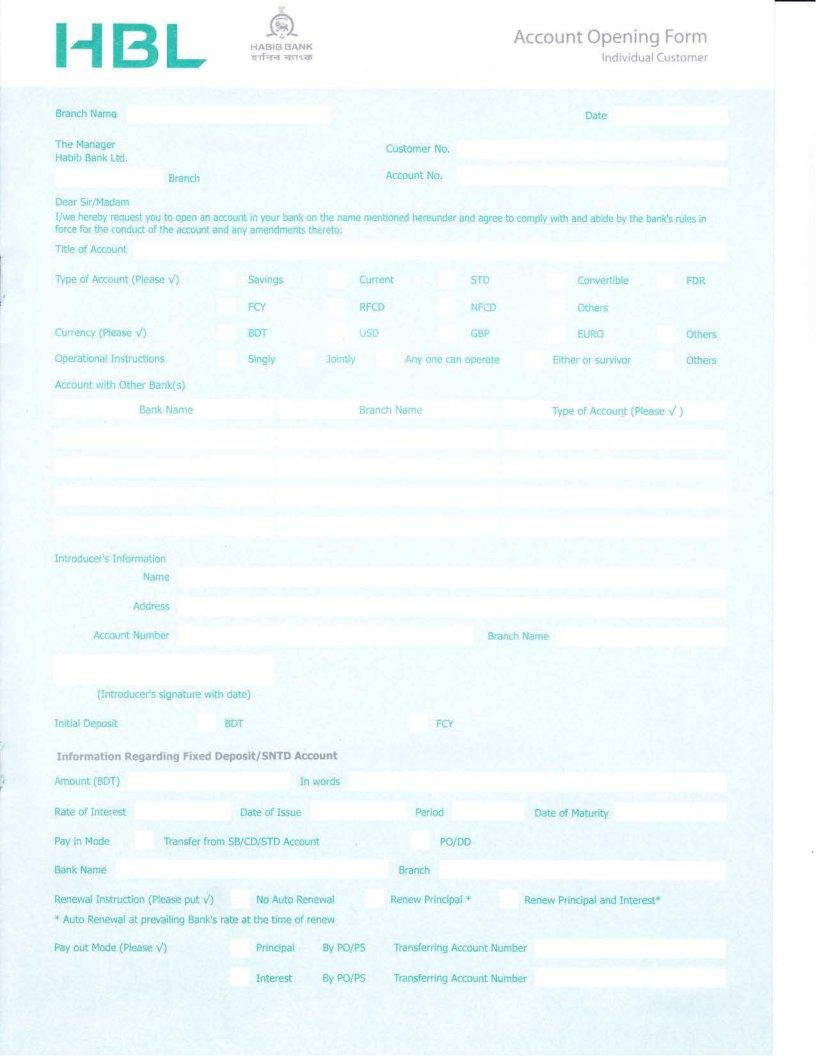

Exploring the intricacies of opening an account with Habib Bank Ltd. (HBL) requires navigating through a comprehensive document, the HBL Account Opening Form. This essential piece of paperwork is the first step for prospective account holders to formalize their relationship with the bank. It begins with a formal salutation to the branch manager and proceeds to gather crucial information, including personal details, the type of account desired (ranging from savings and current to foreign currency and fixed deposits), and operational instructions specifying how the account should be managed. Additionally, detailed sections on introducing information, initial deposit requirements, and fixed deposit terms showcase the bank’s effort to gather all necessary data to not only establish the account but also to comply with regulatory and internal risk management protocols. The form also outlines terms and conditions that bind the account holder to the bank’s operational framework, ensuring clarity on matters such as transaction processing, interest calculations, and the handling of cheques and electronic transfers. By requiring signatures from the applicant(s), the document serves as a legally binding agreement between the bank and its clients, highlighting the importance of a thorough and accurate completion of the form to facilitate a smooth banking experience.

| Question | Answer |

|---|---|

| Form Name | Hbl Account Opening Form |

| Form Length | 8 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 2 min |

| Other names | online hbl account open, hbl account opening online, online bank account open in pakistan, open hbl account online |

l{tsL |

1fF\ |

|

|

|

t Y*,r, |

|

|

|

6\gf+ |

|

|

|

I.IArlIB SIANK |

|

|

|

|

||

Branch Name |

|

|

|

The Manager |

Customer No. |

||

Habib Bank Ltd. |

|||

|

|

||

Branch |

Account |

No. |

|

|

|

||

Dear Sir/Madam

I/we hereby request you to open an account in your bank on the name mentioned hereunder and agree force for the conduct ofthe account and any amendments thereto:

