When you intend to fill out EZ, it's not necessary to download and install any sort of applications - just give a try to our PDF tool. In order to make our editor better and easier to use, we constantly implement new features, bearing in mind suggestions coming from our users. Here's what you'd want to do to get started:

Step 1: Firstly, open the pdf editor by clicking the "Get Form Button" above on this site.

Step 2: With our online PDF tool, you're able to do more than merely fill in blank fields. Edit away and make your docs seem perfect with custom text added, or tweak the original input to excellence - all backed up by an ability to add your personal images and sign the file off.

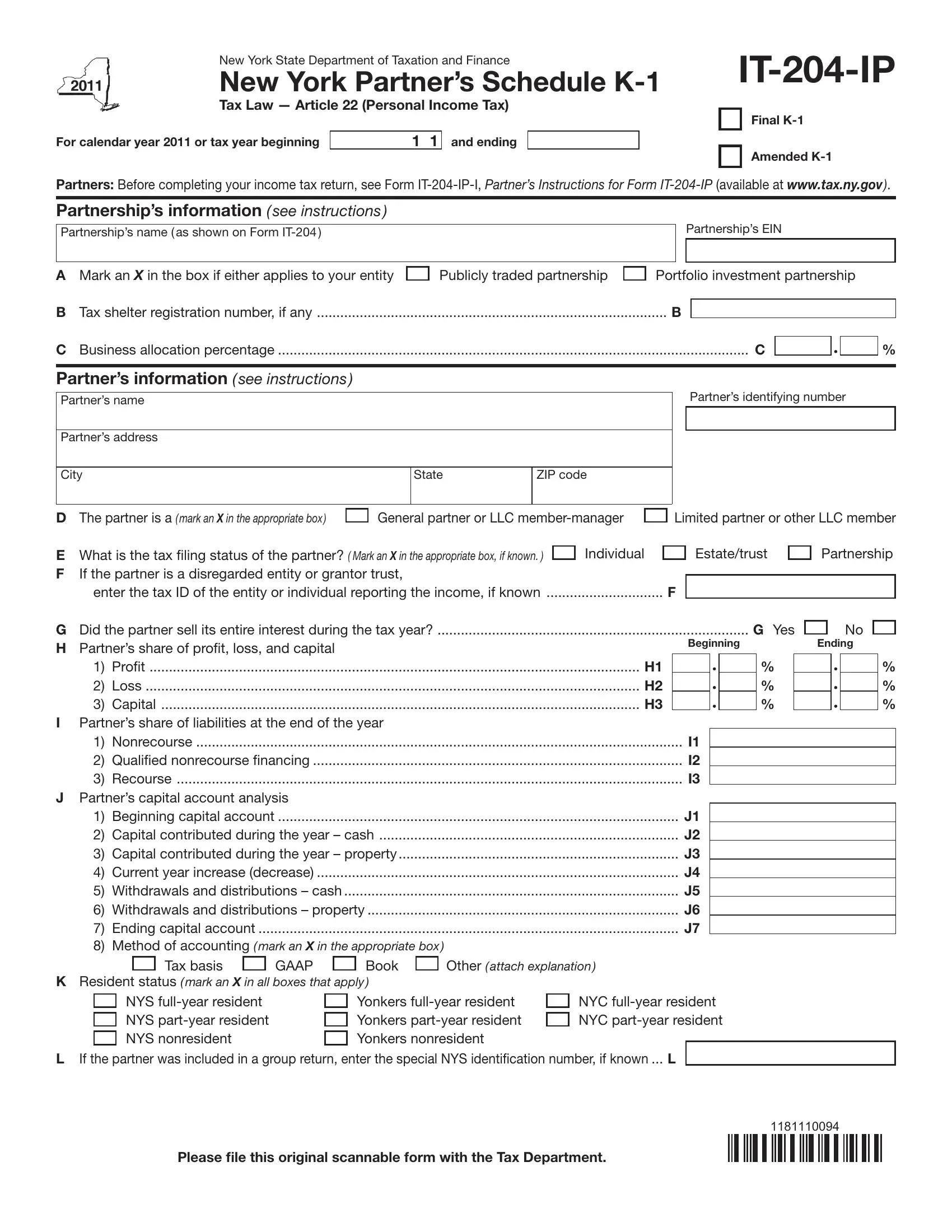

