Should you want to fill out il form 1120, you won't need to download and install any programs - just try our online PDF editor. To maintain our tool on the forefront of practicality, we work to put into practice user-driven features and enhancements on a regular basis. We're routinely looking for suggestions - join us in reshaping PDF editing. Getting underway is easy! All you should do is follow the next simple steps down below:

Step 1: Click the "Get Form" button above. It's going to open up our editor so you could start filling out your form.

Step 2: Using this state-of-the-art PDF file editor, it is easy to accomplish more than simply complete blanks. Express yourself and make your forms seem perfect with customized textual content incorporated, or tweak the file's original content to excellence - all comes with the capability to insert your personal images and sign the document off.

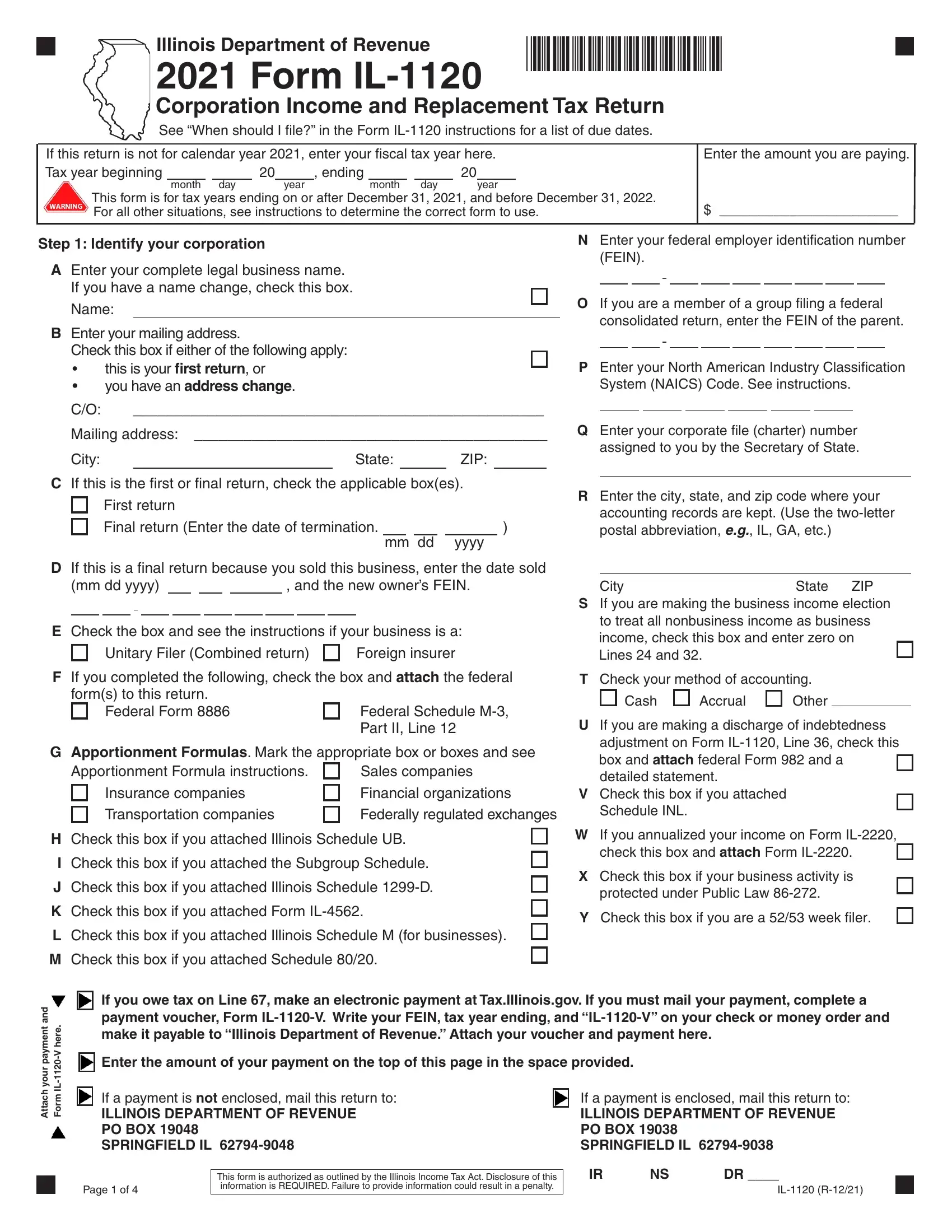

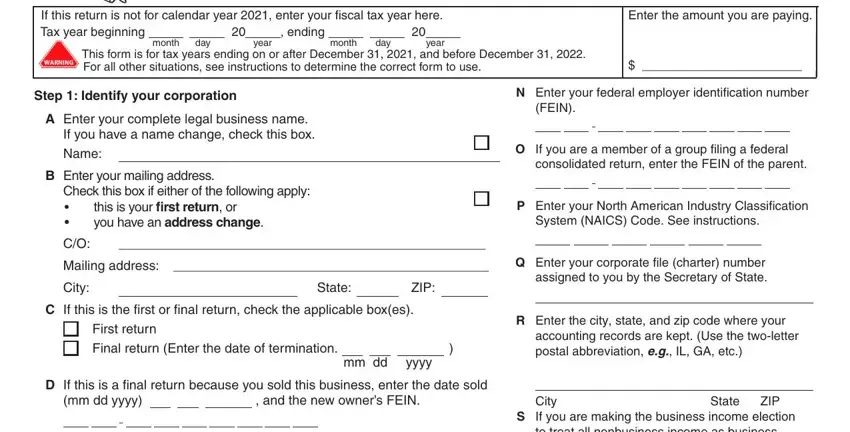

As a way to complete this PDF form, ensure that you enter the right details in every blank field:

1. The il form 1120 needs particular information to be inserted. Make certain the following blanks are filled out:

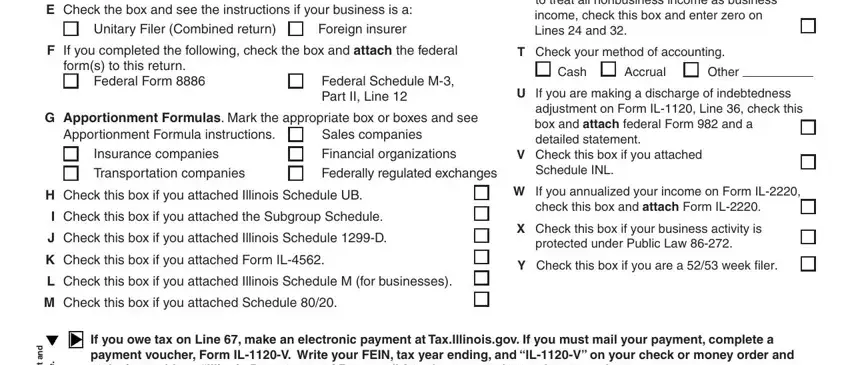

2. Right after this section is filled out, proceed to enter the suitable details in these - E Check the box and see the, Unitary Filer Combined return, Foreign insurer, S If you are making the business, income check this box and enter, F If you completed the following, T Check your method of accounting, forms to this return, Federal Form, Federal Schedule M Part II Line, G Apportionment Formulas Mark the, Apportionment Formula instructions, Sales companies, Insurance companies Transportation, and Financial organizations Federally.

