Handling PDF files online is easy with our PDF editor. Anyone can fill out iht form 205 here in a matter of minutes. The editor is consistently maintained by us, acquiring cool functions and turning out to be a lot more versatile. To get the process started, consider these easy steps:

Step 1: Access the PDF in our tool by clicking on the "Get Form Button" in the top part of this page.

Step 2: With our online PDF editing tool, you are able to accomplish more than merely fill in forms. Express yourself and make your docs look sublime with custom textual content added, or fine-tune the original input to perfection - all that backed up by the capability to add any kind of graphics and sign the PDF off.

It is straightforward to finish the document with this practical tutorial! This is what you must do:

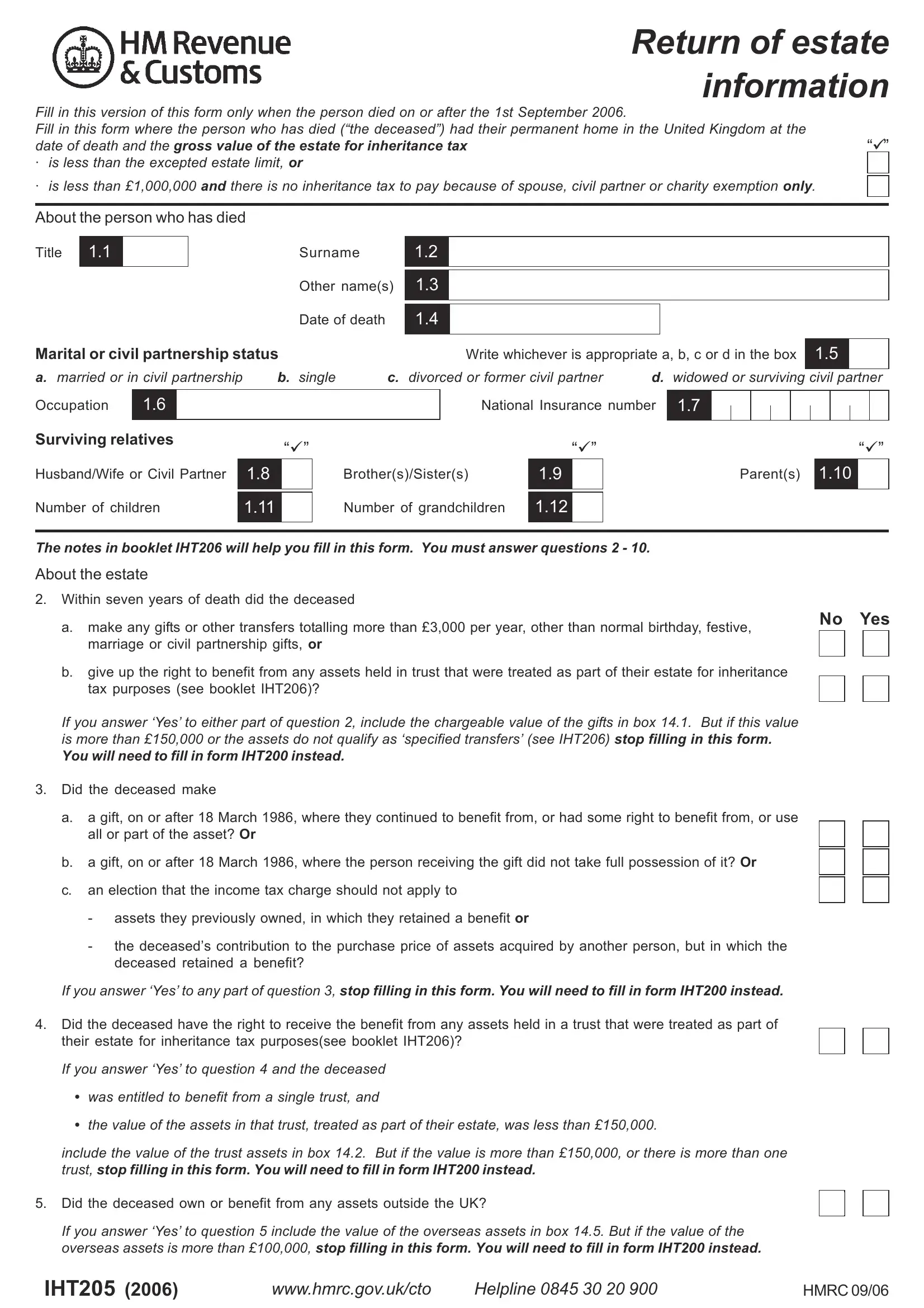

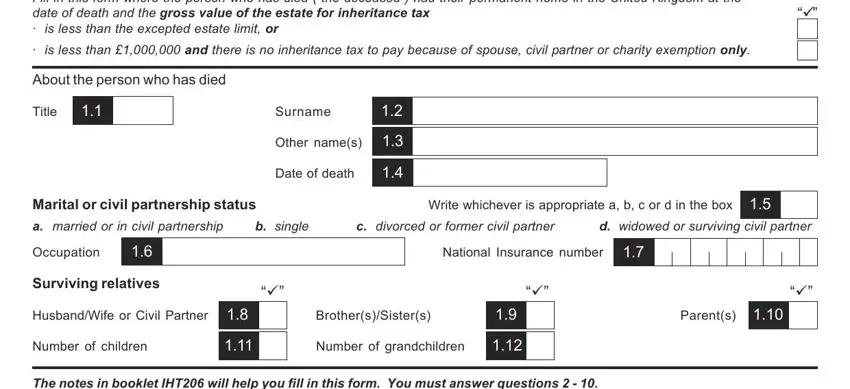

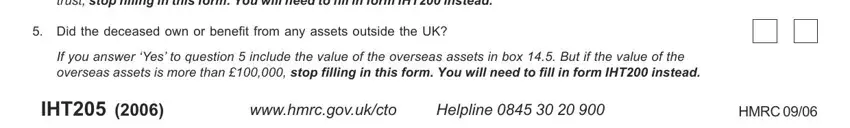

1. Complete the iht form 205 with a number of necessary fields. Consider all the required information and make sure not a single thing overlooked!