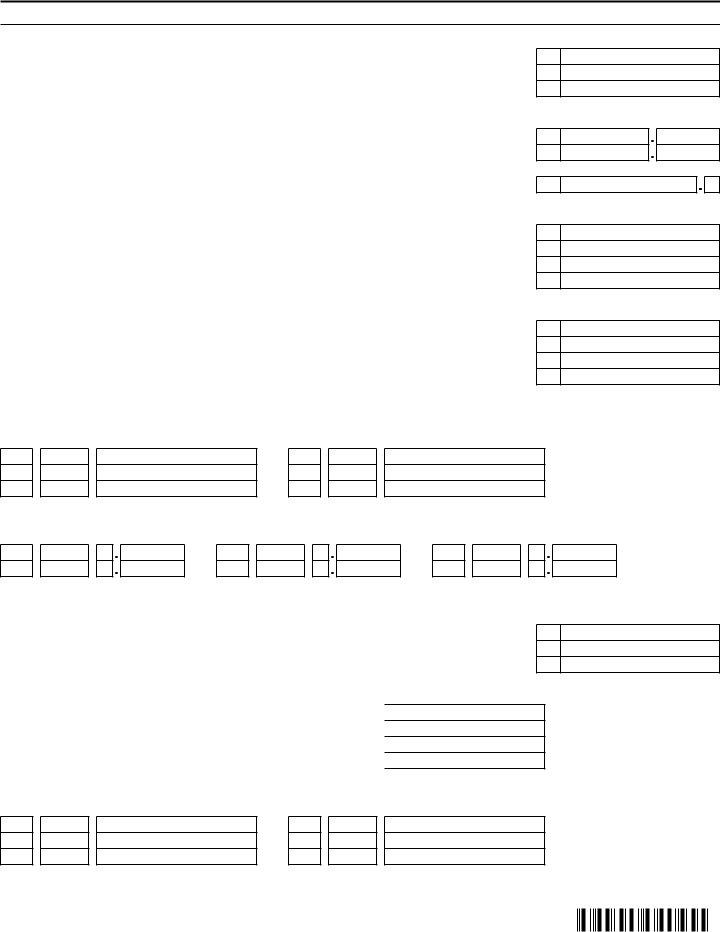

With regards to the fields of this particular document, here is what you need to know:

1. Begin filling out the EZ with a group of essential blanks. Note all the necessary information and be sure nothing is neglected!

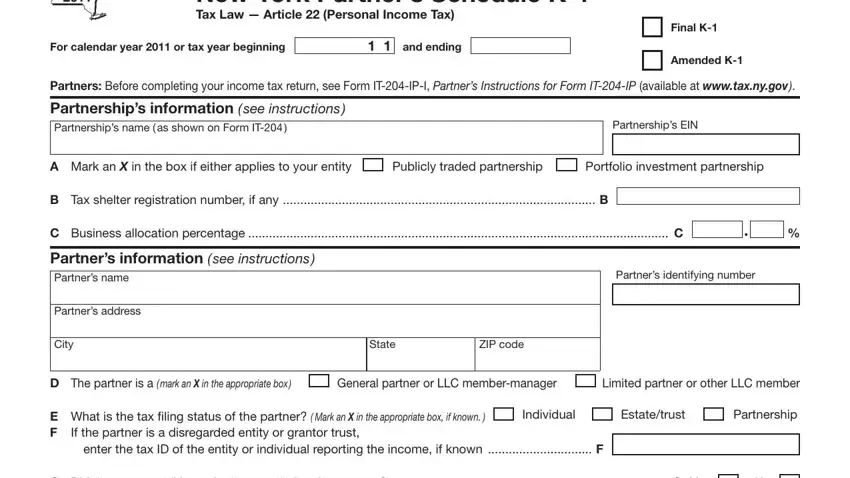

2. The third step is usually to complete the following blank fields: Beginning, Proit H Loss H Capital H, Nonrecourse I Qualiied, G Did the partner sell its entire, Beginning capital account J, Ending, K Resident status mark an X in, Tax basis, GAAP, Book, Other attach explanation, NYS fullyear resident NYS partyear, Yonkers fullyear resident Yonkers, NYC fullyear resident NYC partyear, and If the partner was included in a.

