subject to a short sale instituted by the mortgagee, whereby the seller agreed not to receive any proceeds from the sale and the mortgagee will receive all proceeds paying off an agreed amount of the mortgage.

The deed is dated prior to August 1, 2004, and was not previously recorded.

The real property is being transferred under a relocation company transaction where a trustee of the relocation company buys the property from the seller and then sells the house to a third party buyer for the same price.

The real property is being transferred between spouses or incident to a divorce decree or property settlement agreement under 26 U.S. Code section 1041.

The property transferred is a cemetery plot.

The seller is not receiving net proceeds from the sale. Net proceeds from the sale means the net amount due to the seller on the settlement sheet.

The seller is a retirement trust that received an acknowledgment letter from the Internal Revenue Service that the seller is a retirement trust, and is therefore not required to make the estimated Gross Income Tax payment.

The seller (and/or spouse/civil union partner) originally purchased the property while a resident of New Jersey as a member of the U.S. Armed Forces and is now selling the property as a result of being deployed on active duty outside of New Jersey. (Only check this box if applicable and neither boxes 1 nor 2 apply.)

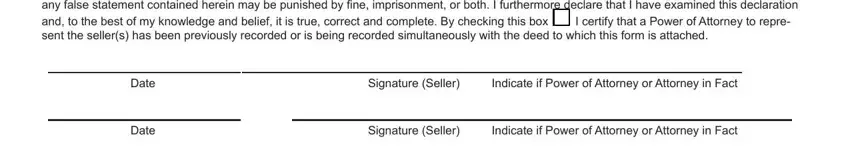

Seller’s Declaration

The undersigned understands that this declaration and its contents may be disclosed or provided to the New Jersey Division of Taxation and that any false statement contained herein may be punished by fine, imprisonment, or both. I furthermore declare that I have examined this declaration

|

|

|

|

|

|

|

and, to the best of my knowledge and belief, it is true, correct and complete. By checking this box |

|

I certify that a Power of Attorney to repre- |

sent the seller(s) has been previously recorded or is being recorded simultaneously with the deed to which this form is attached. |

|

|

|

|

|

|

|

Date |

Signature (Seller) |

Indicate if Power of Attorney or Attorney in Fact |

Date |

Signature (Seller) |

Indicate if Power of Attorney or Attorney in Fact |

GIT/REP-3 |

Page 2 |

(2-21) |

Seller’s Residency Certification/Exemption Instructions |

Individuals, estates, trusts, or any other entity selling or transferring property in New Jersey must complete this form if they are not subject to the Gross Income Tax estimated payment requirements under N.J.S.A. 54A:8-9. A nonresident seller is required to make an estimated Income Tax payment if none of the Seller’s Assurances apply in the Seller’s Assurances section of this form (GIT/REP-3). If one of the Seller’s Assurance boxes on the GIT/REP-3 applies to the transfer, complete the form following the instructions below. Do not submit a completed GIT/REP-3 to the Division of Taxation. Note: Boxes 2 through 16 also apply to nonresidents.

Name(s). Enter the name of the seller. If there is more than one seller, each must complete a separate form unless they are a married/civil union couple that files their Income Tax returns jointly.

Address. Enter the seller’s primary residence or place of business. Do not use the address of the property being sold. The seller is considered to be a nonresident unless a new residence (permanent place of abode, domicile) has been established in New Jersey and the new residence is listed here. Part-year residents are considered nonresidents.

Property Information. Enter the information listed on the deed of the property being sold. Enter the seller’s percentage of ownership, the total consideration for the transaction, the seller’s share of that consideration, and the closing date.

Consideration. “Consideration” means, in the case of any deed, the actual amount of money and the monetary value of any other thing of value constituting the entire compensation paid or to be paid for the transfer of title to the lands, tenements, or other realty, including the remaining amount of any prior mortgage to which the transfer is subject or which is assumed and agreed to be paid by the grantee and any other lien or encumbrance not paid, satisfied, or removed in connection with the transfer of title. If there is more than one owner, indicate the seller’s portion of the total consideration received. If the total consideration for the property is $1,000 or less, the seller must check box 6 under Seller’s Assurances.

Seller’s Assurances. Check the appropriate box(es). If one or more of the Seller’s Assurances applies, the seller is not required to make an estimated Income Tax payment at this time.

Any seller claiming the principal residence exemption (box 2) must also be claiming an income/gain exclusion for the property being sold on their federal income tax return (26 U.S. Code section 121).

1031 like-kind exchange. A nonresident who completes the GIT/REP-3 and claims exemption for a 1031 transaction (box 7) must show the value of the like-kind property received. If the transaction includes non-like kind property (i.e., money, stocks, etc.), the seller must also compete the GIT/REP-1, Nonresident Seller’s Tax Declaration, show the greater of the consideration or the fair market value of the non- like kind property received, and remit an estimated tax payment of 2% of that amount. If the transaction is a deferred like-kind exchange and the seller receives non-like kind property, the qualified intermediary (QI) must remit an estimated tax payment of 2% of the greater of the consideration or the fair market value of any non-like kind property when the 1031 transaction is completed. If the deferred exchange is voided, the QI must complete a GIT/REP-1, Nonresident Seller’s Tax Declaration, and remit an estimated tax payment of 2% of the total consideration with an NJ-1040-ES Voucher.

Example: Mr. Smith is a nonresident of New Jersey who exchanges rental property A with a fair market value of $1.2 million for rental property B with a fair market value of $1.0 million and receives $200,000 in cash (non-like kind property). An estimated tax payment is required on the $200,000 non-like kind property for nonresidents.

PROPERTY A |

$ |

1,200,000 |

PROPERTY B |

$ |

1,000,000 |

CASH |

$ |

200,000 |

Estimated tax payment for GIT/REP-1 |

$ |

4,000 |

Box 16 is only for sellers and their spouses/civil union partners if the sellers and/or their spouses/civil union partners are members of the U.S. Armed Forces. Note: Stolen Valor is a crime in New Jersey pursuant to N.J.S.A. 38A:14-5.

Signature. The seller must sign and date the Seller’s Declaration. If the seller has appointed a representative who is signing the Seller’s Declaration on their behalf, either the Power of Attorney executed by the seller must have been previously recorded or recorded with the deed to which this form is attached, or a letter signed by the seller granting authority to the representative to sign this form must be attached.

The seller must give the completed GIT/REP-3 to the settlement agent at closing. The county clerk will attach this form to the deed when recording it. If the form is not completed in its entirety, or if the settlement agent does not submit the original form with the deed, the county clerk will not record the deed.