2. Given that the last section is finished, you have to put in the essential specifics in a make any gifts or other, marriage or civil partnership, No Yes, b give up the right to benefit, tax purposes see booklet IHT, If you answer Yes to either part, Did the deceased make, a a gift on or after March where, all or part of the asset Or, b a gift on or after March where, c an election that the income tax, assets they previously owned in, the deceaseds contribution to the, If you answer Yes to any part of, and Did the deceased have the right in order to move forward further.

As for tax purposes see booklet IHT and Did the deceased have the right, make certain you get them right in this section. The two of these are certainly the most significant fields in the page.

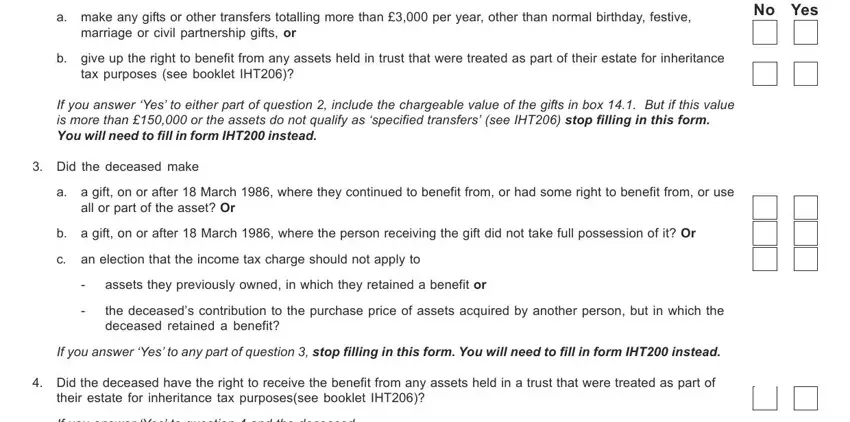

3. In this part, review include the value of the trust, Did the deceased own or benefit, If you answer Yes to question, IHT, wwwhmrcgovukcto, Helpline, and HMRC. All these must be filled out with highest focus on detail.

