Instead of filing Form 8453-EO, an organization officer or person subject to tax filing an exempt organization’s return through an

TIP electronic return originator (ERO) can sign the return using a personal identification number (PIN). For details, see Form 8879-EO, IRS e-file Signature Authorization for an Exempt Organization.

Future Developments

For the latest information about developments related to Form 8453-EO and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form8453EO.

Purpose of Form

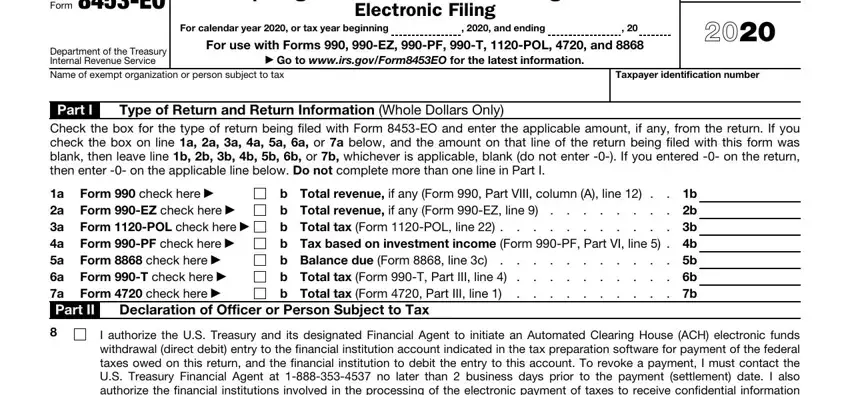

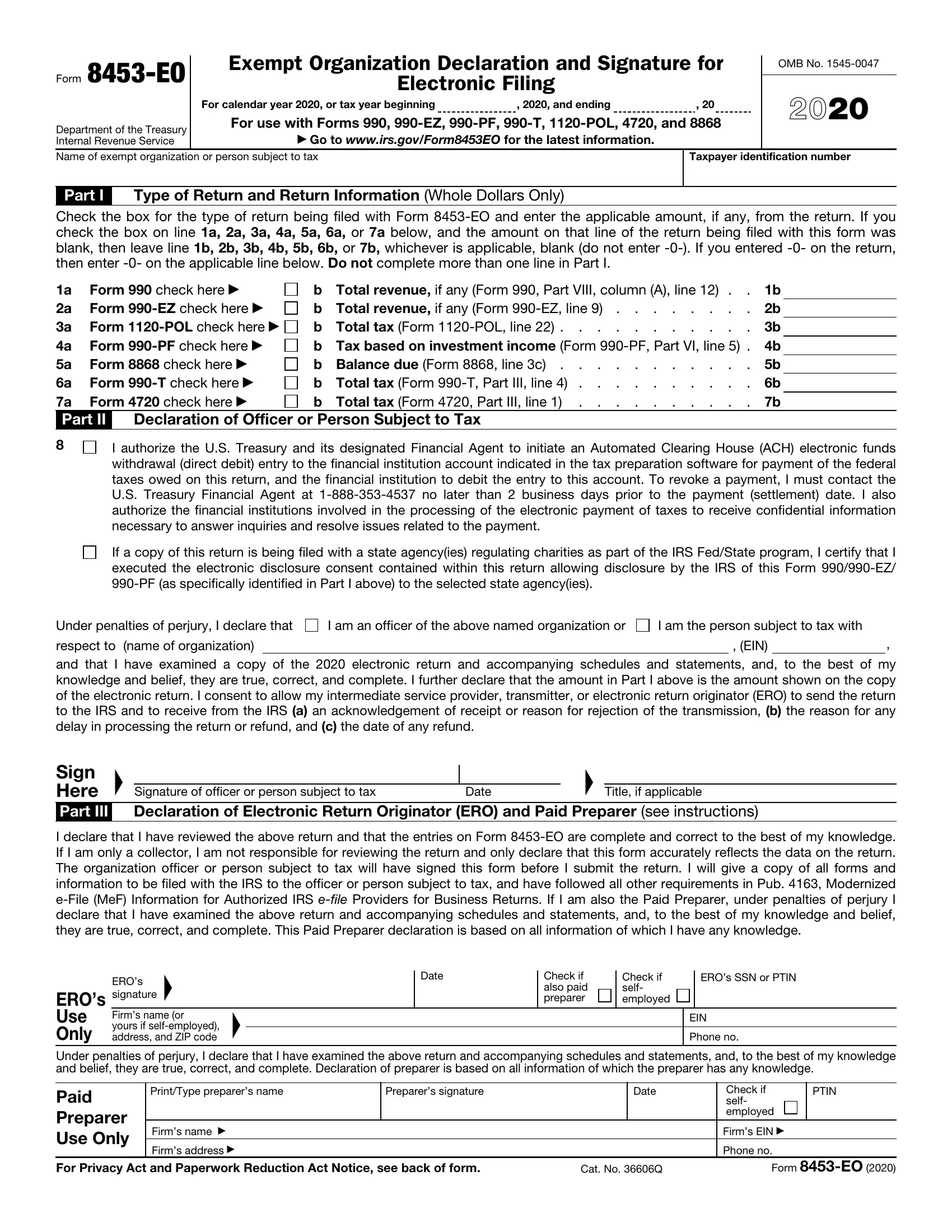

Use Form 8453-EO to:

•Authenticate the electronic Form 990, Return of Organization Exempt From Income Tax; Form 990-EZ, Short Form Return of Organization Exempt From Income Tax; Form 990-PF, Return of Private Foundation; Form 990-T, Exempt Organization Business Income Tax Return; Form 1120-POL, U.S. Income Tax Return for Certain Political Organizations; Form 4720, Return of Certain Excise Taxes Under Chapters 41 and 42 of the Internal Revenue Code; or Form 8868, Application for Automatic Extension of Time To File an Exempt Organization Return;

•Authorize the ERO, if any, to transmit via a third-party transmitter;

•Authorize the intermediate service provider (ISP) to transmit via a third- party transmitter if you’re filing online (not using an ERO); and

•Authorize an electronic funds withdrawal for payment of federal taxes owed (Form 990-PF, Form 990-T, Form 1120-POL, Form 4720, or Form 8868 with payment).

Who Must File

If you’re filing a 2020 Form 990, Form 990-EZ, Form 990-PF, Form 990-T, Form 1120-POL, Form 4720, or Form 8868 with payment through an ISP and/or transmitter and you’re not using an ERO, you must file Form 8453-EO with your electronically filed return. An ERO can use either Form 8453-EO or Form 8879-EO to obtain authorization to file a Form 990, Form 990-EZ, Form 990-PF, Form 990-T, Form 4720, Form 1120-POL, or to file a Form 8868 with payment.

When To File

