In case you would like to fill out oas application, you won't have to download and install any sort of software - just use our PDF tool. To have our tool on the forefront of efficiency, we strive to put into operation user-driven features and enhancements on a regular basis. We're routinely grateful for any suggestions - play a vital role in revampimg PDF editing. It just takes a few easy steps:

Step 1: Press the "Get Form" button above. It's going to open up our pdf editor so that you could begin filling in your form.

Step 2: After you access the tool, you'll notice the document made ready to be filled out. Apart from filling in different blank fields, you may also do some other actions with the Document, that is adding custom text, editing the original textual content, adding illustrations or photos, placing your signature to the form, and more.

It is actually simple to fill out the document using this helpful tutorial! This is what you should do:

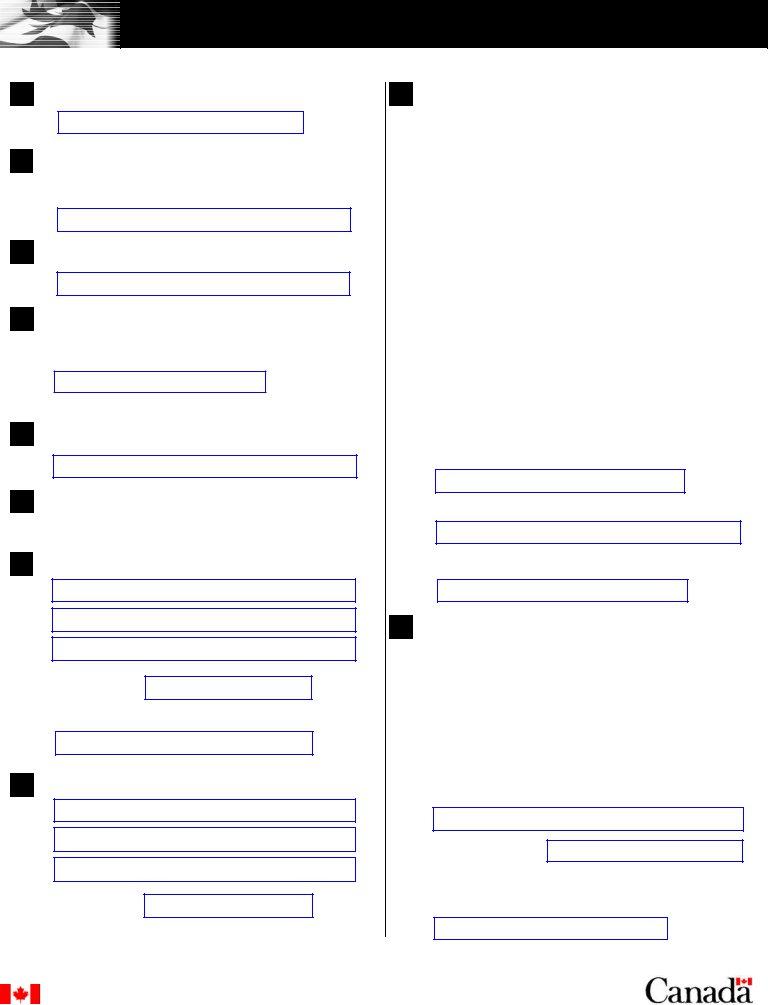

1. While completing the oas application, make certain to complete all of the essential fields within the associated section. This will help hasten the process, which allows your details to be processed promptly and accurately.

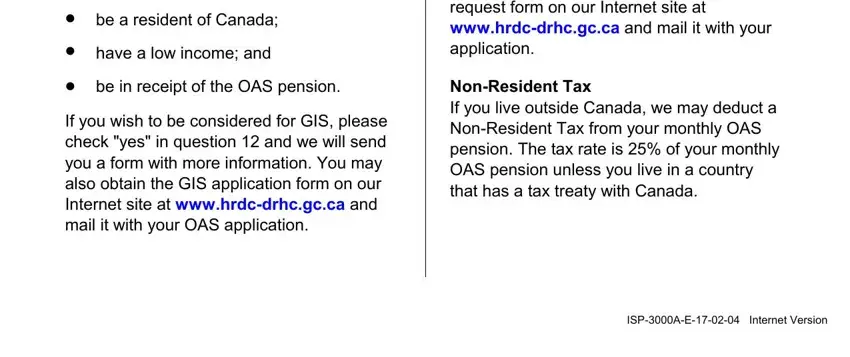

2. Once your current task is complete, take the next step – fill out all of these fields - be a resident of Canada, have a low income and, be in receipt of the OAS pension, If you wish to be considered for, You may also obtain the tax, NonResident Tax If you live, and ISPAE Internet Version with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

