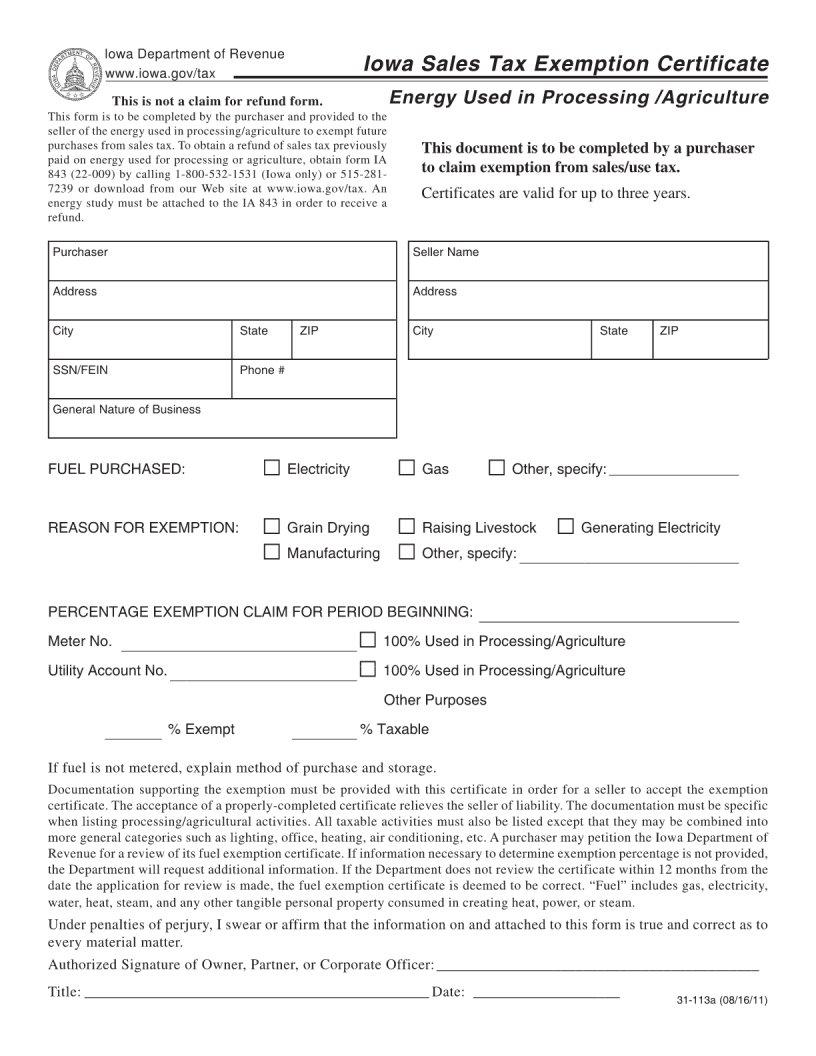

The Iowa Resale Certificate form represents a crucial tool for businesses operating within the state, paving the way for the purchase of goods intended for resale without the imposition of sales tax at the point of purchase. This form, essential for both vendors and resellers, serves as a declaration that the items bought are for resale purposes, thereby exempting the transaction from sales tax under Iowa law. It is vital for sellers to meticulously maintain records of these forms as proof of tax-exempt sales, to comply with state tax regulations. Failure to properly use or accept these certificates can lead to significant tax liabilities and penalties, emphasizing the importance of understanding the form’s requirements and its applicability. The form’s role in facilitating a smoother flow of goods in the business-to-business market cannot be understated, providing a legal avenue for avoiding unnecessary tax burdens on items that are not end-consumed but rather, sold to the final consumer. Through its effective use, businesses can ensure compliance with Iowa’s tax laws while optimizing their operations for better financial efficiency.

| Question | Answer |

|---|---|

| Form Name | Iowa Resale Certificate Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | certificate for resale iowa, iowa tax exempt form, iowa sales tax exemption certificate, resale certificate iowa |