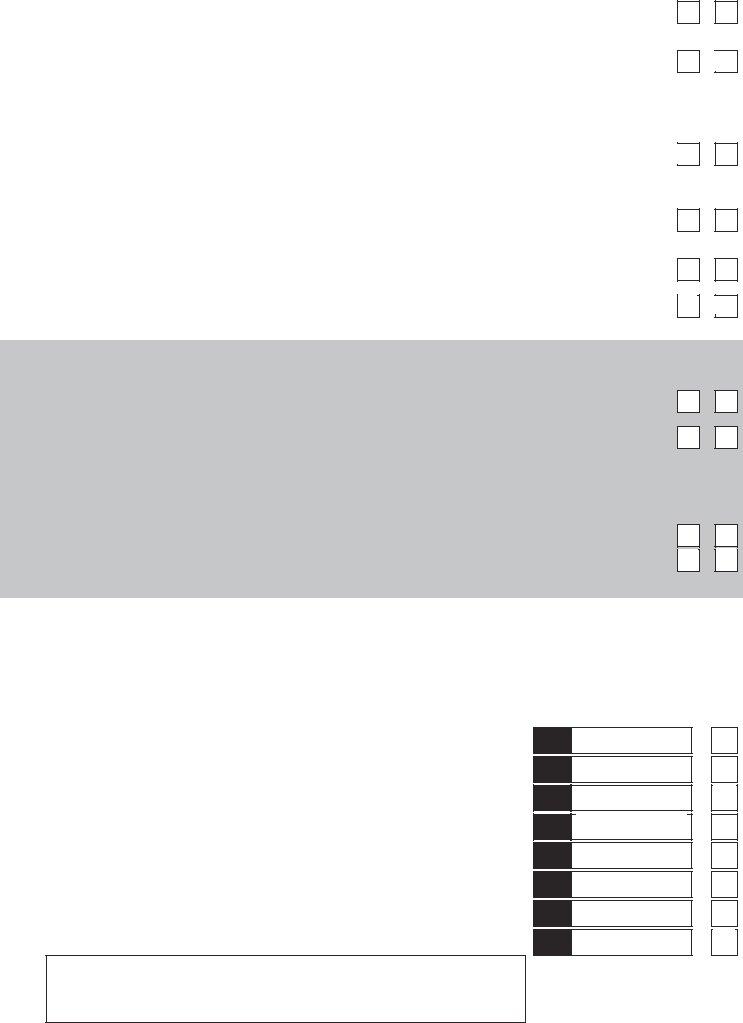

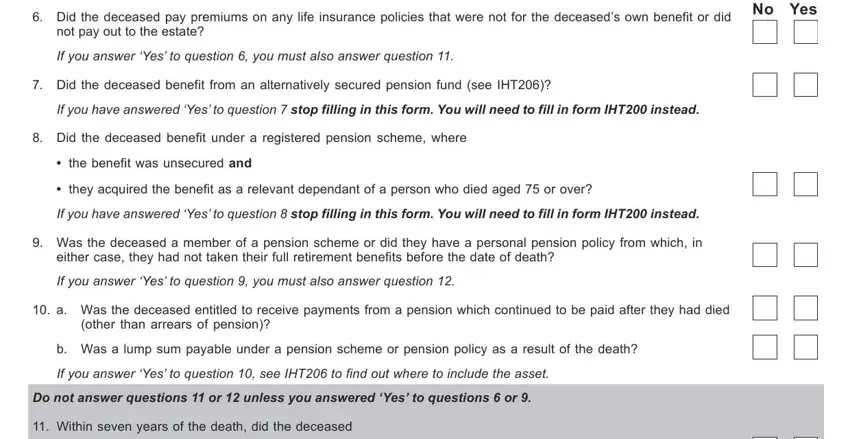

4. Your next subsection will require your attention in the following places: Did the deceased pay premiums on, No Yes, not pay out to the estate, If you answer Yes to question you, Did the deceased benefit from an, If you have answered Yes to, Did the deceased benefit under a, the benefit was unsecured and, they acquired the benefit as a, If you have answered Yes to, Was the deceased a member of a, either case they had not taken, If you answer Yes to question you, a Was the deceased entitled to, and other than arrears of pension. Make certain you give all required information to move onward.

