form 8823 can be filled out with ease. Simply open FormsPal PDF editor to perform the job without delay. The editor is consistently maintained by our team, getting useful functions and becoming greater. This is what you would want to do to get started:

Step 1: Click on the orange "Get Form" button above. It'll open our tool so that you could begin completing your form.

Step 2: This tool lets you change PDF documents in a range of ways. Modify it by including any text, correct existing content, and put in a signature - all within several mouse clicks!

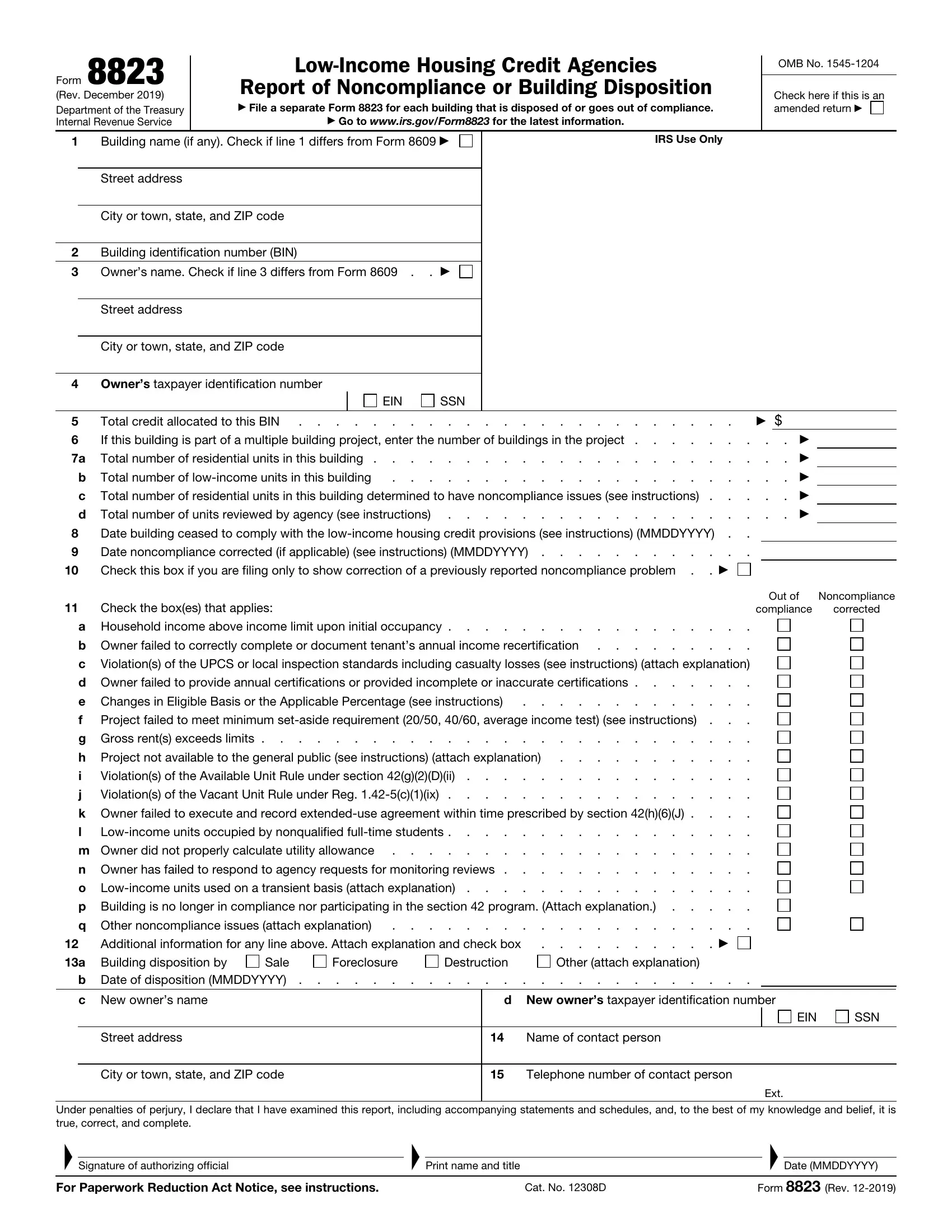

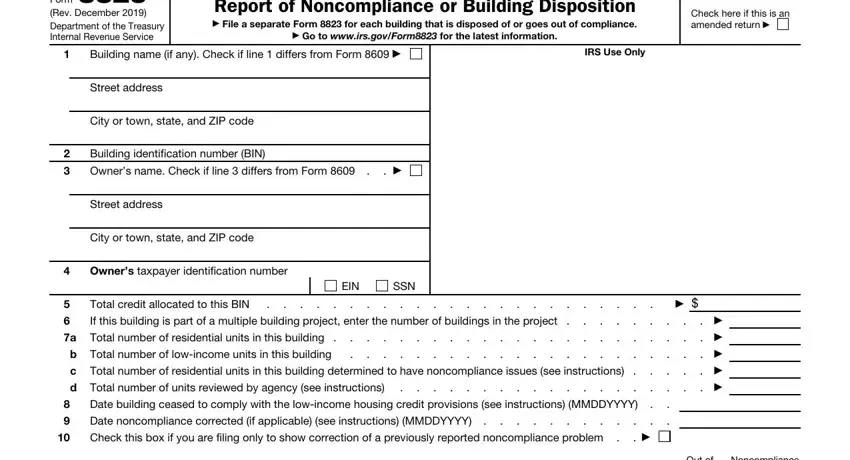

With regards to the blanks of this precise document, this is what you should do:

1. Begin completing your form 8823 with a selection of essential blanks. Get all of the required information and be sure nothing is missed!

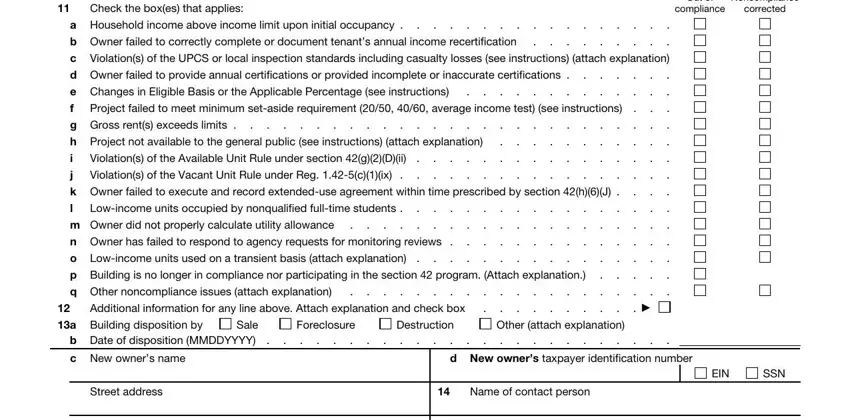

2. Your next stage would be to complete the next few blanks: Check the boxes that applies, Out of, Noncompliance, compliance, corrected, a Household income above