Through the online PDF tool by FormsPal, you'll be able to fill in or change contacting irs representative here. Our editor is consistently evolving to grant the very best user experience achievable, and that's thanks to our resolve for continual development and listening closely to customer feedback. In case you are seeking to begin, here's what it will take:

Step 1: Click the orange "Get Form" button above. It is going to open our pdf editor so that you could begin filling out your form.

Step 2: With this state-of-the-art PDF editor, it is easy to do more than simply fill out blank fields. Express yourself and make your documents seem great with customized textual content put in, or fine-tune the file's original content to perfection - all that accompanied by the capability to incorporate any photos and sign the file off.

This PDF form will involve some specific details; to ensure accuracy, don't hesitate to take into account the suggestions further down:

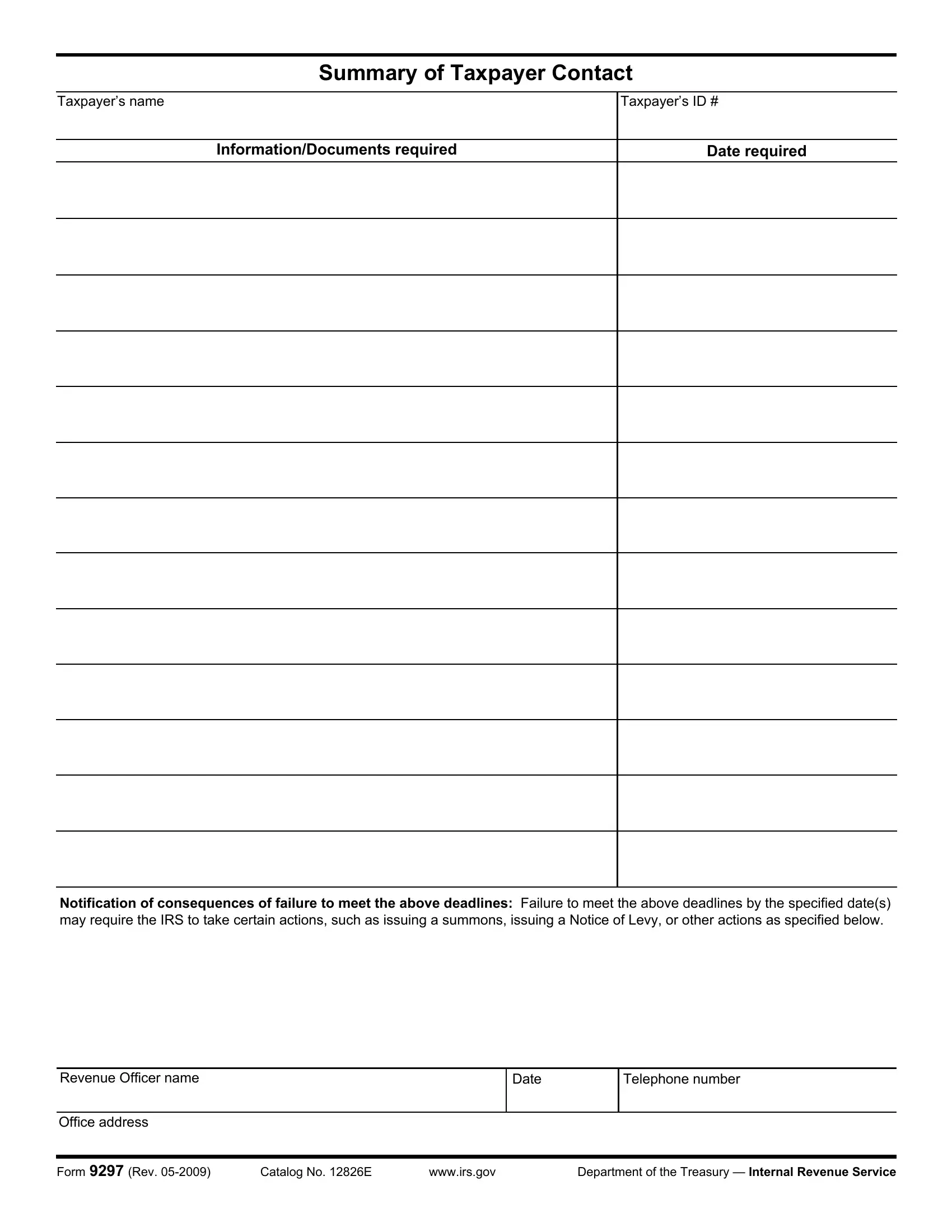

1. It is recommended to fill out the contacting irs representative properly, hence take care while filling out the sections including all these blank fields:

2. Right after the prior part is filled out, go on to type in the relevant information in these: Notification of consequences of.

3. Through this stage, review Revenue Officer name, Date, Telephone number, Office address, Form Rev, Catalog No E, wwwirsgov, and Department of the Treasury. All of these should be filled out with utmost accuracy.

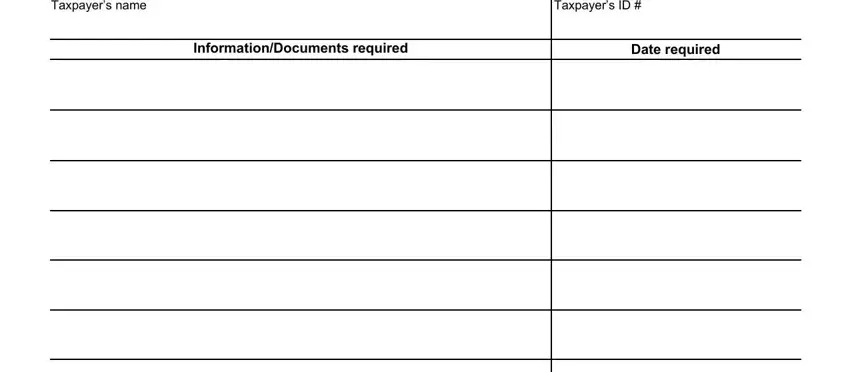

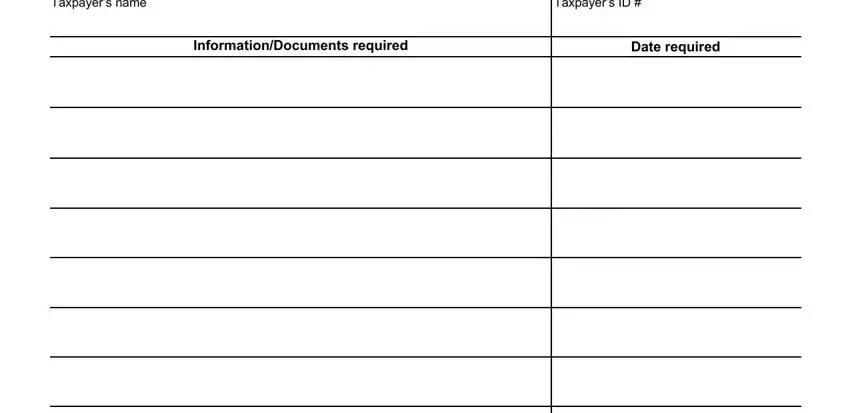

4. Filling out Taxpayers name, Taxpayers ID, InformationDocuments required, and Date required is paramount in this fourth step - you'll want to invest some time and take a close look at every single blank area!

5. The form must be finished by going through this section. Here you will see a detailed list of blank fields that have to be filled out with correct information to allow your document usage to be complete: Notification of consequences of.

Regarding Notification of consequences of and Notification of consequences of, be sure that you take another look in this current part. The two of these could be the most significant fields in the document.

Step 3: Immediately after taking one more look at the form fields you have filled in, hit "Done" and you are all set! Right after setting up a7-day free trial account at FormsPal, you'll be able to download contacting irs representative or send it through email at once. The PDF file will also be readily available from your personal account page with your every change. FormsPal ensures your information confidentiality with a protected method that in no way records or distributes any sort of sensitive information used in the PDF. Rest assured knowing your files are kept protected every time you use our services!