Account Opening Form

lndividual Custcmer

Date

to comply with and abide by the bank's rules in

litle ofAccount

Type oi Account iPlease y') |

Savings |

|

FCY |

Currenc,v lRlease y') |

BDT |

Operationai Instructicns |

Singly |

Account rryith Other Bank(s) |

|

Bank Name |

|

introd ucer's Information

Narne

Address

Account Nurnber

(Introducer's signature wiih date)

Initiai Deoosit |

BDT |

Cui'rent |

STD |

Convertible |

FDR |

RFCD |

h]FCD |

Others |

|

,.,,5D |

GBP |

EURO |

Others |

joinliy |

Any cne can operate |

Either or survivor |

Others |

Branch l''lame |

Type of Account (Please y' ) |

|

|

Branch Name

FCY

I nfsrrnaticn Regarding Fixed Deposit/ SNTD Acccunt

Amount (BDT) |

|

In words |

|

|

Rate of Interest |

|

Date of Issue |

Period |

Date of Maturity |

Pay in Mode |

Transfer from SB/CD/STD Account |

PO/DD |

|

|

Bank Name |

|

|

Branch |

|

Renewal Instructicn (Pfease put /) |

No Auto Renewal |

Renew Principal x |

Renew Principal and Interest* |

|

x Auto Renewal at prevailing Bank's rate at the time of renew |

|

|

||

Pay out Mode (Please y') |

Principal By PO/PS |

|||

interest By PO/PS Transferring Account Number

' |

, |

',,,,'i,,. ' 'i,i, |

|

|

|

|

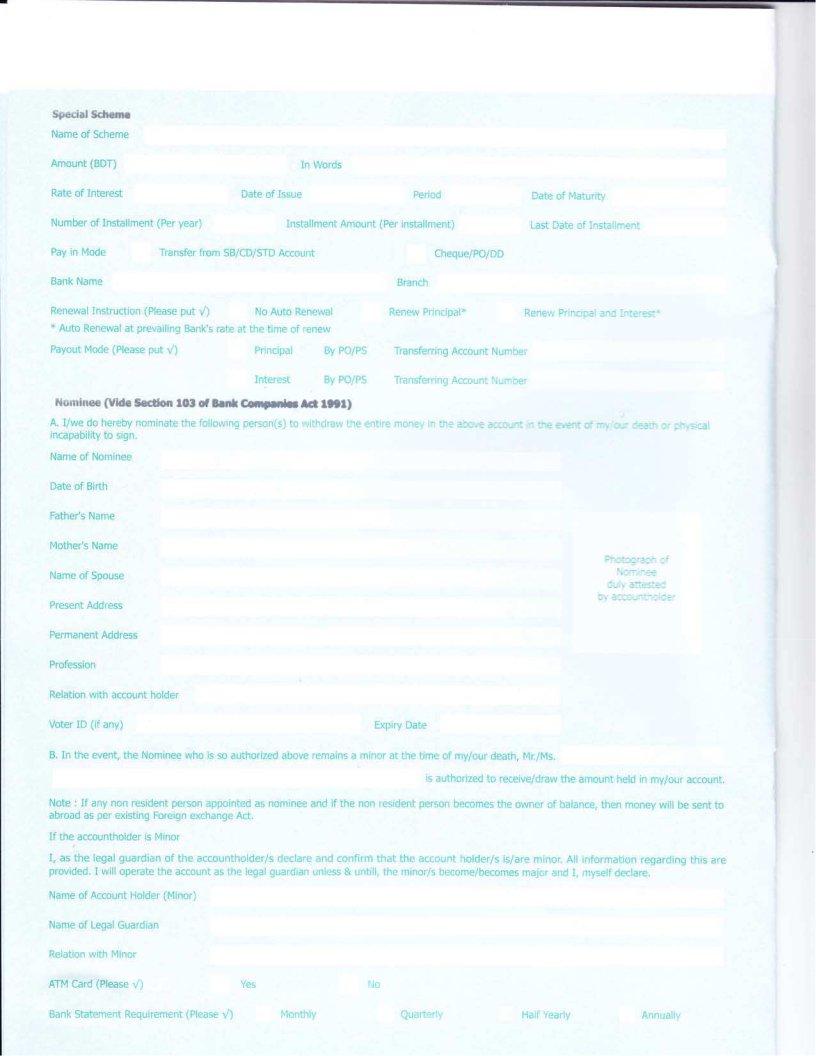

Narneof,Seheme', |

|

, |

|

|

|

|

Amounr{ED'T} |

|

|

In Words |

|

||

Rate of Interest |

|

|

Date of Issue |

Period |

Date of Maturity |

|

|

:. |

|

|

|

|

|

Nnrnber of lnstallment {Per year) |

trnstallment |

Amount {Per installment} |

Last Date of Installnent |

