Should you want to fill out It 2663 Form, there's no need to download and install any kind of programs - simply give a try to our online tool. Our editor is continually developing to give the best user experience possible, and that is because of our resolve for continuous improvement and listening closely to comments from users. With some easy steps, you are able to start your PDF editing:

Step 1: Simply click the "Get Form Button" at the top of this site to access our pdf form editing tool. This way, you'll find everything that is necessary to fill out your file.

Step 2: Once you launch the PDF editor, there'll be the document ready to be filled in. In addition to filling in different fields, you could also do several other things with the PDF, such as putting on any textual content, editing the original textual content, inserting graphics, signing the form, and a lot more.

Pay close attention while filling out this document. Make certain all necessary fields are completed properly.

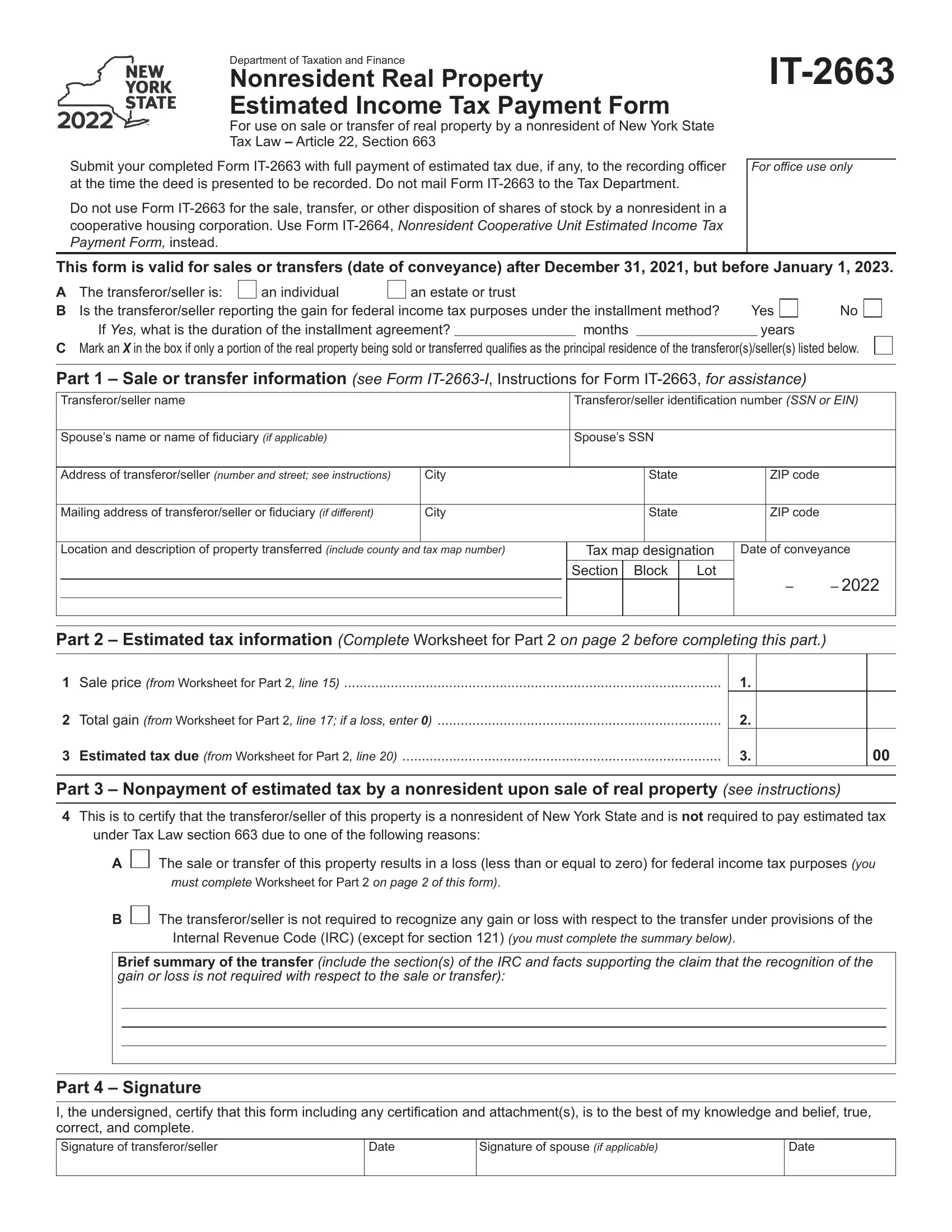

1. Whenever submitting the It 2663 Form, be certain to include all essential blank fields in the associated section. This will help to facilitate the work, allowing your information to be processed without delay and accurately.