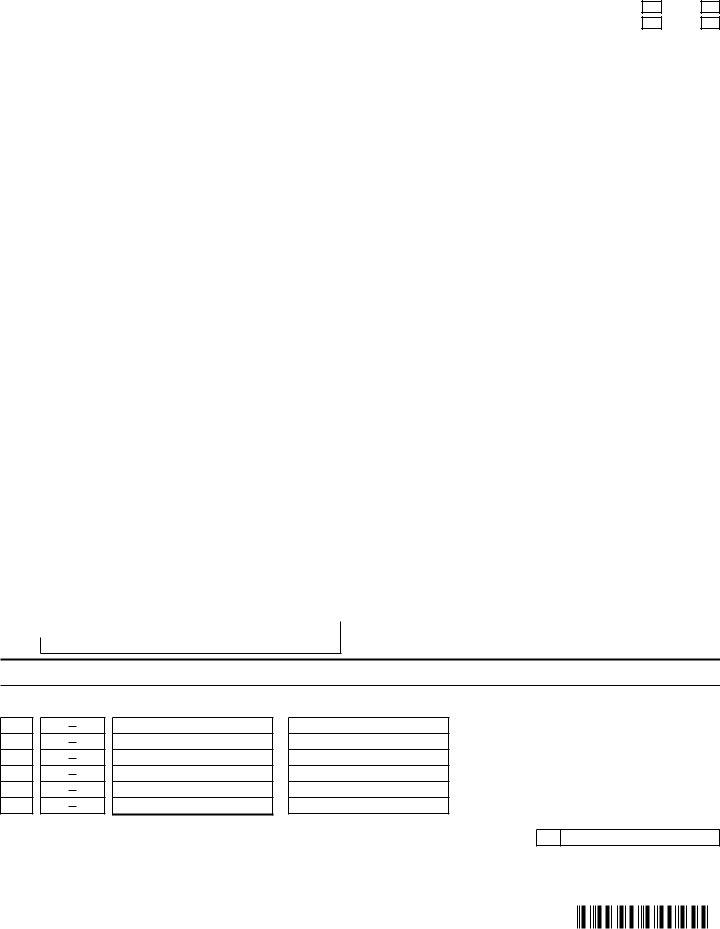

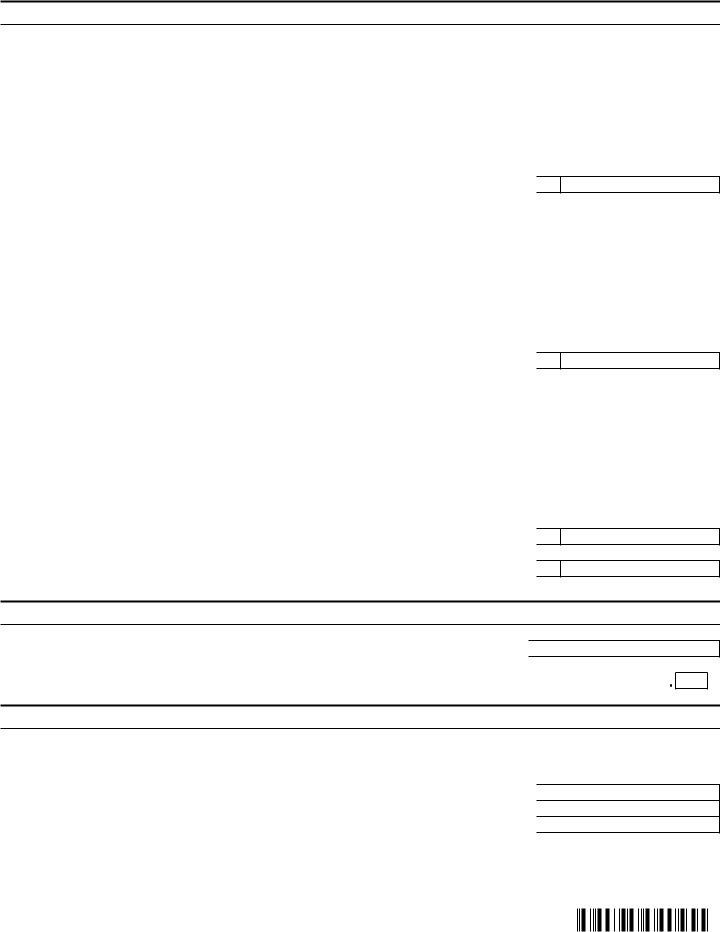

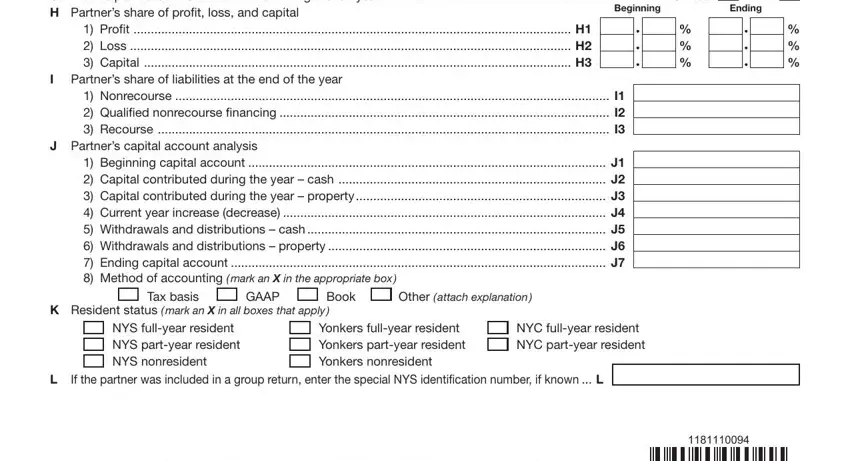

3. This 3rd step is generally pretty easy, Page of, ITIP, M Was Form ITE iled with the, No No, N NYS estimated tax paid on behalf, First installment N Second, Date, Amount, Total NYS estimated tax paid on, O Estimated MCTMT paid on behalf, First installment O Second, Date, Amount, Total estimated MCTMT paid on, and Partners share of income - all of these empty fields will have to be completed here.

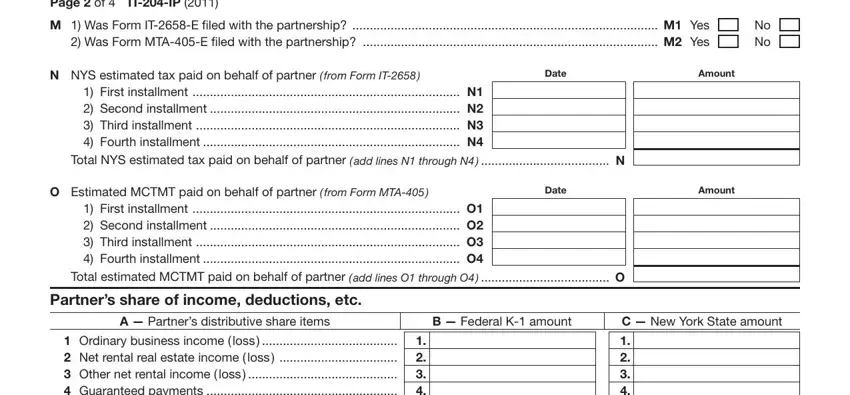

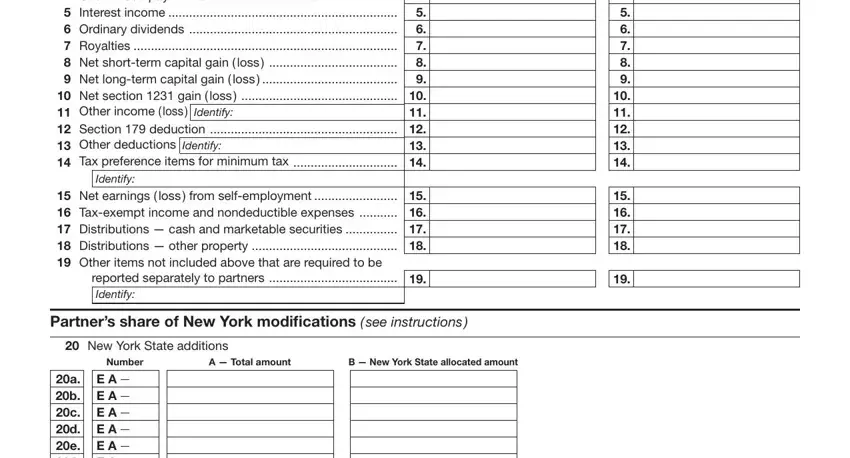

4. This subsection comes with these particular empty form fields to fill out: Ordinary business income loss, reported separately to partners, Identify, Partners share of New York, New York State additions, Number, A Total amount, B New York State allocated amount, and a E A b E A c E A d E A e E A f.

It is possible to get it wrong while completing your reported separately to partners, therefore be sure to reread it before you send it in.

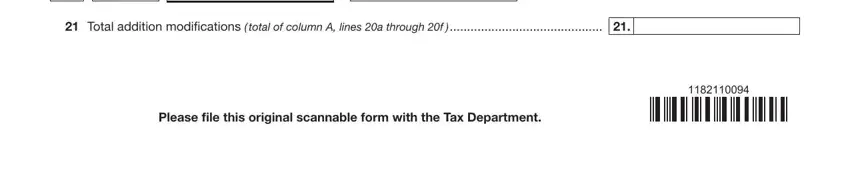

5. Because you come near to the finalization of this document, there are a few extra requirements that need to be met. In particular, a E A b E A c E A d E A e E A f, Total addition modiications, and Please file this original scannable should all be filled in.

Step 3: You should make sure the details are right and then click "Done" to conclude the project. Make a free trial account at FormsPal and get immediate access to EZ - downloadable, emailable, and editable in your FormsPal account. We don't share or sell any information that you provide whenever dealing with documents at FormsPal.