Working with PDF files online can be very simple using our PDF editor. You can fill out isp 1000 pdf here within minutes. In order to make our tool better and more convenient to use, we continuously design new features, taking into account suggestions from our users. All it requires is a couple of simple steps:

Step 1: Hit the "Get Form" button above. It'll open up our pdf tool so you could begin filling out your form.

Step 2: With this state-of-the-art PDF tool, you'll be able to accomplish more than just fill out blank fields. Express yourself and make your documents appear great with custom textual content put in, or modify the original content to perfection - all backed up by an ability to add almost any photos and sign the file off.

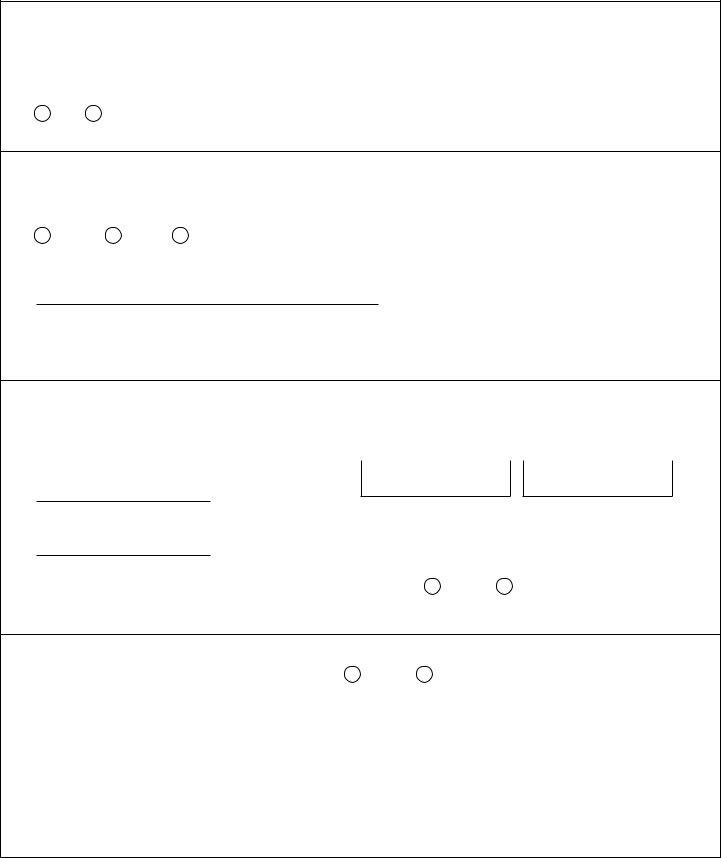

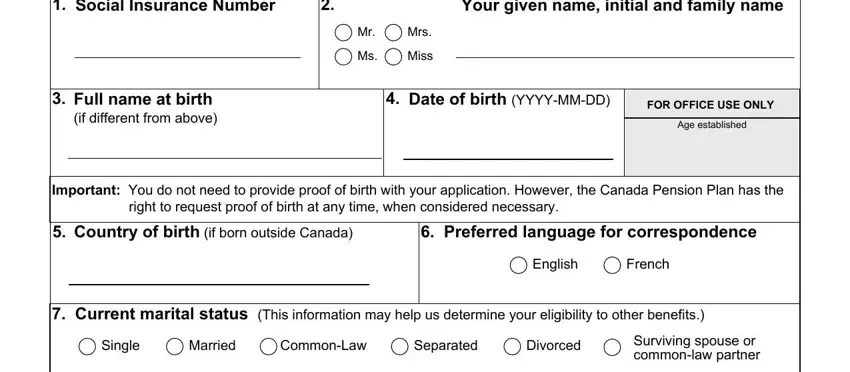

In an effort to complete this PDF form, ensure you type in the right details in every single area:

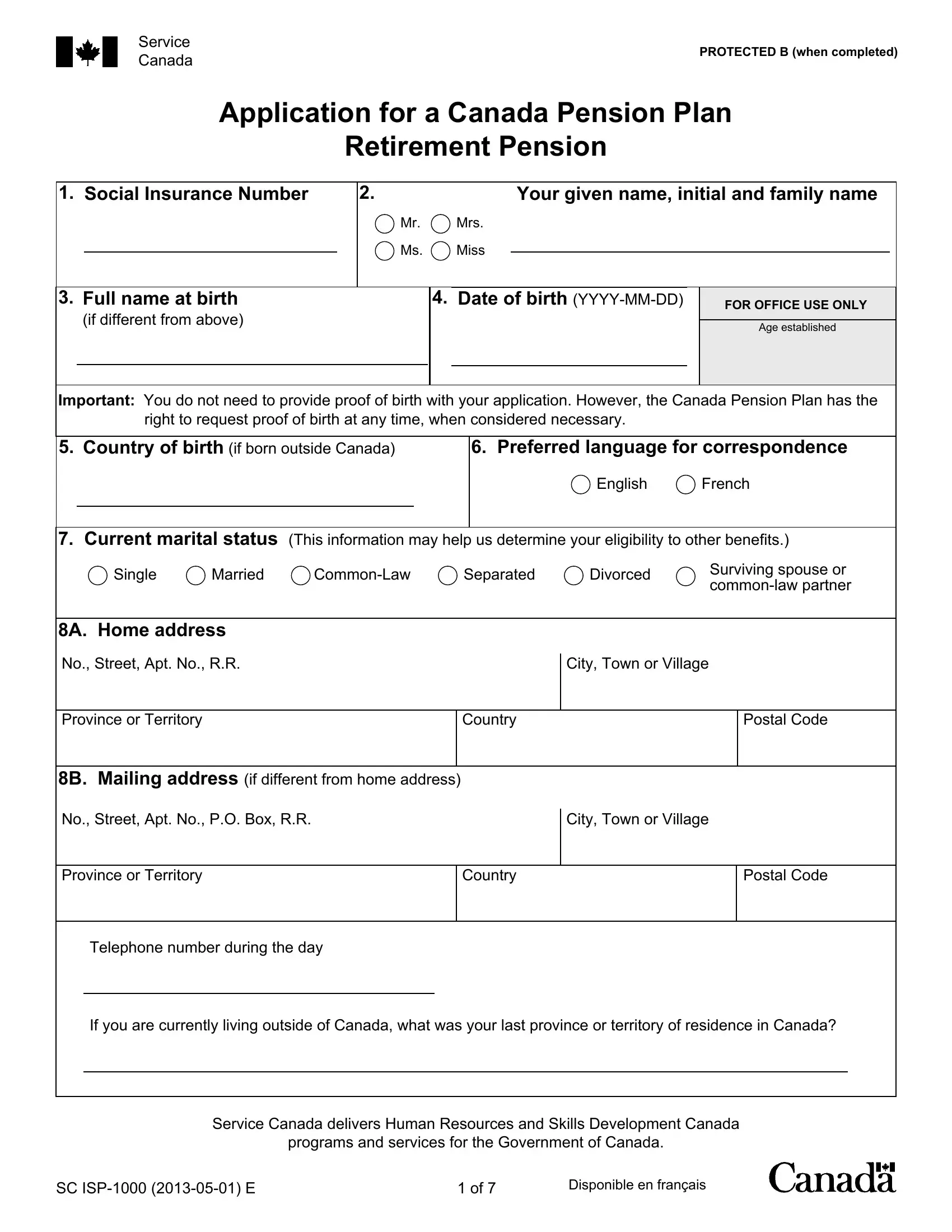

1. Whenever filling out the isp 1000 pdf, make sure to include all of the necessary fields within the corresponding form section. It will help facilitate the process, allowing for your details to be handled without delay and appropriately.

