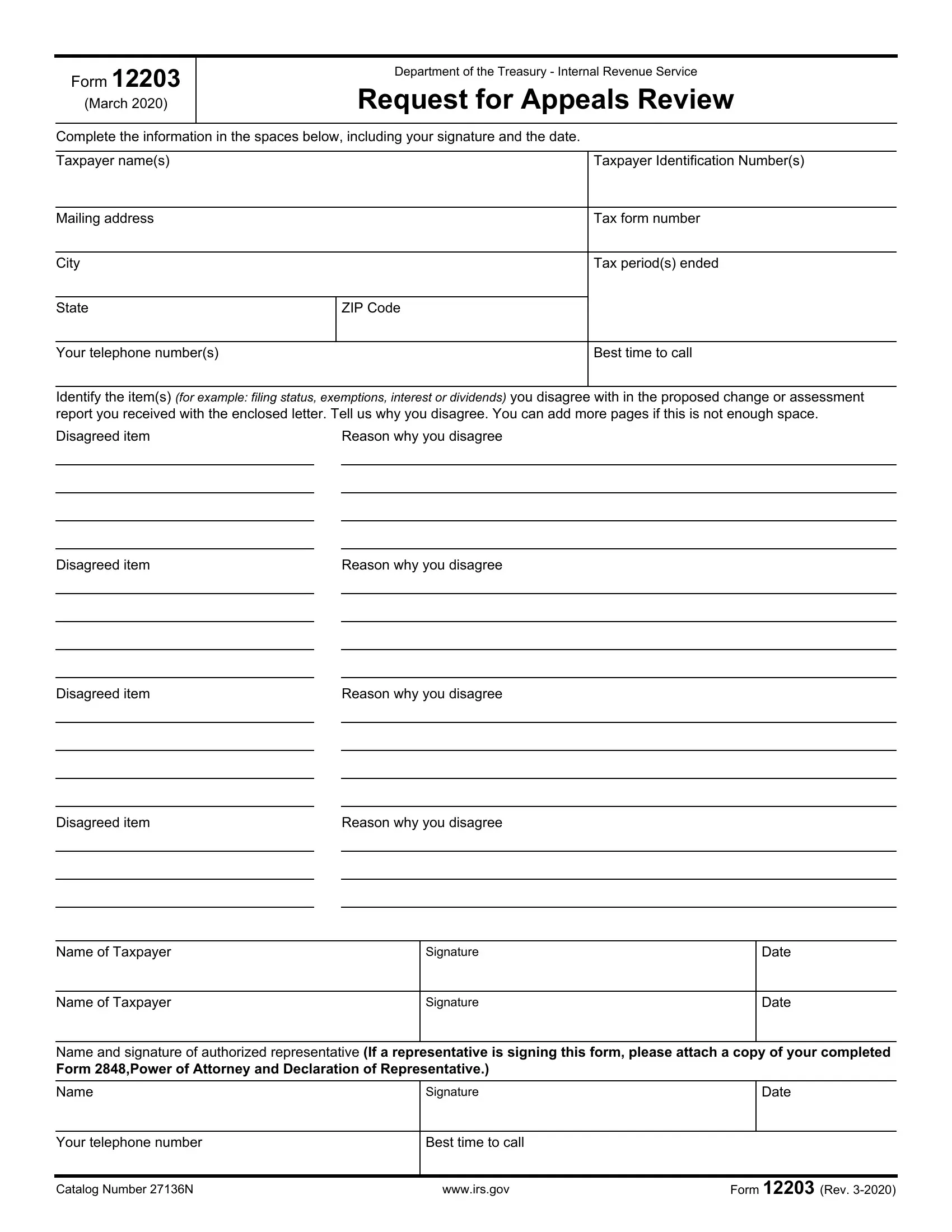

Department of the Treasury - Internal Revenue Service

Request for Appeals Review

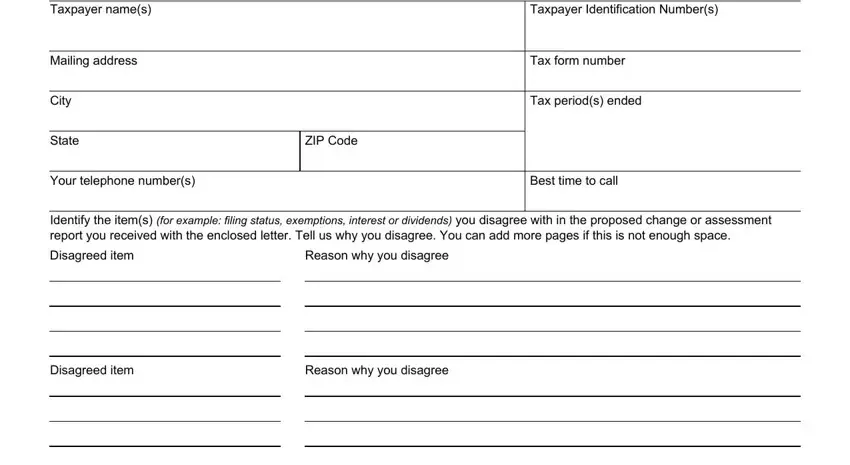

Complete the information in the spaces below, including your signature and the date.