Form 990, Form 990-EZ, Form 990-PF, or Form 990-T. File Form 990, Form 990-EZ, or Form 990-PF by the 15th day of the 5th month after the organization’s accounting period ends. For information on when to file Form 990-T, see the Instructions for Form 990-T. If the regular due date falls on a Saturday, Sunday, or legal holiday, the organization may file on the next business day. The Form 8453-EO must be filed with the electronically filed Form 990, Form 990-EZ, Form 990-PF, or Form 990-T.

Form 1120-POL. File Form 1120-POL by the 15th day of the 4th month after the organization’s accounting period ends. If the regular due date falls on a Saturday, Sunday, or legal holiday, the organization may file on the next business day. The Form 8453-EO must be filed with the electronically filed Form 1120-POL.

Form 4720. Generally, file Form 4720 by the due date of the organization’s Form 990, 990-EZ, 990-PF, 990-T, or Form 5227, Split Interest Trust Information Return. If none of these forms is required, file Form 4720 by the

15th day of the 5th month after the end of the tax year. The Form 8453-EO must be filed with the electronically filed Form 4720.

Form 8868. Generally, file Form 8868 by the due date of the return for which you’re requesting an extension. The Form 8453-EO must be filed with the electronically filed Form 8868.

How To File

File Form 8453-EO with the electronically filed return. Use a scanner to create a PDF file of the completed form. Your tax preparation software will allow you to transmit this PDF file with the return.

Part II. Declaration of Officer or Person Subject to Tax

If a Form 990-PF, Form 990-T, Form 1120-POL, Form 4720, or Form 8868 filer chooses to pay the tax due by electronic funds withdrawal (direct debit), check the box. Otherwise, leave the box blank.

If the officer or person subject to tax checks the box when filing Form 990-PF, Form 990-T, Form 1120-POL, Form 4720, or Form 8868 with payment, that person must ensure that the following information relating to the financial institution account is provided in the tax preparation software.

•Routing number,

•Account number,

•Type of account (checking or savings),

•Debit amount, and

•Debit date (date the organization or person subject to tax wants the debit to occur).

