If you wish to fill out hdmf m1 1 form, it's not necessary to install any sort of software - just use our PDF tool. FormsPal is focused on making sure you have the best possible experience with our tool by regularly introducing new capabilities and enhancements. With these updates, using our editor becomes better than ever before! With just several easy steps, you are able to start your PDF editing:

Step 1: Open the PDF inside our editor by hitting the "Get Form Button" above on this webpage.

Step 2: The editor allows you to work with your PDF document in many different ways. Enhance it with your own text, adjust what's already in the document, and put in a signature - all at your disposal!

Completing this document will require attention to detail. Ensure that all mandatory blanks are done properly.

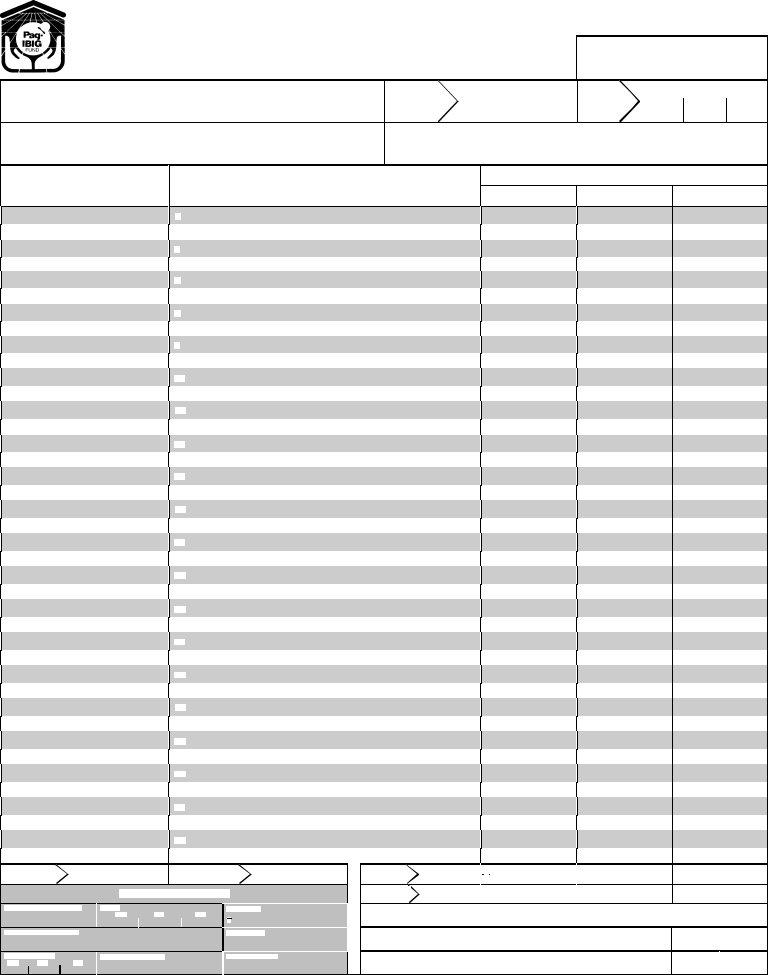

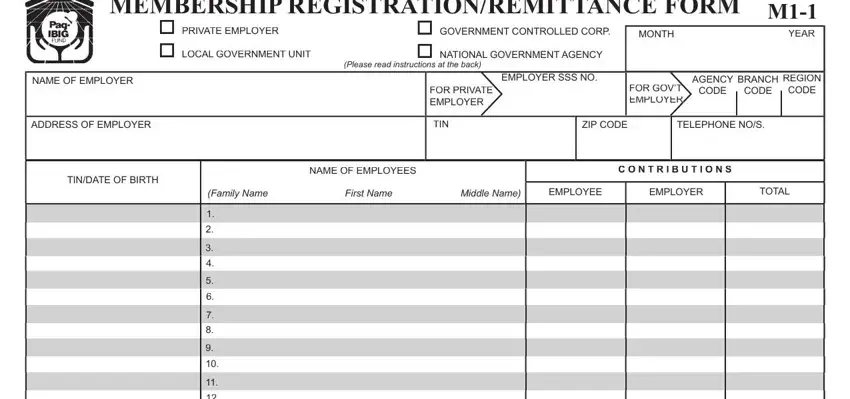

1. When completing the hdmf m1 1 form, be certain to complete all important fields within its relevant area. This will help expedite the work, allowing your information to be handled swiftly and correctly.

2. Right after the prior section is done, go on to enter the relevant details in these - .

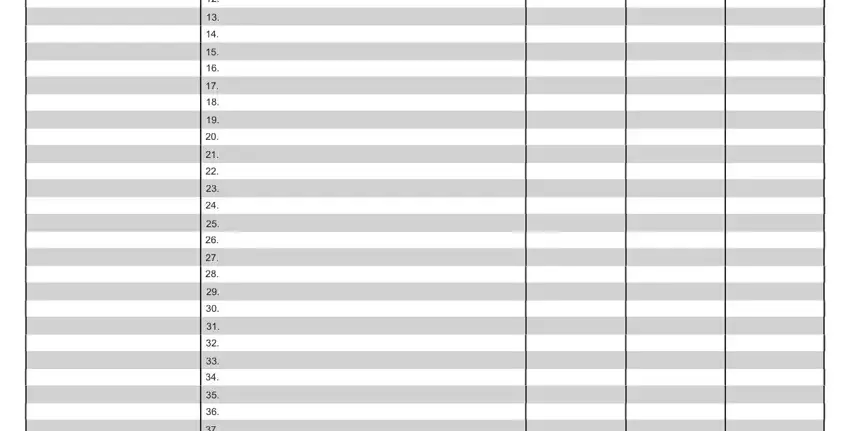

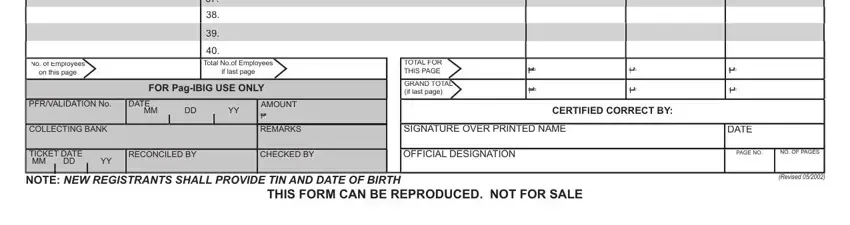

3. The next part is normally easy - fill out all of the blanks in if last page, No of Em ploy ees No of Em ploy ees, on this page, FOR PagIBIG USE ONLY, PFRVALIDATION No, DATE, MM DD YY, COLLECTING BANK, AMOUNT PPP REMARKS, TICKET DATE MM DD YY NOTE NEW, RECONCILED BY, CHECKED BY, THIS FORM CAN BE REPRODUCED NOT, TOTAL FOR THIS PAGE GRAND TOTAL, and PPP in order to complete this part.

Regarding CHECKED BY and COLLECTING BANK, be sure you get them right in this current part. Both these are viewed as the most significant fields in this form.

Step 3: Glance through what you've inserted in the blanks and hit the "Done" button. Grab the hdmf m1 1 form the instant you join for a free trial. Easily gain access to the pdf from your personal account, with any edits and changes being conveniently preserved! With FormsPal, you can easily complete documents without needing to be concerned about data leaks or entries being distributed. Our protected platform helps to ensure that your private data is maintained safe.