|||

|

Transfer frorn SB/CDISTD Account |

CheguelP€lDD |

|

|||

Bank:Name |

|

|

|

Branch |

|

|

|

|

|

|

|

.t |

|

Renewal Instruction |

{Please put y'J |

No Auto Renewal |

Renew Principalx |

Renew Principal and lrturest! |

||

xAuto Renewal at prevailing Bank's rate at the time of renew

Payout Mode {Flease put V)Principal By PO/PS Tnnsfening Account Number

Interest By PO/PS Tiansferring Account Numbs

krilr @ atr tA Cl- O*It |

tta8l |

e. q4Oo A"tary *rhete the following person(s) to M*drdw the entire mon€y in ttte doe ant

r*Hdutd*,rro

:.'..

meq&1

fue*'l*ane

ift&'&l\dii

|

|

|

|

|

Phmgraph of |

I'larneof Spouse |

|

l{qrstre |

|||

: |

d.fy me*d |

||||

|

|

|

|

|

|

Present Address |

|

by muntholder |

|||

|

|

||||

Perrnanent Addre |

|

|

|||

.t' . |

. |

' |

: : |

|

|

Frotession |

|

, |

|

||

Relation |

with account holder |

|

|||

Voter ID (if any) |

|

Expiry Date |

|||

&In tia erd& ihe t{sdr!t66 *}to b Eo eltlHftd itbov€ rEmafrs

{ |

,,6 |

aottcruea to,tq.9ry./o*"gp |

A ke46l6y/srr agqs |

|

|

"Ittt |

UEsr n*,t**** |

H:Yggffig1*llg|lg |

s! rDlnin€€ d d tf th nan rEsittsrt Fr6on te€oru€s 61€ offiEr cf balane€, |

||

|

|

|

|

iy*Y*1*e'ahanseAct

Sffid'affii!@blFnot

t, as.l tegat guardian of the accountholder/s declare and confirrn that the account holder./s is/are minor. Al[ information regarding this are prp ided. I wilt operate the account as the legal guardian unless & untill, the minor/s becomelbeeomes major and I, myself declare.

Name sf nccount,fi older (Minor)

