wisconsin request payment form can be filled in with ease. Just open FormsPal PDF editor to perform the job right away. To have our editor on the leading edge of practicality, we work to put into practice user-driven features and improvements on a regular basis. We are always looking for feedback - join us in revolutionizing PDF editing. With a few basic steps, you can start your PDF editing:

Step 1: Click the "Get Form" button above on this page to get into our tool.

Step 2: Using this handy PDF file editor, you can actually do more than merely complete blank form fields. Edit away and make your forms look sublime with customized textual content added in, or fine-tune the original content to excellence - all comes along with the capability to insert any graphics and sign the PDF off.

It's simple to fill out the pdf with our helpful tutorial! Here's what you need to do:

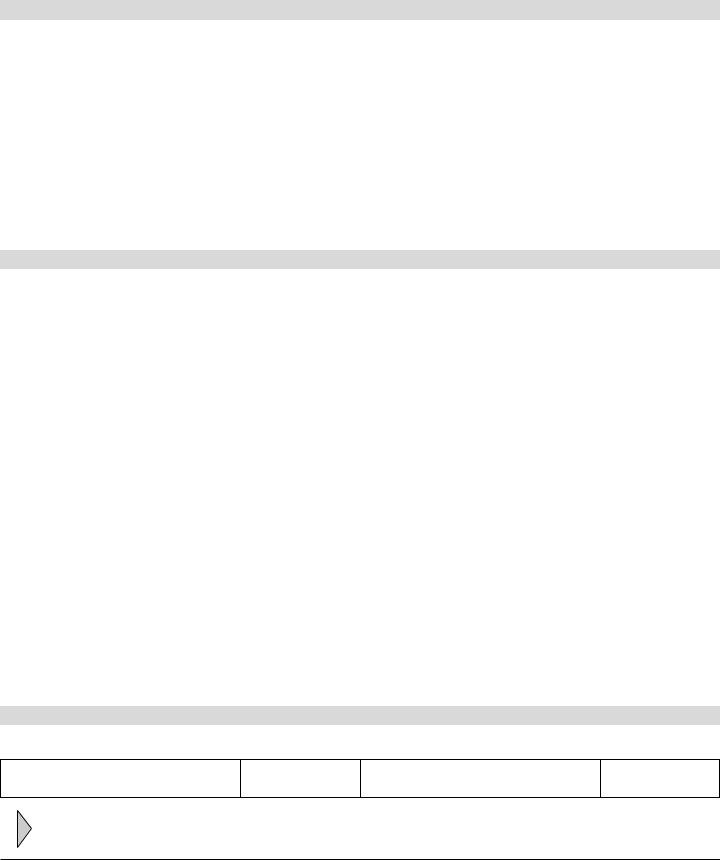

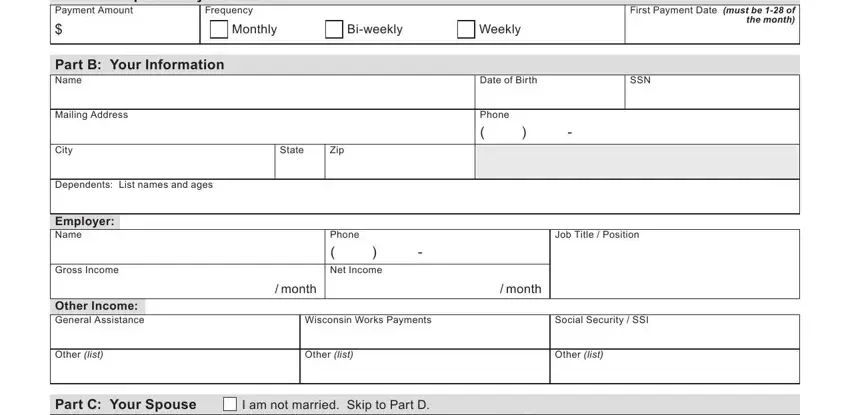

1. First of all, when filling in the wisconsin request payment form, begin with the section with the subsequent fields:

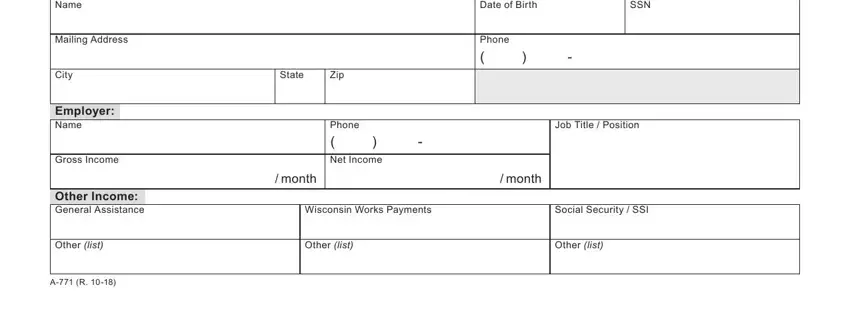

2. Soon after the first part is done, go to enter the relevant information in all these: Part C Your Spouse Name, Mailing Address, City, State, Zip, Date of Birth, SSN, Phone, Employer Name, Gross Income, Other Income General Assistance, Other list, A R, Phone Net Income, and Job Title Position.

