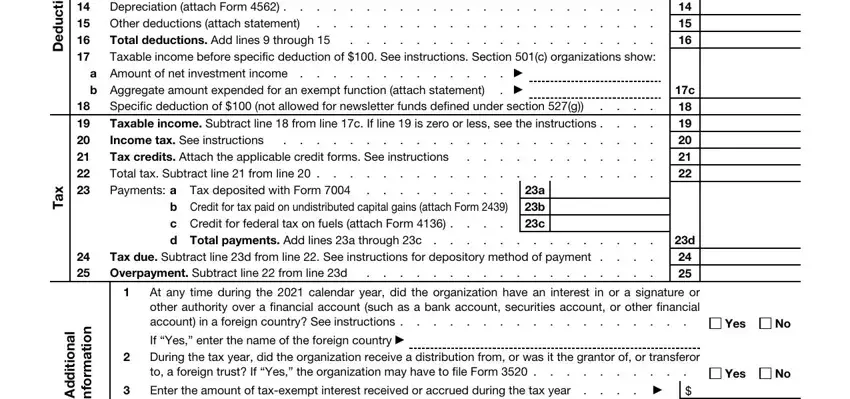

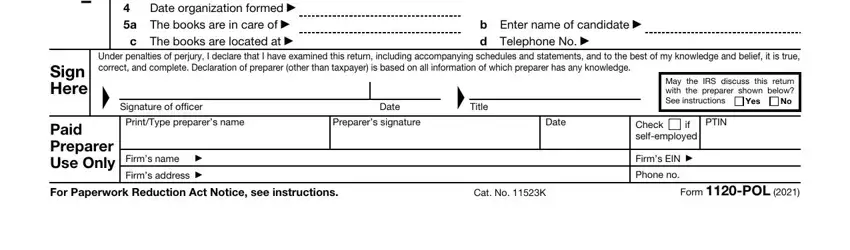

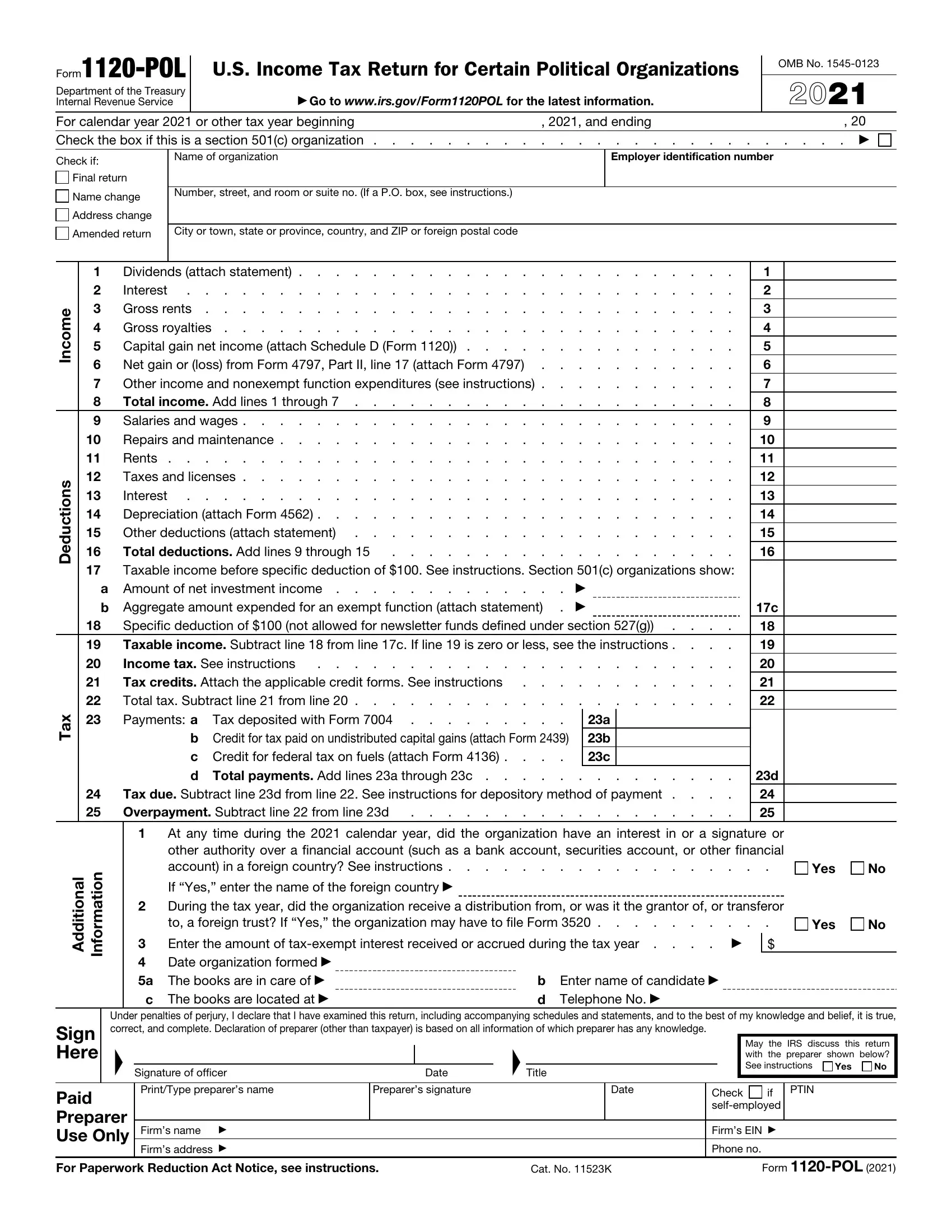

Who Must Sign

The return must be signed and dated by:

•The president, vice president, treasurer, assistant treasurer, chief accounting officer; or

•Any other officer (such as tax officer) authorized to sign.