,Name,of .Legal Guardian |

|

|

||

Relation |

with Minor |

|

|

|

/) |

|

|

||

Ariq'cald Hease) |

Yes |

No |

||

':' . '., |

:,'llit: |

|

|

|

Bahk''statement Requirement (Please y') |

Monthly |

Quarterly |

Hatf Yearly |

Annually |

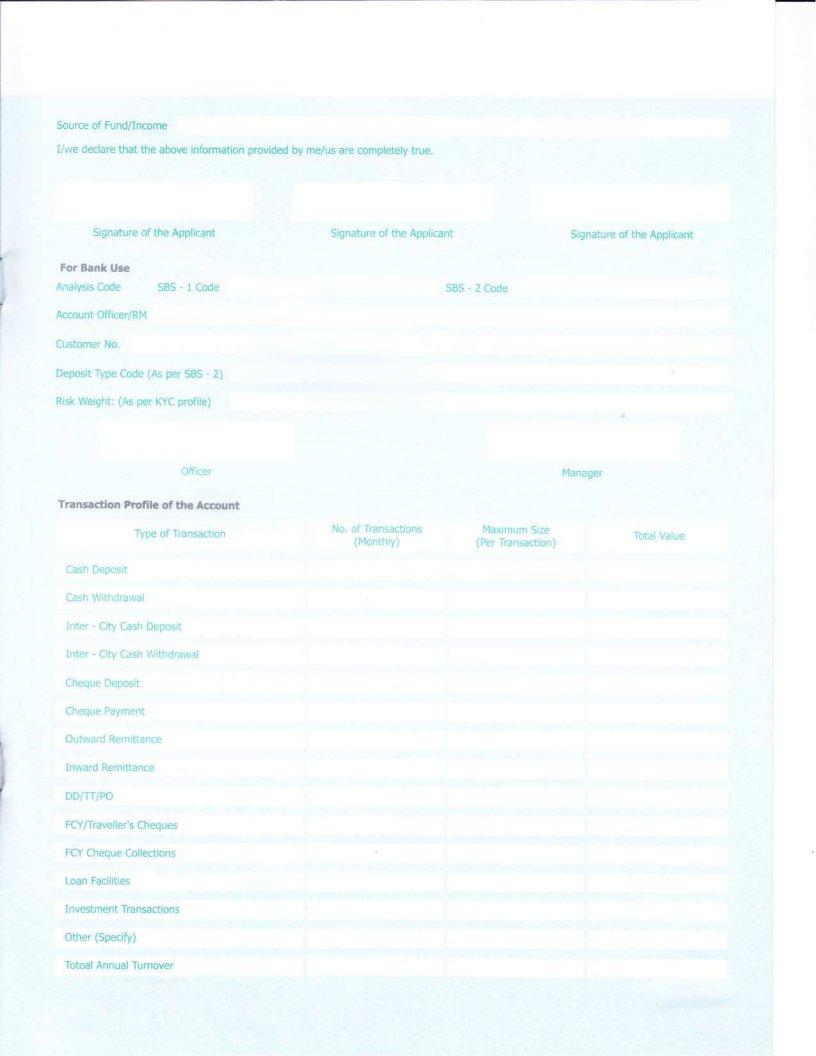

Source of Fund/income

I/we declare that the above information provided by me/us are completely true.

Signature of the ApplicantSignature of the ApplicantSignature of the Applicant

For Bank Use

Anaiysis Code |

5BS - 1 Code |

SBS - 2 Code |

Account Officer/R.M |

|

|

Custorner No. |

|

|

Deposit Type Code {,As per SBS - 2)

Risk Weight: (As per KYC profile)

