it2664 can be filled out online with ease. Simply open FormsPal PDF editor to complete the job without delay. Our editor is consistently developing to grant the very best user experience possible, and that's thanks to our commitment to constant improvement and listening closely to customer feedback. With a few simple steps, you can start your PDF journey:

Step 1: Hit the "Get Form" button above. It's going to open our pdf tool so you can begin filling out your form.

Step 2: This editor helps you modify the majority of PDF files in many different ways. Transform it by adding your own text, adjust existing content, and include a signature - all manageable in minutes!

It will be simple to finish the document using out helpful tutorial! This is what you have to do:

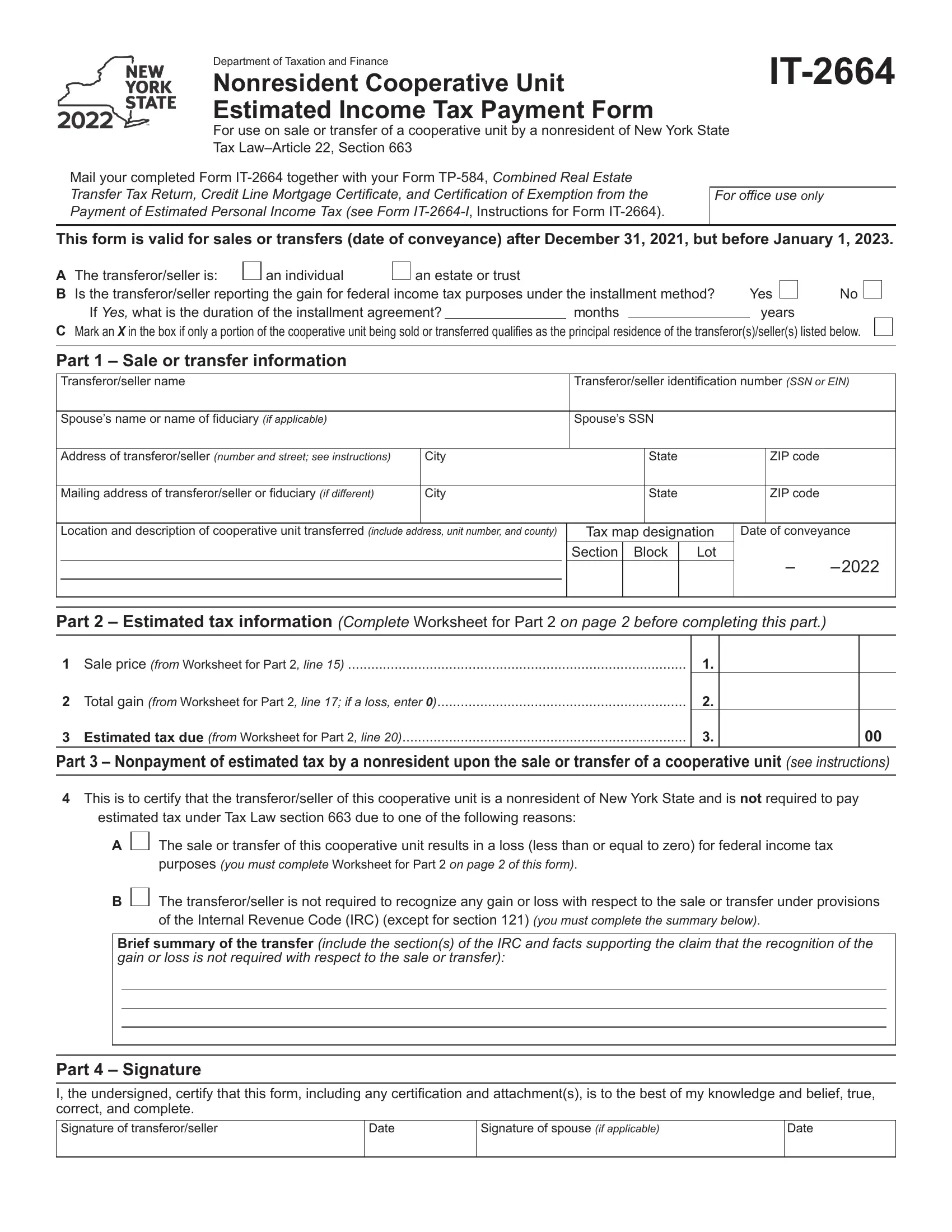

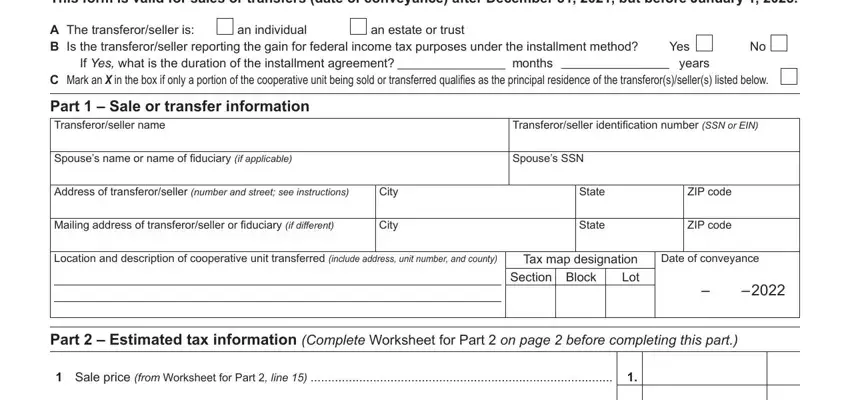

1. It is crucial to fill out the it2664 properly, therefore be careful when filling in the sections comprising all these blanks:

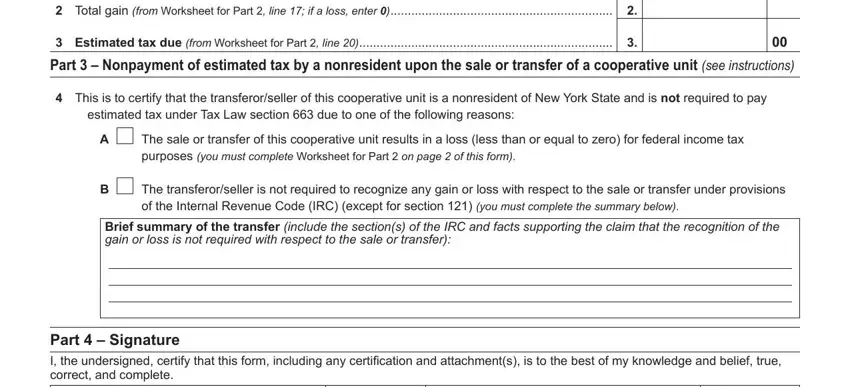

2. Right after performing the previous part, go on to the next stage and fill out the essential details in these blank fields - Total gain from Worksheet for, Estimated tax due from Worksheet, This is to certify that the, estimated tax under Tax Law, The sale or transfer of this, The transferorseller is not, Brief summary of the transfer, and Part Signature I the undersigned.

Regarding Total gain from Worksheet for and estimated tax under Tax Law, make sure you review things here. These two are thought to be the most significant fields in this PDF.

3. Completing Part Signature I the undersigned, Signature of spouse if applicable, Date, and Date is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

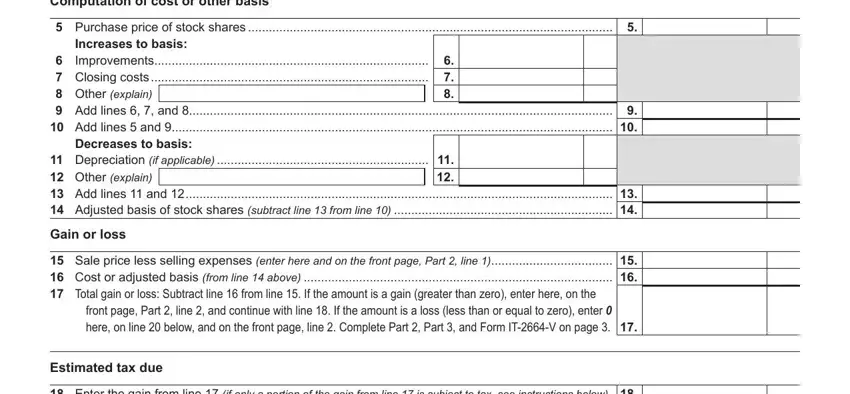

4. The next subsection will require your attention in the following places: Computation of cost or other basis, Purchase price of stock shares, Decreases to basis, Gain or loss, Sale price less selling expenses, here on line below and on the, front page Part line and, Estimated tax due, and Enter the gain from line if only. Make certain to provide all needed info to move forward.

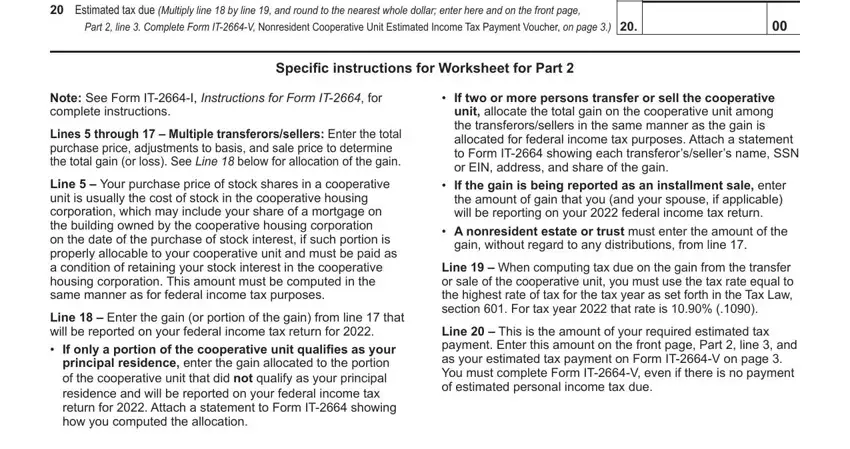

5. To conclude your document, the last subsection requires several additional fields. Filling in Enter the gain from line if only, Part line Complete Form ITV, Specific instructions for, Note See Form ITI Instructions for, Lines through Multiple, Line Your purchase price of, If two or more persons transfer, If the gain is being reported as, A nonresident estate or trust, gain without regard to any, Line When computing tax due on, and Line This is the amount of your is going to wrap up the process and you're going to be done in a tick!

Step 3: Once you have looked over the information in the blanks, click on "Done" to complete your form. Join FormsPal now and instantly obtain it2664, set for downloading. All alterations you make are preserved , meaning you can change the file at a later point if required. Here at FormsPal, we do our utmost to make sure all of your information is maintained protected.