You'll be able to prepare nj tax clearance without difficulty with our PDFinity® PDF editor. Our team is focused on giving you the ideal experience with our editor by regularly releasing new capabilities and upgrades. Our tool is now a lot more intuitive as the result of the most recent updates! Now, filling out documents is simpler and faster than ever before. Getting underway is simple! All you should do is adhere to the following basic steps below:

Step 1: Press the "Get Form" button above on this webpage to get into our PDF tool.

Step 2: After you start the tool, you'll see the form made ready to be completed. Aside from filling in different blank fields, you can also do other sorts of actions with the form, including adding your own words, editing the initial textual content, inserting images, affixing your signature to the form, and much more.

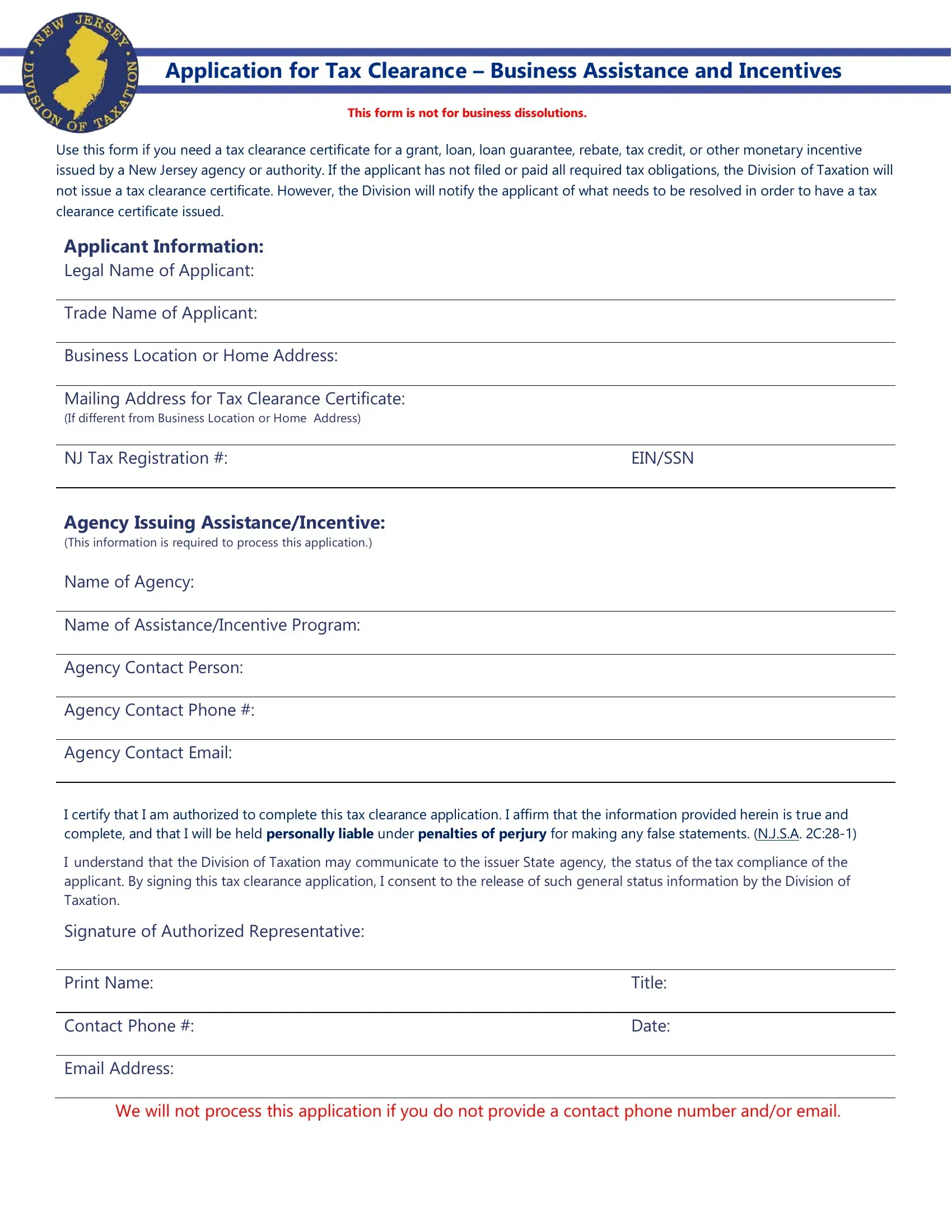

As for the blanks of this particular document, here is what you should know:

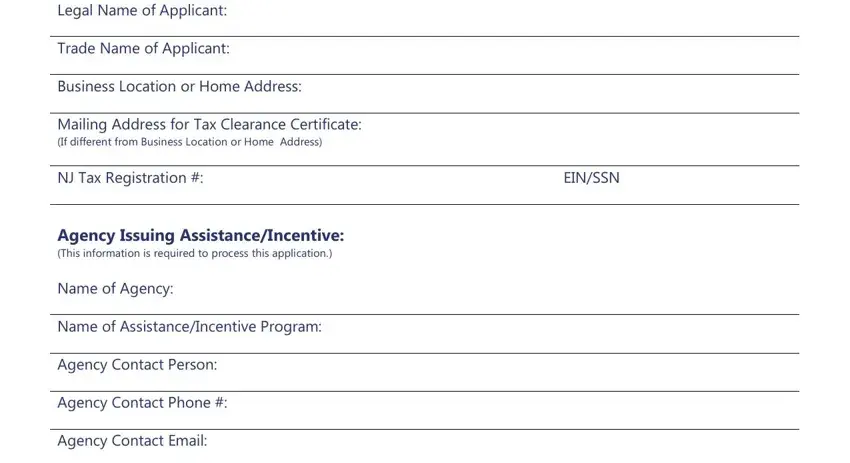

1. Start filling out the nj tax clearance with a selection of essential blank fields. Note all of the information you need and make sure nothing is missed!