^9" - ^- |

Manager |

'JllrLCI |

Transaction Profilc of the Account

Type of T;'ansaction |

No. cf Transactions |

Maximiim Size |

Totai Value |

|

(t'lorithiy) |

{Per Transaction) |

|||

|

|

|||

|

|

|

||

Cash |

|

|

|

|

inter - City Cash Deposii |

|

|

|

|

Inier - City Cash Withdrau,ia! |

|

|

|

|

CheqLre Deposlt |

|

|

|

|

Cheque Payment |

|

|

|

|

Outward Remittance |

|

|

|

|

I |

|

|

|

|

Inward Remittance |

|

|

|

|

DD/TT/PO |

|

|

|

|

FCY/Travelier's Cheques |

|

|

|

|

FCY Cheqtie Collections |

|

|

|

|

Loan Facilities |

|

|

|

|

Investment Transactions |

|

|

|

|

Other (Specify) |

|

|

|

Totoal Annual Turnover

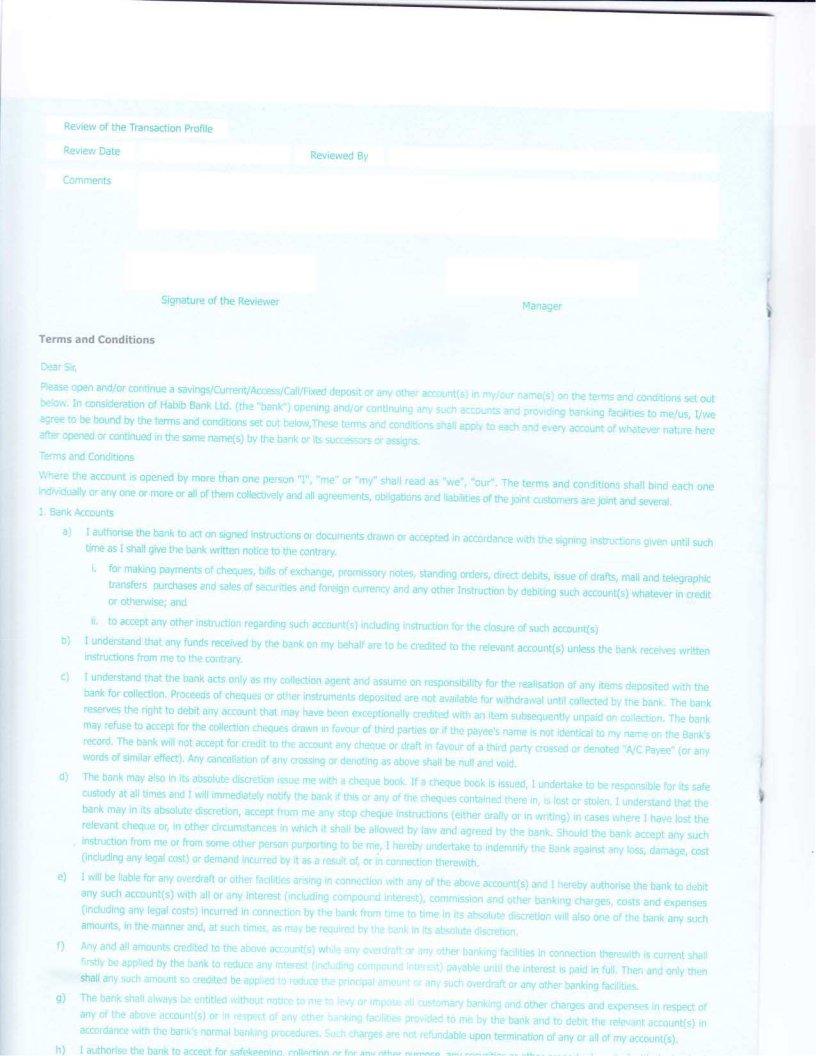

Review of the Transaction profile |

|

Review Date |

Reviewed By |

|

|

Comments |

|

Signature of the Reviewer |

Manager |

|

T€flns and f;ondtions |

|

|

|

|

|

|

|

|

|

|

|

..,:. |

|

|

|

|

||||

Dearst |

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please open and/or c6ntinue |

a savings/cunenvAccesis/GlyFixed |

deposit or any |

other account(s) in my/our nanE(s) on the terns and condibons set out |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

beb^'' ln consideration of Habib gank Ltd. (the "bank") opening and/or continuing any such |

accounb and providing bnkiftg h€fities to me/us, Vwe |

|||||||||||||||||||

agree b be bound by qle terms and |

|

|

|

|

|

|

|

|

|

|

||||||||||

conditions set out below,These terms and conditons sllall apdy to eacfi and ev€ry a€count of whate\€r nature here |

||||||||||||||||||||

after opened or continued in the same narnqs) by the bank or its successors gr assijns. |

|

|

|

|

|

|||||||||||||||

Tems and Condi6ons |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

wh€re the account is opridd by more than one person 'I", "me" or ''my' shall read as |

|

|

|

|

||||||||||||||||

|

or anv one or rnre or all of them colHjvely and all |

|

|

|

|

|

"we," 'our,,. The terms ad, fihdjtions shall bind each on€i |

|||||||||||||

indMduallv |

agreemenb, obligations and tiabititjes of *" i"'"i **."=1" |

.*"' |

- - |

|||||||||||||||||

1. Bank Accounb |

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.. |

|||

") |

::liiT |

|

|

to |

act on signed instrudions or doclmenb drawn |

or |

accepted in accordance with the signing |

|

given untit such |

|||||||||||

I shall |

P"k |

|

|

|

|

|

|

|

|

|

|

instructions |

||||||||

|

bme as |

give |

the bank wyitten notjce to the @ntrary |

|

|

|

|

|

|

|

|

|||||||||

|

i fur making paynEnb of cheques, bills of exclEnge, promissory |

not€€, standing orders, direct detib, issue of drafu, mail and telegrdphic |

||||||||||||||||||

|

transfers purciuses and sahs cf securities. and foreign |

|||||||||||||||||||

, |

|

ana iny othei tnstuaion ry aehting. ;l;ir;;;*#;;; |

|

|

||||||||||||||||

or otiErwise; and |

|

|

|

|

|

currency |

.*'" |

|||||||||||||

' |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

ii to accept any other |

instructjon regarding such account(s) including instruction for the closure of such accoun(s) |

|

|

||||||||||||||||

b) |

|

|

|

|

|

|

|

|||||||||||||

l1y.TYl:hat |

any funds |

received bv the bank |

on nry behalf are |

to be credited to the retevant accoun(s) untess the bank receives written |

||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||

|

rn$ruqlong rom rne to the contrary |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