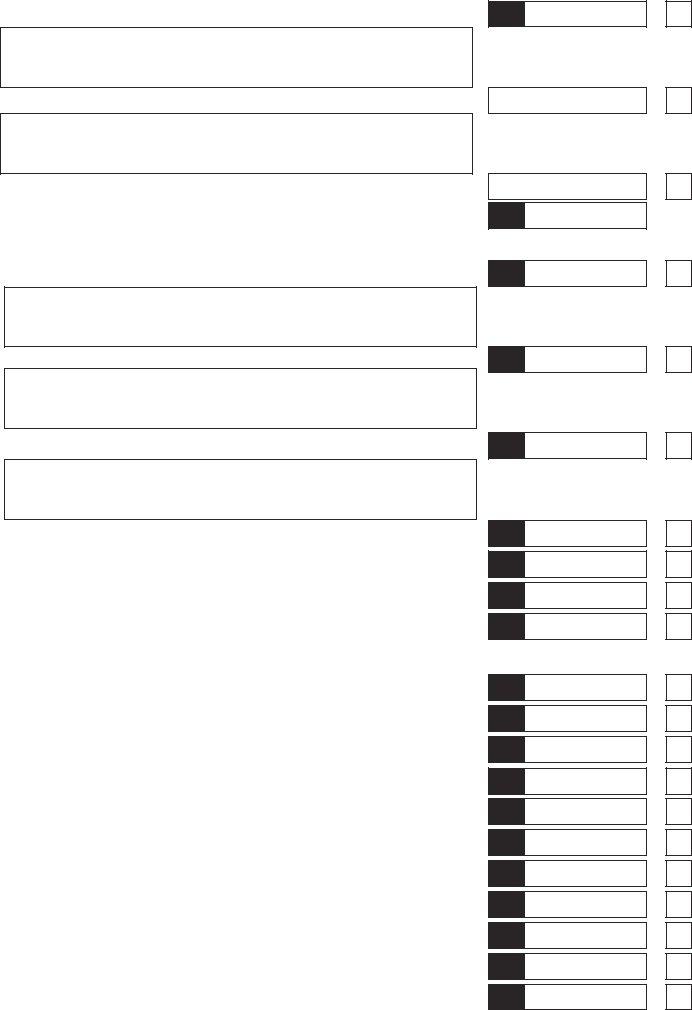

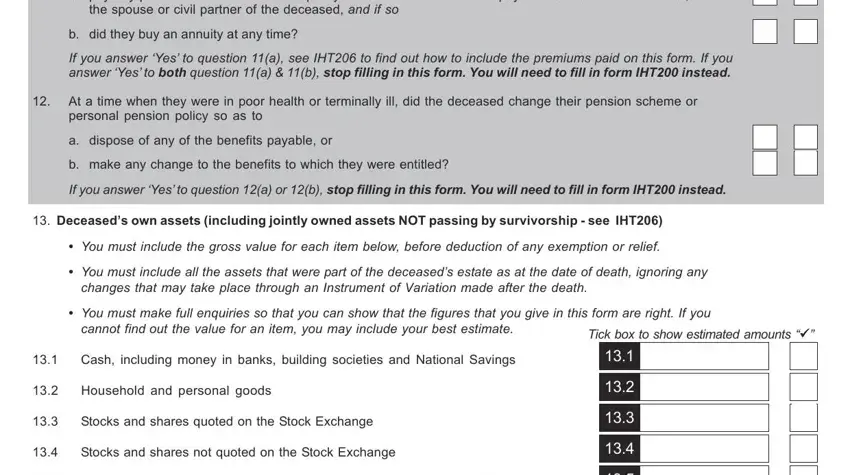

5. To wrap up your document, the final section requires a couple of extra blanks. Typing in a pay any premium on a life, the spouse or civil partner of the, b did they buy an annuity at any, If you answer Yes to question a, At a time when they were in poor, personal pension policy so as to, a dispose of any of the benefits, b make any change to the benefits, If you answer Yes to question a or, Deceaseds own assets including, You must include the gross value, You must include all the assets, changes that may take place, You must make full enquiries so, and cannot find out the value for an is going to conclude everything and you can be done in no time at all!

Step 3: Make sure your details are accurate and then click on "Done" to finish the project. Sign up with us today and instantly use iht form 205, available for download. Each and every change made is handily saved , letting you modify the document further when required. Here at FormsPal, we strive to ensure that all of your details are maintained protected.