Handling PDF documents online is certainly a piece of cake with this PDF editor. Anyone can fill out form 8879 eo here effortlessly. Our team is constantly endeavoring to expand the tool and help it become even easier for clients with its cutting-edge features. Bring your experience to a higher level with constantly developing and amazing possibilities available today! To get the process started, consider these simple steps:

Step 1: Open the PDF form in our tool by clicking the "Get Form Button" above on this webpage.

Step 2: This editor will let you modify your PDF in various ways. Enhance it by writing any text, adjust what's already in the document, and put in a signature - all within the reach of a couple of clicks!

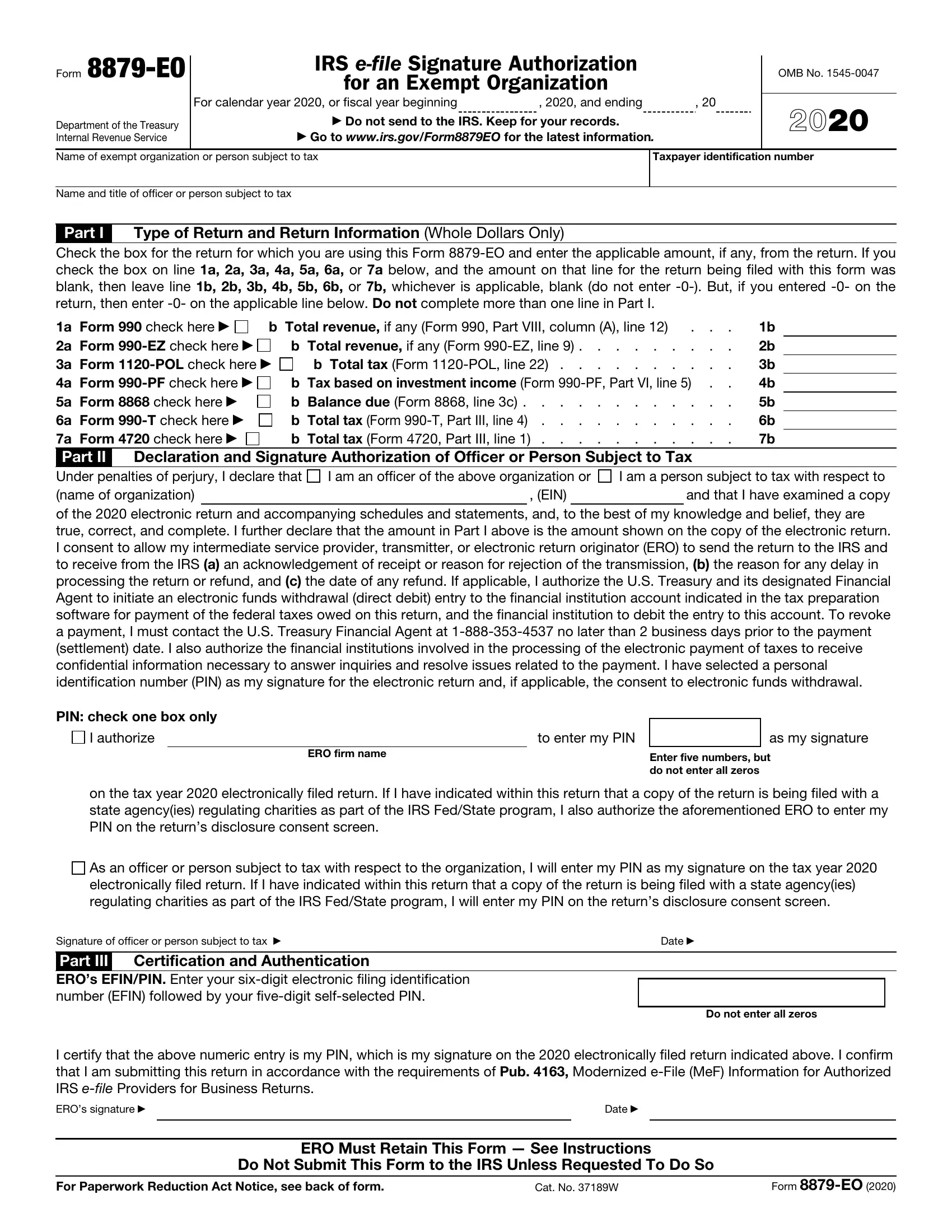

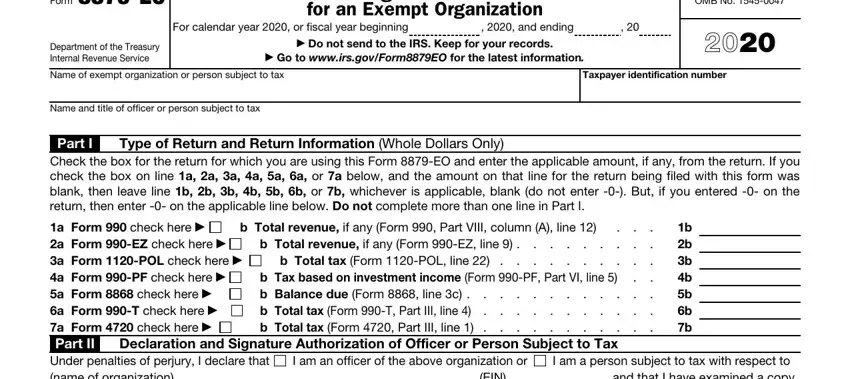

In an effort to finalize this form, make sure you provide the right details in every field:

1. When completing the form 8879 eo, be sure to include all essential fields in the associated part. This will help facilitate the process, allowing your details to be processed quickly and properly.

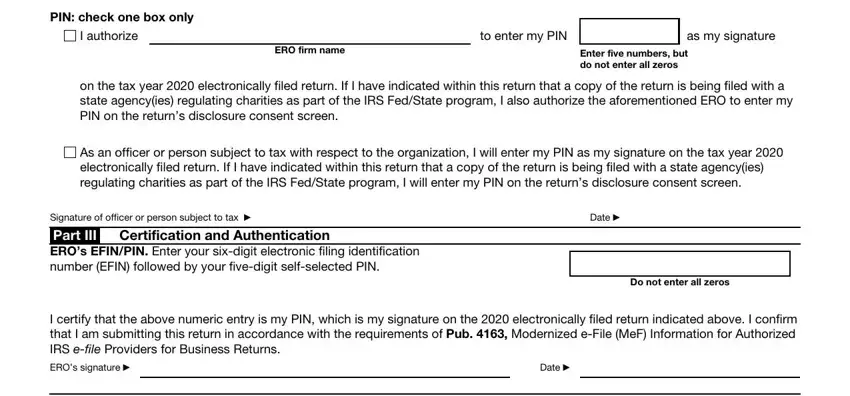

2. Right after the prior part is done, proceed to enter the suitable information in these - PIN check one box only, I authorize, ERO firm name, to enter my PIN, as my signature, Enter five numbers but do not, on the tax year electronically, As an officer or person subject to, Signature of officer or person, Date, Certification and Authentication, Part III EROs EFINPIN Enter your, Do not enter all zeros, I certify that the above numeric, and EROs signature.

Be very careful while filling out Part III EROs EFINPIN Enter your and Certification and Authentication, because this is the part in which most users make mistakes.

Step 3: Right after taking another look at the fields and details, hit "Done" and you're good to go! Try a free trial account with us and obtain instant access to form 8879 eo - accessible inside your FormsPal cabinet. FormsPal is devoted to the personal privacy of our users; we make certain that all information used in our tool is secure.