c) I undersbnd that the bank acG onty as my collection agent |

|

|

|

|

|

|

|

|

||||||||||||

|

bank for |

collection Proceeds |

|

|

|

|

and assume on responsibility for the realisation of any items deposited with the |

|||||||||||||

|

of cheques or other instrumenb deposited are not ava abh b, wir,urawar ,ntr corre[i by ttre bank. The bank |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

reserves the right to deblt any account that may have |

|

|

|

|

|

|

|

|

|||||||||||

|

may refuse to accept for the collectlon |

|

|

|

been excepdonally credtud with an item s"o*;;,', trn;;; .olection. The bank |

|||||||||||||||

|

cheques drawn in favour of third parties or if the payee's name is not identkal to my name on the Bank s |

|||||||||||||||||||

|

ac:pt |

in ravour of a thkd party cross€d or denoted 'A/c |

payee" (or any |

|||||||||||||||||

woros or |

|

etfect), Any cancellation of any crossing or denoting as |

;bove Shall be null and void. |

|

|

|

||||||||||||||

|

|

|

|

|

|

|||||||||||||||

d)The bank may also in its absolute discretion issue me with a cheque book. If a cheque book is issued, I undertake to be responsible for its safe luMv at all times and I will immediately notify the bank if this or any of the cheques contained there in, is lost or stolen, I understand that the ba,nk may in its absolute discretion, accept from me any stop cheque instructions (either orally or in writing) in cases where I have lost the relevant cheque oq in other circumstances in which it shall be allowed by law and agreed by the bank. should the bank accept any such

'instruction from me or from some other person purporting to be me, I hereby undertake to indemnifiT the Bank against any loss, damage, cost (including any tegal cost) or demand incurred by it as a result o[, or in connection therewith.

e)I will be.liable for any overdraft or other facilities arising in connection ivith any of the above account(s) and i hereby authorise the bank to debit any such account(s) with all or any interest (including compound interest), commission and other banking charges, costs ano u*o"nru, linctuolno. any legal costs) incurred in connection by the bank from time to time in its absotute discretion will also one of the bank any such amounts, in the manner and, at such times, as may be required by the bank in its absolute discretion.

f)Any and all amounts credited to the above account(s) while any overdraft or any other banking facilities in connection therewith is current shall firstly be applied by the bank to reduce any interest (including compound interest) payable until the interest is paid in full. Then and only- ' r

s)The bank shall always be entitled without notice to me to levy or impose all customary banking and other charges and expenses in respect of any of the above account(s) or in respect of any other banking facilities provided to me by the bank and to debit the relevant account{s) in accordance with the bank's normal banking procedures. such charges are not refundable upon termination of any or all of my,account(s).

h)

lecei\€d fb*l mc bnd to deesb or iiffirei or give up arry of th€se ag*d rnrwd6en F$fafiEnta

i)ftes deposlts and ttreir paynnent are governed W tne hws in etrect from tfiae b tlme,h BarEhd€{t ald are payable oary at fne braDdHf Hablb 8ar ( Umited where the depGts wer€ made

J)I understaM that any deposits or initMrawak in res€ct €t afiy or the auoe accorre may be rnade at any of tlle

k) The rdb of any interest payable on arry account may b€ dlsplayed by the bank at b Erious branchs in Bangladesh and turftq I ccept that thb may be subjed to change without notice to me interest on any ac@rnt will accrue in arrears from day to d; in ot as osE wise d*rmined by Sre Bank (in its absolute discidion), aM be crcdited by $e bank b the rele\Ent rccoflqs).

DTh€ bank may, at ib sole discretion, allow prernahrle withdrawal of fred depoGfts. I accept that all such pre.mature wi$dra$,als wi be subj€rt

m) I appreciate that there can be risks associated with any account(s) denomlnated in foreign cunency, convertible accounts and forcjgn cunEnqy investments. Accordingly, I aacept that I am solely responsible for all such risks and any cosb and expenses hovre!€r arislng (including without limitation, thos€ arising from any intemational or domestic legal or regulatory restuictions) in respect of any such accoun(s). WiFdra,vak or dealings on any such accoun(s) are also subjed to the reievdnt cunency beinq avdilable at dre bank'6 rel€vant bGnch. Con\,/e$ion ftom one cureflcy to ancther shall be at th€ rate of orcharu€ as deermined by the bank (in ib abEohrte discretion) from Sme to tifie,

n) I understand that the bank wll send or delircr to me a statement of accoun(s) at least haf yearly (save in resped of,any account tflat has, in

