You could prepare form il without difficulty with the help of our online PDF editor. We are dedicated to making sure you have the perfect experience with our tool by continuously introducing new capabilities and improvements. With all of these improvements, using our editor becomes easier than ever before! Getting underway is effortless! What you need to do is follow the next simple steps down below:

Step 1: Firstly, access the pdf editor by pressing the "Get Form Button" in the top section of this webpage.

Step 2: This editor provides you with the ability to work with your PDF in a range of ways. Change it by adding any text, correct what is originally in the PDF, and put in a signature - all within the reach of a couple of clicks!

This PDF form requires some specific details; in order to guarantee correctness, please be sure to heed the recommendations further on:

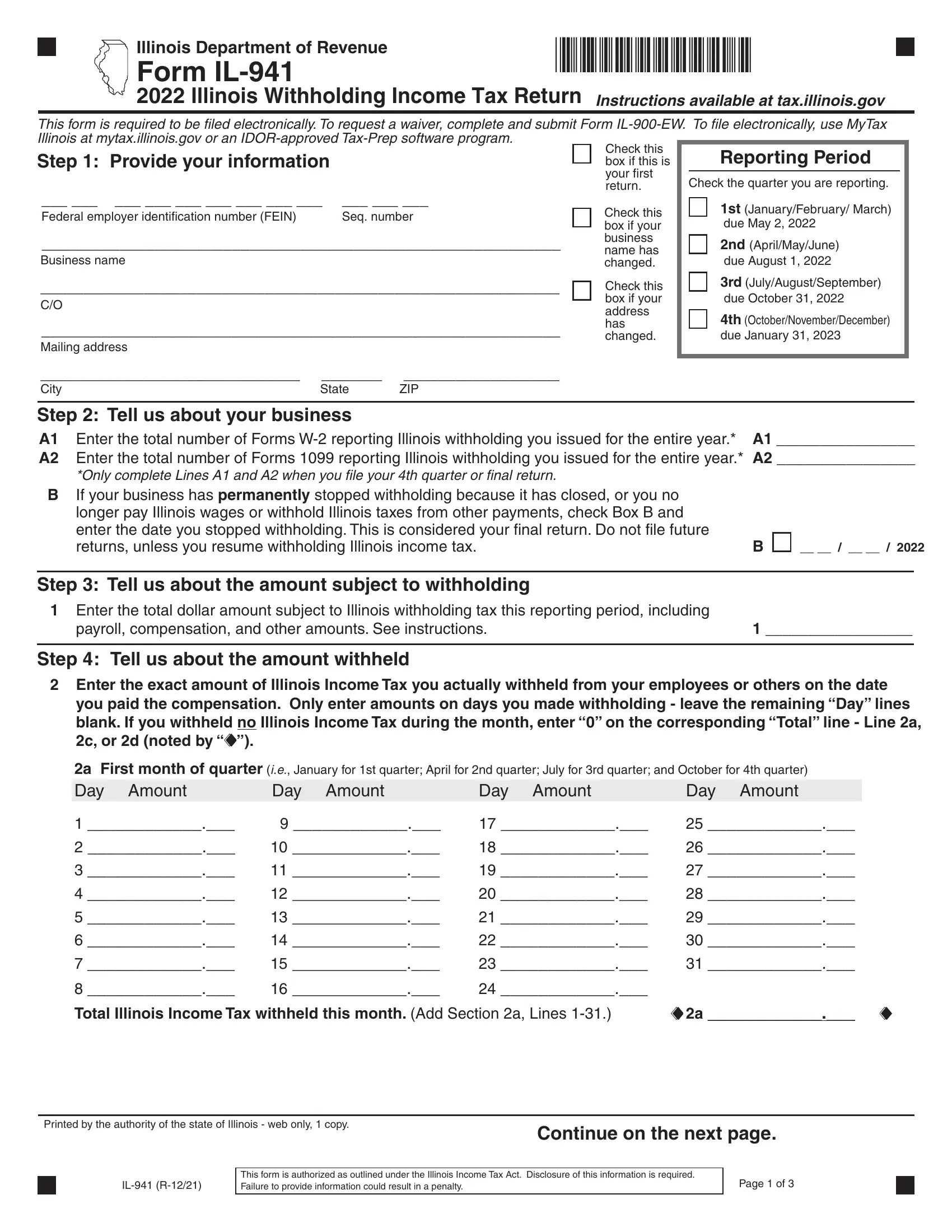

1. First of all, when filling out the form il, beging with the section that features the following blanks:

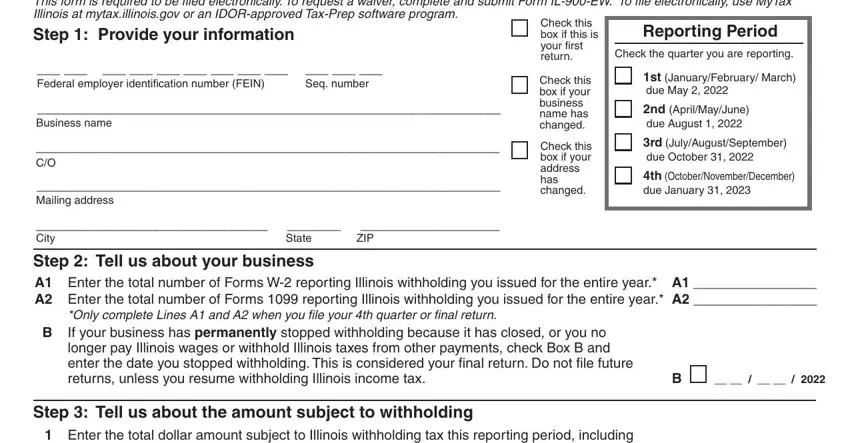

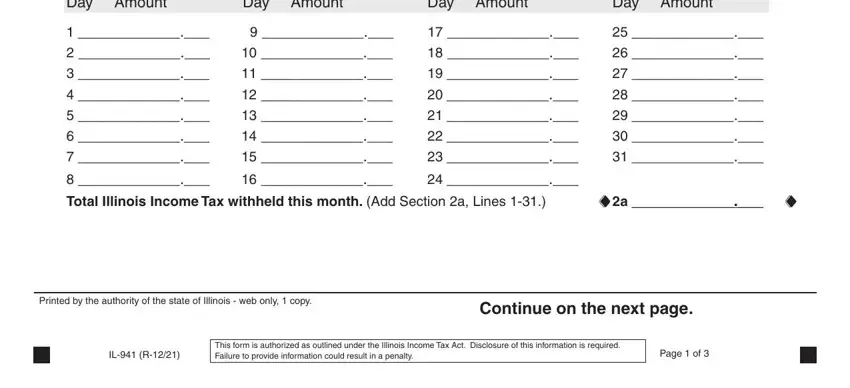

2. Right after this part is completed, go on to type in the applicable details in all these - a First month of quarter ie, Day Amount, Day Amount, Day Amount, Total Illinois Income Tax withheld, Printed by the authority of the, Continue on the next page, IL R, This form is authorized as, and Page of.

