You are able to fill out indiana tax np effortlessly with the help of our PDF editor online. FormsPal expert team is always working to enhance the editor and help it become even easier for people with its multiple functions. Benefit from today's innovative prospects, and discover a trove of unique experiences! Starting is simple! Everything you should do is follow these simple steps directly below:

Step 1: Just click the "Get Form Button" in the top section of this site to launch our pdf file editing tool. This way, you will find all that is needed to fill out your file.

Step 2: When you open the file editor, you'll see the form ready to be filled in. Other than filling out different blanks, you could also perform some other things with the form, such as writing custom textual content, changing the initial textual content, adding illustrations or photos, affixing your signature to the PDF, and more.

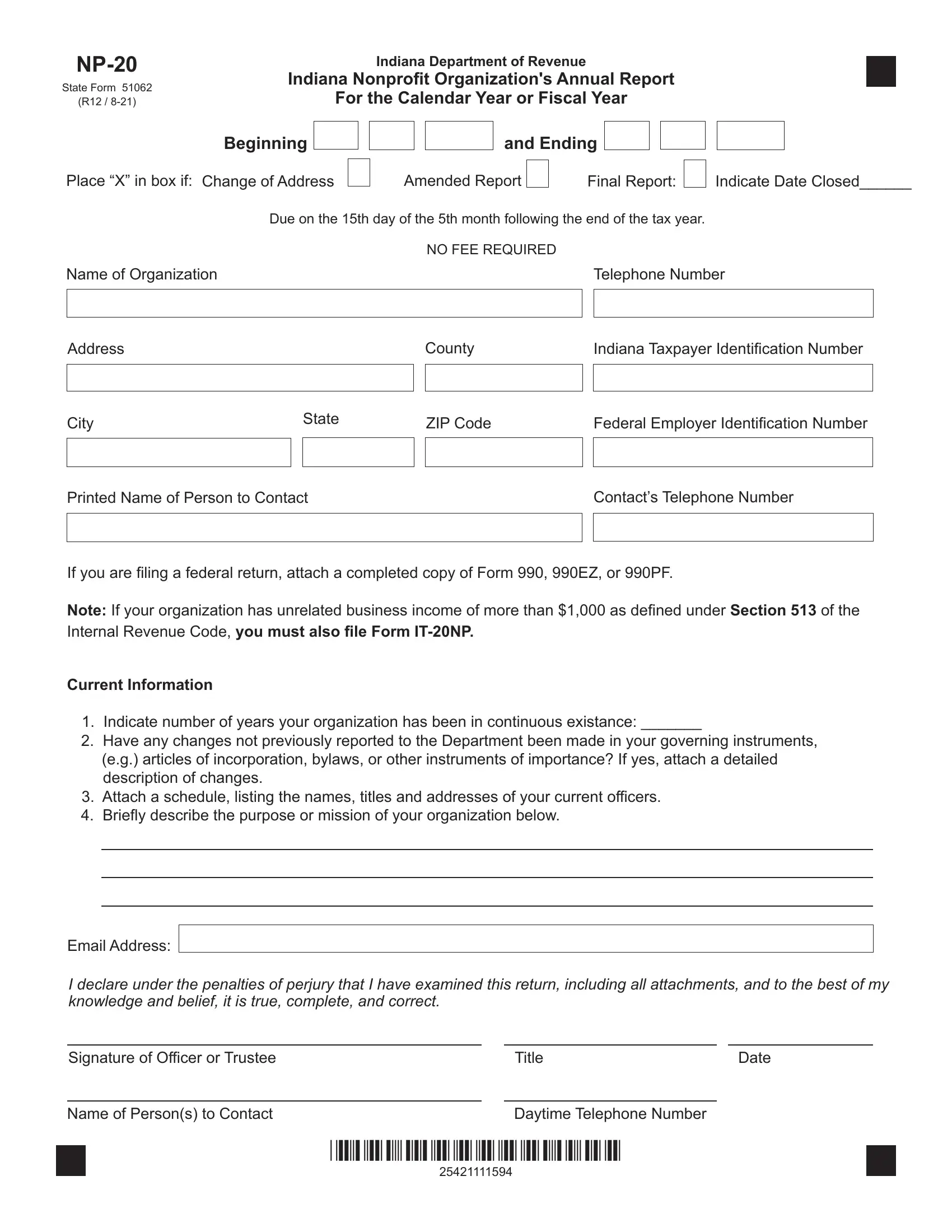

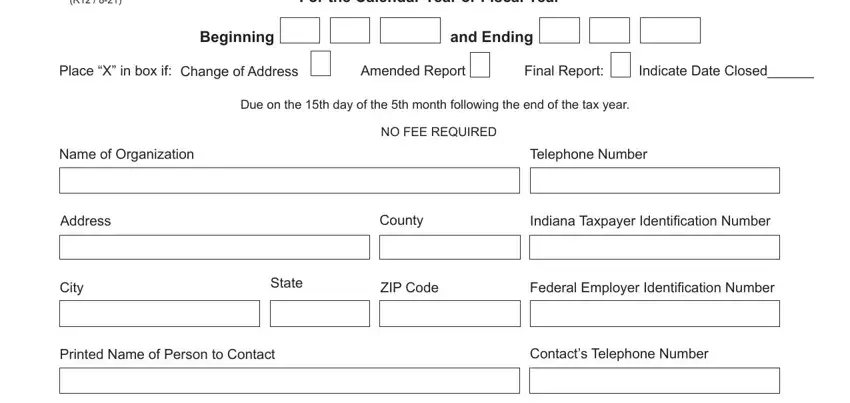

This PDF form requires specific info to be typed in, thus you must take whatever time to enter precisely what is expected:

1. Complete the indiana tax np with a group of necessary fields. Collect all the information you need and make certain nothing is neglected!

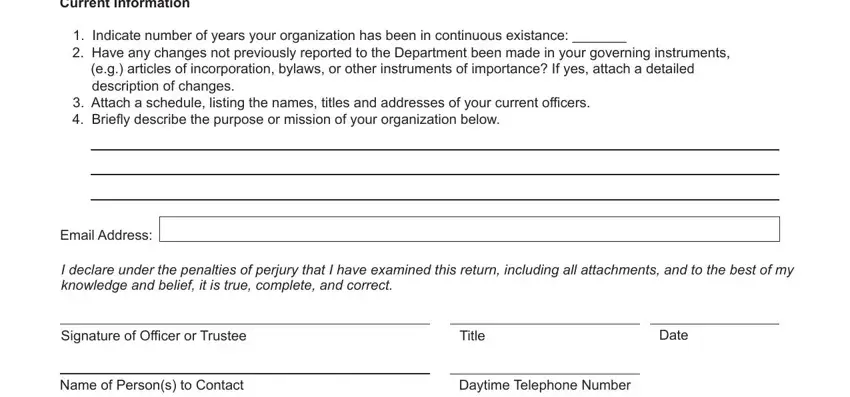

2. The third step is to fill out these particular fields: Current Information, Indicate number of years your, eg articles of incorporation, Attach a schedule listing the, Email Address, I declare under the penalties of, Signature of Officer or Trustee, Title, Date, Name of Persons to Contact, and Daytime Telephone Number.

Always be very attentive while filling in Daytime Telephone Number and Title, because this is where most people make errors.

Step 3: Immediately after going through your fields and details, click "Done" and you are done and dusted! Make a 7-day free trial account at FormsPal and gain immediate access to indiana tax np - download, email, or change inside your FormsPal account page. When you work with FormsPal, it is simple to complete documents without the need to be concerned about database incidents or records getting shared. Our secure software makes sure that your personal information is maintained safe.