Receivers, trustees, and assignees must also sign and date any return filed on behalf of an organization.

If an employee of the organization completes Form 1120-POL, the Paid Preparer Use Only area should remain blank. In addition, anyone who prepares Form 1120-POL but doesn’t charge the organization shouldn’t complete that section. Generally, anyone who is paid to prepare the return must sign it and fill in the Paid Preparer Use Only area.

The paid preparer must complete the required preparer information and:

•Sign the return in the space provided for the preparer’s signature, and

•Give a copy of the return to the taxpayer.

Note: A paid preparer may sign original or amended returns by rubber stamp, mechanical device, or computer software program. Also, facsimile signatures are authorized.

Paid Preparer Authorization

If the organization wants to allow the IRS to discuss its 2021 tax return with the paid preparer who signed it, check the “Yes” box in the signature area of the return. This authorization applies only to the individual whose signature appears in the Paid Preparer Use Only section of the return. It doesn’t apply to the firm, if any, shown in that section.

If the “Yes” box is checked, the organization is authorizing the IRS to call the paid preparer to answer any questions that may arise during the processing of its return. The organization is also authorizing the paid preparer to:

•Give the IRS any information that is missing from its return;

•Call the IRS for information about the processing of its return or the status of any refund or payment(s); and

•Respond to certain IRS notices that the organization may have shared with the preparer about math errors, offsets, and return preparation. The notices won’t be sent to the preparer.

The organization isn’t authorizing the paid preparer to receive any refund check, bind the organization to anything (including any additional tax liability), or otherwise represent it before the IRS. If the organization wants to expand the paid preparer’s authorization, see Pub. 947, Practice Before the IRS and Power of Attorney.

However, the authorization will automatically end no later than the due date (excluding extensions) for filing the 2022 tax return. If you want to revoke the authorization before it ends, see Pub. 947.

When and Where To File

In general, an organization must file Form 1120-POL by the 15th day of the 4th month after the end of the tax year.

If the due date falls on a Saturday, Sunday, or legal holiday, the organization may file on the next business day.

File Form 1120-POL with the:

Department of the Treasury Internal Revenue Service Center Ogden, UT 84201

If the organization’s principal business, office, or agency is located in a foreign country or a U.S. possession, the address for mailing their return should be:

Internal Revenue Service Center P.O. Box 409101

Ogden, UT 84409

Private delivery services. Political organizations can use certain private delivery services (PDS) designated by the IRS to meet the “timely mailing as timely filing” rule for tax returns. Go to www.irs.gov/PDS for the current list of designated services.

The PDS can tell you how to get written proof of the mailing date.

For the IRS mailing address to use if you’re using PDS, go to www.irs.gov/ PDSstreetAddresses.

|

|

▲ |

PDS can’t deliver items to P.O. |

! |

boxes. You must use the U.S. |

Postal Service to mail any item |

CAUTION |

to an IRS P.O. box address. |

Extension. File Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns, to request an extension of time to file.

Other Reports and Returns That May Be Required

An organization that files Form 1120-POL may also be required to file the following forms.

1. Form 8871.

Generally, to be tax exempt, a political organization must file this form within 24 hours of the date it is established and within 30 days of any material change in the organization. However, don’t file this form if the organization is:

•An organization that reasonably expects its annual gross receipts to always be less than $25,000,

•A political committee required to report under the Federal Election Campaign Act of 1971 (2 U.S.C. 431 et seq.),

•A political committee of a state or local candidate,

•A state or local committee of a political party, or

•A tax-exempt organization described in section 501(c) that is treated as having political organization taxable income under section 527(f)(1).

2.Form 8872, Political Organization Report of Contributions and Expenditures (periodic reports are required during the calendar year).

Generally, a political organization that files Form 8871 and accepts a contribution or makes an expenditure for an exempt function during the calendar year must file this form. However, this form isn’t required to be filed by an organization excepted from filing Form 8871 (see (1) earlier), or a qualified state or local political organization (QSLPO) (see the Instructions for Form 8871, and Rev. Rul. 2003-49, 2003-20 I.R.B. 903, for the definition of a QSLPO).

3.Form 990, Return of Organization Exempt From Income Tax, or Form

990-EZ, Short Form Return of Organization Exempt From Income Tax.

An exempt political organization must also file one of these forms if its annual gross receipts are $25,000 or more ($100,000 or more for a QSLPO).

The following political organizations aren’t required to file Form 990 or Form 990-EZ.

•Any political organization excepted from the requirement to file Form 8871.

•Any caucus or association of state or local officials.

See the instructions for Form 990 or Form 990-EZ.

4.Form 8997, Initial and Annual Statement of Qualified Opportunity Fund (QOF) Investments.

Use Form 8997 to identify qualified investments held in a qualified opportunity fund at any time during the year. If you held a qualified investment in a qualified opportunity fund at any time during the year, you must file your Form 1120-POL with Form 8997 attached. See the instructions for Form 8997.

5.Form 8992, U.S. Shareholder Calculation of Global Intangible Low-Taxed Income (GILTI).

Use Form 8992 to figure the domestic corporation’s GILTI and attach it to Form 1120-POL. See section 951A for more information.

Accounting Methods

Figure taxable income using the method of accounting regularly used in keeping the organization’s books and records. Generally, permissible methods include:

•Cash,

•Accrual, or

•Any other method authorized by the Internal Revenue Code.

In all cases, the method used must clearly show taxable income.

Change in accounting method. Generally, the organization may only change the method of accounting used to report taxable income (for income as a whole or for any material item) by getting consent on Form 3115, Application for Change in Accounting Method. For more information, see Pub. 538, Accounting Periods and Methods.