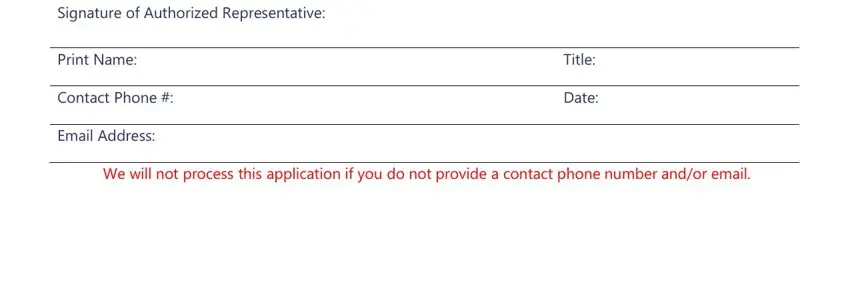

2. After the prior array of blanks is filled out, proceed to enter the relevant information in all these: Signature of Authorized, Print Name, Contact Phone, Email Address, Title, Date, and We will not process this.

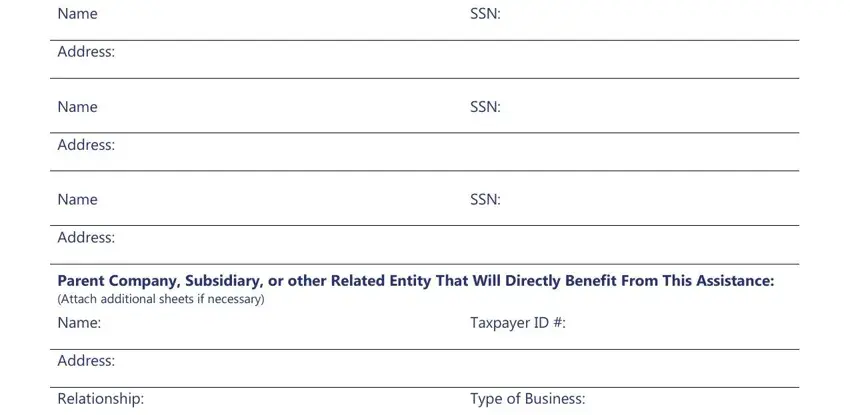

3. Completing Name, Address, Name, Address, Name, Address, SSN, SSN, SSN, Parent Company Subsidiary or other, Name, Address, Relationship, Taxpayer ID, and Type of Business is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Lots of people generally make some mistakes while filling in Type of Business in this section. Ensure you double-check what you type in here.

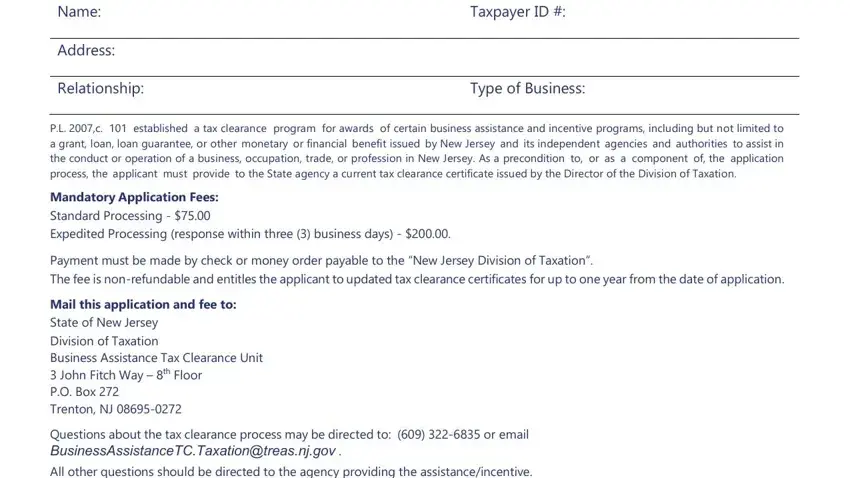

4. The subsequent part needs your involvement in the subsequent places: Name, Address, Relationship, Taxpayer ID, Type of Business, PL c established a tax clearance, Mandatory Application Fees, Payment must be made by check or, Mail this application and fee to, Questions about the tax clearance, and All other questions should be. It is important to fill in all needed info to go onward.

Step 3: Be certain that the information is right and then click "Done" to complete the project. Right after registering a7-day free trial account with us, you'll be able to download nj tax clearance or send it through email right away. The form will also be readily available in your personal cabinet with your each and every edit. We do not share or sell the details that you enter when working with forms at our website.