ir8a form can be completed online very easily. Simply try FormsPal PDF editing tool to do the job in a timely fashion. In order to make our editor better and simpler to use, we consistently design new features, bearing in mind suggestions from our users. This is what you'd need to do to begin:

Step 1: Firstly, access the pdf tool by clicking the "Get Form Button" above on this webpage.

Step 2: This tool enables you to change your PDF document in a range of ways. Improve it by adding customized text, correct original content, and place in a signature - all doable within a few minutes!

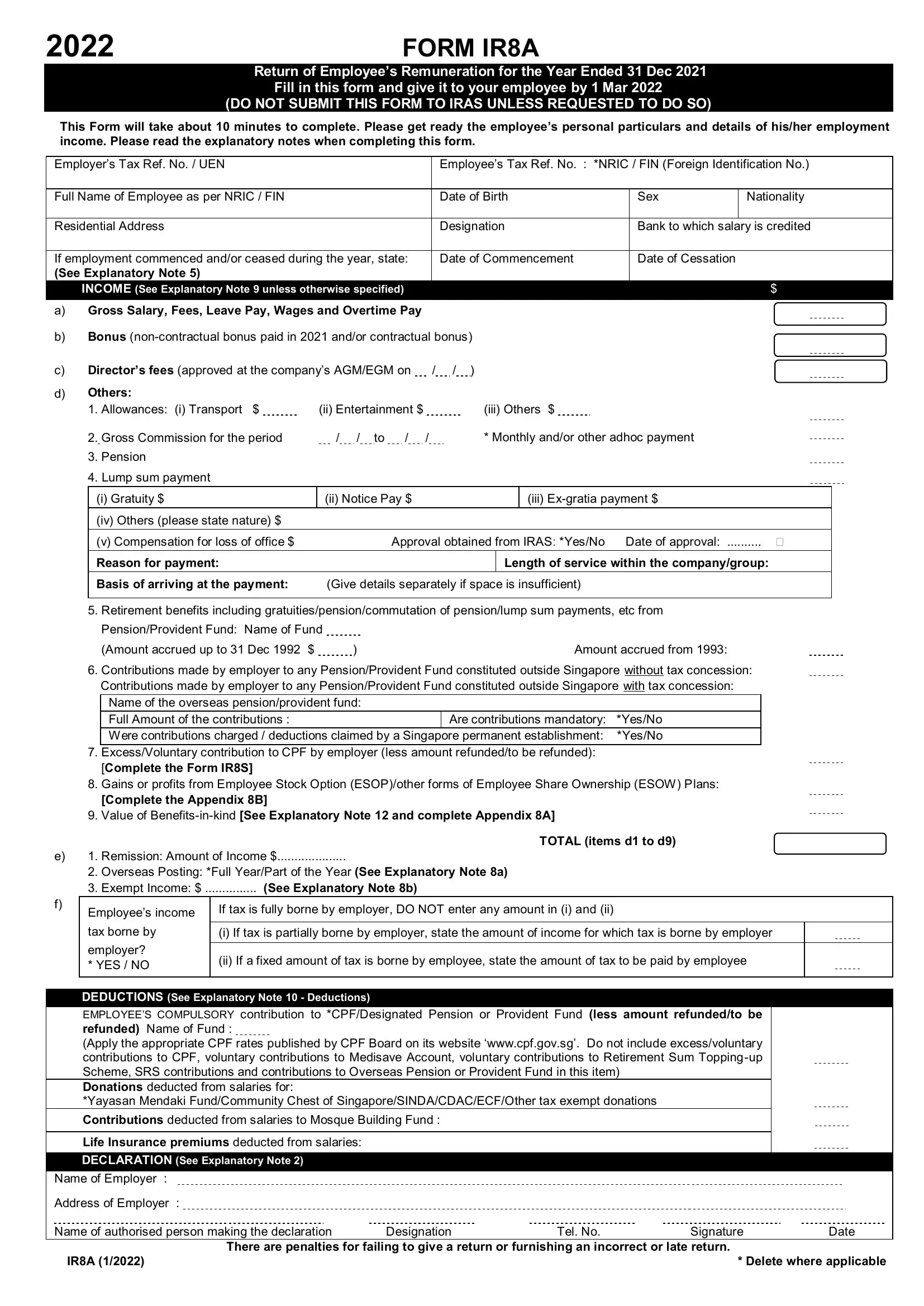

This form will need particular details to be filled in, hence be sure you take some time to fill in what is requested:

1. Fill out the ir8a form with a number of major fields. Consider all the important information and be sure nothing is neglected!

