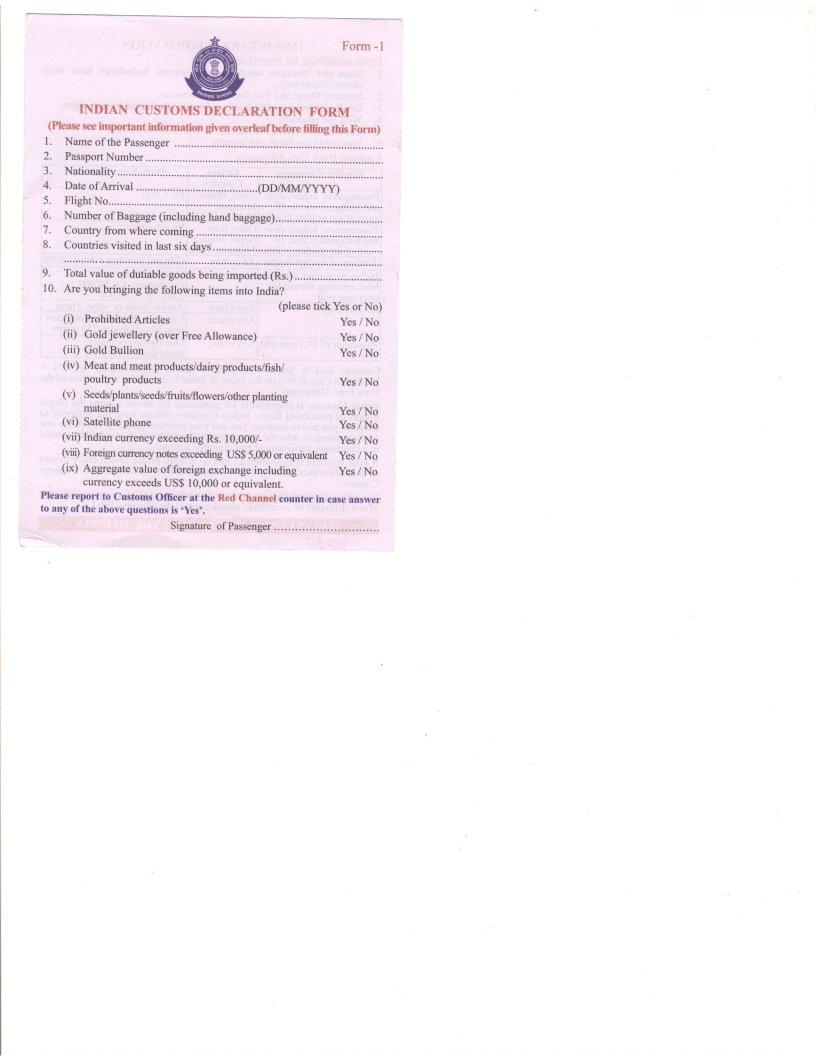

Traveling to India introduces an essential procedure for all travelers: completing the Indian Customs Declaration Form. This form is pivotal for passengers entering the country to declare items of various natures, ensuring adherence to the country's regulations on imports. Key sections encompass personal information such as the passenger's name, passport number, and nationality, along with specific details about their journey, including date of arrival, flight number, and countries visited recently. It requires disclosure of the quantity of baggage, which includes hand baggage, and the country of origin. Crucially, the form queries passengers on the possession of dutiable goods, prohibited items, gold beyond the allowed quantity, meat and dairy products, seeds and satellite phones, exceeding amounts of Indian and foreign currency, and the aggregate value of foreign exchange in their possession. Accompanying the form is vital information regarding prohibited items — which includes narcotics, counterfeit currency, and wildlife products — and details about duty-free allowances, which vary for passengers of different origins and stay durations. Penalties for non-compliance can be strict, necessitating honest and careful completion of the form. Customs officials are tasked with protecting India's borders from illegal imports, and as such, they hold the authority to conduct personal and property searches to ensure compliance. However, they are also committed to treating travelers with courtesy and professionalism throughout the process. This form is integral for safeguarding the country’s economic and physical security, making it a critical component of the international travel experience to India.

