You may complete 1095a form to print instantly using our PDF editor online. In order to make our editor better and easier to use, we consistently implement new features, with our users' suggestions in mind. For anyone who is looking to begin, here is what it's going to take:

Step 1: First, open the pdf editor by pressing the "Get Form Button" in the top section of this page.

Step 2: Once you start the PDF editor, you will see the document ready to be filled in. Other than filling in different blank fields, it's also possible to perform other sorts of things with the Document, such as adding your own text, editing the original text, adding images, putting your signature on the form, and much more.

As a way to finalize this PDF form, be sure to type in the necessary details in each blank:

1. Complete the 1095a form to print with a selection of necessary blank fields. Note all of the required information and be sure not a single thing omitted!

2. After filling out the last section, go to the next stage and complete all required particulars in these fields - If you wish you can submit, instructions or publications on, page on IRSgov We cannot respond, volume we receive but we will, we may not be able to consider, and revision of the product.

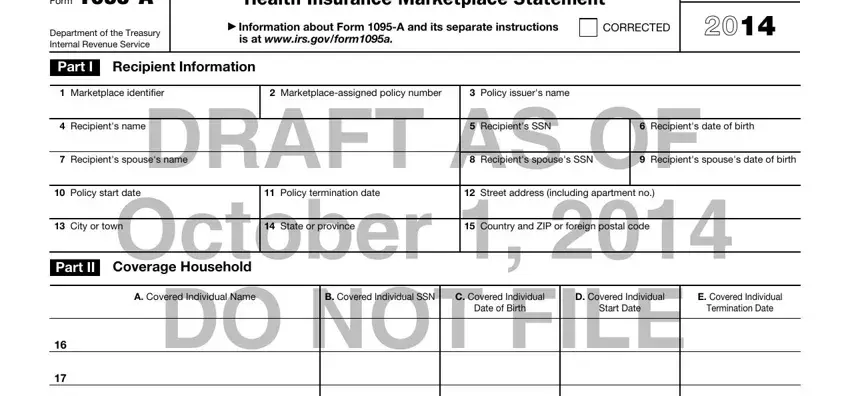

3. The following step is mostly about Form A, Department of the Treasury, Health Insurance Marketplace, Information about Form A and its, CORRECTED, is at wwwirsgovforma, OMB No, Part I Recipient Information, Marketplace identifier, Marketplaceassigned policy number, Policy issuers name, Recipients name, Recipients spouses name, Policy start date, and City or town - complete all of these blanks.

When it comes to Policy issuers name and City or town, ensure you do everything right here. These could be the key ones in the document.

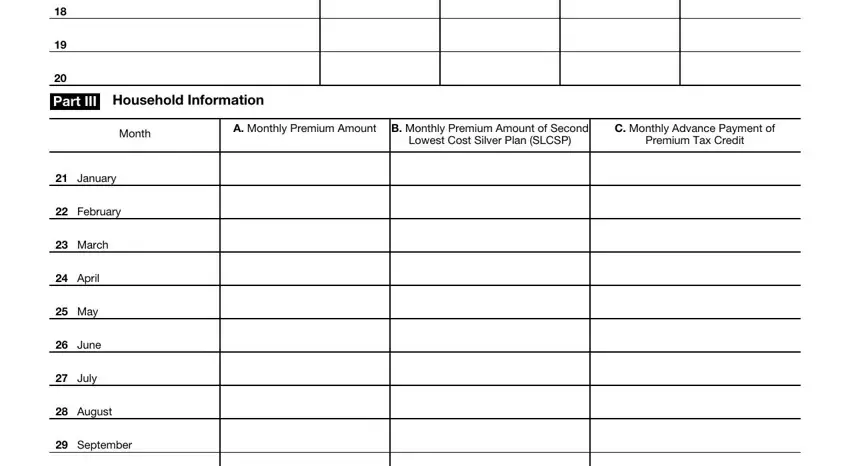

4. You're ready to fill in the next section! In this case you will have all of these Part III Household Information, Month, A Monthly Premium Amount B Monthly, C Monthly Advance Payment of, Lowest Cost Silver Plan SLCSP, Premium Tax Credit, January, February, March, April, May, June, July, August, and September form blanks to fill out.

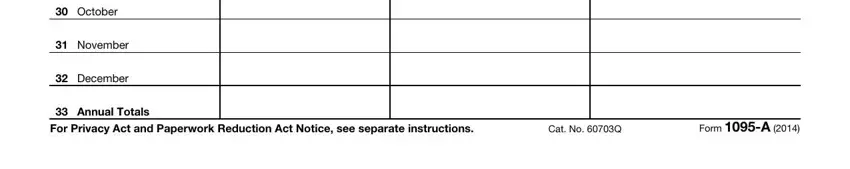

5. The document must be finalized by filling out this area. Below you will see a detailed set of blanks that must be filled in with correct details to allow your document usage to be accomplished: October, November, December, Annual Totals, For Privacy Act and Paperwork, Cat No Q, and Form A.

Step 3: Soon after proofreading your form fields, click "Done" and you're all set! Make a free trial account at FormsPal and get direct access to 1095a form to print - available inside your personal account. FormsPal is focused on the confidentiality of our users; we always make sure that all information entered into our editor stays secure.