You could work with irs form 851 pdf instantly with our PDF editor online. FormsPal team is constantly endeavoring to enhance the editor and insure that it is even better for people with its multiple functions. Uncover an constantly progressive experience now - check out and discover new possibilities along the way! To get the process started, consider these easy steps:

Step 1: Click on the orange "Get Form" button above. It'll open up our tool so that you can start filling out your form.

Step 2: As you start the PDF editor, you will get the form all set to be completed. In addition to filling out different blank fields, you may as well perform several other actions with the PDF, such as writing custom words, editing the initial text, adding graphics, signing the document, and more.

This PDF will require particular data to be entered, thus make sure to take your time to enter precisely what is required:

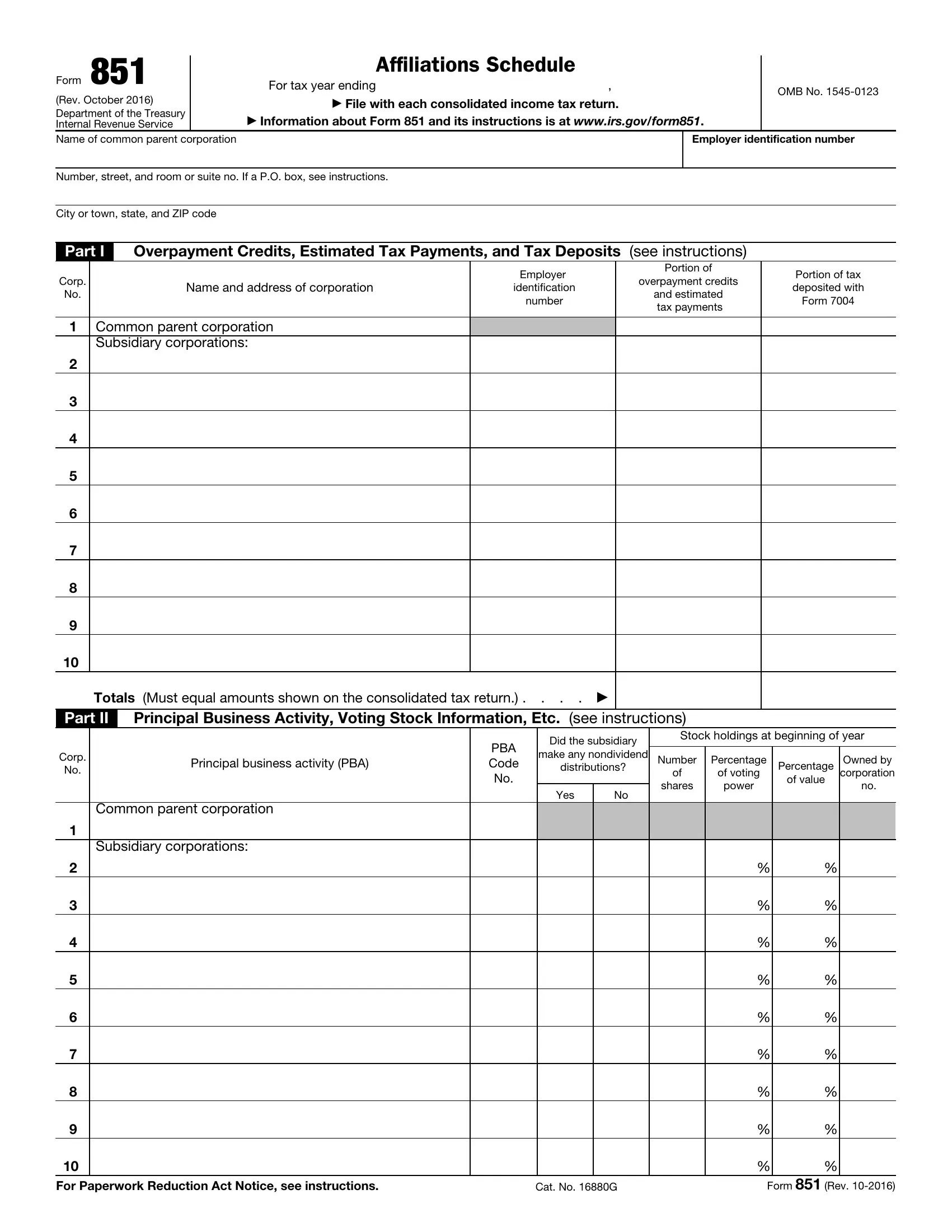

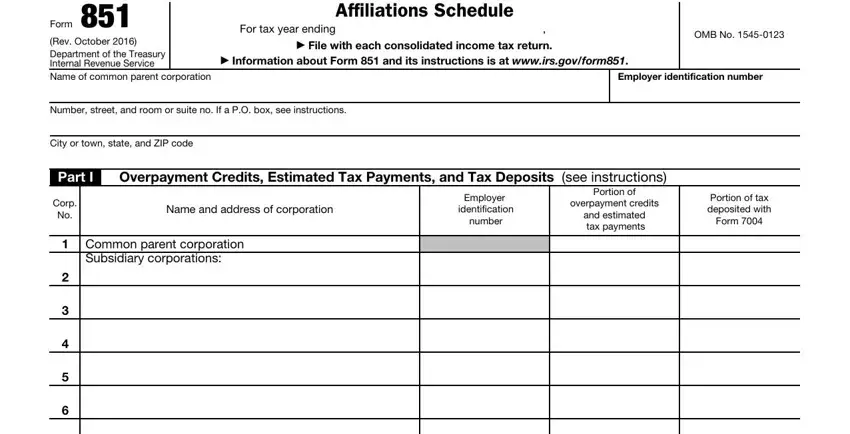

1. First, while completing the irs form 851 pdf, beging with the section that features the subsequent blank fields:

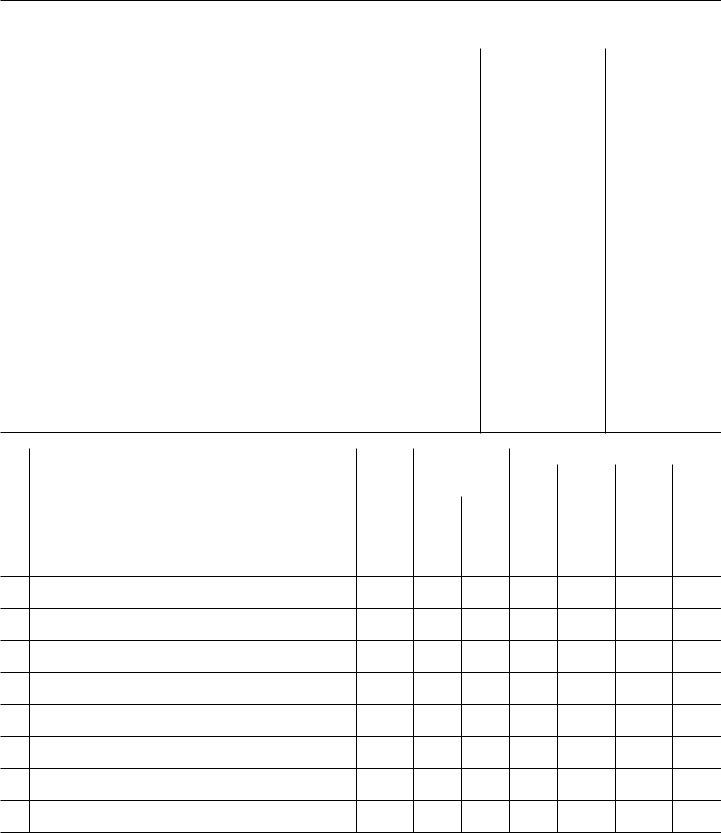

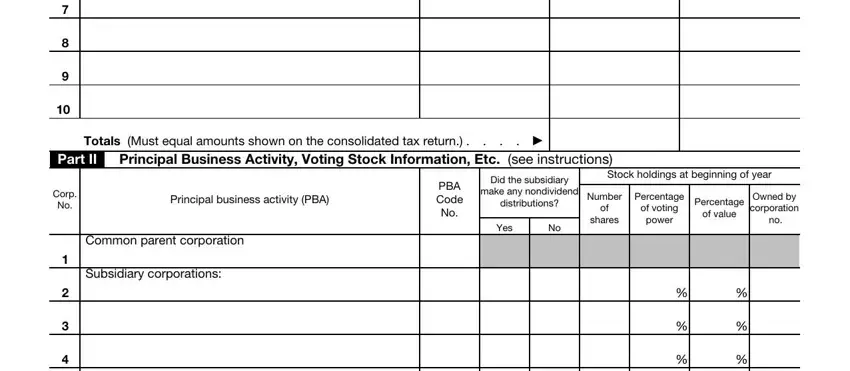

2. Soon after this section is done, go to enter the suitable information in all these - Totals Must equal amounts shown on, Part II Principal Business, Principal business activity PBA, Common parent corporation, Subsidiary corporations, Did the subsidiary, make any nondividend, distributions, PBA Code No, Yes, Stock holdings at beginning of year, Number, Percentage, shares, and of voting power.

