Navigating the intricacies of the Indiana Prop 1 form is crucial for carriers seeking to optimize their operational efficiency while staying compliant with state regulations. This form, officially titled the Indiana Department of Revenue Proportional Use Credit Certification Application, is specifically designated for motor carriers operating vehicles with diverse usage patterns across state lines. With a nominal fee of $7.00, as indicated in its latest revision, the form serves as a gateway for obtaining certification that potentially unlocks significant tax savings under the Proportional Use Credit system. Notably, applicants are required to furnish comprehensive details ranging from basic identification and contact information to more specialized data such as federal and state transportation numbers, thus underlining the form's exhaustive nature. Additionally, it meticulously outlines the requisite documentation for both Indiana-based carriers and those headquartered out of state, emphasizing its inclusive applicability. The form further bifurcates entities based on their structural composition, thereby ensuring tailored processing for sole proprietorships, partnerships, corporations, and governmental organizations alike. Moreover, the vehicle information section demands precise input on the fleet, highlighting the tax department's emphasis on accuracy and detail. This elaborate documentation process underscores Indiana's commitment to equitable taxation while affording carriers the opportunity to claim justified proportional use credits, subject to meticulous certification by the Department of Revenue prior to the stipulated April 1 deadline each calendar year.

| Question | Answer |

|---|---|

| Form Name | Indiana Form Prop 1 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | prop 1 indiana form prop 1 |

|

|

|

|

Indiana Department of Revenue |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

Proportional Use Credit |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

Certification Application |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

Fee $7.00 |

|

|

|

|

|

|

|

|

||||||

Rev. 08/00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

Complete this Section only if different than lines 1, 3, 5, 6, 7. |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1. Legal Name |

|

|

|

|

|

|

|

2. |

Doing Business As (DBA) |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

3. Physical Address |

|

|

|

|

|

|

|

4. |

Mailing Address |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

5. City |

|

6. State/Province |

|

7. Zip Code |

8. City |

|

9. State/Province |

|

|

10. Zip Code |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

11. County |

|

12. Telephone Number |

|

|

13. Federal Identification Number |

|

14. Social Security Number |

||||||||||||||

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

15. Interstate U.S. DOT Number |

16. Indiana IFTA Number |

17. IFTA Number (If |

|

18. Base State/Jurisdiction |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

19. Indiana U.S. DOT Number |

|

|

20. Indiana Motor Carrier Number |

21. |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

NOTE: If you ARE NOT an Indiana IFTA/Motor Carrier Account and are registered in another jurisdiction, |

|||||||||||||||||||||

proceed to line 22. All others go to line 24. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22. Check the type of organization of this business: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Sole Proprietorship |

Partnership |

Corporation |

|

Government |

|

Other ______________ |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

23. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

State of Incorporation: |

|

|

Date of Incorporation: |

|

|

State of Commercial Domicile: |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Enter the date authorized to do business: |

|

Accounting period year ending date (MM/DD): |

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Last Name, First, Middle Initial |

|

Title |

|

Street Address |

City |

State |

Zip |

|

Social Security Number |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I do hereby certify under penalty of perjury that the foregoing and attached information is a true and correct statement to the best of my knowledge and is a complete and full representation based upon the best information available.

24. Signature of Taxpayer/Authorized Agent |

Typed or Printed Name |

Title |

|

|

|

|

|

- |

Date Signed |

Telephone Number |

|

|

( |

) |

|

|

|

||

|

|

|

|

This application MUST be signed by the owner, general partner or corporate officer before it will be processed by the Department.

For more information regarding this application, you may contact the Department at (317)

