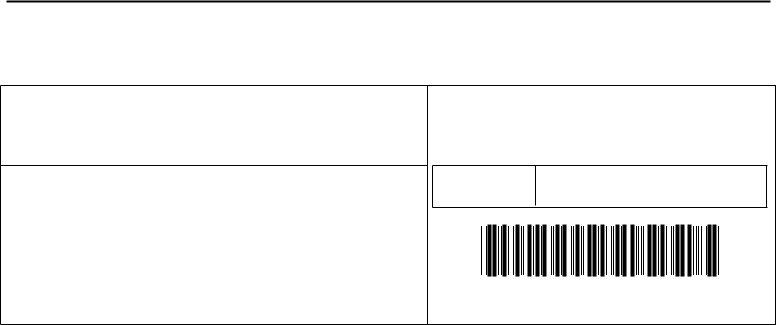

When it comes to managing payroll for a business, understanding and utilizing the right forms is crucial for compliance with state tax obligations. Among the critical documents for employers in West Virginia is the IT 101V Payment Voucher, a form designed for employers to report and remit withheld income tax. Housed under the jurisdiction of the West Virginia State Tax Department, and destined for PO Box 1667 in Charleston, WV, this form facilitates a streamlined process for reporting employees' withheld state income tax. The IT 101V form requires specific information, including the reporting period's end date, due date, the number of employees at the period's end, as well as the total amount of tax withheld. It also requires the employer’s account number, name, and address, ensuring that the payment is accurately applied to the right account. Clear and precise, this voucher is essential for maintaining tax compliance, preventing penalties, and ensuring that state income taxes are properly remitted on time. With designated spaces for each required piece of information, the form adds to the efficiency and accuracy of the tax reporting and payment process, serving as a key component in the financial administration repertoire of West Virginia employers.

| Question | Answer |

|---|---|

| Form Name | It 101V Payment Voucher Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | wv state tax form it 101, west virginia wv it 101v, payment voucher 2020, it 101v form |

Employer's West Virginia Income Tax Withheld |

|

|

WV State Tax Department |

|

PO Box 1667 |

|

Charleston, WV 25326 |

PERIOD ENDING |

DUE DATE |

|

|

MM DD YYYY |

MM DD YYYY |

|

|

#OF EMPLOYEES AT END OF PERIOD

PAYMENT

VOUCHER

TOTAL

ACCOUNT NUMBER ___________________________________________

NAME_________________________________________________________

ADDRESS______________________________________________________

_______________________________________________________________

CITY |

STATE |

ZIP |

REMITTANCE.

B 4 2 2 0 1 6 0 1 W