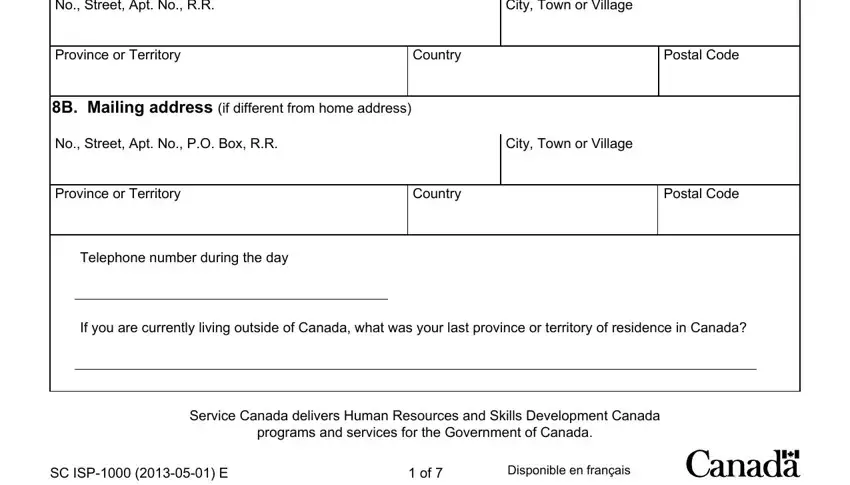

2. Once the previous part is filled out, proceed to type in the relevant information in all these: No Street Apt No RR, City Town or Village, Province or Territory, Country, Postal Code, B Mailing address if different, No Street Apt No PO Box RR, City Town or Village, Province or Territory, Country, Postal Code, Telephone number during the day, If you are currently living, Service Canada delivers Human, and programs and services for the.

