Handling PDF documents online is always very simple with our PDF tool. Anyone can fill in documentation internal revenue form here and use a number of other functions we offer. Our professional team is continuously working to develop the tool and ensure it is even faster for users with its extensive functions. Make use of present-day progressive possibilities, and discover a heap of emerging experiences! To get started on your journey, take these basic steps:

Step 1: Simply press the "Get Form Button" above on this webpage to open our form editing tool. This way, you will find everything that is needed to fill out your file.

Step 2: As soon as you access the file editor, you will find the form made ready to be filled in. Aside from filling out different blank fields, you can also perform several other actions with the file, particularly putting on custom words, modifying the original textual content, adding illustrations or photos, placing your signature to the document, and more.

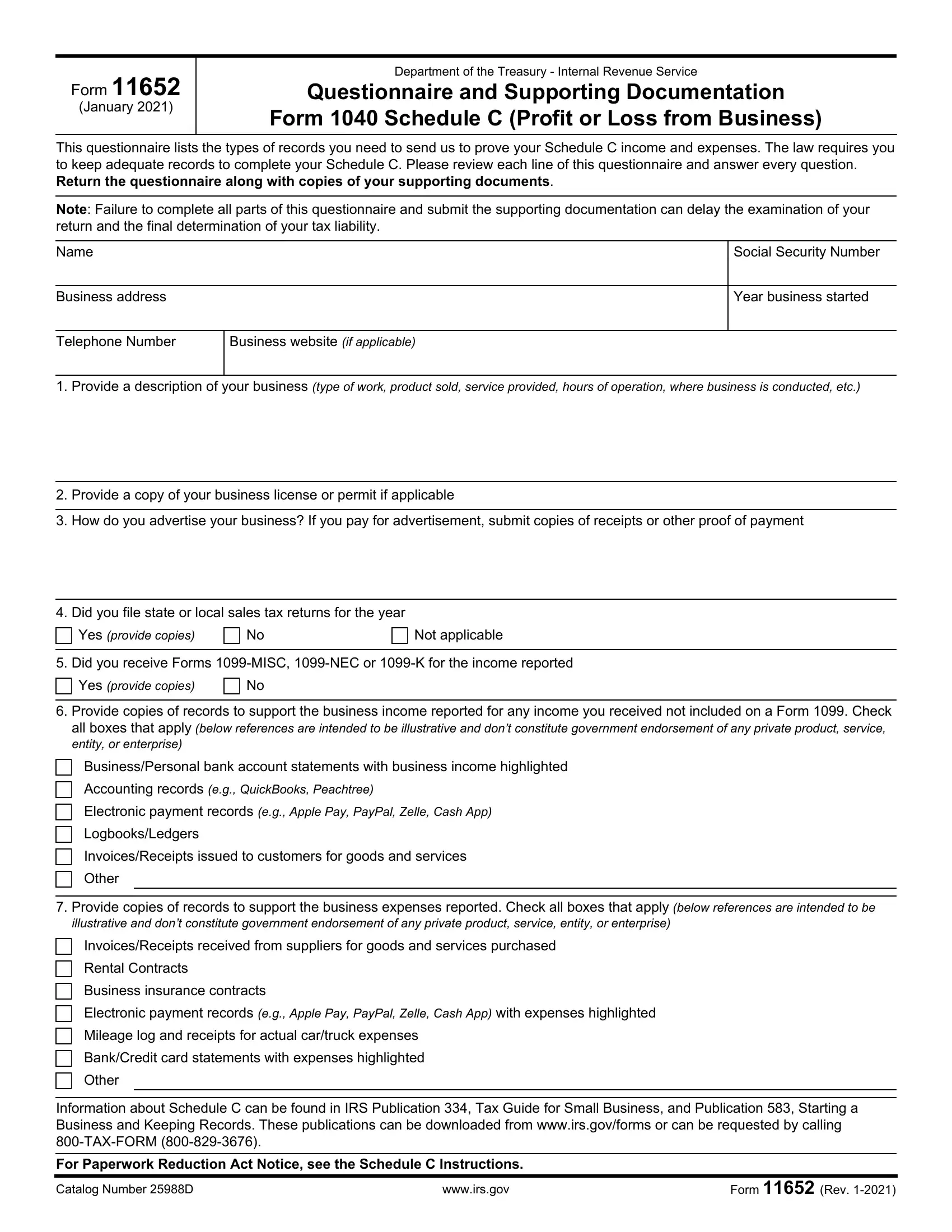

In order to finalize this PDF form, be sure you provide the right details in each blank field:

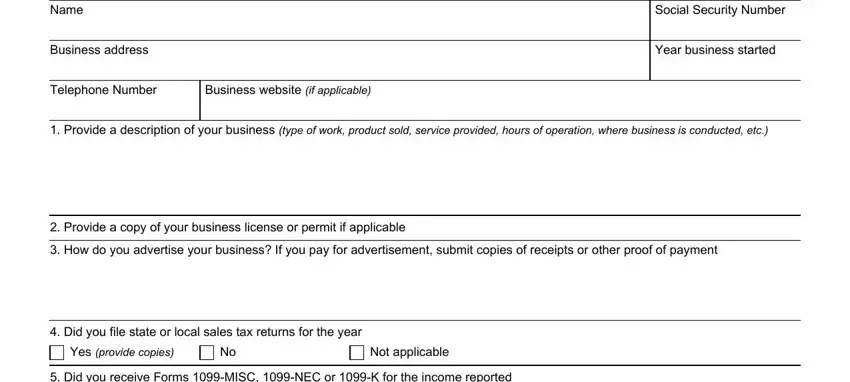

1. When filling in the documentation internal revenue form, be sure to incorporate all of the important blank fields in the relevant form section. It will help facilitate the work, allowing for your information to be handled fast and appropriately.

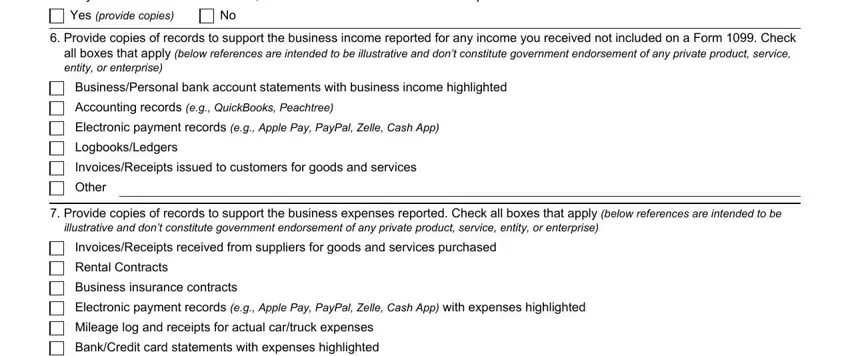

2. Once your current task is complete, take the next step – fill out all of these fields - Did you receive Forms MISC NEC or, Yes provide copies, Provide copies of records to, BusinessPersonal bank account, Accounting records eg QuickBooks, Electronic payment records eg, LogbooksLedgers, InvoicesReceipts issued to, Other, Provide copies of records to, illustrative and dont constitute, InvoicesReceipts received from, Rental Contracts, Business insurance contracts, and Electronic payment records eg with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

3. The following segment is relatively simple, Other, Information about Schedule C can, For Paperwork Reduction Act Notice, Catalog Number D, wwwirsgov, and Form Rev - all of these fields will have to be filled in here.

People generally make mistakes while filling in Other in this part. Be sure to read again what you enter here.

Step 3: After you have looked once more at the details provided, just click "Done" to complete your form. Get hold of your documentation internal revenue form the instant you register online for a 7-day free trial. Immediately access the pdf form inside your FormsPal cabinet, together with any modifications and adjustments being all kept! Whenever you work with FormsPal, you can complete forms without being concerned about personal information leaks or records being distributed. Our secure software ensures that your private information is stored safely.