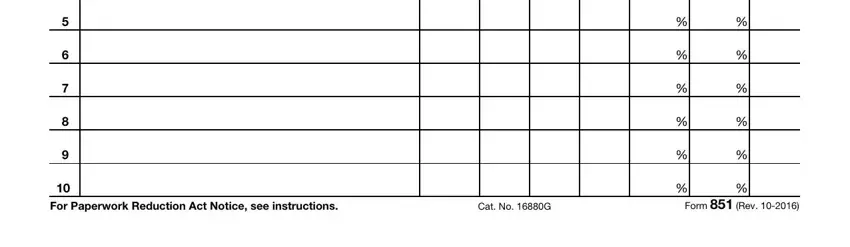

3. Within this step, take a look at For Paperwork Reduction Act Notice, Cat No G, and Form Rev. Every one of these should be taken care of with greatest attention to detail.

It is easy to make a mistake while completing your Cat No G, therefore make sure you reread it prior to when you finalize the form.

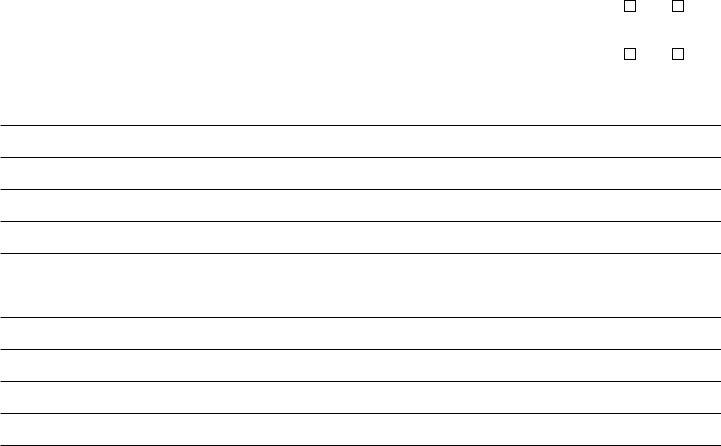

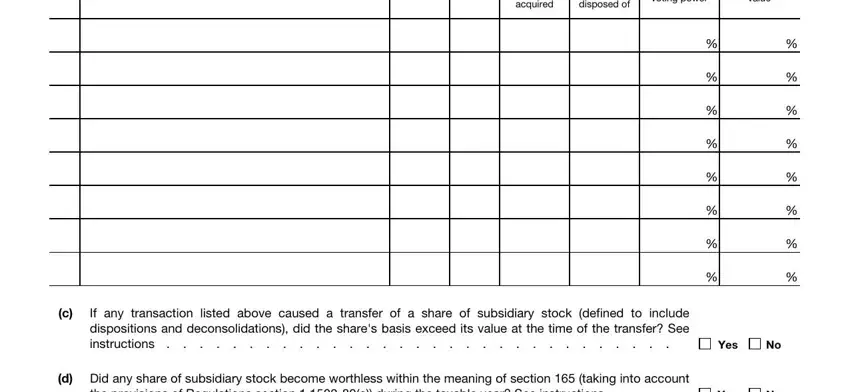

4. The next paragraph will require your involvement in the following areas: shares acquired, disposed of, Percentage of voting power, value, Yes, If any transaction listed above, d Did any share of subsidiary, the provisions of Regulations, and Yes. Remember to enter all required info to move further.

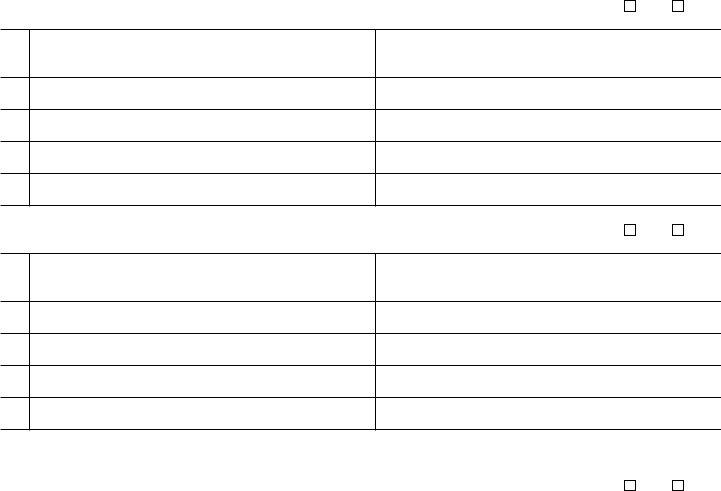

5. To conclude your document, this particular part includes several extra fields. Entering If the equitable owners of any, If additional stock was issued or, and Form Rev will conclude everything and you'll surely be done in an instant!

Step 3: Go through all the information you have inserted in the blanks and then click on the "Done" button. Create a free trial subscription at FormsPal and obtain immediate access to irs form 851 pdf - download, email, or change in your FormsPal account. FormsPal guarantees safe form completion devoid of personal information record-keeping or sharing. Feel at ease knowing that your data is safe here!