Taxpayer name(s) |

Taxpayer Identification Number(s) |

Identify the item(s) (for example: filing status, exemptions, interest or dividends) you disagree with in the proposed change or assessment report you received with the enclosed letter. Tell us why you disagree. You can add more pages if this is not enough space.

Disagreed item |

|

Reason why you disagree |

|

|

|

|

|

|

|

|

|

|

|

|

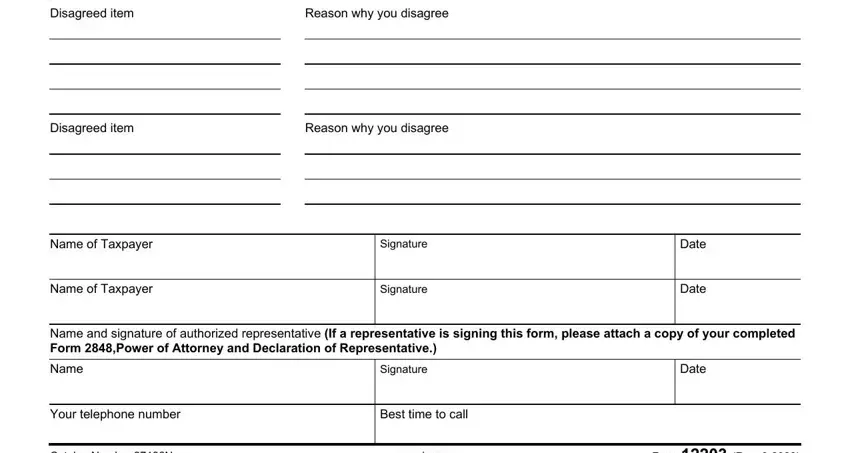

Disagreed item

Disagreed item

Disagreed item

Reason why you disagree

Reason why you disagree

Reason why you disagree

Name of Taxpayer |

Signature |

Date |

|

|

|

Name of Taxpayer |

Signature |

Date |

|

|

|

Name and signature of authorized representative (If a representative is signing this form, please attach a copy of your completed

Form 2848,Power of Attorney and Declaration of Representative.)

Name |

Signature |

Date |

|

|

|

Your telephone number |

Best time to call |

|

|

|

|

Catalog Number 27136N |

www.irs.gov |

Form 12203 (Rev. 3-2020) |

Purpose of this form: You can use this form to request a review in the Internal Revenue Service Independent Office of Appeals when you receive Internal Revenue Service (IRS) proposed adjustments or other changes of $25,000 or less to a tax year questioned in the IRS letter you received with this form.

When you take no action and your case involves income taxes, we will send you a formal Notice of Deficiency and bill for the amount you owe. The Notice of Deficiency allows you to go to the Tax Court and tells you the procedure to follow.

When you don't agree with the IRS proposed adjustments or changes and you have submitted all supporting information, explanations, or documents, you may:

(1)discuss the IRS findings with the person identified (or their supervisor) in the heading on the IRS letter that provided you this information; and if you can't reach agreement,

(2)appeal your case by requesting an Appeals Review.

If you want to request an Appeals Review, complete this form and return it in the envelope provided to the address in the heading of the IRS letter.

The IRS Independent Office of Appeals is independent of the IRS office proposing the action you disagree with. Appeals conferences are conducted in an informal manner. Most differences are settled in these conferences without expensive and time consuming court trials. Appeals will independently consider the reason(s) you disagree, except for moral, religious, political, constitutional, conscientious objection, or similar grounds.

You can represent yourself in Appeals. If you want to be represented by another person, the person you choose must be an attorney, a certified public accountant, or an enrolled agent authorized to practice before the IRS. If you plan to have your representative talk to us without you, we need a signed copy of a completed power of attorney (Form 2848, Power of Attorney and Declaration of Representative).

If you don't reach an agreement in Appeals, the Appeals office will send you a Notice of Deficiency. After you receive the Notice of Deficiency, you may take your case to the United States Tax Court before paying the amount due as shown on the Notice of Deficiency. If you want to proceed in the United States Court of Federal Claims or your United States District Court, see Publication 5, Your Appeal Rights and How to Prepare a Protest if You Disagree, for more information.

You can get more information about your appeal rights by visiting the IRS Internet Web Site at http://www.irs.gov or the Appeals Web Site at http://www.irs.gov/appeals. You also can order blank tax forms, schedules, instructions and publications by calling toll-free

1-800-829-3676. Once you've placed your order, allow two weeks for delivery. For IRS Tax Fax Services, call (703) 487-4160 (not a toll- free number).

PRIVACY ACT STATEMENT

Under the Privacy Act of 1974, we must tell you that our legal right to ask for information is Internal Revenue Code Sections 6001, 6011, 6012(a) and their regulations. They say that you must furnish us with records or statements for any tax for which you are liable, including the withholding of taxes by your employer. We ask for information to carry out the Internal Revenue laws of the United States, and you are required to give us this information. We may give the

information to the Department of Justice for civil and criminal litigation, other federal agencies, states, cities, and the District of Columbia for use in administering their tax laws. If you don't provide this information, or provide fraudulent information, the law provides that you may be charged penalties and, in certain cases, you

may be subject to criminal prosecution. We may also have to disallow the exemptions, exclusions, credits, deductions, or adjustments shown on the tax return. This could make your tax higher or delay any refund. Interest may also be charged.

Catalog Number 27136N |

www.irs.gov |

Form 12203 (Rev. 3-2020) |