documentation and application fees to: |

Indiana Department of Revenue |

|

Motor Carrier Services Division |

|

P.O. Box 6078 |

|

Indianapolis, IN |

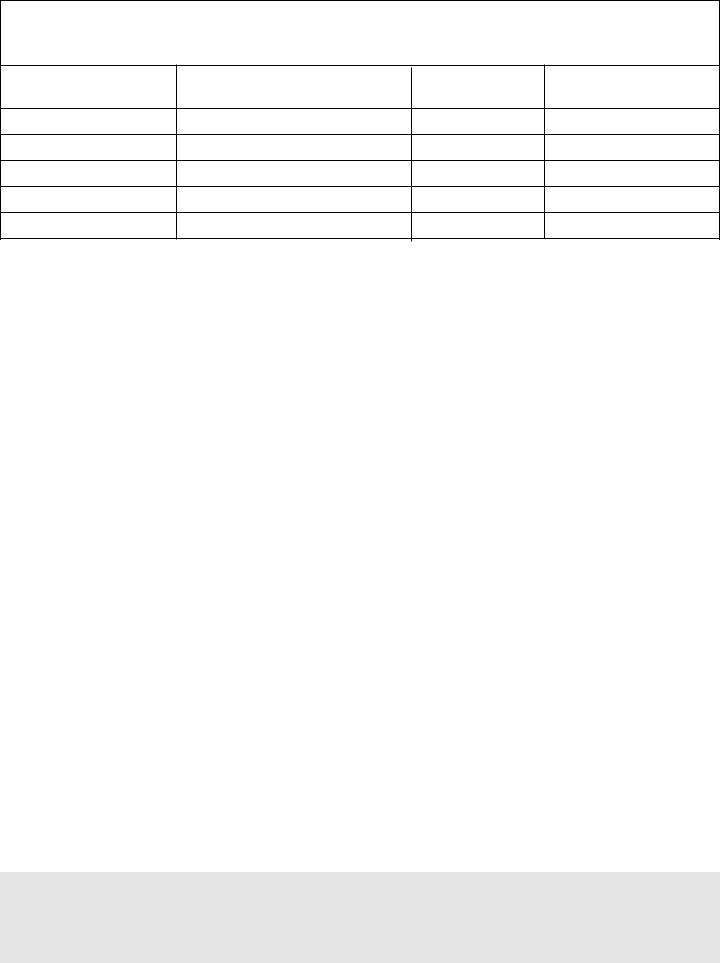

Vehicle Information

(This section must be completed by all applicants)

If you have more than 5 vehicles, please attach printout

Vehicle

Code

Vehicle Identification Number

Power Units Only

Vehicle Type

TK or TR

Vehicle Make

Line By Line Instructions |

List of Eligible Vehicles |

|

CODE |

Line 1: Enter Legal Name or Sole Proprietorship, Partnership, Cor- poration, or other legal name.

Lines 3, 5, 6, 7 & 11: Enter the actual location of your business by providing the Street Address, City, State/Province, Zip Code and County* (*Indiana businesses only).

Lines 2,4,8,9,10: Enter the appropriate information ONLY if differ- ent than lines 1,3,5,6,7,11.

Line 12: Enter the area code and telephone number of your prin- ciple place of business.

Line 13: Enter your nine (9) digit Federal Identification Number.

Line 14: Enter your Social Security Number if your business does not have a Federal Identification Number.

Line 15: Enter your INTERSTATE US DOT Number (you will have an Interstate US DOT Number if your vehicle(s) operate outside the state of Indiana.)

Line 16: Enter your Indiana IFTA Tax Identification Number (if based in Indiana.)

Line 17: Enter your IFTA Account Number if based outside the state of Indiana.

Line 18: Enter your Base State/Jurisdiction in which you have your IFTA registered.

Line 19: Enter your Indiana US DOT Number (you will have an IN US DOT Number if your vehicle(s) operate in the state of Indiana only).

Line 20: Enter your Indiana Motor Carrier Account Number.

Line 21: Enter an

Line 22: To be entered by

Line 23: Enter the requested information below. This certificate will not be processed without this section completed.

Line 24: Enter the signature of Taxpayer/Authorized Agent.

10 |

Air Conditioning Unit for Buses |

10% |

11 |

Bookmobile |

35% |

12 |

Boom |

20% |

13 |

Bulk Feed Trucks |

15% |

14 |

Car Carrier with Hydraulic Winch |

10% |

15 |

Carpet Cleaning Van |

15% |

16 |

Cement Mixers |

30% |

17 |

Distribution |

10% |

18 |

Dump Trailers |

15% |

19 |

Dump Trucks |

23% |

20 |

Fire Truck |

48% |

21 |

Leaf Truck |

20% |

22 |

Lime Spreader |

15% |

23 |

Line |

20% |

24 |

Milk Tank Trucks |

30% |

25 |

Mobile Cranes |

42% |

26 |

Pneumatic Tank Truck |

15% |

27 |

Refrigeration Truck |

15% |

28 |

Salt |

15% |

29 |

Sanitation Dump Trailers |

15% |

30 |

Sanitation Truck |

41% |

31 |

Seeder Truck |

15% |

32 |

Semi Wrecker |

35% |

33 |

Service Truck with Jackhammer, Pneumatic Drill |

15% |

34 |

Sewer Cleaning Truck Sewer Jet, Sewer Vactor |

35% |

35 |

Snow Plow |

10% |

36 |

Spray Truck |

15% |

37 |

Super Sucker |

90% |

38 |

Sweeper Truck |

20% |

39 |

Tank Trucks |

24% |

40 |

Tank Transport |

15% |

41 |

Truck with Power Take Off Hydraulic Winch |

20% |

42 |

Wrecker |

10% |

Please use the code number when listing the vehicles on this Certification and all Claims for Credit forms. Also use these codes when adding/deleting vehicles quarterly.

****IMPORTANT****

A carrier must complete this application and be certified by the department in order to qualify for a proportional use credit. A carrier must apply to the Department for certification before April 1 of the first calendar year for which the proportional use will be claimed. NOTE: Once the carrier has been certified by the Department, that certification is valid for all subsequent calendar years.