income, m Owner did not properly, Additional information for any, Violations of the Available Unit, Lowincome units occupied by, a Building disposition by, Sale b Date of disposition MMDDYYYY, c New owners name, Foreclosure, and Destruction.

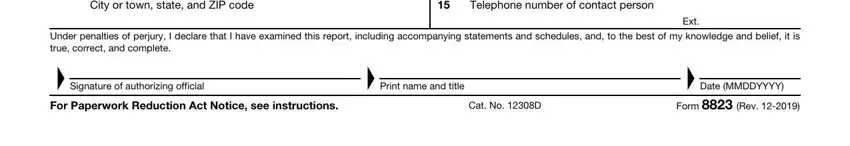

3. In this step, review City or town state and ZIP code, Telephone number of contact person, Ext, Under penalties of perjury I, Signature of authorizing official, Print name and title, For Paperwork Reduction Act Notice, Cat No D, Date MMDDYYYY, and Form Rev. All these will have to be completed with greatest attention to detail.

When it comes to Print name and title and Date MMDDYYYY, be certain that you take a second look in this current part. These are certainly the most important fields in this document.

Step 3: Right after proofreading the completed blanks, hit "Done" and you're all set! Try a free trial option at FormsPal and get immediate access to form 8823 - available from your personal account. We don't share the information that you enter when filling out forms at FormsPal.