.r . r tie sole opinion ofthe ba k,b€en inactive ftji a period.of one year or more, such 6*gineil.if.Aacoults i4ili b€rrent.of.deltue,ed.hy the baDk annually) or in each case at such other intervals as may be agreed between th€ bank aM me, from time to tim€ and I agrre that I am solely responsible for promptly examining all entries thereon and that I must give $e bank written notice (Not witfuanding the provisions of paragraph 4) within 14 days of the date of the relevartt statement of any disdepancy that I believe exlsb Hvreen arry such sbtement ln nry own records ln the abs€nce of any such notice from me, I shall b€ deemed to have agr€ed and certified conclusively (for all purposes) the correcbess of the rel€\rdnt stateme;t of account.

I I

I

i

o)

p)

,.

'',.q)l

r)

I authorise the bank to respond, if it shall so choose, to any and all enquiries recdrved ftom any other bankeE concerning the above accounb without reference to me. For the avoidance of doubt any such response may includ€ a baDk rcfercnce

I understand that I may close arry of tie above accounts by givinE prior written notice to the bank. The bank may, however, either, at ib own instaoce or, at the instams

tn r"tutton i i uni d€alings m.rcsp€rt.b anfof the aboveaccounb, ,nu ouo**n, n* *,,uOte ftx any lo$ tesulting frc. ry a*if,, irropaeitvn,

bankru'ptcy {or any o$er.anakjgorig event of Foceedlng) unlei,s and until the bank has rcceilieii.i'Yrlttd\ noree or'anv suci e,,ent ;;; ;,; such documentary e!4ideiiJe aS the .bank may iequire. Futh€f the banli shall not be liable to .ile for. airy t*s, dain6ge or Oehy attributable in

whole or part to the action of any government or governrnent dgenry or any cfther e\€nt oubide the bsnk's control (including without

limitation, strikes, industrial actlon, equipment fdlurd oi interrupti6h of fi:wer suppli*) proviUeO that the bank stialllr eadr iase gnaeivbr io give notice generally to its customers or any anticipat€d delayg dG.!o any. of the aboye events by noti{ce in ib branches or ogrcrwise, r i

In respect of accounts opened in the name of minors (whether or not jointly with an indivkiual who is not a minor)L tlle bank shall be ediu€d to act on the instructions received ftom the guardian named on dle accouflt opening form, inespective of whetler the minor account holder

I

continues to be aminor or not, unless the banlt r€ceives written notice to $e do{itfary frbm- ao appropdate althority (inctudittg, but not lifnited

to, termination of service) or any other loss, damage, claims or proceedings tlia! niayffise ai:a resuh of thd payment of such tills.by this.

method. In particular (but not by way of limitation of paEgrdph 12 below or otheh ise) thF.ban* sh:att ttave no liabilify arising ftom miss use cf the card, malfunctioninq of the ATM or othervise)

2.Banking Instructions by Telex/Facsknile

'a)

b)

unl€ss lnstructed Oy rne in writing to ttre contrary (not withstanding the imvisions oltaragraph +) $re benk is authoriind, brt no otiliqed, to act on my banfung instructons (including any lnstrucEons required by or, given by me in relation to these tetrms and conditiom unless $iese terms and conditions otherwise expressly state to the contrary) transmitted tlrrough B telex or iacsimile machin6,

I shall release the ban from and indelodry dnd hqld the bank haiml€ss.from and against all actions, suits. prpceedingt !osb, claimt demands charges, expenses, losses and liabillties however arising in consequences of or jn any way related tD:

i' The bank having acted in good faith in accordance with my written telephone, facsimiles or telex instruction(s), notwithstanding that such instruction(s) as above may have been initiated or transmitted in error or fraudulentty altered, misunderstood or distorted in the line of communication of transmission; and

ii. The bank having refrained from acting in accordance with my written telephone, facsimile or telex instructions(s) by reason of failure of actual transmission thereof ta the bank or receipt by the bank for whatever reason, whether connected w1h fault. failure of unread ness

of the senciing or receiving machine; or

iii' My failure to forward all original copies of facsimile instruction(s) to the bank within such period as the Bank may specifl/,