If you desire to fill out ifta form, you don't have to download any kind of applications - simply use our PDF editor. The tool is consistently upgraded by our staff, acquiring useful functions and becoming greater. If you are seeking to get started, here's what it will require:

Step 1: Click on the "Get Form" button above. It'll open up our pdf tool so that you could begin filling out your form.

Step 2: With this online PDF tool, you may do more than merely fill out blanks. Express yourself and make your docs appear perfect with customized textual content put in, or adjust the file's original content to perfection - all comes along with an ability to add just about any pictures and sign the PDF off.

Filling out this form typically requires focus on details. Make sure each blank is done correctly.

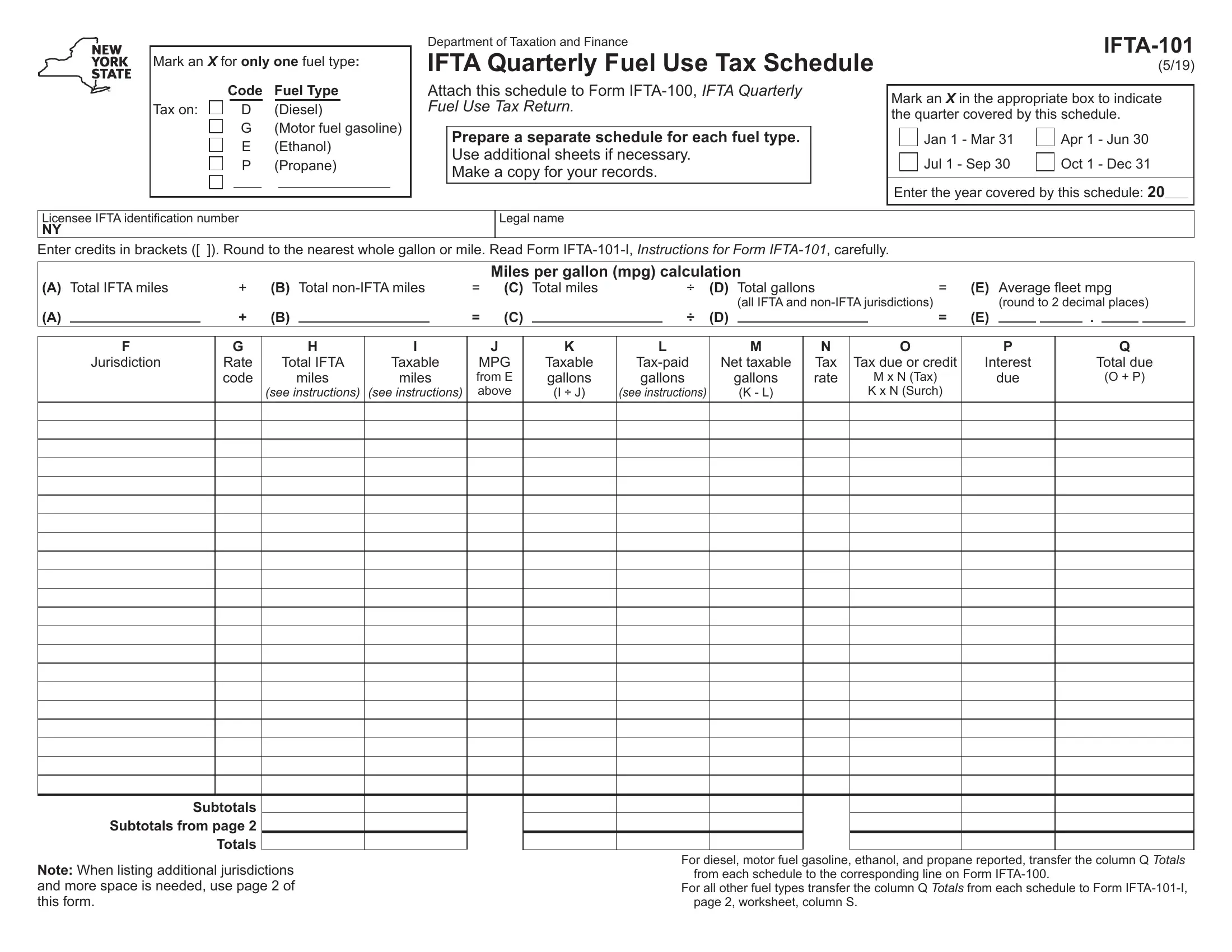

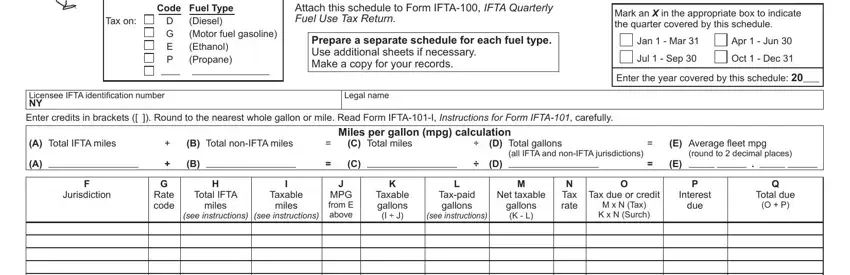

1. While submitting the ifta form, make certain to complete all of the essential fields within its corresponding part. This will help facilitate the work, making it possible for your information to be handled without delay and correctly.

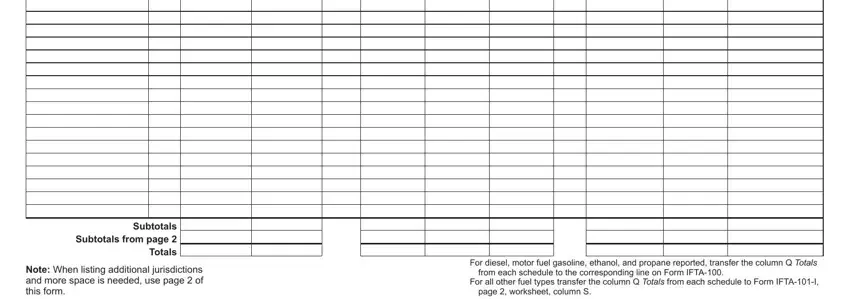