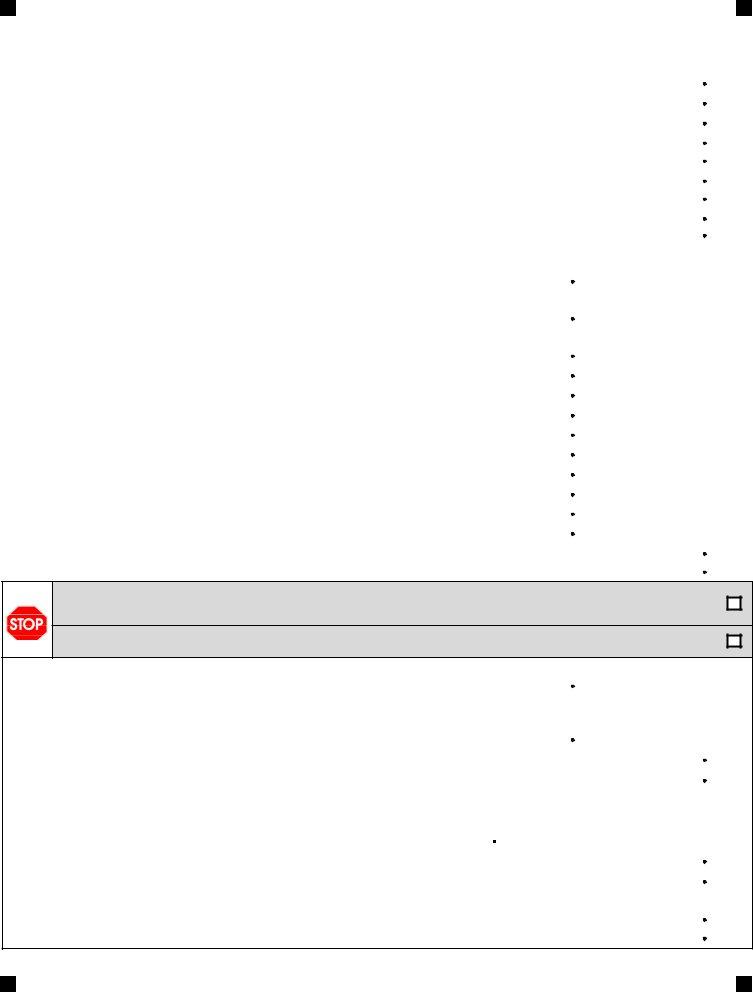

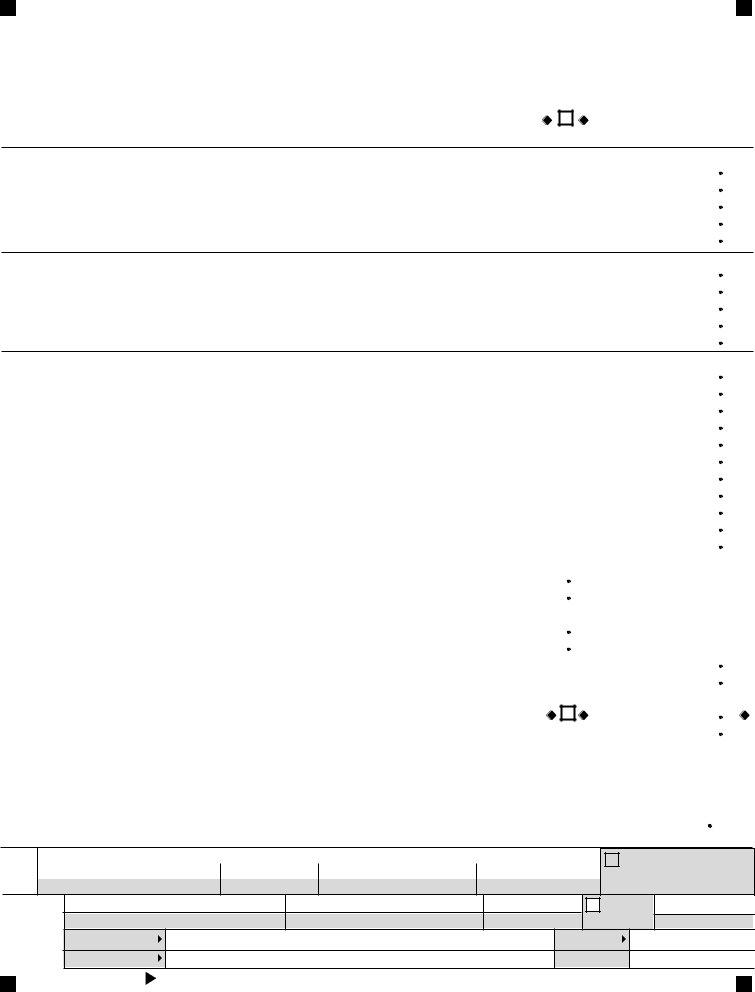

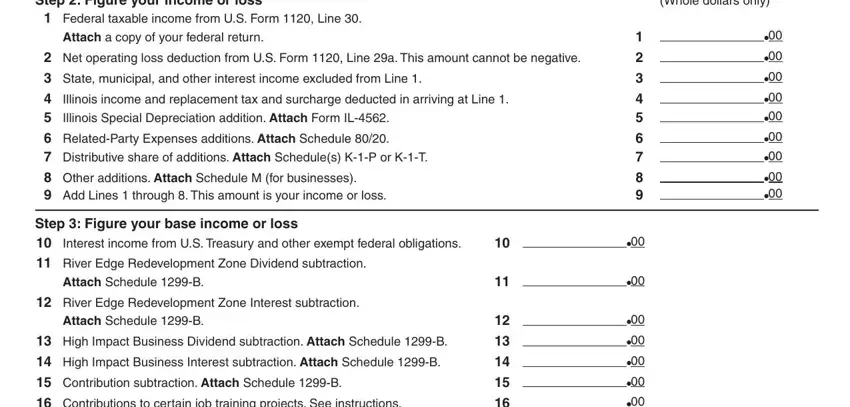

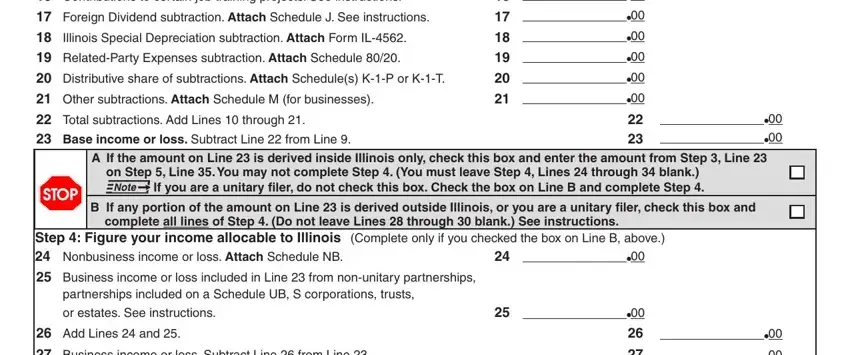

3. Your next part will be easy - fill in every one of the form fields in Step Figure your income or loss, Federal taxable income from US, Attach a copy of your federal, Net operating loss deduction from, State municipal and other, Illinois income and replacement, Illinois Special Depreciation, Other additions Attach Schedule M, Attach Schedule B, Attach Schedule B, Step Figure your base income or, and Whole dollars only in order to complete this process.

4. This fourth paragraph comes next with all of the following empty form fields to complete: Step Figure your base income or, A If the amount on Line is, on Step Line You may not, B If any portion of the amount on, complete all lines of Step Do not, Step Figure your income allocable, partnerships included on a, or estates See instructions, and Add Lines and Business income.