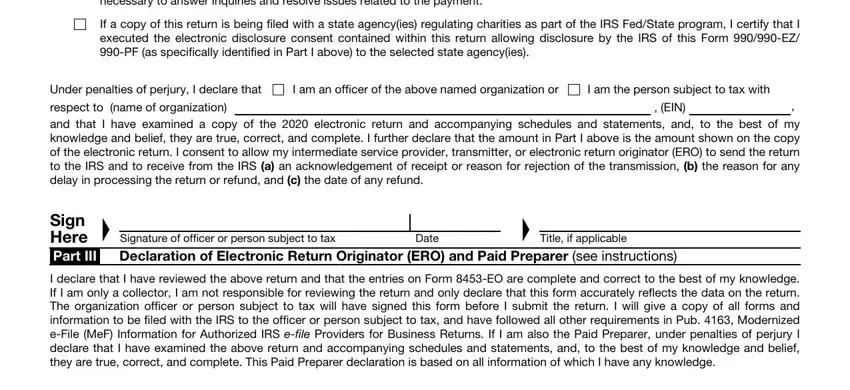

In the third paragraph, check the appropriate box to declare whether you are an officer or person subject to tax (and enter the name of the organization and employer identification number (EIN)).

An electronically transmitted return will not be considered complete (and therefore not considered filed) unless either:

•Form 8453-EO is signed by an officer or person subject to tax, scanned into a PDF file, and transmitted with the return; or

•The return is filed through an ERO and Form 8879-EO is used to select a PIN that is used to electronically sign the return.

The signature of the officer or person subject to tax allows the IRS to disclose to the ISP, ERO, and/or transmitter:

•An acknowledgment that the IRS has accepted the electronically filed return, and

•The reason(s) for a delay in processing the return or refund.

The declaration of officer or person subject to tax must be signed and dated by:

•The president, vice president, treasurer, assistant treasurer, chief accounting officer; or

•Any other officer or person subject to tax authorized to sign the return.

If this return contains instructions to the IRS to provide a copy(ies) of the return to a state agency(ies) regulating charities as part of the IRS Fed/State program, the checkbox in Part II must be checked.

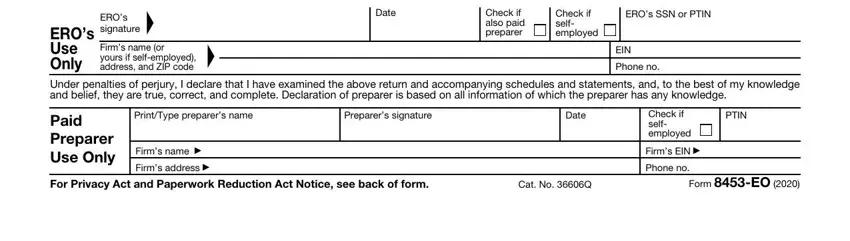

Part III. Declaration of Electronic Return Originator (ERO) and Paid Preparer

Note: If the return is filed online through an ISP and/or transmitter (not using an ERO), don’t complete the ERO’s Use Only section in Part III.

If the return is filed through an ERO, the IRS requires the ERO’s signature. A paid preparer, if any, must sign Form 8453-EO in the space for Paid Preparer Use Only. But if the paid preparer is also the ERO, don’t complete the paid preparer’s section. Instead, check the box labeled Check if also paid preparer.

An ERO may sign the Form 8453-EO by rubber stamp, mechanical device, or computer software program. The alternative method of signing must include either a facsimile of the individual ERO’s signature or of the ERO’s printed name.

Use of PTIN

Paid preparers. Anyone who is paid to prepare the organization’s return must enter their PTIN in Part III. The PTIN entered must have been issued after September 27, 2010. For information on applying for and receiving a PTIN, see Form W-12, IRS Paid Preparer Tax Identification Number (PTIN) Application and Renewal, or visit www.irs.gov/PTIN.

EROs who aren’t paid preparers. Only EROs who aren’t also the paid preparer of the return have the option to enter their PTIN or their social security number in the ERO’s Use Only section of Part III. If the PTIN is entered, it must have been issued after September 27, 2010. For information on applying for and receiving a PTIN, see Form W-12, or visit www.irs.gov/PTIN.

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. You’re required to give us the information. We need it to ensure that you’re complying with these laws and to allow us to figure and collect the right amount of tax.

You’re not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Internal Revenue Code section 6103. However, certain returns and return information of tax exempt organizations and trusts are subject to public disclosure and inspection, as provided by section 6104.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated burden for tax exempt organizations filing this form is approved under OMB control number 1545-0047 and is included in the estimates shown in the instructions for their information return.