| Question | Answer |

|---|---|

| Form Name | Indian Customs Declaration Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | india post cn22 form, cn 22 form, cn22 india post, cn22 custom declaration form india post |

Form - l

INDIAN CUSTOMSDECLARATION FORM

SAMPLE - IMMIHELP.COM

@leaseseeimportant informatirm given overleaf before filting this Form)

l . |

Nameof thePassenger |

|

|

2. |

PassportNumber |

|

|

3 . |

Nationa1ity |

.... !: |

|

|

|

|

|

4. |

DateofArrival |

.................. |

(DDAdM/yyyl) |

5. |

FlightNo |

|

|

6.Number of Baggage(includinghandbaggage)........:.

7.Countryfrom wherecoming........

8. Countriesvisitedin lastsixSAMPLEdays......,,.....,;...;....,...,........

9.Totalvalue of dutiablegoodsbeing impofted(Rs.)...,....,.,.....

10.Are you bringingIMMIHELPthe following items into tndia?.COM

|

(please |

yes |

or No) |

||

|

tick |

|

|

||

(i) |

ProhibitedArticles |

|

Yes/No |

||

|

|

|

|||

(ii) |

Goldjewellery (over FreeAllowance) |

|

Yes/No |

||

(iii) |

Gold Bullion |

|

Yes/ No |

||

|

|

|

|||

(iv) Meat and meatproducts/dairy products/fish/ |

|

|

|

|

|

|

poultry products |

|

Yes/ No |

||

|

|

|

|||

(v) |

SeedVplantdseedVfruits/flowers/other |

|

|

|

|

|

planting |

|

|

|

|

(vi) |

material |

|

yes /No |

||

Satellitephone |

|

yes /No |

|||

(vii) hdian curency exceedingRs. 10,000/- |

|

yes /No |

|||

(viif Foreigncuffencynotesexceeding |

|

yes |

/ No |

||

|

US$5,000or equivalent |

|

|

||

(ix) |

Aggrcgate value of foreign exchangeincluding |

|

yes / No |

||

.crnrencyexceedsUS$ 10,000or equivalent.

Plcaseroport.to custom' officer at the Red channsr eounter in crse answer to any of the abovequestionsis .yeg,.