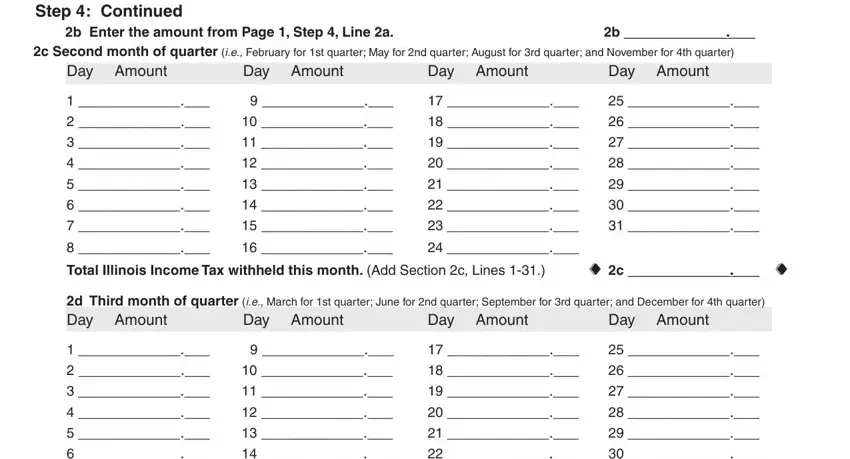

3. In this part, look at b Enter the amount from Page Step, Step Continued c Second month of, Total Illinois Income Tax withheld, d Third month of quarter ie March, and Day Amount Day Amount Day Amount. These need to be completed with utmost precision.

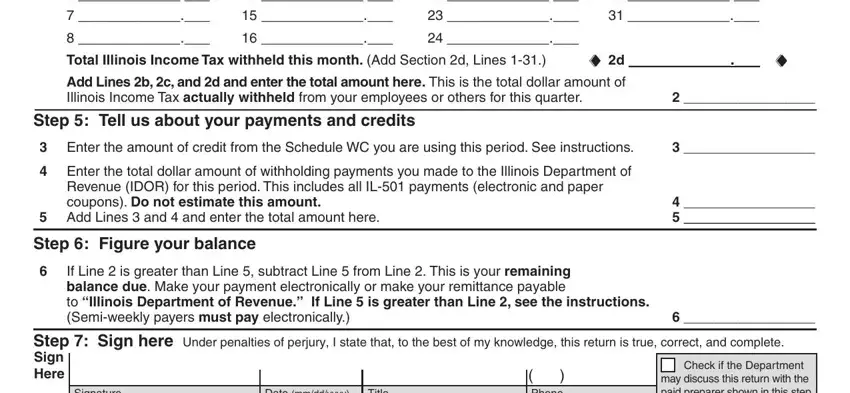

4. This particular subsection comes with the following blanks to look at: Total Illinois Income Tax withheld, Add Lines b c and d and enter the, Illinois Income Tax actually, Step Tell us about your payments, Enter the amount of credit from, Enter the total dollar amount of, Revenue IDOR for this period This, Step Figure your balance, If Line is greater than Line, Check if the Department may, Phone, Signature, Date mmddyyyy, and Title.

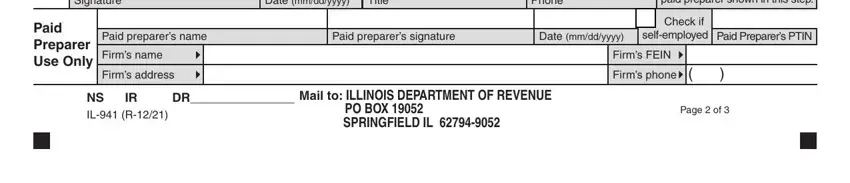

5. This pdf has to be finished by filling out this section. Here you can find a full listing of fields that have to be filled in with correct information to allow your document usage to be complete: Check if the Department may, Phone, Firms FEIN, Firms phone, Page of, Signature, Date mmddyyyy, Title, Paid preparers name, Paid preparers signature, Date mmddyyyy, Check if selfemployed, Paid Preparers PTIN, Paid Preparer Use Only, and Firms name.

In terms of Paid preparers name and Paid Preparer Use Only, ensure you review things in this section. These two are certainly the key ones in the file.

Step 3: Prior to finalizing this form, check that all blank fields are filled out properly. When you’re satisfied with it, press “Done." Get hold of your form il once you register here for a 7-day free trial. Quickly use the pdf form inside your personal cabinet, together with any edits and changes conveniently preserved! FormsPal guarantees secure form completion without personal information recording or sharing. Rest assured that your data is in good hands here!