You are able to fill in idaho effectively with our PDFinity® PDF editor. Our editor is continually developing to provide the very best user experience attainable, and that is due to our resolve for constant development and listening closely to customer opinions. Here's what you will have to do to begin:

Step 1: Firstly, open the pdf tool by pressing the "Get Form Button" above on this page.

Step 2: With our advanced PDF file editor, you'll be able to do more than just complete blanks. Try each of the features and make your docs appear sublime with customized text added, or tweak the original input to perfection - all comes along with the capability to incorporate almost any pictures and sign it off.

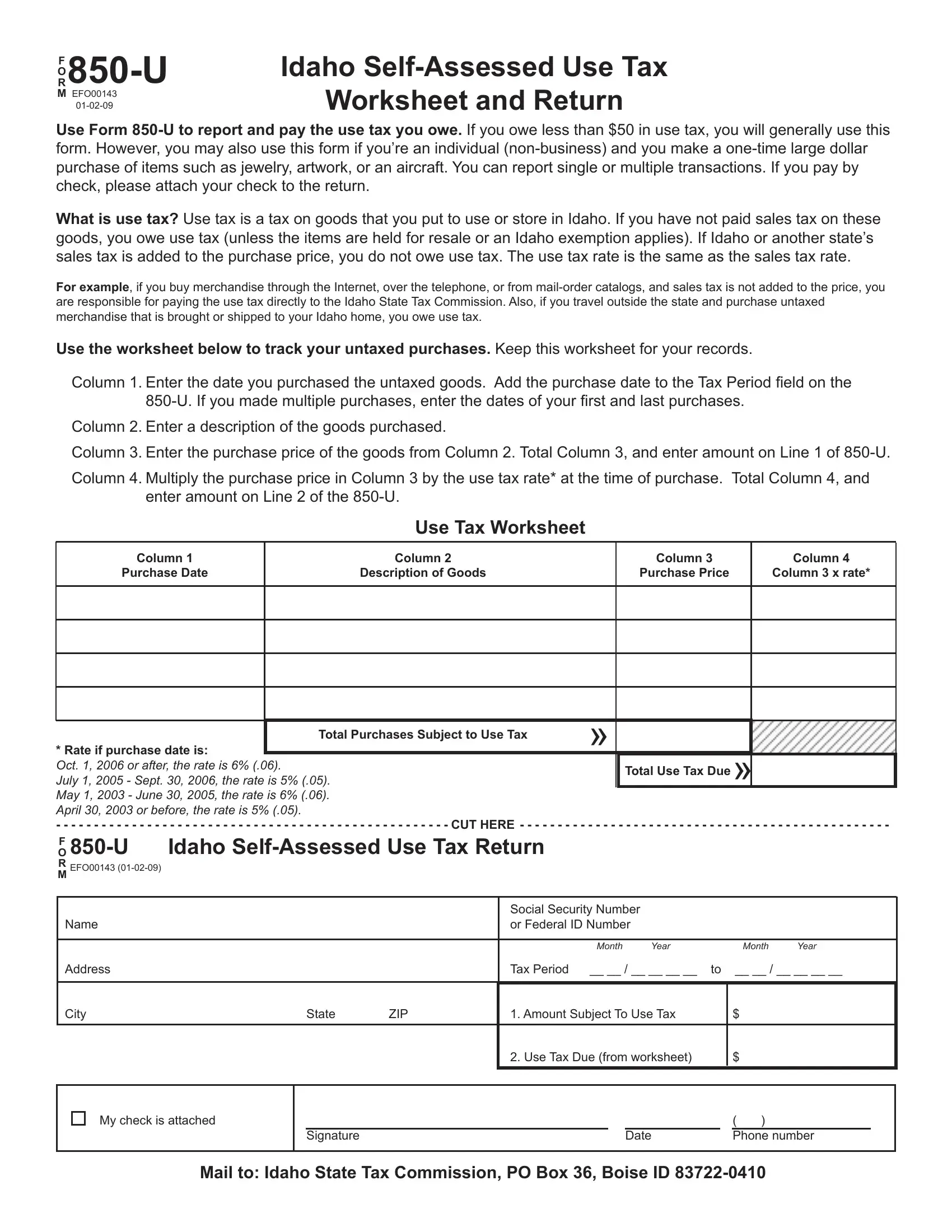

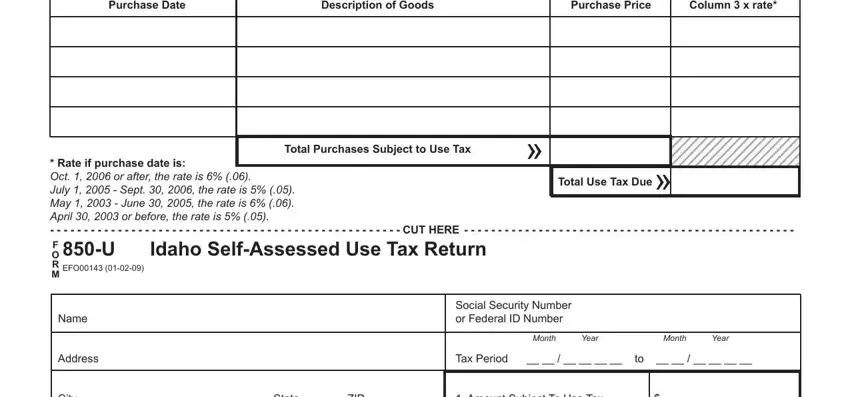

So as to finalize this form, make certain you provide the right details in every field:

1. The idaho usually requires particular details to be typed in. Be sure that the following fields are complete:

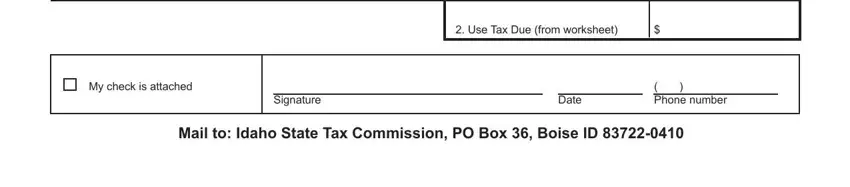

2. Once your current task is complete, take the next step – fill out all of these fields - Use Tax Due from worksheet, My check is attached, Signature, Date, Phone number, and Mail to Idaho State Tax Commission with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

People often get some things wrong when filling in My check is attached in this section. Ensure that you read twice whatever you type in right here.

Step 3: Ensure that your information is right and just click "Done" to continue further. Make a 7-day free trial subscription at FormsPal and get instant access to idaho - downloadable, emailable, and editable from your FormsPal cabinet. FormsPal offers safe document completion without data record-keeping or distributing. Rest assured that your information is secure here!