form 8802 can be filled in online without any problem. Simply try FormsPal PDF editing tool to complete the task quickly. Our editor is consistently developing to present the best user experience possible, and that is because of our resolve for constant enhancement and listening closely to feedback from customers. To start your journey, take these easy steps:

Step 1: First, open the pdf tool by pressing the "Get Form Button" at the top of this site.

Step 2: When you launch the editor, you'll notice the document made ready to be filled out. Besides filling out different fields, you could also do various other things with the file, specifically adding your own text, editing the original text, adding illustrations or photos, putting your signature on the form, and much more.

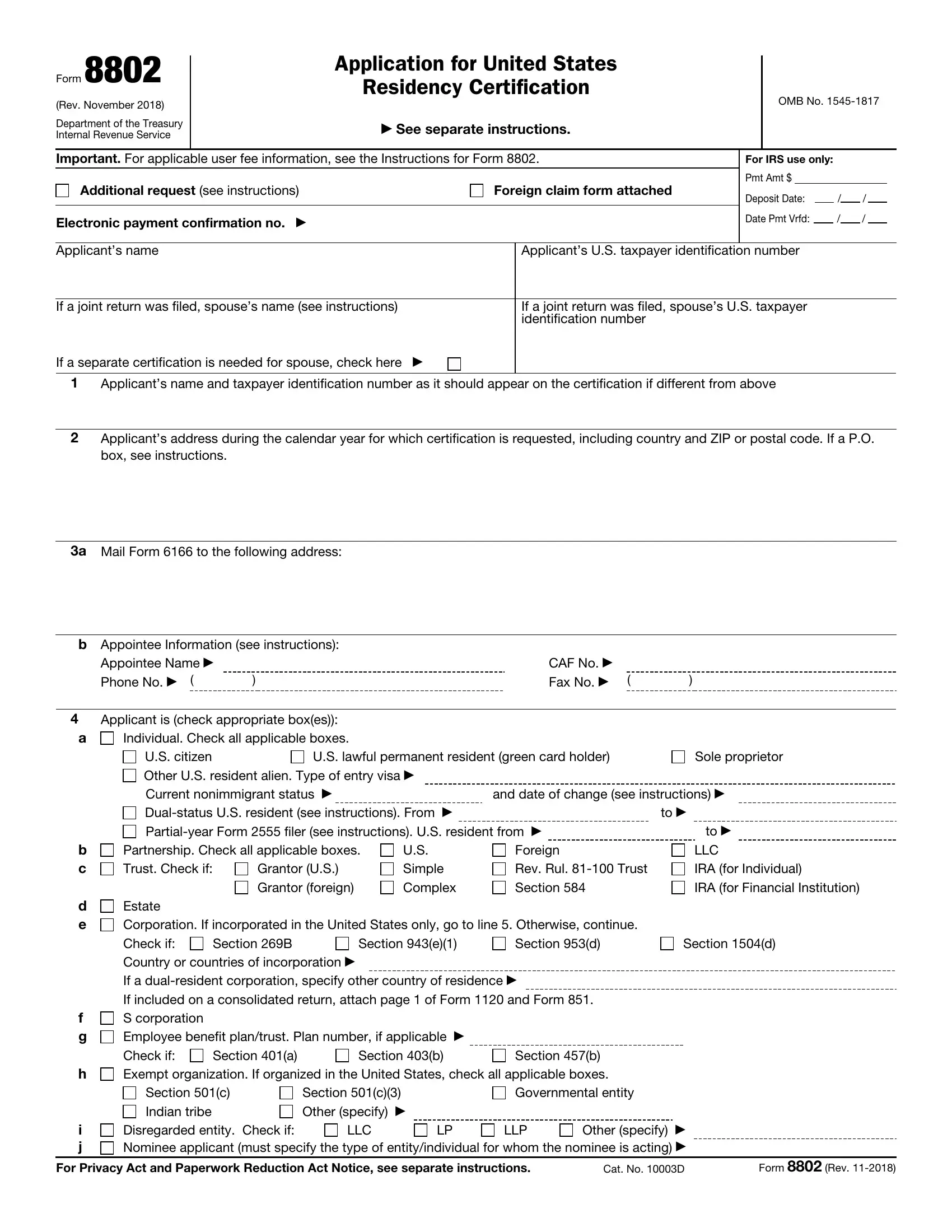

If you want to finalize this form, make certain you type in the information you need in each and every area:

1. The form 8802 necessitates certain details to be entered. Be sure the subsequent blanks are filled out:

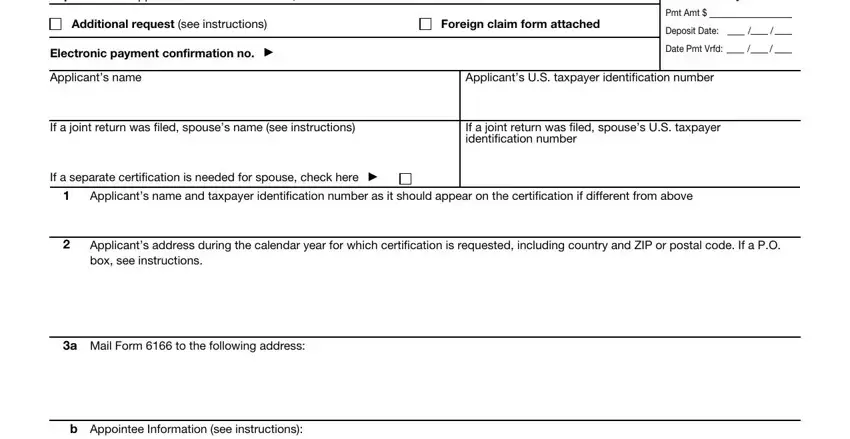

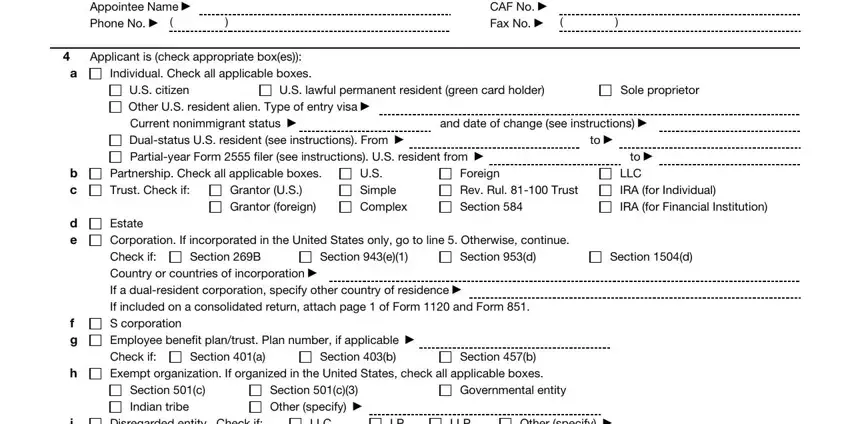

2. Once your current task is complete, take the next step – fill out all of these fields - Appointee Name Phone No, Applicant is check appropriate, Individual Check all applicable, CAF No Fax No, US lawful permanent resident green, Sole proprietor, US citizen Other US resident alien, and date of change see, b c, d e, f g, i j, Partnership Check all applicable, Grantor US Grantor foreign, and US Simple Complex with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

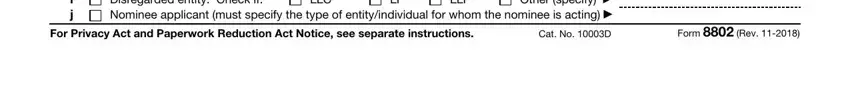

3. The following segment is related to i j, Other specify Disregarded entity, LLC, LLP, For Privacy Act and Paperwork, Cat No D, and Form Rev - complete all of these fields.

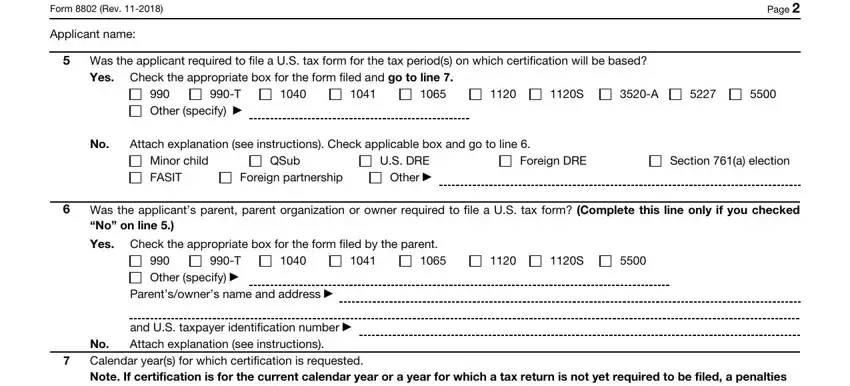

4. Completing Form Rev, Applicant name, Page, Was the applicant required to, Yes Check the appropriate box for, T Other specify, Attach explanation see, Minor child FASIT, QSub, Foreign partnership, US DRE Other, Foreign DRE, Section a election, Was the applicants parent parent, and No on line is vital in the fourth section - don't forget to be patient and be attentive with each blank!

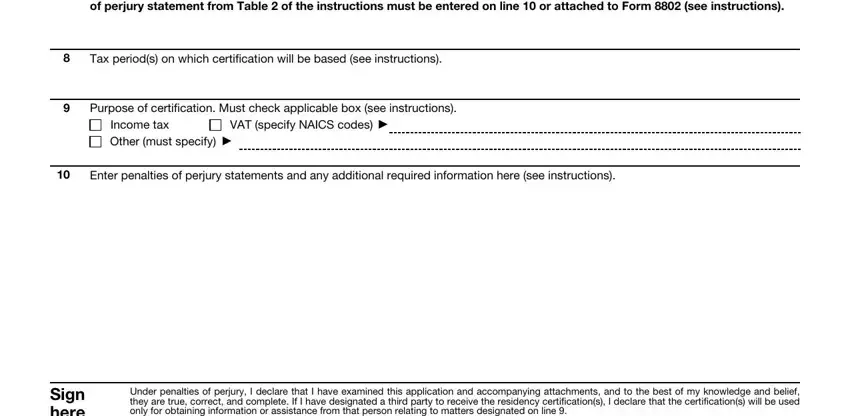

5. When you near the finalization of the document, you'll find just a few more requirements that must be fulfilled. Mainly, No Calendar years for which, Tax periods on which certification, Purpose of certification Must, Income tax Other must specify, VAT specify NAICS codes, Enter penalties of perjury, Sign here, and Under penalties of perjury I must all be filled out.

People frequently get some things wrong while filling in Income tax Other must specify in this area. You need to read again what you enter here.

Step 3: Right after rereading the completed blanks, click "Done" and you're done and dusted! Try a free trial option at FormsPal and get direct access to form 8802 - with all adjustments kept and available in your personal cabinet. When using FormsPal, you can certainly fill out forms without the need to be concerned about personal information incidents or entries getting distributed. Our protected platform helps to ensure that your private data is stored safe.