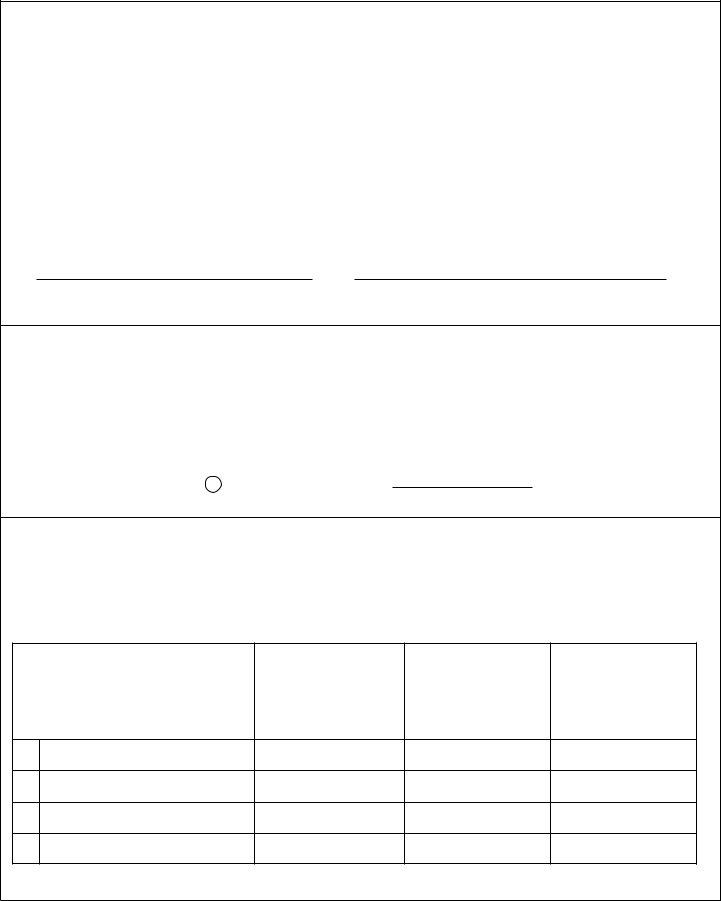

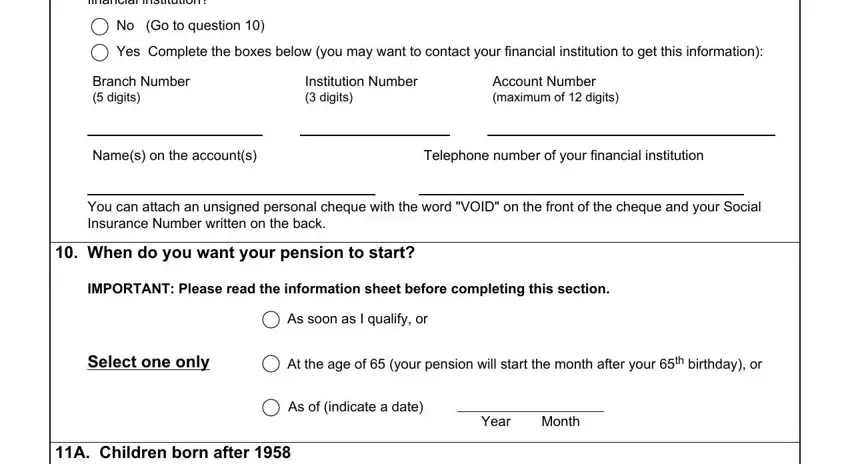

3. This stage will be hassle-free - complete all the fields in If your application is approved do, No Go to question, Yes Complete the boxes below you, Branch Number digits, Institution Number digits, Account Number maximum of digits, Names on the accounts, Telephone number of your financial, You can attach an unsigned, When do you want your pension to, IMPORTANT Please read the, As soon as I qualify or, Select one only, At the age of your pension will, and As of indicate a date in order to complete this segment.