2. After this part is filled out, go on to type in the suitable details in these - Subtotals Subtotals from page, Note When listing additional, from each schedule to the, and For diesel motor fuel gasoline.

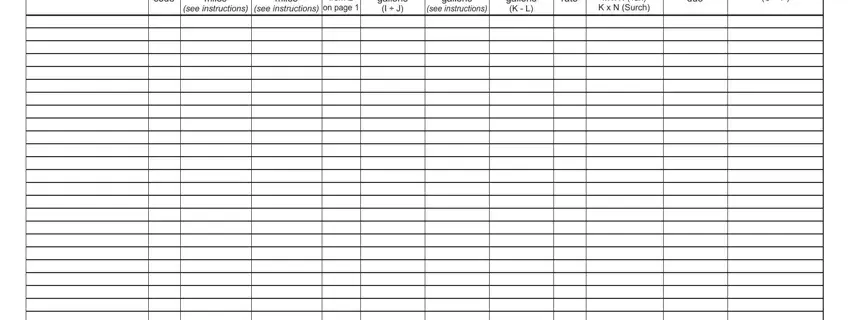

3. In this stage, check out gallons K L, N Tax rate, M x N Tax K x N Surch, due, O P, Rate code, miles, Taxable miles, see instructions, see instructions, MPG from E on page, Taxable gallons I J, Taxpaid gallons, and see instructions. Each of these should be completed with greatest precision.

Those who use this form frequently make mistakes when filling out M x N Tax K x N Surch in this part. Ensure that you read twice whatever you type in right here.

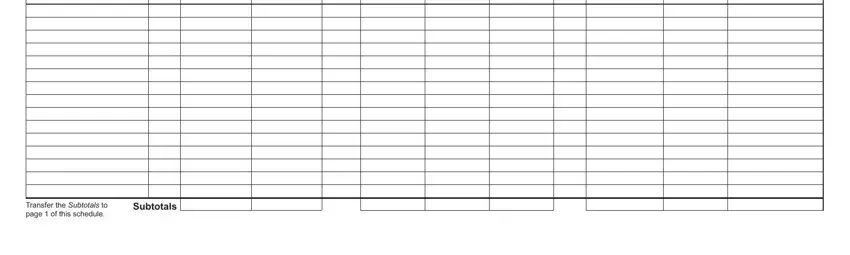

4. You're ready to proceed to the next portion! Here you have all these Transfer the Subtotals to page of, and Subtotals fields to complete.

Step 3: Right after you have reread the information in the fields, press "Done" to complete your form. Right after getting afree trial account with us, it will be possible to download ifta form or email it without delay. The PDF document will also be available in your personal account menu with your every single modification. We don't share or sell any details that you provide while dealing with documents at FormsPal.