Lots of people frequently get some points incorrect while filling out Date of Birth in this section. Be certain to re-examine whatever you enter right here.

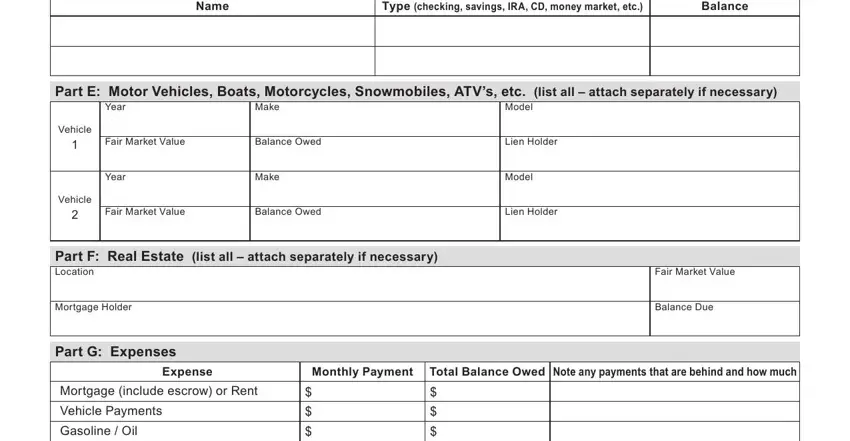

3. This next segment is about Name, Type checking savings IRA CD money, Balance, Part E Motor Vehicles Boats, Year, Make, Fair Market Value, Balance Owed, Year, Make, Fair Market Value, Balance Owed, Vehicle, Vehicle, and Model - complete each one of these blank fields.

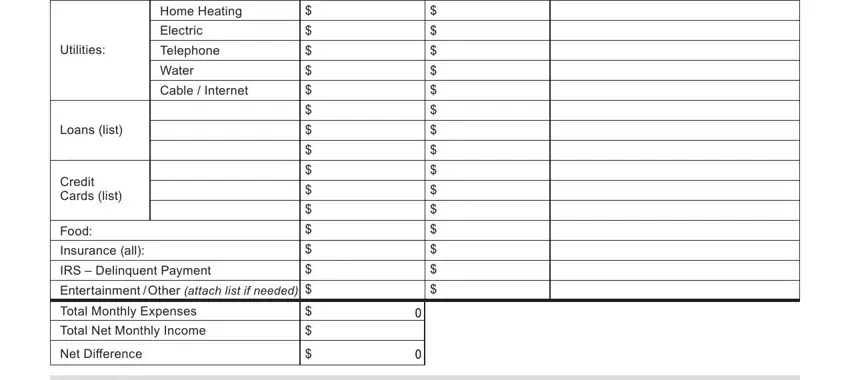

4. The next section will require your attention in the subsequent areas: Home Heating Electric, Telephone, Water, Cable Internet, Utilities, Loans list, Credit Cards list, and Food Insurance all IRS Delinquent. Ensure you provide all of the required details to move forward.

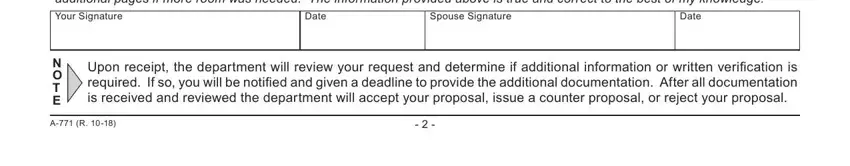

5. This document should be finished with this section. Here one can find an extensive listing of fields that need to be filled out with accurate information to allow your form submission to be faultless: I have read and understand the, Spouse Signature, Date, Date, N O T E, Upon receipt the department will, and A R.

Step 3: When you have reviewed the information you given, just click "Done" to complete your FormsPal process. Right after starting afree trial account with us, it will be possible to download wisconsin request payment form or send it through email directly. The PDF form will also be easily accessible in your personal cabinet with your every change. Here at FormsPal, we endeavor to ensure that your details are stored private.