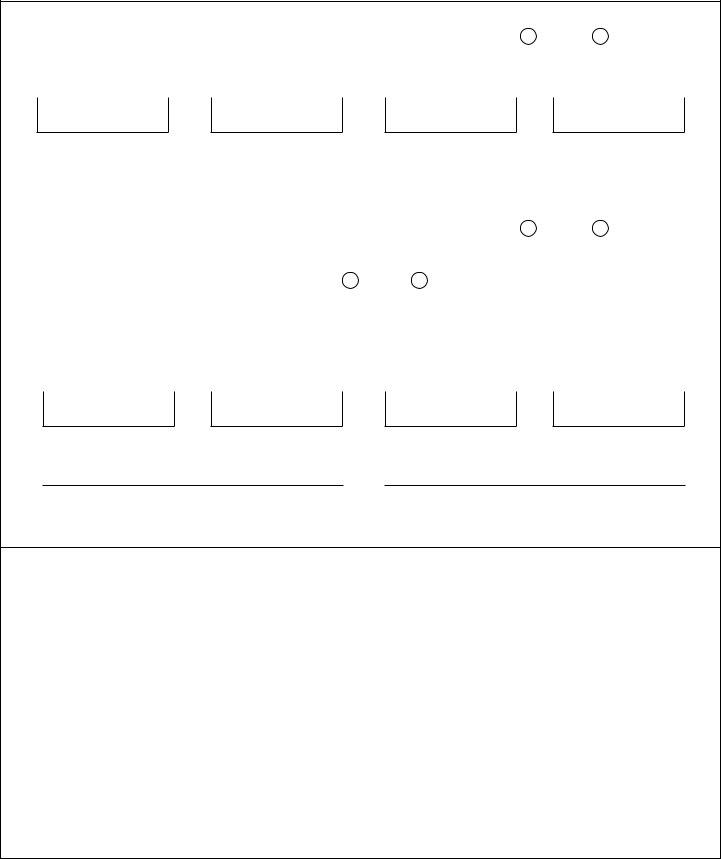

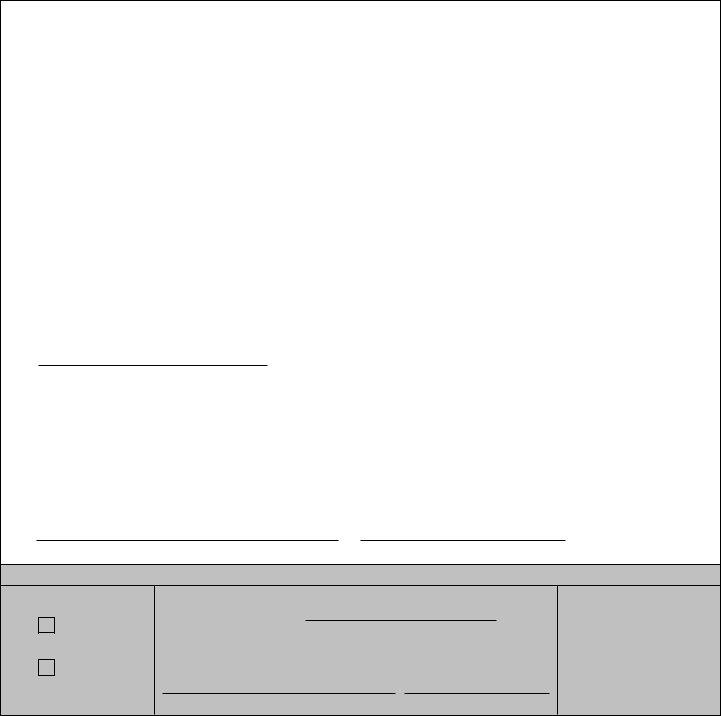

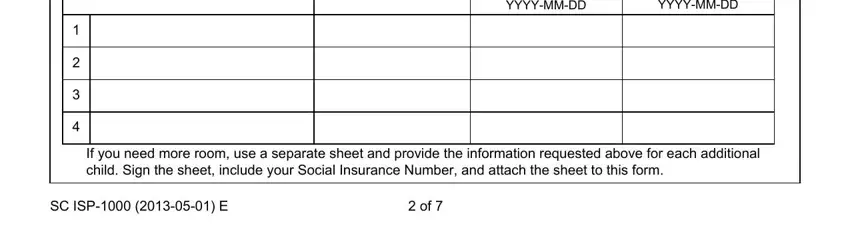

4. This next section requires some additional information. Ensure you complete all the necessary fields - YYYYMMDD, YYYYMMDD, If you need more room use a, and SC ISP E - to proceed further in your process!

Regarding YYYYMMDD and SC ISP E, make sure that you get them right in this section. Both these could be the most important fields in this file.

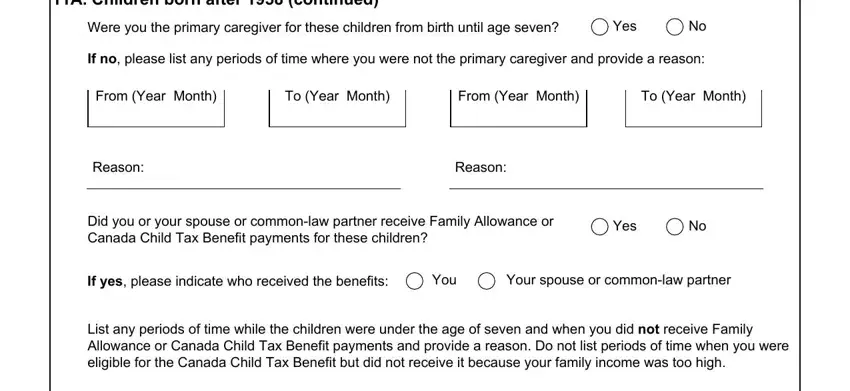

5. Because you reach the completion of your form, you will find a few extra things to complete. Particularly, A Children born after continued, Were you the primary caregiver for, Yes, If no please list any periods of, From Year Month, To Year Month, From Year Month, To Year Month, Reason, Reason, Did you or your spouse or, Yes, If yes please indicate who, You, and Your spouse or commonlaw partner must all be done.

Step 3: Once you have looked over the information provided, press "Done" to conclude your form. Create a free trial account at FormsPal and get immediate access to isp 1000 pdf - download or modify from your FormsPal account page. FormsPal provides risk-free document editor devoid of personal data recording or any kind of sharing. Rest assured that your details are secure with us!