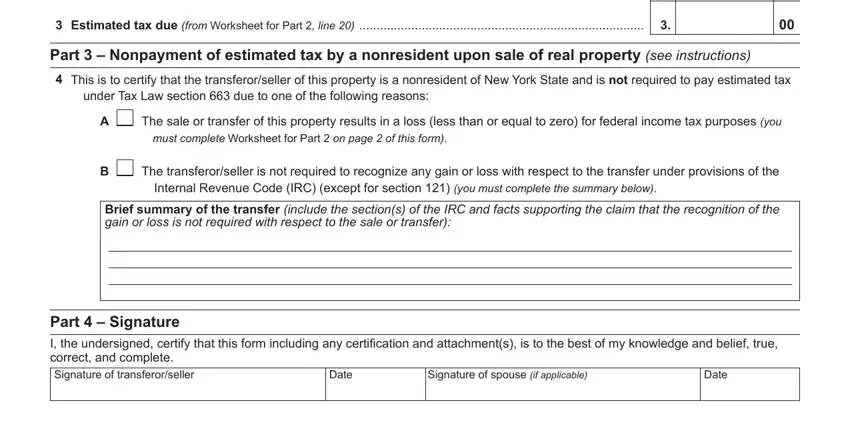

2. Once your current task is complete, take the next step – fill out all of these fields - Total gain from Worksheet for, Estimated tax due from Worksheet, Part Nonpayment of estimated tax, This is to certify that the, under Tax Law section due to one, The sale or transfer of this, The transferorseller is not, Internal Revenue Code IRC except, Brief summary of the transfer, Part Signature I the undersigned, Signature of spouse if applicable, Date, and Date with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

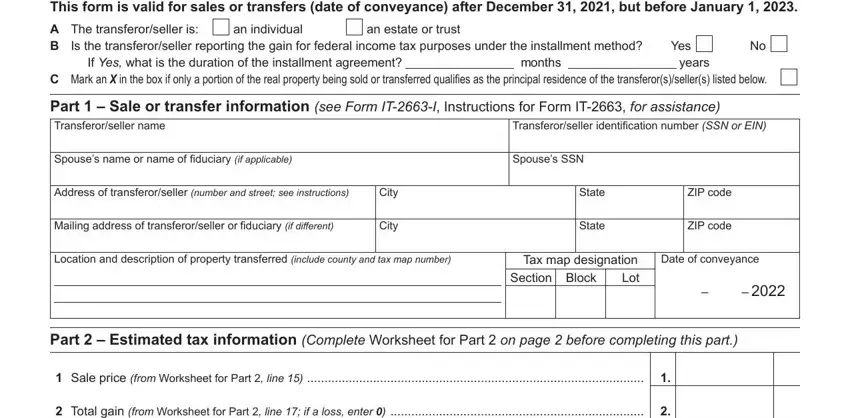

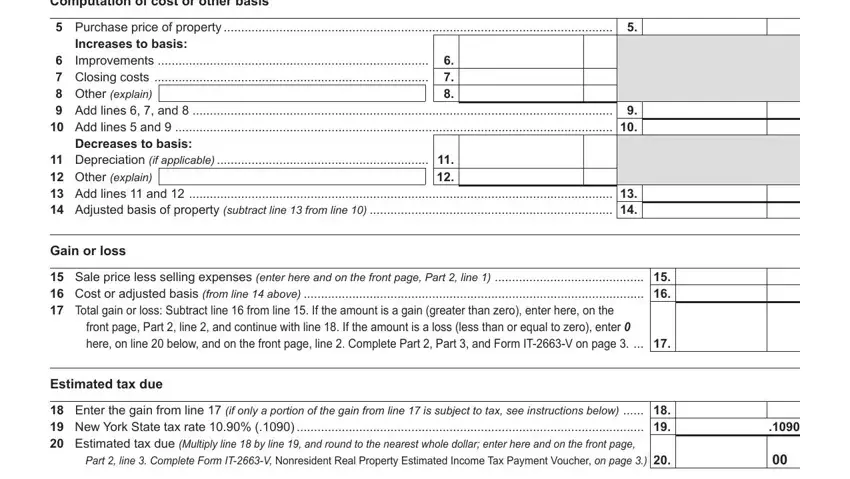

3. Your next stage will be easy - complete all the fields in Computation of cost or other basis, Purchase price of property, Decreases to basis, Gain or loss, Sale price less selling expenses, here on line below and on the, front page Part line and, Estimated tax due, Enter the gain from line if only, and Part line Complete Form ITV in order to complete this process.

As to here on line below and on the and Estimated tax due, ensure that you take another look here. Those two are the most important ones in this document.

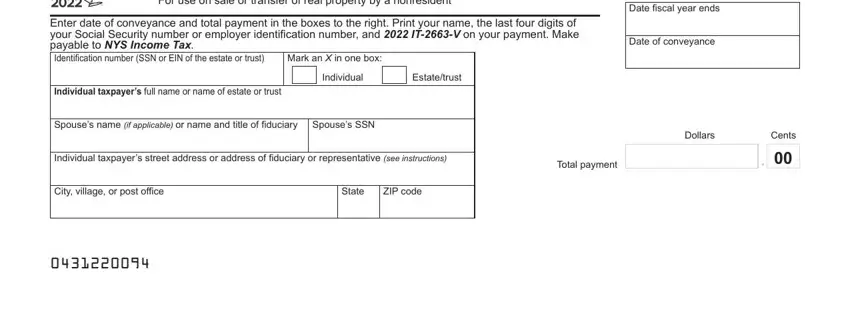

4. It's time to complete this fourth section! In this case you'll have these Department of Taxation and Finance, Enter date of conveyance and total, Mark an X in one box, Individual taxpayers full name or, Individual, Estatetrust, Date fiscal year ends, Date of conveyance, Spouses name if applicable or name, Individual taxpayers street, City village or post office, State, ZIP code, Dollars, and Cents empty form fields to do.

Step 3: Immediately after rereading your filled in blanks, hit "Done" and you are all set! Create a 7-day free trial plan with us and get immediate access to It 2663 Form - download or modify inside your personal cabinet. At FormsPal, we aim to be certain that all your details are kept private.