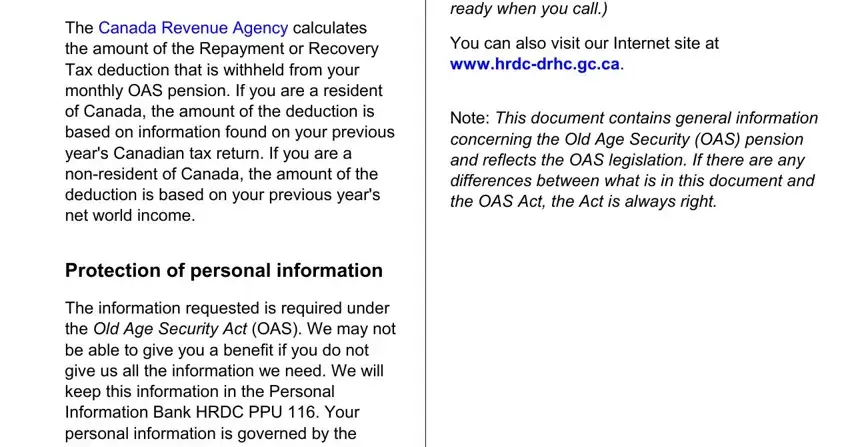

3. This third stage will be hassle-free - fill out all of the empty fields in Please have your Social Insurance, You can also visit our Internet, Note This document contains, The Canada Revenue Agency, Protection of personal information, and The information requested is to conclude this part.

It's easy to make an error while filling in the You can also visit our Internet, and so make sure you look again before you decide to send it in.

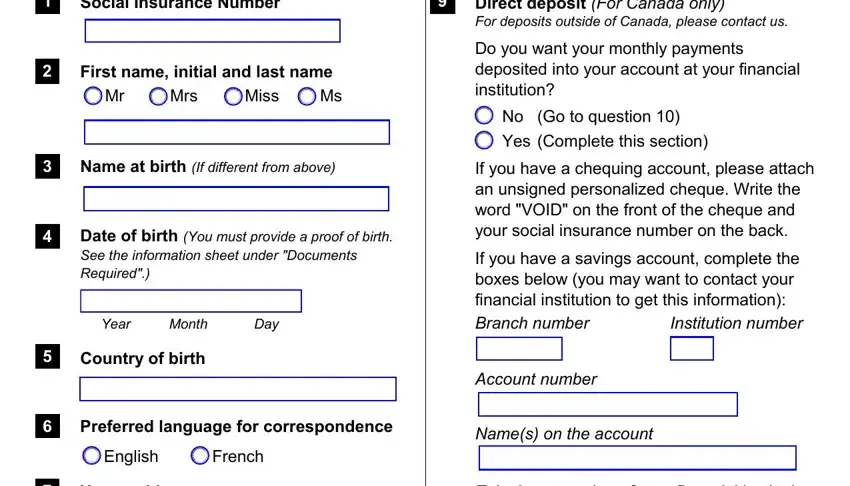

4. This next section requires some additional information. Ensure you complete all the necessary fields - Social Insurance Number, First name initial and last name, Mrs, Miss, Name at birth If different from, Date of birth You must provide a, Year Month Day, Country of birth, Direct deposit For Canada only For, Do you want your monthly payments, No Go to question, Yes Complete this section, If you have a chequing account, If you have a savings account, and Institution number - to proceed further in your process!

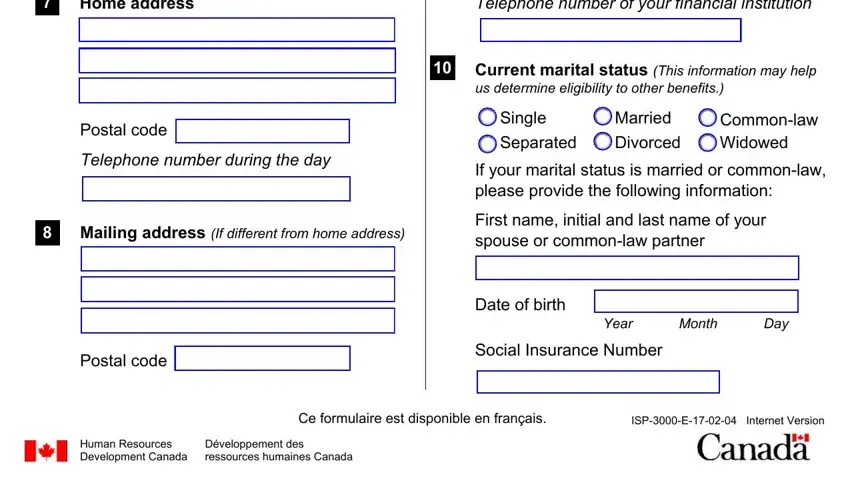

5. When you approach the final parts of your document, you'll notice just a few extra things to do. Notably, Home address, Telephone number of your financial, Postal code, Telephone number during the day, Mailing address If different from, Postal code, Current marital status This, Single, Married, Separated, Divorced, Commonlaw Widowed, If your marital status is married, First name initial and last name, and Date of birth must be filled out.

Step 3: As soon as you have reread the details provided, just click "Done" to complete your form. Try a free trial option with us and gain direct access to oas application - downloadable, emailable, and editable in your FormsPal cabinet. At FormsPal, we do everything we can to make sure your information is kept protected.