SignatureofPassenger

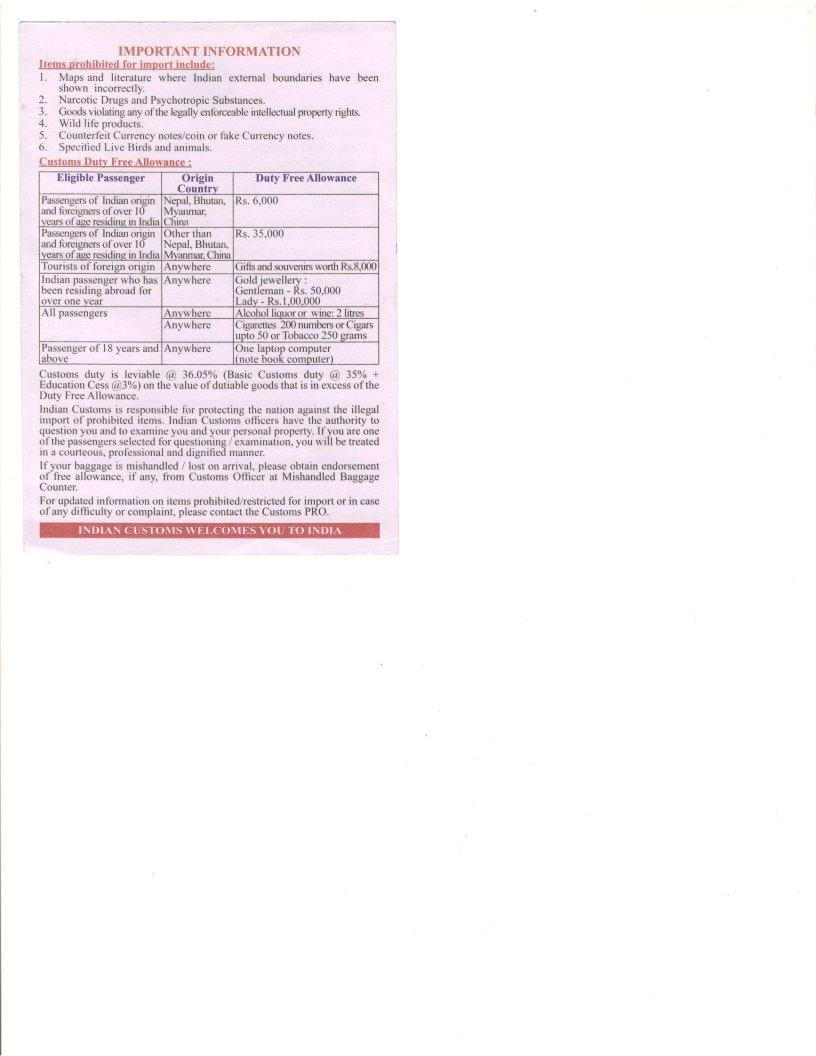

IMPORTANT INFORMATION

Items piohibited for imnort include:

l.Maps and literature where Indian extemal boundaries have been shown incorrectly.

2.Narcotic Drugs and PsychotropicSubstances.

3.Goodsviolatinganyofthe legallyenforceableintellectualpropertyrighb.

4.Wild life products.

5.CountedeitCurrencynotes/coinor fake Currencynotes.

6.SpecifiedLive Birds and animals.

Customs Dutv Free Allowance : |

|

|

||

Etigible Passenger |

Origin |

|

lruty I reeA[owance |

|

rassengers |

Countrv |

|

|

|

Nepal,Bhutan, |

Rs.6.000 |

|||

of Indianoriein |

||||

rndfo6ipnersof over ld' |

Myanmm, |

|

|

|

rearsofise residinsin India lhinq |

|

|

||

Passengersof Indianoriein |

Otherthan |

Rs.35,000 |

||

u:d foriisnersofover I 0- |

Nepal,Bhutan, |

|

|

|

reanof &e residinsin India |

SAMPLE |

|||

|

Munmar Chinr |

|

|

|

fouristsof foreisn orisin |

Anywhere |

Gfts andsouveninworthRs.8,00( |

||

Indianpassengerwho has Anywhere |

Goldiewellerv: |

|||

|

|

|

- |

|

overone vear |

|

Lcdv - Rs I OO OOO |

||

\ll passengers |

Anvwhere |

Alcohol liouor or wine: 2 litres |

||

|

Anywhere |

uEiar€treszw ilrmbersor u€ars |

||

|

|

Lroto50 or Tobacco250 erams |

||

of l8 yearsandAnywhere |

une laptopcomputer |

|||

lfl:r":rc.t |

|

'nnfe |

hnnL nnmnrrter\ |

|

Customsdutv is leviable@, 36.050/o(Basic CustomsduW @ 35% +

Duty FreeAllowance.

IndianCustomsis resoonsiblefor orotectinsthe nationacainstthe illeqal import of prohibited iiems.

questionvou andto examinevou andvour oersonalDroDeffyIfvou. areone dfthe paJsengersselectedfor questioriing/'examinaiion,yoir will betreated in a courteousorofessional.and disnified manner.

Ifvour bassaeeis mishandled/

For updatedinformationon itemsprohibited,/restrictedfor import or in case of any difficulty or complaint,pleise contactthe CustomsPRO.

SAMPLE - IMMIHELP.COM