Be very careful when completing on Step Line You may not and or estates See instructions, since this is where most users make mistakes.

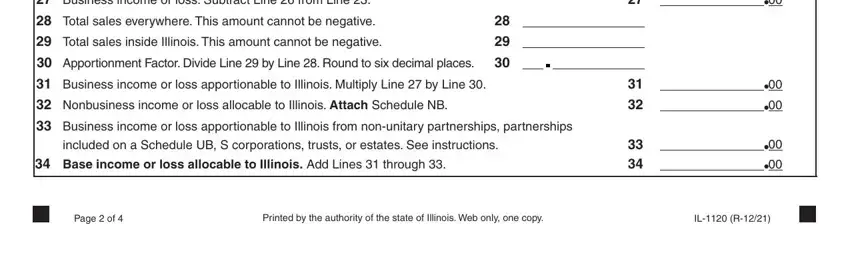

5. This last point to finalize this PDF form is integral. You'll want to fill out the required form fields, which includes Add Lines and Business income, Business income or loss, included on a Schedule UB S, Base income or loss allocable to, Page of, Printed by the authority of the, and IL R, before submitting. Or else, it could generate a flawed and possibly unacceptable form!

Step 3: Prior to addressing the next step, make certain that blank fields have been filled out the right way. The moment you’re satisfied with it, click on “Done." Join FormsPal right now and immediately access il form 1120, available for download. All adjustments made by you are kept , so that you can change the pdf at a later stage if necessary. At FormsPal, we aim to be sure that your details are kept secure.