With the help of the online PDF editor by FormsPal, you're able to fill out or modify printable state tax forms right here. To maintain our tool on the forefront of practicality, we aim to adopt user-driven capabilities and enhancements regularly. We're routinely happy to receive suggestions - help us with revampimg PDF editing. All it requires is a few simple steps:

Step 1: Access the PDF form in our tool by hitting the "Get Form Button" at the top of this page.

Step 2: With our advanced PDF editing tool, you can actually accomplish more than simply complete blank form fields. Edit away and make your docs seem perfect with customized text incorporated, or modify the file's original input to excellence - all that supported by the capability to insert any kind of graphics and sign the file off.

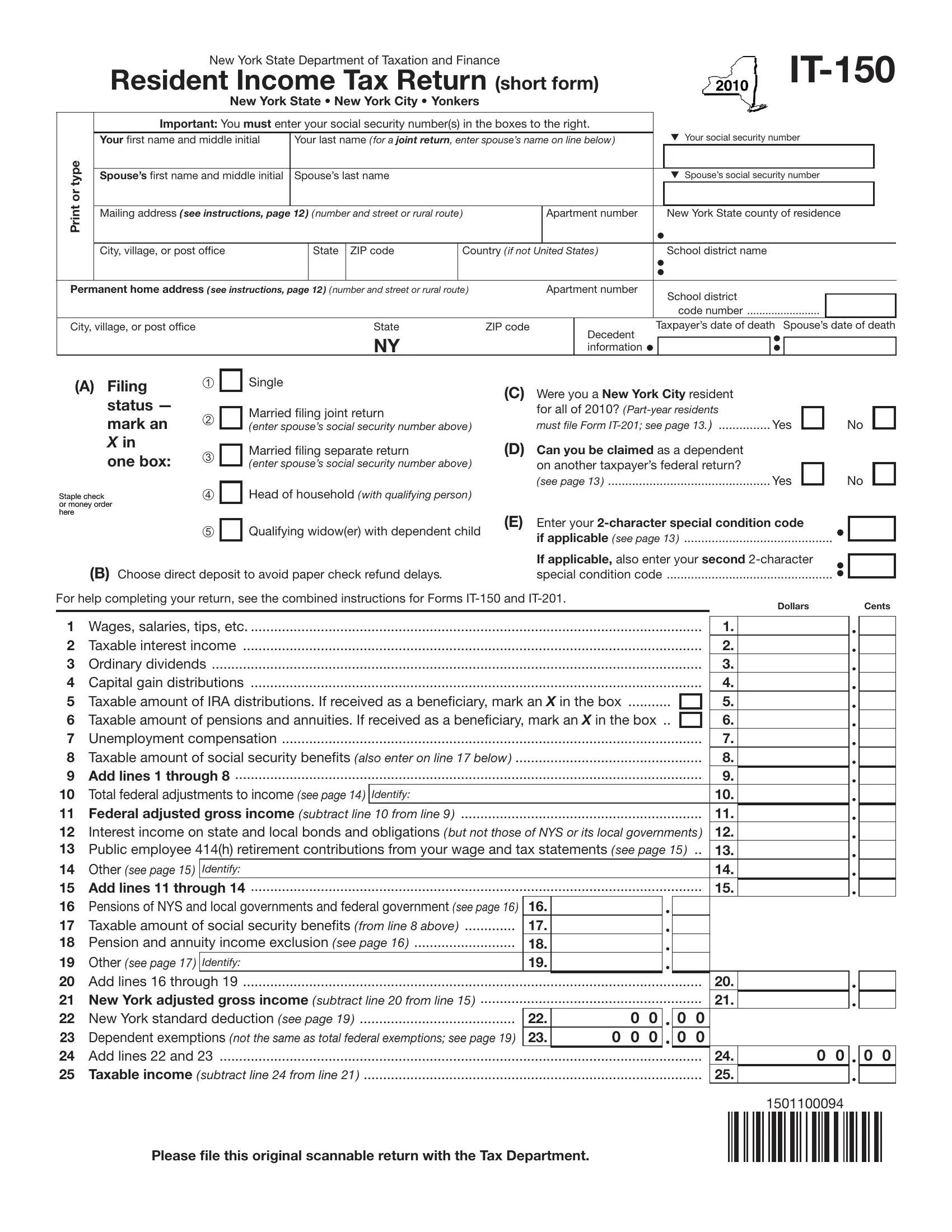

For you to finalize this form, make sure that you enter the required details in every blank:

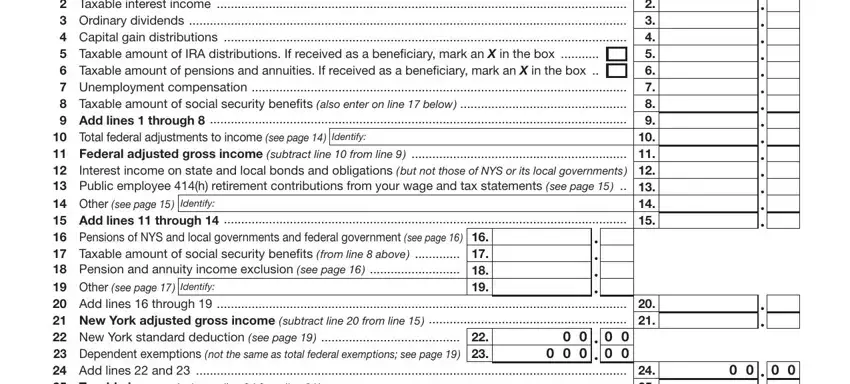

1. The printable state tax forms necessitates certain details to be typed in. Ensure the subsequent blank fields are finalized:

2. Once your current task is complete, take the next step – fill out all of these fields - Wages salaries tips etc with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

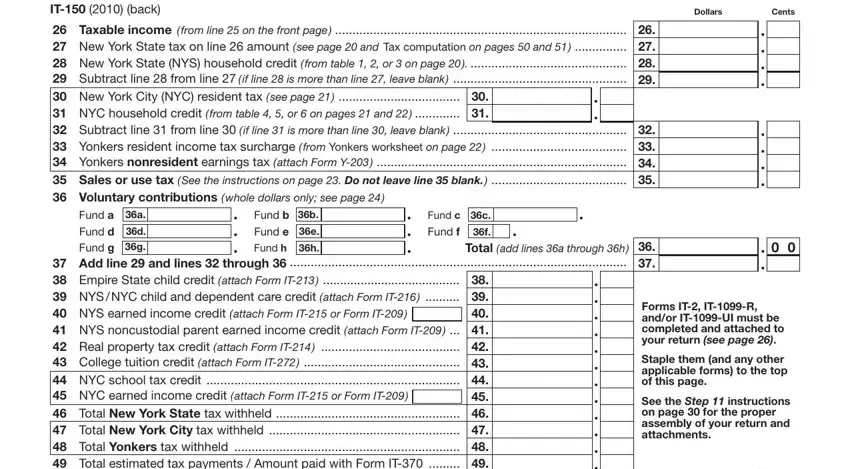

3. The next step is fairly uncomplicated, Fund a a Fund d d Fund g g, IT back Taxable income from, Fund b b Fund e e, Fund f f, Fund c c, Fund h h, Total add lines a through h, Dollars, Cents, Forms IT ITR, andor ITUI must be completed and, Staple them and any other, See the Step instructions, and on page for the proper assembly - each one of these blanks will have to be filled out here.

People who use this document often make mistakes while completing Fund b b Fund e e in this section. Be certain to read again what you enter right here.

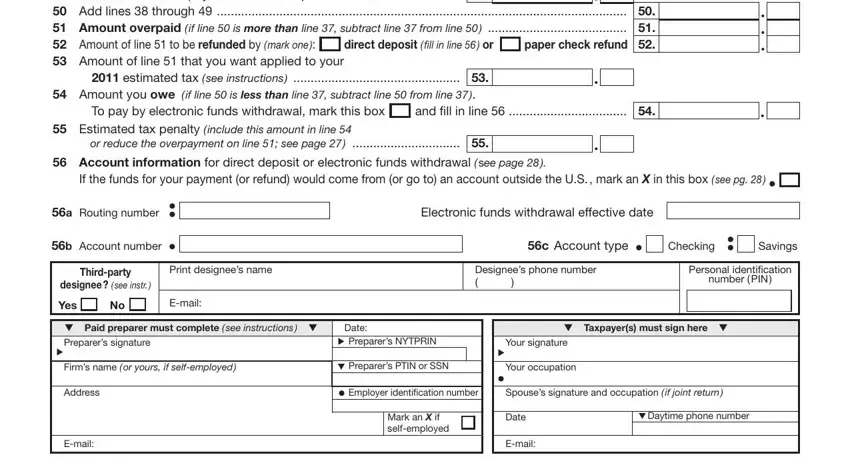

4. It is time to complete the next form section! In this case you will have these Total add lines a through h, estimated tax see instructions, To pay by electronic funds, and fill in line, direct deposit fill in line or, Estimated tax penalty include, or reduce the overpayment on line, Account information for direct, If the funds for your payment or, a Routing number, b Account number, Thirdparty, designee see instr, Print designees name, and Yes blanks to fill in.

Step 3: As soon as you've reread the information you given, just click "Done" to complete your FormsPal process. Try a free trial option with us and get instant access to printable state tax forms - download, email, or edit inside your personal cabinet. FormsPal guarantees protected form completion without personal data recording or distributing. Rest assured that your information is safe with us!