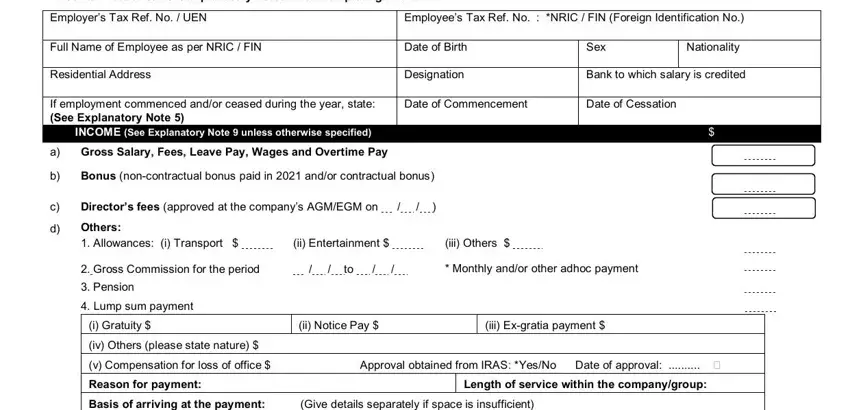

2. Once your current task is complete, take the next step – fill out all of these fields - Retirement benefits including, PensionProvident Fund Name of Fund, Amount accrued up to Dec, Amount accrued from, Contributions made by employer to, Contributions made by employer to, Name of the overseas, ExcessVoluntary contribution to, TOTAL items d to d Remission, Employees income tax borne by, employer YES NO, If tax is fully borne by employer, i If tax is partially borne by, ii If a fixed amount of tax is, and DEDUCTIONS See Explanatory Note with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

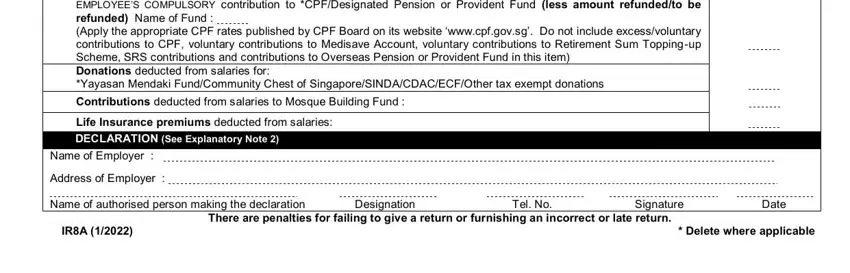

Regarding DEDUCTIONS See Explanatory Note and ii If a fixed amount of tax is, be sure that you don't make any mistakes here. These are the most important fields in this document.

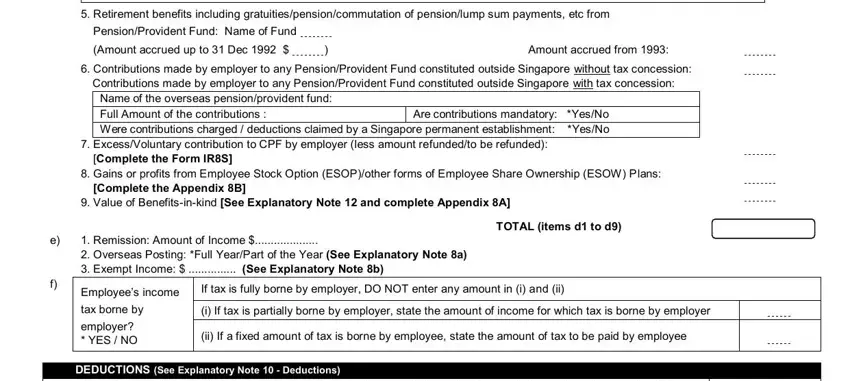

3. This third stage is usually straightforward - fill out all of the form fields in DEDUCTIONS See Explanatory Note, EMPLOYEES COMPULSORY contribution, Contributions deducted from, Life Insurance premiums deducted, DECLARATION See Explanatory Note, Name of Employer, Address of Employer Name of, Signature, Tel No, Designation, Date, IRA, Delete where applicable, and There are penalties for failing to in order to complete this process.

Step 3: Make certain your details are accurate and then click "Done" to complete the task. Go for a free trial account at FormsPal and get direct access to ir8a form - downloadable, emailable, and editable from your FormsPal account page. We don't share or sell any information you provide while completing documents at FormsPal.